*This article is reproduced from the autocarweekly account

Author: Du Debiao

Yesterday, there was news that Didi also started its own car-making project.

But for those who have experienced Baidu, Xiaomi, Apple, and even LG’s transition from phone maker to car supplier, we have become accustomed to this news with a calm and rational attitude. Even if Huawei announces its entry into the car-making industry someday, it would only be a normal variation in the supply chain.

Transitioning from the periphery to the core of the field, whether or not they can produce whole vehicles, or the quality of their products, is not particularly important once you have studied Tesla. What is important is the phenomenon itself. If Tesla represents the current ceiling of intelligent products and Nvidia’s futures chip represents the ceiling of computing power, then the concept of intelligent vehicles has a framework. So imagining the product forms of Xiaomi and Didi is mostly just speculation on pricing. Instead of racking our brains over this, it is better to observe this phenomenon itself.

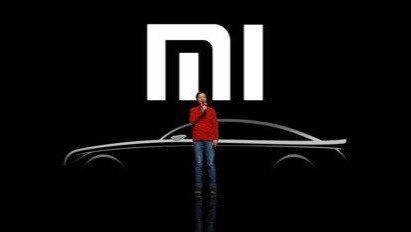

It is inappropriate to understand the car-making behavior of internet companies or suppliers as solely driven by profit. Although theoretically, there are fewer parts involved in making a car or a phone after transitioning from fuel cars to electric cars, making cars, or making use of idle resources for individual rental, is a gap larger than that between Douyin and the LOTR trilogy. Nevertheless, everyone pours their heart and soul into it, as can be seen in Lei Jun’s impassioned speech at product releases. This inevitable challenge to a difficult task is perplexing.

One day, my experience with my wife’s retired iPhone 11 that she gave to my mother, and her own iPhone 12, made me realize this is a complicated matter. I had doubts about my own ability to differentiate between the two models. Was the OLED screen better than LCD or was the camera more effective? When subconsciously we ask ourselves whether we are following inertia or purchasing a necessary commodity while upgrading, Cook needs to come up with a solution to this issue.Translate to English Markdown text with HTML tags preserved:

In the same way, for Baidu, which has little breakthroughs in Baidu Cloud and Baidu Maps (I used the maximum goodwill and restraint here to describe the feeling of using them), shifting the focus seems to be a wise choice. From my personal experience, I think it’s a good idea for Baidu to combine with self-driving technology to create original cars, as many brands now claim that their products can achieve high-speed navigation after implanting high-precision maps, which is the real stage of autonomous driving. In the future, the ultimate goal is to drive in the city with navigation, which is a staged goal. Therefore, will Baidu’s map function force itself to upgrade and further improve in the aspect of micro-navigation and positioning, which is not satisfactory? In other words, even if it cannot create a complete car, Baidu can still be a leading map software provider.

This is a possibility and imagination.

Therefore, for Xiaomi, entering the automobile industry is not like Haier and Chuangwei expanding into the parallel household appliances industry from a certain branch field. After all, the scale gap between microwave ovens, refrigerators, and televisions is not as huge as that between mobile phones and cars.

Although Xiaomi’s daily operations have made everyone start to estimate its product prices in advance, this is actually not a good signal, because the industry expects it to be associated with lowering the average car price, which may hinder our imagination space for products and affect Xiaomi designers’ imagination. However, the important thing is that Lei Jun still holds the possibility of creating various possibilities.

Similarly, for Didi, it seems to start from scratch even more than Xiaomi, and we should not ignore the massive user data in Didi’s hands. Just like Didi was established to solve users’ problems in certain scenarios, such as difficult to hail a taxi, Didi’s mission for cars may also start from here. It can be a self-driving shuttle service for specific routes and periods, or it can deliver oxygen to the dying shared cars. In short, there seems to be more room for business orientation than just calling a Didi, which has already been seen through by everyone.

Moreover, for intermediaries like Didi, how to achieve large-scale autonomous driving and how much the manpower-based taxi will be useful are also very suspenseful. Therefore, announcing to make cars at this time, Didi may upgrade the taxi industry or directly make and sell cars, which has a choice and retreat, so we should not think that Didi is just exaggerating and joining in the fun.You can learn a lot from Musk’s playbook. If you are both a product expert and a marketing specialist, congratulations, you will be a master at creating gimmicks. A tech company has much more material to tell stories with than a phone company or speaker manufacturer, and it is more appealing. This is the difference between Apple and Sony, but in fact, Sony has also begun to develop cars. The future of the automotive industry may complete an overall transformation, or the automotive industry may cease to exist, replaced by tech companies and travel service providers.

Therefore, the question we should ask is not only “how will their products be”, but also “who will be the next car maker”. Maybe it’s Meituan, maybe it’s Pizza Hut, or maybe it’s KFC. If cars move from being personal or family properties to service properties, then logistics and travel manufacturers will have a reason to make cars.

In the EV field, the concept of host factories is being weakened and replaced by systematized car manufacturing. Having infrastructure capability is not the most important thing. Just like in the future, you can use a car without a license or car. Basic skills are not a big problem, so Wang Xing, who has already begun to play with shared electric bicycles, may be the next candidate to enter the field. And what kind of car is being made may not be important. In the current automotive circle, there is such an unwritten rule that the process is more exciting than the result, and the story is better than the product. I believe that in the short term, we cannot beat Musk in electric vehicles itself, so we might as well enjoy the process of listening to stories.

NIO has given us a good example, although it is a semi-solid state battery, it is sufficient to excite the capital market. The future drop is another matter. Between reality and illusion, this is the most vivid business format in the automotive industry.

However, manufacturers that enter from the periphery and new forces and traditional host factories play different roles and will form new levels and structures in the future. The former is more targeted and committed to solving certain specific scenario problems. For example, Meituan’s acquisition of Mobike, the product has been upgraded from manpower to semi-automatic, and the technology threshold is not high. From electric bicycles to cars, there is theoretically no insurmountable barrier. This means that the target problem that needs to be solved in the future will not change, but the tools and methods for solving them will change. Or conversely, tool upgrades can solve more scenario problems. As a result, our concept of the market in the traditional field will also change. Perhaps the product manufactured by peripheral manufacturers will form a new so-called “segmented market”.

There is a lot of room for development, much more than just delivering take-out.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.