Translation in English Markdown Format

Special thanks to: my friends from the PM Club of Highway Flying last night. Everyone exchanged and collided together, giving me a lot of inspiration and validation.

On the evening of March 30, 2021, Gaohe’s team may have regretted a little for choosing this day to hold their product launch. It’s not their fault, as Xiaomi’s launch was actually on the 29th – they just didn’t expect that Lei Jun chose to hold two consecutive days. The next day, Xiaomi’s announcement of building electric cars after the stock market closed set off discussions across various industries, from the digital to the home appliances and automobile sectors, with everyone talking about Xiaomi.

The discussions of the masses easily pushed Xiaomi’s electric cars to first place on Zhihu’s hot list.

At Garage 42, it’s been a long time since we’ve seen users crazily join a new brand’s communication group. After responding to too many requests to manually add people to the group, founder Daji reluctantly said that everyone should refer to the intelligent assistant’s instructions and apply themselves. I quickly joined one of the groups and witnessed a fierce argument among friends with different attitudes towards Xiaomi’s electric cars. I don’t care what they were arguing about, as the argument itself is a barometer. Nowadays, how many brands are worth people getting angry about?

In the PM Club, a car product manager group of “Highway Flying”, nearly 300 people in the electric car industry had their most exciting discussion of 2021 this evening. Apart from the group chat, I hosted a Tencent Meeting and started a local version of ClubHouse dialogue, where 40 classmates participated in a lively discussion for 80 minutes, which I had to forcefully stop.

Obviously, tonight belongs to Xiaomi’s electric cars.

It has become the most eye-catching player in the second wave of new car-making forces. You can confidently remove one or two words, and even the competitors won’t dare sue you for false advertising.

Why is it so anticipated even though it’s not their expertise?

At 12 midnight, I received a call from a senior colleague, and we only talked about one topic: why did Xiaomi only hold one product launch, without even presenting a concept car or any actual car pictures in their PPT (only an outdated fuel-burning motorhome design appeared), yet still garnered so much attention and anticipation from the public?

To answer that, we have to go back 11 years ago when Lei Jun founded Xiaomi…

Skipping half an hour of lengthy conversation, we summarized our main opinions into five aspects:

Product Category

Xiaomi has built an international and particularly Chinese influential brand in the smart consumer industry, and its core is a smart phone brand. It’s important to emphasize the product category attribute of smart phones here.The phone is indeed quite small, and the car is certainly very large. But, both phones and cars are industrial manufactured consumer goods. This lays the foundation for positive associations and brand value transfer between the two categories.

Can you imagine buying an electric car from a food delivery company that is launched three years from now? Can you imagine buying an electric car from a car rental company that specializes in rentals three years from now? Can you imagine buying an electric car from a company that specializes in entertainment news videos or information searches three years from now? To put it more bluntly, Coca-Cola and Durex are both famous brands, but if a car has their logo, would you really be willing to pay for it?

It is possible, but the larger the difference between the categories, the more difficult the transfer of brand value will be.

Recently, my team and I visited dozens of electric car users from different brands and different price ranges, to a certain extent verifying the above judgment.

We posed such a hypothetical question: “If Apple, Huawei, Xiaomi, DJI, Baidu, DiDi, and Evergrande all made cars and launched them together in three years, which one would you prefer to buy or look favorably upon?” We hope to indirectly observe the user’s attitudes towards future electric car brands, whether they are more pursued by classic mainstream or inclined towards innovative changes and what kind of changes they are seeking.

The results were very interesting. Xiaomi, the focus of this article, was not the first, but belongs to Huawei, and is noticeably ahead. Xiaomi and Apple are second together, each with their own supporters. Evergrande is ranked last, with no one liking it, and even questioning whether mentioning Evergrande in this question was a typing mistake.

In many cases, launching a new brand in a full category will be very difficult. That’s because you lack the accumulation, and users lack trust. But in this once in a century disruption of the car industry, the situation is different.

Recently, I watched an episode of the professional program, “Dongche Talks”, from the Dongchedi. It invited McKinsey Global Partner and China Auto Lead, Guan Mingyu, to do a sharing. Guan talked about a phenomenon, China’s high-end electric car market, which we define as a sub-market with a price above 200,000 yuan, is almost entirely controlled by the new electric car startups.

McKinsey’s research shows that among the pure electric car users in China, “because the brand I like only offers electric cars, I bought this brand of electric car”, this option’s proportion has jumped from 10% in 2019 to 15% in 2020, an increase of 50%.

Seeing McKinsey’s research results resonated with me because of a recent electric car user research project I was involved in, which showed the same trend.

I believe that when users face a comprehensive innovation of a new category (electric cars and fuel cars may be treated rigorously by engineers in the same way, but in the eyes of users, they are already two different categories), their inner desire is for a brand that is fully innovative. Many users’ subconscious minds just don’t want to see a logo that smells like gasoline.

I still remember what my little nephew said to me when he bought his new phone in 2012.

Translated English Markdown Text:

I question why he didn’t buy Nokia or Motorola phones and instead bought a model called Xiaomi 2, whose brand name sounds really strange.

He said: “Uncle, you don’t understand! Xiaomi is a smartphone designed specifically for us young people. Nokia and others are all traditional feature phones.”

Reputation by Category

In terms of popularity, many big business brands are well known. Evergrande, Wanda, Lenovo, Mengniu, Gree, all have very good name recognition.

But how many people have intense love for a brand, and is the key watershed for measuring a consumer brand’s excellence in the mobile internet age.

Apple, Nike, Harley, Costco, Tesla, NIO, Iverson (yes, that bad boy from the NBA), Luo Yonghao, Xiao Zhan, the common feature of these new and old cases is that they all have a group of people who love them dearly, regardless of how many people dislike these brands. Such brands often have stronger user stickiness and unique competitive advantages.

Xiaomi is clearly among them. This startup company can achieve a global top-3 sales volume for smartphones, not relying on Apple’s unparalleled ecosystem and software capabilities, Huawei’s massive resource investment to build solid self-developed capabilities, or Samsung’s deep control of the upstream and downstream industry chains. Its core lies in its ability to capture user needs and communicate with users, thus creating a great brand with a soul and winning the love of many fans.

Bad brand decision-makers always like to come up with a new story to please themselves and deceive the world.

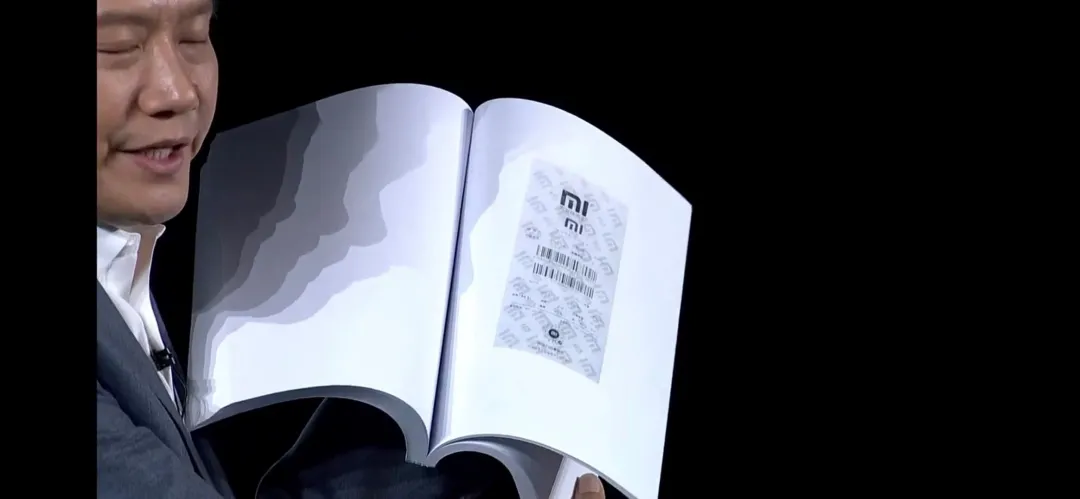

Excellent brand decision-makers are always uncreative repeaters who copy themselves. Xiaomi is now 11 years old. Lei Jun repeated the story he has been telling since his first year at today’s press conference: Xiaomi’s dedication to users and users’ love for Xiaomi.

Regarding making cars, Lei Jun didn’t say it was his own decision, he said Xiaomi did some research on making cars, and 92% of users said they would buy Xiaomi’s electric car.

He who wins the people’s hearts will win the world. Although the technology in the automotive industry is complex, after all, it is a consumer goods industry. In terms of capturing user needs and shaping brand appeal, Xiaomi has a significant advantage.

Not only do Xiaomi users love Xiaomi, but the whole society also has widespread recognition.

Zhihu Big V Sun Shaojun has ten years of experience in automotive channel retail, and he shared some fresh first-hand information.Markdown result:

Recently, the Volkswagen ID4 series was launched and is finding commercial locations in various places. Volkswagen went to negotiate with a quality commercial area they had set their sights on, but were rejected.

The reason for the rejection may leave car people speechless. The other party felt that the Volkswagen brand was too traditional and lacked customer flow attraction. They would prefer to introduce new leading brands or brands like Huawei and Xiaomi.

Shaojun said this is not an isolated case. He himself has heard of two similar events.

User Scale

Here, there is no need to say more. Just share some numbers.

Since the release of Xiaomi 1, Xiaomi has been in operation for ten consecutive years.

Xiaomi Group achieved 146 million shipments of smart phones in 2020, a year-on-year increase of 17.5%, and the average selling price of smart phones increased by 6.1% year-on-year to 1,039.8 yuan per unit.

Xiaomi IoT connection equipment reached 325 million, a year-on-year increase of 38.0%. The number of users who have five or more devices connected to the IoT platform reached 6.2 million, a year-on-year increase of 52.9%.

Many people are worried that Xiaomi users have limited payment capabilities. But in fact, this will not be a problem.

Because after the scale is large enough, there will always be a certain percentage of relatively high-budget users.

Xiaomi’s users continue to grow.

Seven or eight years ago, young people who spent one or two thousand yuan on Xiaomi phones may have succeeded in their careers today, their consumption vision has improved, their life stage is changing, and their consumption capabilities will be upgraded.

In 2020, Xiaomi sold 10 million high-end smart phones priced above 3,000 yuan in mainland China or priced above 300 euros in overseas markets. Although the proportion is not high compared to the global shipment volume of 146 million, the absolute number is relatively objective.

The user behind the 10 million high-end mobile phones is the most precise seed customer group of Xiaomi electric vehicles in the early stage.

Ecological Coordination

At the beginning of any strategic deployment, you always ask yourself a question: where are you stronger than your peers? The core of any conference is to answer this question.

As Lei Jun candidly admitted at the press conference, formal research into the electric vehicle business only began on January 15, 2021, and now obviously nothing can be released.

I believe this will also be the writing point where external criticism of Xiaomi’s release of electric vehicles: too much sentiment and too little substance.

But I think Lei Jun has actually hinted to the outside world about Xiaomi electric cars’ killer. One is the brand and users discussed above. The other is the ecological advantages of the product.

Lei Jun’s original words on stage were “A high-quality intelligent electric car for users, allowing global users to enjoy ubiquitous intelligent life.”

He also said that the reason for making the company 100% owned by Xiaomi is to achieve more complete ecological synergy, enabling seamless connection between cars, phones, and tablets. 100% ownership means that other Xiaomi old businesses, such as phones, will devote themselves completely to inputting resources into Xiaomi Electric Vehicle Company.

He also said that the reason for making the company 100% owned by Xiaomi is to achieve more complete ecological synergy, enabling seamless connection between cars, phones, and tablets. 100% ownership means that other Xiaomi old businesses, such as phones, will devote themselves completely to inputting resources into Xiaomi Electric Vehicle Company.

We’ve all seen the synergy between Apple’s iPhones, headphones, laptops, tablets, clouds, music, movies, and maps, and what kind of user experience and stickiness it brings.

Imagine what would happen if this synergy extended to cars. Users always prefer simple, consistent, and super low learning cost experiences. Nobody wants to sit in a car and have to say “Hello BMW” to activate the ABC function, “Hello zebra” to activate the DEF function, and “Hello Tmall” to activate XYZ.

This is forcing users to understand the Tier1 industrial layout of a complex industrial product. It would be a tragic experience, but it’s happening in this new era of “cars + the internet.”

Among the potential players in the current EV industry, there are only three that have the most potential worldwide: Xiaomi, Huawei, and Apple. They all possess the scale of smart hardware across categories, software development capabilities at a considerable level, and influential consumer brands. Xiaomi is the first to make a move.

Lei Jun’s Role

In the second round of new car-making, there are state-owned enterprises, private enterprises, car-makers, mobility services providers, search-engine makers, and autonomous-driving tech-makers. However, among the players known to the public, none of them is a big boss getting into action personally.

The other day, a friend asked me what I thought about Xiaomi making cars. I said it would depend on Lei Jun’s role. Whether an entrepreneur who has repeatedly proven himself would take on the role of the emperor or the pioneer would make this game look completely different. Li Bin, He XPeng, and Li Xiang ranked among the top three in the first round of new car-making, which was no coincidence.

Cars are something entirely different from other products, with many decisions here involving costs that amount to billions and years of verification cycles. What is the creative space left for managers? Those outside the industry find it hard to understand.

Some of my colleagues who worked at Nio used to be pretty efficient, but after they moved to a new company, they found themselves slowing down. Upon closer analysis, oh, it turns out that things that an individual could just do are now subject to reporting.

Reporting alone is not enough; a good PPT must be made before reporting. Even reporting doesn’t necessarily work. Leaders may veto it. Even if leaders don’t veto, it may not work. They may say: “You guys look into it again.”

Who wants to be like Carlos Ghosn, the hero who saved Nissan from near bankruptcy but ultimately became a sacrificial lamb in the Renault-Nissan power struggle? Ghosn had a salary of millions of euros, but he was still a manager.# Lei Jun’s Decision on Xiaomi’s Car Business: A Great Opportunity and Hidden Concern for the Main Business

As a translator in the automotive industry, my responsibility is to provide English translation, proofread the spelling, and refine the wording to ensure the correctness and coherence of the original text. I will only provide corrections and improvements, without any explanations.

Lei Jun’s decision on Xiaomi’s car business presents both a great opportunity and a hidden concern for its main business. Despite being a solid move towards diversification, one person’s span of control and focus are limited, thus facing strong competitors like Huawei and OV is indeed a difficult challenge.

As a large company with diversified businesses and a focus on streamlining and simplifying operations over the last two years, Lei Jun’s decision to participate or not in the car business is a tough choice.

The Xiaomi product launch event held last night was divided into three sections:

- 7:30 PM to 9:00 PM was the main event featuring the launch of new Xiaomi products, including smartphones, air purifiers, and laptops.

In this section, to be frank, Lei Jun, who was dealing with multiple tasks and not feeling well, may not have been able to prepare at 100% capacity. He relied on the team members to introduce some products on stage, giving the event a robotic feel.

- 9:00 PM to 9:15 PM was a transition period with Lei Jun’s personal speech “Transformation,” reflecting on his three major turning points in life.

Starting from this session, Lei Jun gradually gained his momentum, and even the virus that caused him to catch a cold stopped its activity due to his inspiring words. He also noticeably lowered the number of times he looked down to read his script, implying that Xiaomi should use remote, high-positioned teleprompters for the next product launch event.

- 9:15 PM to 9:40 PM was the climax of the event, revealing Xiaomi’s ambition to build cars.

Lei Jun spoke vigorously, displaying his confidence and determination, reminiscent of the hungry and unsatisfied entrepreneur he was a decade ago during the Xiaomi 1 Launch. He stakes his reputation and lifetime accumulation to undertake his last major entrepreneurial venture.

Pictures of Lei Jun in sportswear, repeatedly appearing on the slides, aimed to express his determination to embark on the new car-building journey, reflecting the hardworking and resilient spirit of entrepreneurship. The high-quality of Xiaomi’s product launch event, with meticulous pacing and attention to details, raised its level to the pinnacle of domestic standards, although still slightly below the standard set by NIO.

Will Xiaomi Succeed in Building Cars?

In my previous article, I highlighted Xiaomi’s advantages in building cars, but to avoid turning this article into an advertorial, I decided to write at least 1500 words of non-positive information to counterbalance it.

Lei Jun and his team will face three significant challenges:

The first challenge is to find the resources, including human resources and supply chain resources.

From the end of 2014 to early 2021, China’s automotive industry saw the rise of a handful of innovative and wild car manufacturers, along with their supply chains. Though there were also some swindlers and scalpers, this wave of new carmakers managed to absorb and cultivate a considerable number of industry talents, attracting more than developing from within.

Starting from 2020, a second wave of new carmakers gathered to start their business. Regardless of the financial power, finding talent who possess solid automotive expertise and entrepreneurial spirit is challenging for CEOs, HR professionals, and recruiters alike.# Shortage of Talents and Resources in China’s Automotive Industry

As the talent market in China’s automotive industry turns into a zero-sum game, leading companies like Tesla, NIO, XPeng, and IDEAL are already absorbing a large pool of talents. It is unlikely that the market will generate a significant number of talents to fill the gap.

Experience has shown that a deep understanding of the automotive industry is essential to avoid paying a high “tuition fee.”

In the early stage of building a career, skills and methodology are more critical than in-depth knowledge of the industry, products, and the market.

Even if Soviet representatives and leaders like Wang Ming and Bo Gu mastered classic theories and methodologies for the Revolution, without an understanding of the essence of the Chinese labor force, agriculture, and revolution, they could not expertly lead the national Red Army.

Similarly, in the supply chain, high-quality resources are scarce. As Pan Changxing, a project director at the Yo-auto Public Road Flight PM Club, stated, “since the second half of last year, excellent supply chains have been facing serious capacity shortages, receiving on average 2-3 visits or quotes per week. To control business risks, many meetings are usually needed to assess OEM’s potential value and economic strength before deciding whether to cooperate.”

Therefore, in the current automotive industry, not only do OEMs select suppliers, but high-quality suppliers also choose OEMs cautiously.

New car-making companies lack proper organizational capabilities, and therefore, they need to focus on winning the war for quality resources and talents.

Zhuka, the founder of Jlearner auto advisory, added that as shopping malls have become the primary contact point between auto brands and consumers, some EV brands have proactively signed marketing agreements, making it harder for newcomers to find good offline sales channels.

As history shows during the blossoming of the Hundred Flowers period, more “heads” involving different ideas often lead to resources increasingly congregating toward the top brands because the market sees the playing cards of every partner.

The Second Priority: Upgrading the Brand Image

For many years, I have never forgotten a line I heard in an old movie. A foreign performer expressed his contempt for Chinese-made products in vivid language. He said, “I love Chinese-made products. My lighter, tie, and suit are all made in China. But when it comes to buying a car, I will never choose a Chinese brand!”

This line of thinking we can now apply to future EV critics of Xiaomi and their products. They might say, “I love Xiaomi! My phone, television, router, notebook, charging head, air purifier, water purifier, air cooler, and sweeping robot were all made by Xiaomi! I am a fervent fan of Xiaomi! But, will I choose a Xiaomi EV? The answer is no.”

First, there are boundaries for every brand when they cross different product domains, and there is a “snobbishness” hierarchy between different product categories. The car industry and Xiaomi are in two totally different brand images. Another reason is that Xiaomi has not established a reputation for reliable quality, durability, and product lifespan over the years.The pepper student at the PM Club put it bluntly, “Users of fast-moving consumer goods do not have high requirements for reliability and lifespan, nor do they have high prices. They will not use it for a long time and can just throw it away if necessary. But users see cars as assets for their families. That’s different. Xiaomi’s quality control in the fast-moving consumer goods market is also struggling.”

As a long-time user of Xiaomi myself, I feel that Xiaomi always produces products with 8-point performance at a 6-point price, but it is not high-performance or high-quality. In fact, its failure rate is higher than that of traditional big brands in the same category.

How can Xiaomi respond to these naive user questions and as a company without car-making experience, create true automotive-grade quality and excellence, ultimately elevating the Xiaomi brand to an automotive-grade brand, will be a huge challenge.

The third is an unprecedentedly strong opponent

Let’s take a look at the strongest opponents Xiaomi has encountered in its history.

When Xiaomi went from 0 to 1 in the mobile phone business, there were many competitors, with new forces such as Apple and traditional old forces such as Nokia, Motorola, HTC, and Lenovo.

This battle was extremely difficult. Xiaomi started from scratch, had no manpower, no supply chain, and no money. There were many opponents, each with their own strengths.

In the end, Xiaomi made a brilliant breakthrough and once topped China’s mobile phone sales!

The battles that followed didn’t seem so difficult. When entering the smart TV market, the biggest opponent was the radical LeTV, followed by traditional TV giants such as Hisense and TCL, which had a stable rhythm.

After LeTV’s funding chain broke, Xiaomi TV did not encounter any major challenges. When entering the laptop market, Xiaomi was up against a group of mainstream old factories. Although it may not be able to obtain a large market share, it is not difficult to break through with its unique qualities.

Just by doing industrial design well and giving users a feeling similar to that of Macbook, it is already possible to win a segmented market.

Air purifiers, smart voice speakers, power banks, and other products often have a leading pace of development from Xiaomi, and with strong advantages in scale, brand empowerment, and self-operated channels, you won’t be surprised by Xiaomi’s triumph in each segmented market.

But cars are completely different. This time, the opponents Xiaomi is facing are probably even stronger than those 11 years ago.

In terms of traditional large car companies, there are Volkswagen, Toyota, BMW, and Mercedes-Benz outside, and BYD, Geely, and Great Wall inside.

In terms of new forces, there are Tesla outside, and WmAuto inside. The opponents encountered in the past, such as Apple, Nokia, and Lenovo, can be identified today, and they are even more challenging, with their scale multiplied several times over.

As a young company with founder genes, internet software capabilities, and an understanding of local users, Xiaomi relied on these differentiated advantages to break through with mainstream giants and international giants back then.

Today, the opponents that Lei Jun encounters, such as WmAuto, seem to have these qualities, and these companies have unimaginable cash reserves of hundreds of billions of yuan in their accounts. It is estimated that their value will double after going public in Hong Kong this year.Besides, the founders of BYD, Great Wall, and Geely are still in their prime, and these companies have more vitality and momentum than Lenovo had back then.

As for Tesla, this company has some similarities with Apple, but pursuing low prices is not like Apple at all. Instead, it is more like Xiaomi.

If the research started on January 15th and was announced yesterday, Xiaomi would still have to recruit and assemble a team and build a supply chain, even if it’s at the pace of 996. The brand new cars will not be delivered to customers until 2024 at the earliest.

By that day, if there is no accident, I estimate that NIO’s annual sales will exceed 200,000 units, equivalent to today’s Lexus China’s scale, with an average price higher than that of LEC.

XPeng is expected to sell 300,000 units annually and become the first high-performance cost-effective smart electric vehicle for young people. XPeng’s NGP is estimated to have iterated to version 5.0, and laser radars might be standard equipped.

On that day, will customers choose a brand new Xiaomi or a seemingly well-known and mature tech brand XPeng?

How can Xiaomi achieve its differentiated positioning and successfully break through on the top of the light magic pillar surrounded by electric car giants?

In the above-mentioned “Car Talk”, McKinsey also revealed another research result.

In 2020, there were 40 car brands with sales of more than 1,000 units in the United States, 39 in Germany, 26 in Japan, while China had as many as 101. China has the richest selection of car brands in the world for users to choose from.

But! In the face of so many choices, Chinese users have become increasingly focused.

In 2019, the initial brand list had 2.7 brands, which had become 1.9 in 2020.

This means that when users really buy a car, they just choose between two brands.

60% of users eventually buy the car they thought of initially from a list of about two brands.

Despite many friends on “Car Empire” and Zhihu’s automobile section being able to name all major car brands and keep up with their news…

Typical ordinary users are not consciously absorbing car knowledge. Just like me, a typical digital product user, I never pay attention to the notebook and mobile phone industry’s new products, I just update Apple products brainlessly, and at most take a glance at Huawei and Xiaomi.

When a typical user suddenly wants to change cars one day, he will find a handful of brands from his subconscious, and then selectively learn, receive and consider others’ opinions and suggestions.Simply put, if you praise the brand that he wants to buy, he is very likely to feel that you are making a lot of sense. If you criticize the brand that he wants to buy, he will think that you really don’t understand cars and may consult someone else instead.

If a brand cannot enter the subconscious of ordinary users, it is basically out of the game.

With Lei Jun entering the car-making industry, this is probably the most interesting time for this industry. Apple has already entered the game, but has not made an official announcement. Xiaomi has just made a decision to enter the game and immediately made an official announcement. From the perspective of the maturity of the industrial chain, it is most likely that the entrepreneurial pioneers will be the first to take the lead, followed by Apple, and then quickly followed by Xiaomi, and the industry will reach its climax.

Xiaomi’s internal attitude towards car-making is very clear. I believe they have anticipated the difficulties mentioned above and other difficulties.

Yesterday, Lei Jun was obviously facing a formidable enemy! Otherwise, the copywriting scale of the speech at the press conference would not be so large. Sometimes he said that this is the last major entrepreneurship in his life, and sometimes he said that he is betting his life’s accumulation and reputation, and sometimes he said “we have money.”

If Xiaomi only entered a wireless earphone category, does Lei Jun still need to speak like this?

Each of us has such life experience. When do you have the greatest scale of speech? Generally speaking, it is when you are confessing your love, proposing, campaigning, financing, and recruiting people. Because at these moments, you are not completely confident in your heart, and the other party may not follow you. Therefore, you need to step out of your usual self, say the most fierce words, boast the greatest, perform the most real drama, and create the biggest scene!

It is necessary to pick the lamp when walking on a road that has not been taken, and to shout bravely when facing an opponent that may not be defeated.

But for Xiaomi, this is a good thing.

It is impossible to make history again by repeatedly winning battles that are sure to win.

Finally, I want to wish Lei Jun and Xiaomi all the best. Lei Jun, like Li Bin, is the Chinese entrepreneur whom I admire the most. Xiaomi is the consumer brand that I have liked for many years.

I hope that such characters and brands can overcome all known and unknown difficulties and eventually succeed!

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.