Author: Su Qingtao

Over the past six months, many investment institutions and friends from car companies have approached me to discuss topics related to LiDAR. There are many reports on LiDAR, but the information is highly fragmented, and there is still confusion regarding some basic concepts. Therefore, after answering numerous homogeneous questions, I decided to compile the answers to these questions and create a “popular science” guide.

Q1: Which technology route is the best for LiDAR?

A: This is not a good question. A more accurate question should be “which technology route is dominant at the present stage?”

Firstly, regarding the technology route, it needs to be clarified that LiDAR has many classification methods: according to the ranging method, according to the laser emitter and detector, and according to the scanning method.

According to the ranging method, the current vehicle-mounted LiDAR mainly includes the dTOF (time-of-flight) and iTOF (measuring flight time indirectly by measuring the phase offset, which is divided into FMCW and AMCW) methods. Currently, dTOF is the market mainstream, while FMCW is in the pre-research stage.

The difference between the two is that dTOF measures the time difference between the laser pulse emitted and detected by the detector to directly calculate the distance between the target and the sensor. FMCW adjusts the laser frequency in time and detects the beat frequency signals between the emission and echo while completing the detection of the distance and speed of the target.

At present, ToF is the most mainstream ranging plan, but companies such as Mobileye, Aeva, and Blackmore (already acquired by Aurora) have adopted the FMCW ranging plan from the beginning. FMCW and ToF are almost two independent categories, except for similarities in optical lenses and scanning devices, everything else is completely different.

Currently, the LiDAR technology routes discussed more in the industry are based on the premise of ToF ranging.

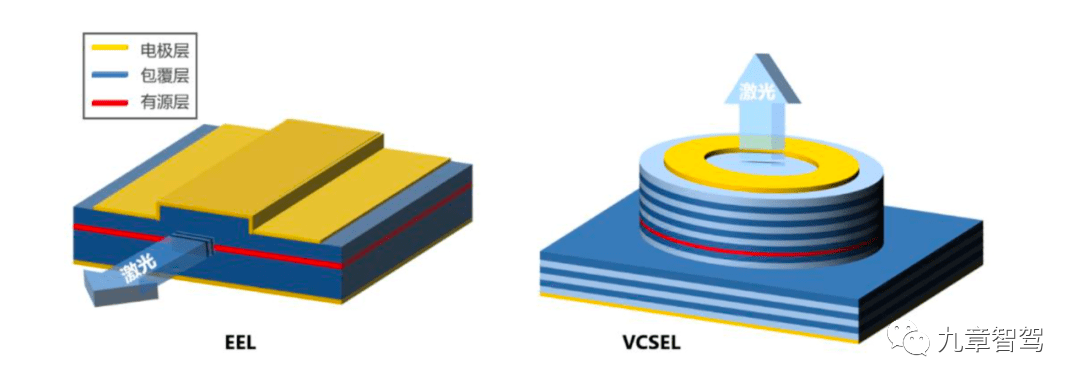

The structure of the ToF LiDAR is divided into three parts: the laser emitter, the laser detector, and the scanning component. The laser emitter can be mainly divided into two types according to the wavelength, 905 nm and 1550 nm, and mainly divided into EEL (edge-emitting laser) and VCSEL (vertical cavity surface emitting laser) according to the integration level. The laser detector can be mainly divided into APD (avalanche photodiode) and SPAD (single-photon avalanche diode) according to the integration level and photosensitive sensitivity. According to scanning components, it can be divided into mechanical rotation, hybrid solid-state and pure solid-state.

(The types listed under each classification method above are not complete, and only the most representative schemes are selected here.)Nowadays, the classification of lidars typically refers to the scanning components.

The traditional “mechanical rotation” concept is no longer controversial. It means the product is rotated 360 degrees by the motor; the concept of hybrid solid state means that some components are mechanically moving while others are not. Although the concept is clear, there have been many misconceptions in the past few years. The concept of pure solid-state means that there are no mechanical moving parts at all, although the concept is clear, there have also been some misconceptions in the past.

Between 2017 and 2019, according to the definition given by some old-fashioned manufacturers, mechanical rotation products became “hybrid solid state” as long as the rotating parts were enclosed in a box, but in fact they were still mechanically rotating. At that stage, MEMS (micro-electro-mechanical systems) were classified as “pure solid state,” which was also a misconception because MEMS also have mechanical moving parts.

By 2020, mainstream manufacturers have basically reached a consensus on how to classify lidars according to scanning methods:

-

Mechanical rotation type: Both the mechanical part (scanning module) and the electronic part (laser transmitter and receiver module) are moving, rotated 360 degrees by a motor.

-

Hybrid solid-state: The laser transmitter and receiver module is stationary, only the scanning module is moving. According to the scanning module’s movement method, hybrid solid-state is divided into MEMS, mirror rotation, and prism rotation (more detailed explanations will be made later).

-

Pure solid-state: Neither the laser transmitter and receiver module nor the scanning module have mechanical motion. There are mainly two pure solid-state schemes: OPA and Flash.

Overall, from mechanical rotation to semiconductors and then to solid-state, the level of product integration is getting higher and the cost is getting lower.

Mechanical rotation type lidars have disadvantages such as large size, low reliability, difficulty in passing vehicle regulations, and high prices, but it has strong performance indicators (long distance, large horizontal scanning angle). It is the mechanical rotary lidar that helped the autonomous driving industry complete the transition from 0 to 1. At this stage, all of its drawbacks can be tolerated.

Mechanical rotation type lidars are mainly sold to Robotaxi’s testing fleets. Because of low demand, sensitivity of Robotaxi customers to lidar prices is not high; and these B-side customers have a relatively rational expectation of the lidar’s technology maturity and reliability. To ensure safety, they will strictly follow the manufacturer’s provided service life and promptly replace lidars if they expire. In addition, they will arrange dedicated personnel to regularly inspect and maintain their lidars and discover any problems in a timely manner.

Currently, in the global Robotaxi market, the highest market share of LIDAR is Velodyne’s 40-line and 64-line products. According to Velodyne’s prospectus, sales of the 64-line product have been better than the 40-line product since 2019. Several Velodyne customers have expressed concerns about the high price of mechanically rotating LIDAR, but they are quite satisfied with its performance.

However, it’s different when it comes to installing LIDAR in front-loading mass-produced cars. Most of these cars are sold as private cars to end consumers. Will the consumers regularly check whether the LIDAR on their car is working properly?

Moreover, some consumers may keep using the LIDAR even when it has reached its designed lifespan. The stability, heat dissipation, and anti-vibration ability of LIDAR will face greater challenges when the private car is used for ride-hailing and working over 16 hours every day.

Therefore, to enter the front-loading mass production market, the LIDAR must meet the automotive safety standards.

Starting from Q4 2020, LIDAR manufacturers and automakers have been clamoring for “front-loading mass production.” At this stage, in addition to performance indicators, automotive safety standards, integration, mass production capacity, and cost are all key considerations. At this stage, mechanically rotating LIDAR has basically withdrawn from the competition, and now, the products competing for the front-loading mass production market are mostly hybrid solid-state products.

In the stage of the autonomous driving industry from 1 to 10, hybrid solid-state LIDAR will play an important role. Huawei skips the mechanically rotating scheme and directly starts with hybrid solid-state because it does not participate in the Robotaix testing market. The most competitive Velodyne in the mechanically rotating LIDAR market is also developing hybrid solid-state products (MEMS and mirror rotation) for the front-loading mass production market.

However, in a longer time frame, hybrid solid-state LIDAR is just a transitional form, and pure solid-state LIDAR is the future. Pure solid-state LIDAR mainly includes OPA and Flash types, but Quanergy, which first proposed the OPA route, has already left the autonomous driving market. Currently, mainstream manufacturers also rarely develop OPA products. Pure solid-state LIDAR products from Ibeo, Continental, Ouster, etc. are all based on the Flash solution. Among them, Ouster’s Flash LIDAR has been installed on unmanned trucks, mining trucks, and sanitation vehicles for many companies.

Even the manufacturers, such as Velodyne and Huawei, who are currently mainly promoting mechanically rotating and hybrid solid-state LIDAR, admit that pure solid-state represents the future trend. Therefore, they all have related technical reserves. Velodyne’s prospectus mentions its reserve of pure solid-state LIDAR, although it does not explicitly state whether it is Flash, it also emphasizes “based on electronic scanning”.The pure solid-state LiDAR not only has a small size but also has higher reliability because it does not have any moving parts. Its cost will be lower when the technology becomes mature. However, the deadly weakness of pure solid-state LiDAR currently is its short detection range, such as the ibeoNext Flash LiDAR provided by Ibeo to Great Wall, which has a detection range of only 130 meters.

There are two ways to achieve long detection range: increasing the power of the laser emitter and improving the photosensitivity of the laser detector. Currently, both of these technologies are not yet mature. When these two technologies become mature and their cost is acceptable, pure solid-state LiDAR represented by Flash will become mainstream.

At the end of 2017, a Velodyne executive said in an interview with the author, “Flash solutions are not suitable for automotive use, and we have already reached a consensus.” Now it seems that Velodyne seriously misjudged the trend of technological evolution. They did not expect that the detection range of Flash LiDAR could be improved with the advancement of technology.

Q2: What are the representative companies for MEMS, mirror-based, and prism-based solutions, and what are their specific differences?

A: The representative companies for MEMS solutions are Innoviz, SenseTime, and Pioneer. The advantages of MEMS LiDAR are high resolution, high integration, small size, and low cost (it has the highest integration and lowest cost among current solutions). However, the small aperture on the scanning mirror leads to insufficient energy on each beam, resulting in a relatively short detection range under current technical conditions, which is criticized by competitors.

However, due to cost and integration, MEMS products have strong competitiveness in the low-speed autonomous driving market. SenseTime has been tied to Cainiao, a strategic customer, and is receiving a lot of feedback from their customers through more than three years of cooperation, which has led to rapid progress in their technology.

In addition, for L2+ or NOA of passenger cars, the responsibility for driving is still held by humans, and the automatic driving system is just an enhancement. Therefore, after considering the overall performance and cost, some automakers have chosen to install MEMS LiDAR on production vehicles. For example, Lucid’s first mass-produced car, the Lucid Air, will soon be equipped with SenseTime’s MEMS LiDAR.

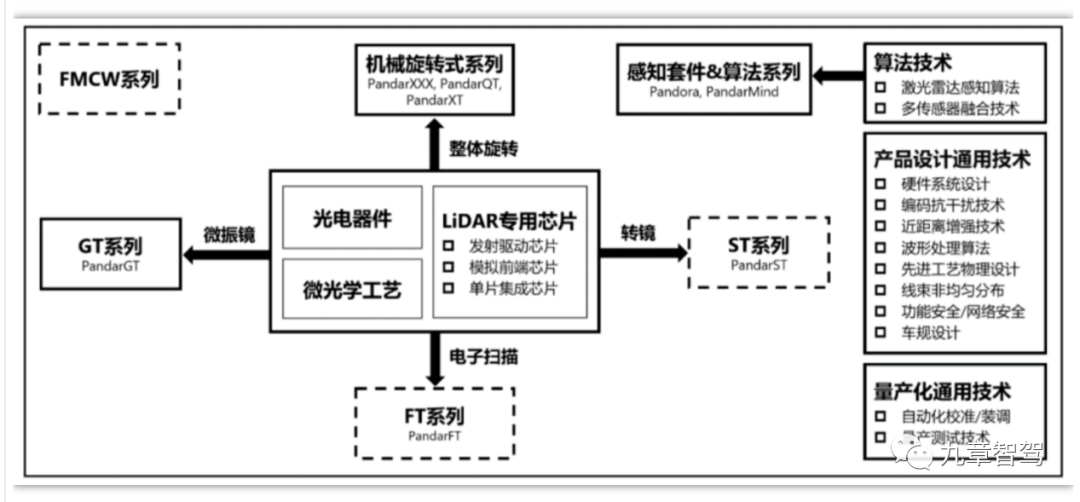

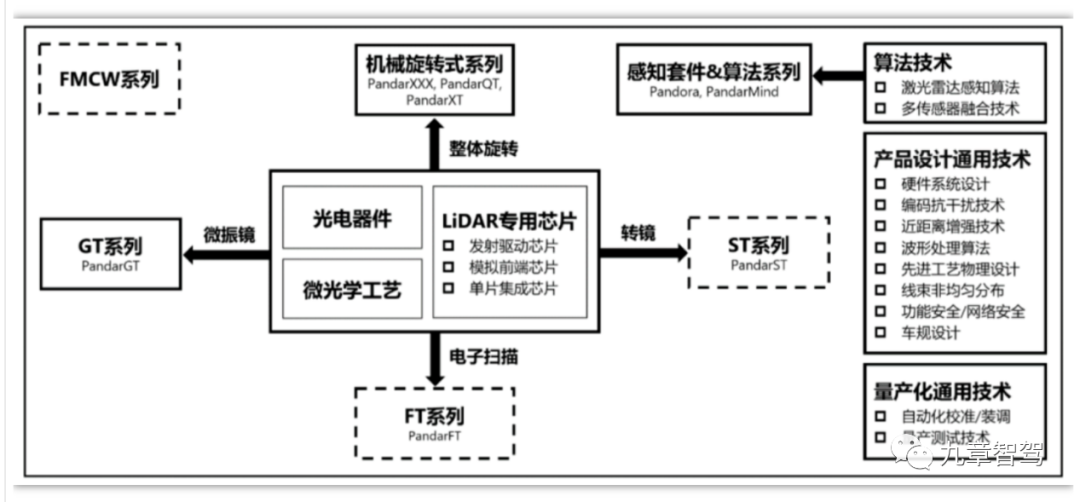

Although Hesai mainly focuses on mechanical scanning LiDAR, its PandarGT 3.0, released in early 2019, is based on MEMS solutions. According to information mentioned in Hesai’s prospectus, the company will also develop MEMS products in the future.Representative players of the scanning mirror scheme include Valeo, Luminar, Innovusion (laser radar supplier for NIO ET7), and Huawei. Valeo’s Scala, the first laser radar to pass the validation test, is based on the scanning mirror scheme, which is easy to pass regulations and has been validated. Other manufacturers targeting the mass production market for front-loading have followed suit.

(Many reports and research institutions classify Luminar and Huawei’s technical route as MEMS, which is a misunderstanding. Each company reserves many types of technology, and though they have applied for relevant patents for some technical schemes, they have not actually developed any products. Some research institutions only judge the technical route of others’ products through patents, without contacting related companies directly, resulting in a bias in the analysis.)

The difference between scanning mirror scheme and MEMS is that the scanning mirror of MEMS vibrates up and down around a certain diameter, while the scanning mirror rotates around the center point in the scanning mirror scheme. This scanning method means that the power consumption is relatively low, and the difficulty of heat dissipation is low, thus making it easy to achieve relatively high reliability.

Currently, among the leading companies that have won mass production orders, those that use the scanning mirror scheme are relatively numerous. Although Hesai’s mechanically rotating products are highly competitive in the Robotaxi market, the company actually laid out the scanning mirror scheme as early as 2017, but it was relatively low-key and never publicly announced it.

In addition, Hesai’s prospectus shows that its product Pandar ST, which is for the mass production market, also adopts the scanning mirror scheme.

The scanning mirror scheme can be divided into one-dimensional scanning mirror (Ibeo, Hesai) and two-dimensional scanning mirror (Luminar, Innovusion). The so-called one-dimensional scanning mirror means that there is only one scanning mirror, and the two-dimensional scanning mirror has one vertical and one horizontal scanning mirror.

One-dimensional scanning mirror means that there are as many laser transmitters as there are lines, which means that not only is the cost high when making high-line-number products, but also the integration difficulty is high, making it difficult to achieve high line numbers (Valeo’s Scala 1 only has 4 lines, and Scala 2 only has 16 lines due to this reason); the two-dimensional scanning mirror is similar to MEMS, using only a small number of laser transmitters and achieving the effect of “multiple lines” through the refraction and reflection in the high-speed rotation of the scanning mirror, which can not only save the cost of laser, but also achieve high “line numbers”.The PandarST from Hesai will adopt a one-dimensional scanning scheme. However, unlike Scala, Hesai plans to integrate the laser transmitter and detector into the chip (this goal will be achieved in the 2.0 phase of the Hesai chip plan roadmap) to achieve a one-to-one correspondence between the laser communication system and “line numbers”. This makes it possible to not only achieve a high number of lines based on one-dimensional scanning, but also to continue to enjoy the dividend of Moore’s law.

Livox is a representative company of the prism scanning scheme. The prism scheme uses non-repetitive scanning technology, which means that the algorithm it needs to match is different from the mainstream laser radar based on repetitive scanning technology.

Compared with MEMS and two-dimensional scanning schemes, the prism scheme uses more laser transmitters and can achieve higher point cloud density and longer detection distance, but its high motor speed presents a great challenge to the reliability of motor bearings, which is several times higher than that of the mirror-based scheme. Livox has accumulated precision motor manufacturing technology in unmanned aerial vehicles, and is confident to overcome this difficulty, while other manufacturers currently have little exploration of this technology.

Livox’s prism products also enjoy a “bonus”: its sister company, “DJI Automotive”, will make requests and provide feedback to them, forming a closed loop which is conducive to the rapid progress of technology.

Q3: Which is better in MEMS, mirror, and prism in the mixed solid-state technology?

A: Currently, the technical route of lidar is still in the stage of hundred flowers competing. All three schemes have mainstream manufacturers trying them out, and even a single company is simultaneously developing products of two or more schemes. Moreover, the products have not yet been widely used, and have not been verified, so it is premature to evaluate “who is better”.

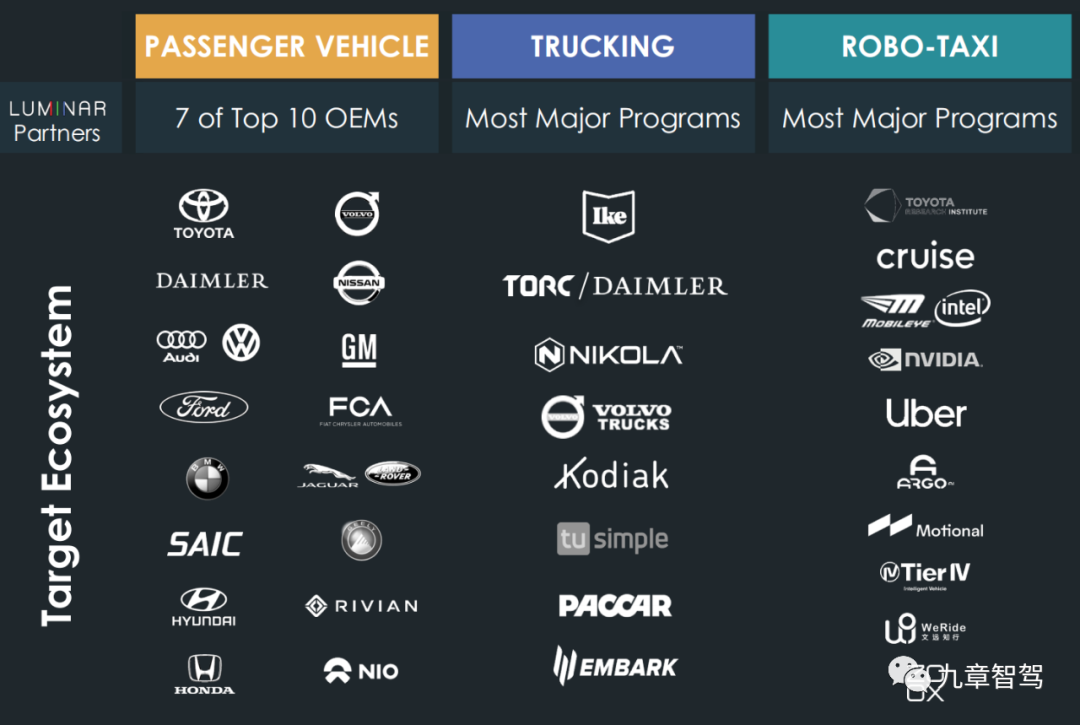

Although Luminar announced more than 1.5 billion U.S. dollars in orders a year and a half ago, according to information released before its listing, it only sold 100 lidars in 2020, and large-scale deliveries will have to wait until after 2022.

Moreover, many of the orders announced by Luminar may be just supply agreements, mainly to restrain the suppliers’ prices, and do not strongly constrain the size of orders from automakers. The following is the customer list from the PPT shown by Luminar to investors before listing, with names such as Audi, GM, Ford, and NIO included. However, in fact, Audi mainly cooperates with Ibeo, Cruise under GM is developing their own lidar (which is also cooperating with Hesai), Ford’s Argo is also independently developing lidar, and NIO has chosen Innovusion.

The head of a certain LiDAR manufacturer said, “Even if we have signed a contract with a certain automaker now, there may still be variables in our subsequent cooperation, and it is not necessarily a long-term collaboration. Those who have not signed now do not mean they will have no chance in the future.”

The head of a certain LiDAR manufacturer said, “Even if we have signed a contract with a certain automaker now, there may still be variables in our subsequent cooperation, and it is not necessarily a long-term collaboration. Those who have not signed now do not mean they will have no chance in the future.”

I estimate that by the end of 2023, there will be a relatively clear answer as to which technology route and which company has stronger product capabilities.

Q4: Is there a first-mover advantage in this industry? For example, if it is ultimately proven that the MEMS solution is the best and the other companies have chosen the wrong route, can they still change in time?

A: First, it needs to be clarified that Hesai and Huawei both have MEMS technology reserves and patents even if they do not have relevant products, so there is no problem of them being clueless if the MEMS route wins.

Moreover, MEMS is still a mirror or prism conversion, and the laser transmitter and receiver modules are interchangeable, with the difference mainly lying in the scanning scheme. Therefore, whether a company can quickly switch from the mirror or prism scheme to the MEMS scheme depends on this question: Is the real barrier of the LiDAR in the scanning module or in the laser transmitter and receiver module?

If it is the former, it will be more difficult to switch to another scanning scheme, while if it is the latter, it will not be difficult.

Some manufacturers believe that the scanning scheme is the point of differentiation in competitive competition, but Hesai mentioned in an interview with the author in July last year that the scanning scheme is only the “external power” of the LiDAR, and the laser transmitter and receiver technology is the “internal power”. Hesai believes that the laser transmitter and receiver technology accumulated when doing mechanical rotating products can be reused in mirror conversion, MEMS, and pure solid-state products, with only minor adjustments to individual parameters. Ouster Company also holds a similar view.

Last year, when Luminar wrote about cost reduction in its prospectus, it mainly emphasized how to control the hardware cost of the ASIC chip, laser transmitter, and laser detector, but did not mention the cost of the scanning mirror.

My understanding is that after Valeo has proven that the conversion scheme is easier to pass the car regulations, many manufacturers have targeted mirror conversion when developing products for the front-loading mass production market. This means that the barrier of the scanning scheme may not be that high. In fact, for long detection distances and improving integration, often it is necessary to “work” around the laser receiver and transmitter module.

In the pure solid-state stage, the laser transmitter and receiver will be integrated into the chip, and there will be no need for separate scanning components. At this point, LiDAR relies heavily on semiconductor technology, and it is difficult to say how much weight the scanning scheme holds.

Therefore, there may not be a significant first-mover advantage in the scanning scheme, but there may be an advantage in the laser transmitter and receiver technology.Q5: What is the highest proportion in the cost structure of LiDAR?

A: From the current core components of LiDAR, chips are the key part in reducing cost, including control chips, ASIC chips, lasers, beam control mechanisms, and photodetectors. Luminar has locked in agreements with suppliers for laser emitters, detectors and ASIC chips, and the cost of these three items can be controlled within 100 dollars under a certain order volume, according to its prospectus.

Q6: Do all LiDAR chips need to be self-developed?

A: In the early stages, many manufacturers used purchased chips. According to the report from French market research firm Yole, Qualcomm, Texas Instruments, LG Innotek, and Ricoh provided chips for LiDAR manufacturers. However, as LiDAR is a relatively new product and the technological line is still uncertain, suppliers do not have mature solutions, so external procurement is difficult.

Moreover, the early barrier to entry of LiDAR is optical knowledge, but in the long term, how to improve performance and reduce costs are all semiconductor issues. Chips are the lifeline of LiDAR manufacturers. Without self-developed core chips, it is difficult for LiDAR manufacturers to survive in this market. Therefore, Luminar decided to independently develop LiDAR chips from the beginning. Ouster, which is about to be listed in the United States, has also self-developed ASIC chips for use in flash LiDAR.

Q7: Will LiDAR undergo significant changes in the functions it provides with the evolution of technology?

A: Basic functions will not change, but performance will become better and better, mainly reflected in longer detection distance, higher ranging accuracy and higher resolution.

Q8: Some LiDAR manufacturers claim that they can provide perception algorithms and do data preprocessing. The LiDAR output is no longer raw data, which can supposedly sell for a higher price. So, do automakers prefer solutions that have added perception algorithms or just buy LiDAR hardware?

A: This is a very good question. Luminar and Velodyne LiDAR have already made it clear that selling algorithms is a source of income. Innovusion, according to its prospectus, said that about 150 million yuan of its financing will be used for algorithm development. However, different automakers will have different choices as to which solution they prefer.The new players in the car industry, such as XPeng, NIO, and Ideal, and traditional car companies such as Great Wall, which aim to master core technology, are unlikely to use algorithms from lidar manufacturers. However, many traditional car companies who are unable to develop perception algorithms in a short period of time and are in a hurry to use lidars, will have to rely on the perception algorithms provided by the lidar manufacturers. After all, consumers only care about the experience brought by the installation of lidar and whether the money is worth spending, rather than whether the lidar algorithm is self-developed or supplied by a supplier.

In the next few years, many lidars will still be sold to V2X projects, and these customers are infrastructure companies who do not have the ability to develop algorithms themselves. Lidar manufacturers must provide algorithms to these customers, which is not a matter of willingness, but a necessity. If the algorithms are not provided, they will not be able to gain a foothold in this market.

Of course, the lidar algorithm is much simpler than the camera algorithm. Therefore, manufacturers provide algorithms to increase the added value of their products, but the algorithm itself is not enough to constitute a competitive barrier.

Q9:Will Huawei’s lidar be bundled with the MDC?

A: No, it will not be bundled. The MDC team has frequently contacted other lidar manufacturers hoping that MDC’s interface can be compatible with other lidar manufacturers, which is a good practice for Huawei, other lidar manufacturers, and car companies.

Q10: With companies like Huawei providing full-stack solutions, where is the survival space for startups such as Hesai and Velodyne?

A: The capabilities and needs of each host manufacturer’s system are different. Some host manufacturers tend to adopt Huawei’s full-stack solution, but many host manufacturers tend to develop software algorithms in-house and choose chip and sensor suppliers based on their algorithm capabilities and needs.

Q11:I am from the strategic investment department of a car company, is it necessary for car companies to develop their own lidar?

A: In the long run, the difference in autonomous driving capabilities between car companies lies in the decision-making algorithm rather than the perception link – “just as we evaluate whether a person is great or not based on their thinking ability, not their vision ability” (Guo Jishun). After the technology matures, perception will become a highly standardized and universal technology.

From a technical perspective, investing in a universal technology does not help improve the competitiveness of car companies. However, if the car company’s procurement volume is large enough, and it can enjoy discounted prices through investment, that is another matter.

Q12: As a car company, do we need to invest in a lidar company, hold a 10-15% stake, and obtain a seat on the board of directors to strive for the right of priority supply?

A: Perhaps, in a few years, the right to “priority loading” will not be that important.A few years ago, during the stage when Velodyne monopolized the supply of LiDAR and its production capacity was extremely tight, Baidu Ford invested in order to prioritize the purchase of Velodyne’s LiDAR. However, now LiDAR is already a fully competitive market with over 100 players, of which around 10 are influential. In a few years, the production capacity should also catch up, so the necessity of “priority installation” no longer exists, right?

Besides, if your algorithm is not advanced enough to require high-end sensors, then the significance of “priority installation” is not great, right?

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.