Introduction

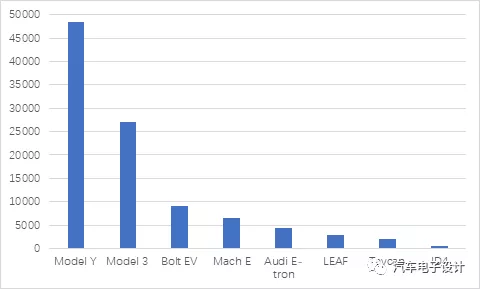

Briefly describing the data found on the US electric vehicle market. It was interesting to look at the market data for the first quarter in the US, as major electric vehicle manufacturers were quite active due to a series of plans by the Biden administration.

1) US manufacturers: Ford’s Mach-E has started delivery, but the overall pace has not been well grasped and it has only reached the fourth place. GM is still relying on the Bolt EV before its new platform is released.

2) European companies: BMW sells very few iX3 vehicles in the US market, similar to Mercedes-Benz. Volkswagen’s E-tron, Taycan, and ID4 all gradually gain solid footing.

3) Japanese and Korean companies: Hyundai-Kia’s KONA has cut down on its volume early on, and currently the main Japanese product sold in the US market is LEAF. Overall, due to Trump’s policies, most companies have a weak willingness to launch new products. In 2021, the market is still stagnant, with Tesla being the only dominant player.

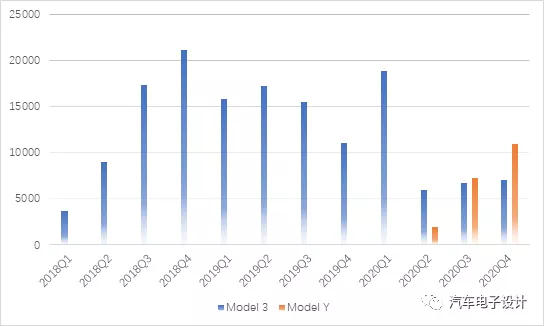

Model 3 and Model Y switching

Last year, we already noticed that in major regions such as California, the sales momentum of Model Y had surpassed that of Model 3, which means that the larger Model Y not only grabs the market of gasoline cars but also diverts the sales of Model 3. Therefore, according to this calculation, the demand for Model Y and Model 3 has already doubled.

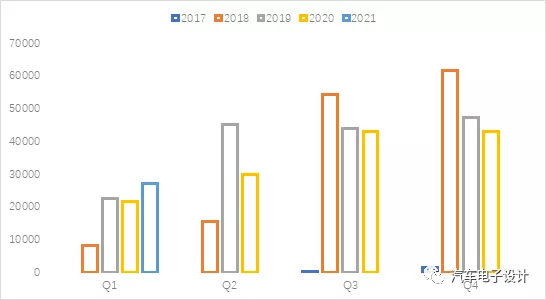

Regarding Model 3, if the quarterly sales data is listed, the highest delivery in history in the US was in Q4 2018, with 61,650 units delivered per quarter, then stabilized to about 40,000 units. As the sales focus shifted to Model Y, especially with the introduction of the standard mileage version, the incremental increase of Model Y is relatively large.

The data for the fourth quarter of last year in California has fully reflected that Tesla’s Model Y has surpassed Model 3 in sales volume (with 38,580 units sold for Model 3 and 20,124 units sold for Model Y in the whole year of 2020, which is not fully reflected in this data). According to California vehicle statistics, the quantity of Model Y in Q4 is 10,961, which exceeds Model 3’s 7,032. With the price adjustment, this data is expected to become more and more significant.

The data for the fourth quarter of last year in California has fully reflected that Tesla’s Model Y has surpassed Model 3 in sales volume (with 38,580 units sold for Model 3 and 20,124 units sold for Model Y in the whole year of 2020, which is not fully reflected in this data). According to California vehicle statistics, the quantity of Model Y in Q4 is 10,961, which exceeds Model 3’s 7,032. With the price adjustment, this data is expected to become more and more significant.

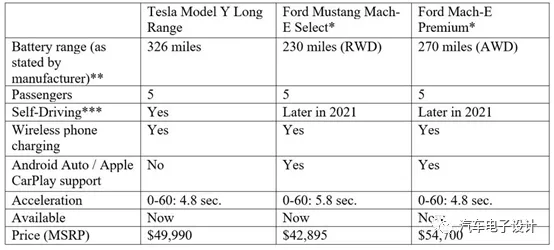

From the current situation, Tesla’s sales focus has entirely shifted to the Model Y. With the delay in the replacement of Model S and X, this year’s impact on sales can be seen. The most important adjustment is to produce low-priced Model 3 in China and expand the capacity optimization of Model Y in the United States. In terms of competition, similar to Mach-E, the quarterly sales volume is probably about 1/8. I think there are several reasons for this:

1) The price adjustment of Model Y is too fast, which is due to the cost reduction brought by the rapid increase in production capacity in the supply chain. Secondly, the increase in sales volume is more important than the increase in gross profit for Tesla, so we can see that they are continuously pushing for sales.

2) Mach-E’s sales in the United States, and Ford’s support and control over dealers are relatively limited. When a new car is launched, there is a delivery period, during which terminal price fluctuations are often more flexible for traditional dealers. However, with the comparison of Model Y, even with tax incentives, they still need to control prices to increase sales volume.

Biden’s New Energy Vehicle Policy

As the US electric vehicle market has been stagnant, Biden’s policy mainly aims to stimulate American automobile electrification through four aspects: encouraging the localization of the industrial chain, purchasing subsidies, building charging piles, and promoting the electrification of special fields. However, the specific rules and quantitative targets are yet to be determined.

1) Propose to invest $174 billion to stimulate the development of electric vehicle industry. The plan will enable automobile manufacturers to stimulate the domestic supply chain from raw materials to components, restructure factories to compete globally, and support American workers in producing batteries and electric vehicles.

Note: The localization of the battery industry chain is basically the goal of the United States and Europe, but it is unclear how to achieve it.2) Purchase subsidy (7500 USD refund before), which is subject to constraints on sales discounts, tax refunds and tax incentives for electric vehicles manufactured in the United States. The details of this will affect the actual sales volume of Tesla and GM in the future.

3) Build 500,000 charging stations before 2030. Funding and incentive plans will be established for state, local governments and private sectors to establish a nationwide network with 500,000 charging stations before 2030, while promoting strong labor, training and installation standards.

4) Commercial fleet: This is basically the rhythm before in China, promoting the electrification of transport vehicles, buses, school buses and other public vehicles. It is planned to replace 50,000 diesel transport vehicles and, with the support of the Department of Energy, make at least 20% of yellow school buses electric through a new clean bus project of the US Environmental Protection Agency; promote 100% clean-up of public transportation.

Summary

I estimate that when Model Y’s production capacity comes to China, the focus of discussion will be how it affects the market pattern of electric SUVs during continuous price adjustments. The US is about 9 months ahead of China in this regard. With the introduction of new energy vehicle support policies in the United States, the overall supply pattern of electric vehicles will be affected.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.