Introduction

I took a day off today and visited Gu Village Park and saw the cherry blossoms with Yan Yan. There was a promotion for A00 new energy cars, including the promotion of Sihao and Euler.

With the new A00 models led by Changan and JAC lowering the prices to 40,000 yuan, I personally think there are a few points to consider:

-

This expansion of A00 BEV models is based on fuel consumption and new energy credits to survive outside of subsidies, meaning that the vitality of these cars is relatively strong. If the subsidies are removed, the cost impact of these low-priced BEVs on the market after a year and a half would be smaller than that of A-class.

-

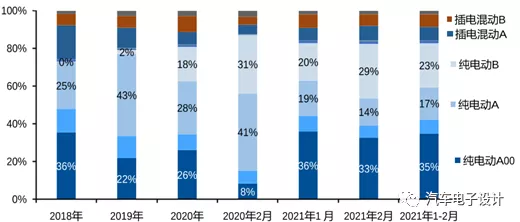

With the premise of certain accessibility for low-priced A00, it effectively replaces the functional A-class sedans for private consumption. Faced with the pressure of continuously decreasing B-level and A00-level prices, the pure electric A-class market that once occupied 43% of the market is very dangerous.

-

Although the channels for A00-level models differ for each car brand, in order to comply with strategies, car companies will continue to increase the number of 40,000-level models. As shown in the following figure, A00 BEV which was suppressed on the edge in 2019 has successfully resurrected and is estimated to account for 40%+ or even more than 50% of the market according to the situation this year.

The 2020 A00 market landscape

In 2020, several A00-level models had sales numbers as follows: Wuling Mini EV 119,200; eQ 38,200; Heima 37,400; Baojun E100 and E200, respectively 21,100 and 15,600. The Benben EV, which sold for 69,800-74,800 yuan in 2019, sold 11,200 units.

In this round of reshuffling for A00-level models in 2020, Wuling, Great Wall Euler, and Chery accounted for a large part of the market, while Zhi Dou, JAC, JMC, and Zotye, who enjoyed subsidy dividends in the previous round, were basically left behind, mostly due to the overall situation.

Looking at the situation of these car models in this round of variables, Wuling first lowered the price of non-subsidized 120 km vehicles to 28,800 yuan, while Great Wall and Chery maintained subsidies through longer mileage of 301 km on the one hand, and differentiation on the other.

Note: Wuling added a 200 km model in 2021, and prices are estimated to increase to just over 40,000 yuan.

Price Reduction in 2021

In 2021, Changan imported a special version priced at 29,800 yuan with a range of 150 kilometers, which competes directly with the Wuling Mini EV. The 301-kilometer version dropped from the original 69,800 yuan to 39,800 yuan, indicating their preparation for competition.

JAC transformed their iEV6 into the JAC Volkswagen Sihao E10, and positioned it under the Sihao brand, promoting the 150-kilometer version for 39,900 yuan and the 200-kilometer version for 46,900 yuan.

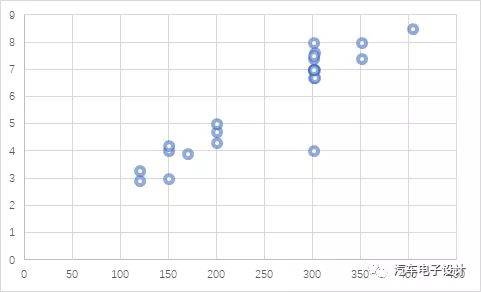

For these A00-level electric cars, power is not a major concern and range is the main focus of design. The prices are under 40,000 yuan for a 150-kilometer range and under 45,000 yuan for a 200-kilometer range. These cars are equipped with 10-20kWh batteries, while cars with ranges of over 300 kilometers typically require batteries with more than 30 kWh, which leads to a cost difference of 7,000 to 14,000 yuan due to a price of 0.7 yuan /Wh. Therefore, cars with ranges over 300 kilometers will be sold for over 60,000 yuan.

Note: Actual retail prices may decrease to around 50,000 yuan.

In fact, from the discussions on product definition and engineering initiated in 2020, after half a year of close research and analysis, various car companies will adjust the product layout of A00-level cars one after another by reducing battery systems and further reducing costs, which will have a significant effect on the fuel consumption of car companies.

Therefore, as we become increasingly certain of the new energy vehicle market, including A00-level cars priced around 60,000 to 90,000 yuan, we will continue to promote A00-level cars to third, fourth, and fifth-tier cities every month, priced at 50,000 to 70,000 yuan.

ConclusionCurrently, the A00 level is moving towards the extreme cost reduction mode. The restrictions on sales in this field are mostly due to each company’s own calculation of fuel consumption and credit needs. On the other hand, the willingness of suppliers to make losses and gains in volume under the rise of raw material prices is also a factor. Objectively, this has created an impact on the A0 and A-level markets for commuting vehicles.

Interestingly, in cities like Shanghai, there is a gradual increase in the number of BEVs that restrict driving below the A00 level for commuting purposes.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.