*Author: Empowering Manufacturing with Technology

Introduction

The first Yanzhi Intelligent Automotive Conference was held in Shanghai on March 25th – 26th. High-level guests provided insights and proposals on the difficulties of intelligent vehicle evolution, smart driving sensors, high-precision maps and positioning, vehicle communication and smart transportation, and autonomous driving safety.

During the event, Mr. Li Yunxiang, co-founder and VP of products at Unicore Technology, was interviewed by journalists and had an in-depth discussion on the development of lidar technology, particularly solid-state lidar technology.

Building the Best Intelligent Driving Infrastructure

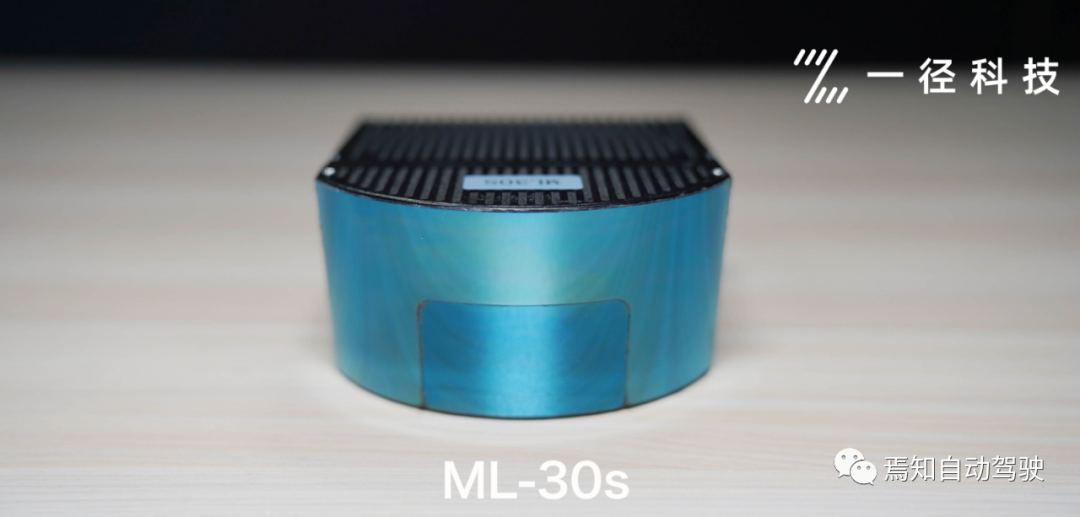

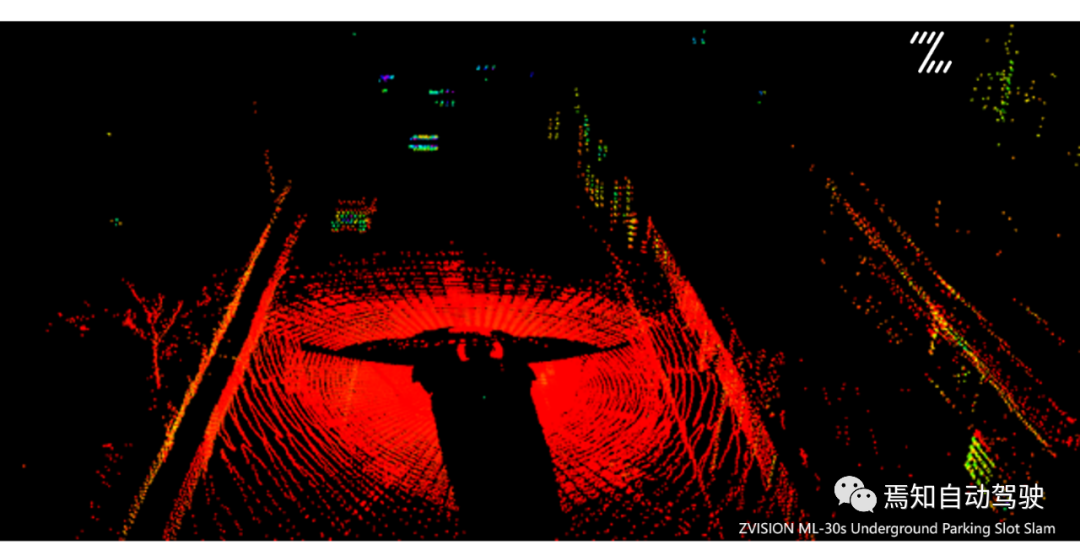

Mr. Li Yunxiang first introduced his company and the co-founders. Unicore Technology was founded in 2017, dedicated to providing internationally leading all-solid-state lidar solutions. Based on advanced technology and closely integrating market demand, the company provides high-performance, small-sized integrated, mass-produced vehicle-level all-solid-state lidar products, endowing unmanned driving vehicles, robots and other artificial intelligence applications with reliable, stable, wide-angle, long-distance, and high-resolution 3D depth vision capability.

He introduced that the three co-founders of the company are PhD holders from Tsinghua University and have worked in different fields. CEO Shi Tuo has worked in the optoelectronics industry for over ten years; Vice President Xia Bingbing works mainly on ASIC analog chips; he himself used to work on wireless communication.

He said: “Unicore Technology is one of the earliest teams in China to develop solid-state lidar for automotive applications. The company’s core R&D team comes from internationally renowned universities such as Tsinghua University, Polytechnic University of Madrid, Caltech, as well as internationally renowned Tier 1 and optoelectronic semiconductor companies such as Qianxun Location, Osram, Bosch, Autoliv, etc.”

Currently, UniCore Technology’s main service targets include automotive OEMs and autonomous driving companies. Benchmark customers include [Company names are missing in the original text]. Currently, the mass production and landing direction is to provide integrated lidar solutions for various scenarios of vehicles in specific regions, including L3+ADAS, high-speed logistics, smart mines, smart ports, smart parks, intelligent public transportation, Robotaxi etc.

He told the journalist: “For more than three years since the company was founded, our main business has been mass-producing solid-state lidars for front-end installation. Our specific technical route uses MEMS micro-mirror chips. In fact, micro-mirror technology is very common, and a typical application is a projector. Nowadays, many manufacturers can provide MEMS chips, and our MEMS chips have their own design, and then we let the foundries produce them.”

Vehicle-Level Reliability, Performance, and Cost

Li Yunxiang said that the MEMS chips used in cars are very different from those used in consumer products. The main difference is that the latter has lower requirements for lifespan and reliability. For example, a projector may be discarded after one or two years, but the lifespan of car products is required to be three to five years or even more than ten years. Moreover, the automotive environment is much harsher than that of a projector, with high and low temperatures, rain and snow, dust and vibration, shocks, etc. Therefore, the reliability of the device itself is higher for automotive products so that the resulting system can achieve high performance as well as high reliability.

From a theoretical perspective, automotive lidars are also different from consumer products. Projectors are mainly emitting devices and do not have a receiving function. The automotive lidar requires a certain scanning range, such as a 120-degree field of view for forward radar.

In terms of lidar development, today’s lidar technology is not comparable to the mechanical radar that used to be placed on car roofs. It’s like comparing mechanical hard drives with solid-state drives. Computers used to rely on rotating hard drives with magnetic heads to read data. Their reliability and resistance to vibration or shock are relatively low, and they are easily damaged when in high-speed motion. From mechanical to solid-state, this shift has not only improved reliability and lifespan but also helped to reduce costs. Lidars have also undergone this transformation.

The cost of the earliest radars was comparable to that of a high-end car. At that time, Velodyne, an American company, sold rotary radars for several hundreds of thousands of dollars. Now, the company’s radar is semi-solid-state. However, everyone is moving towards full solid-state technology. Currently, most of the market share for automotive lidars is held by international giants. Facing this monopoly, how should domestic manufacturers, including start-ups, respond?

Li Yunxiang said, “This is an interesting topic. Unlike other radars or chips, the starting time for foreign automotive lidars is two or three years earlier than that of domestic ones. Therefore, from a technical point of view, the technology of domestic lidars is not inferior to that of foreign manufacturers. In recent years, the most critical issue is to see who can have innovative and unique designs and who can present products that can be quickly realized. Because there is nothing that can be copied or referred to from predecessors, it requires starting anew.”

He believes that compared with international manufacturers, domestic manufacturers are also relatively cheaper in terms of price, not only because solid-state lidars are cheaper than mechanical ones but also because of advantages in research and development costs, production material costs, and labor costs. In addition, since lidars are very complex, in addition to basic performance, there are a lot of tasks to be done for installation, and customer support and response are also advantages of domestic companies.

3D perception provides an extra layer of safety for travel.Li Yunxiang also explained the importance of the lidar from the perspective of ADAS and autonomous driving. He stated that autonomous driving increasingly requires reducing human intervention. Whether it is ADAS or L3, adaptability to different driving scenarios is a major challenge. One issue that pure cameras and mmWave radars face is color recognition, as seen in several accidents involving Tesla cars unable to recognize white objects. If such issues exist, it is impossible to reduce human involvement, and people must remain alert at all times, preventing higher levels of autonomous driving.

Therefore, the entire vehicle’s sensor system, whether it is cameras, lidars, or mmWave radars, must be treated as part of the visual system. Each sensor has its own advantages, and while their combined ability may not reach that of the human eye, through a fusion scheme that incorporates multiple sensors and algorithms, visual capability can be improved.

This way, as the level of autonomous driving increases, the driver’s hands can be truly freed, and additional value can be created. He added that while the human eye cannot accurately judge distance, human intuition and brainpower can estimate it, but machine vision is different, as distance is precisely measured.

So, how should the weights of the three sensors, cameras, mmWave radars, and lidars, be allocated during the fusion process? How to ensure safety? How to achieve intelligent cabin logic? Which sensor should be trusted?

Li Yunxiang believes that these are all related to the decisions that need to be made, which is a very complex matter. Sensor fusion is about solving the question of which sensor to trust in different scenarios. For example, in insufficient lighting situations, mmWave radars should be trusted, while during the day, cameras with high resolution and effect can guarantee higher weights.

In addition to perception, there is also a concept called algorithmic fallback, which is the bottom-up security safeguard. When all upper layers fail, algorithms are used for protection. For example, once a lidar detects an obstacle, if it has the highest priority, a decision will be made and action taken. The logic is very complex, but essentially, it depends on combining different products and sensor advantages.

There is also the issue of redundancy. To what extent can safety be ensured? He stated that using multiple sensors is a redundancy consideration because each sensor has its failure mode, and the purpose of selecting different sensors is to ensure that not all sensors fail under various circumstances. Therefore, from this perspective, using different sensors, including domain controllers, can help ensure safety.

He also pointed out that different sensors have different CPU requirements for the central processor. For example, cameras are certainly CPU-intensive, as they are now 8 million pixels. For example, NIO’s ET7, which wants to install 11 cameras on a single vehicle, has a high pixel count. Next is the lidar, which has a point count of tens of thousands per second. However, the lidar has a smaller impact on CPU usage than the camera.

Selection of OEMs

Elon Musk, CEO of Tesla, said that he hates LiDAR the most because it is expensive and not practical. He believes that human eyes are analog, while LiDAR is a light signal, so he excludes it. Will some OEMs have concerns about the use of LiDAR due to Musk’s influence?

Li Yunxiang said: “Tesla is a more independent company and has always insisted on using visual solutions, but in fact, other OEMs we have contacted believe that LiDAR is necessary. Many domestic manufacturers, such as XPeng, NIO, and Ideal, and even models recently released by SAIC, all use LiDAR. These manufacturers still consider safety and use LiDAR to enhance the ability of the visual system.”

He said that image detection may have omissions, while LiDAR sees what it is and has accurate distances. Therefore, domestic OEMs can still accept it. However, their concern is whether it can pass regulations. After selecting a manufacturer’s product, if it cannot meet regulations, it is difficult to accept it once it is installed in vehicles. He told reporters: “Before mass production and installation, we will conduct a series of demonstrations with OEMs, including lifespan, reliability, and electromagnetic compatibility; we will also evaluate it in third-party laboratories according to requirements. The final result is recognized by OEMs.”

What is the relationship between OEMs and Tier 1 regarding LiDAR? Li Yunxiang said that LiDAR is a relatively important sensor, and the most important sensor in the field of autonomous driving is LiDAR and the controller. Therefore, in the industry, these two things are more optimized by OEMs or make decisions in a holistic manner. After selecting the target, we will cooperate with Tier 1 to develop an overall solution and combine LiDAR with other parts. This is different from the past, where OEMs directly communicate with Tier 1.

Quantity production shows the true colors

OneWay.AI has independently developed solid-state LiDAR chips and systems, which can achieve performance and reliability that is regulated by regulations. More importantly, it can be mass-produced, which can ensure both supply and have cost advantages.

Li Yunxiang acknowledged that quantity production is a challenge for a company’s survival. There are several aspects that commercialized quantity production of LiDAR needs to achieve: in terms of product performance, now manufacturers can basically achieve similar performance, but production efficiency still needs to be evaluated. However, producing ten LiDARs and producing thousands or even tens of thousands of them are incomparable. To produce ten thousand, there needs to have production efficiency, and it needs to be evaluated once through rate or yield rate, which determines whether it can be mass-produced and whether supply can be guaranteed, an important factor. Only by producing in batches and high efficiency, can the cost be reduced.According to his introduction, Yijing Technology’s domestically produced MEMS lidar production line in Changshu has entered trial production, with a planned capacity of 50,000 units per year in the first phase. He predicts that starting from this year, the lidar market, especially solid-state lidar, will take off and the mainstream automakers will start equipping vehicles with lidars by the end of 2022 or 2023. Although lidar may not be installed on all vehicle models, it will start from tens of thousands, hundreds of thousands and even millions of units. Currently, the opportunity is greatest for models priced above 300,000 yuan.

He revealed that Yijing Technology has reached a strategic cooperation with JD Logistics and, at the commercial vehicle level, it has also reached a strategic cooperation with Plus.ai on commercialized autonomous driving solutions for long-haul logistics trucks, and mass production is an important guarantee for expanding applications.

He said: “Robotaxi and private cars are our two most important directions. I think that private cars will land earlier. At the beginning, the level of autonomous driving may not be that high, but they will land faster and encounter fewer legal and insurance obstacles. L4 requires high unmanned requirements, so it still needs time, but it is definitely a huge market. The Robotaxi market needs to develop before the efficiency of the entire society’s public transportation system can be improved. In addition, the heavy-duty logistics application scenarios are clear, the implementation difficulty is low, and it is already a field that has been landed.”

Unreplaceable Technology

Li Yunxiang believes that the future direction of lidar must be solid-state, with smaller size, lower cost, lower power consumption, and higher integration. Therefore, the technical capabilities of the entire R&D team are the key to success. He believes that lidar will definitely become an important sensor in future vehicles because there are no other products that can replace it under certain conditions. Cameras and millimeter wave cannot replace it.

Finally, he said: “This industry is quite interesting. It’s like the transformation from feature phones to smartphones in the mobile phone industry. Now it’s the turn for cars to enter the smart era from the functional era. We are at a time of change, where there are many opportunities, and the automobile industry chain is very large, involving a production value of more than ten trillion yuan, and it is indeed a pillar industry. We are now in the right place at the right time, and it’s worth a try!”

It is reported that Yijing Technology will showcase its latest technology products at the Shanghai International Auto Show from April 21 to 28.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.