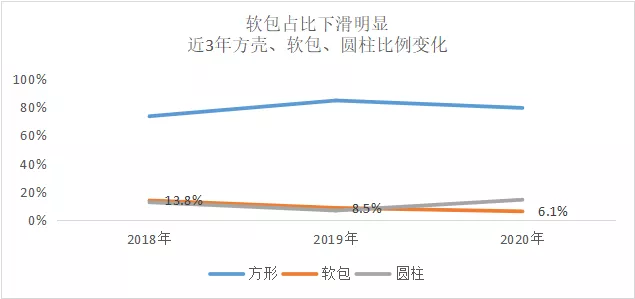

In recent years, the installation amount of Chinese soft-pack batteries in electric vehicles has been constantly decreasing. According to the data of the factory certification for whole vehicles, in 2020, the installation amount of soft-pack batteries was 9.2 GWh, and the market share decreased from 8.5% in 2019 to 6.1%, with a decrease of nearly 1.6 GWh.

Why does the market share of Chinese soft-pack batteries seem to be decreasing? Are they not favored by automakers? What is the future outlook?

On March 18-19, “The Second International Exchange Conference on New Energy Vehicles and Power Batteries (CIBF2021 Shenzhen)” was held in Shenzhen. This conference was organized by the Power Battery Application Branch of the China Chemical and Physical Power Industry Association and BatteryChina.com, and conducted in-depth discussions on the application and development of soft-pack battery technology.

Of course, automakers decide the installation of batteries. To find the root cause of the problems with soft-pack batteries, we still need to start with automakers.

Concerns of Automakers

After communication with responsible persons of automakers, “Electric Vehicle Observer” found that they have two main attitudes. One type of enterprises has preferences for technical routes. For example, Tesla is accustomed to using cylindrical batteries; domestically produced lithium iron phosphate batteries use square batteries from CATL, but the 4680 cylindrical battery was still announced by Tesla CEO Musk on Battery Day. Some domestic automakers like JAIC also prefer cylindrical batteries, while Changan focuses more on square batteries.

Another type of enterprise has no special preference for technical routes. As long as the requirements can be met, there are many such automakers.

“Electric Vehicle Observer” found in interviews with some automakers that there are doubts about the safety, reliability and group efficiency of soft-pack batteries.

(1) Concerns about safety and reliability

The deputy chief engineer of a certain automaker admitted that he had suffered from soft-pack batteries before, and the batteries would bulge and leak, with poor consistency and safety. Therefore, soft-pack products will not be considered until the quality of soft-pack products is significantly improved.

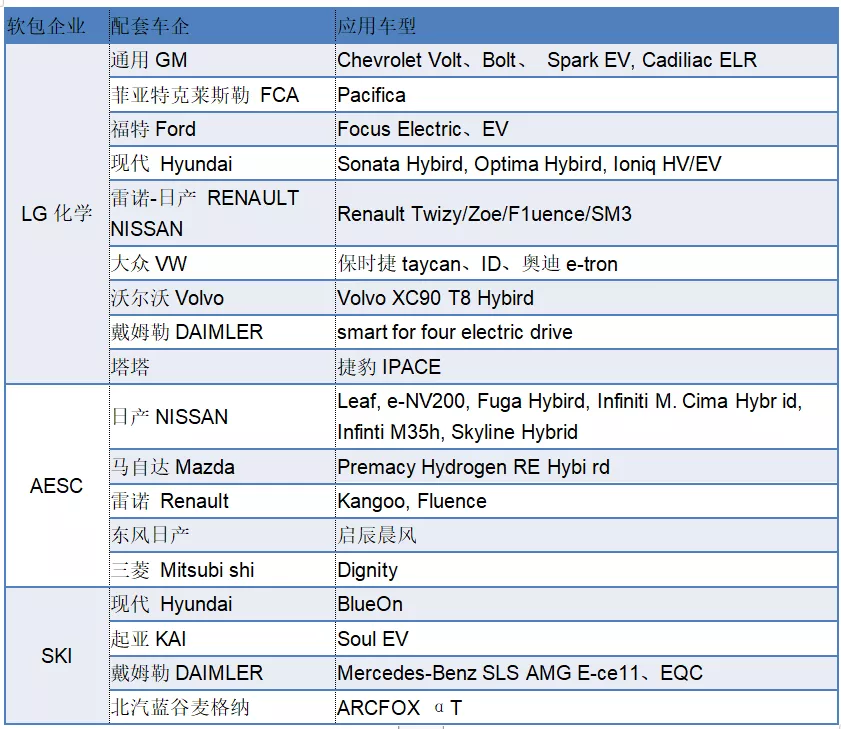

The engineer said that even if they choose soft-pack batteries in the future, they will give priority to LG Chem, Envision AESC and SKI, whose foundation of making soft-pack batteries is more solid and the control of soft-packs is more strict, making their products should be of better quality.

Some responsible persons of enterprises also have concerns about the lifespan of soft-pack batteries and supply chain safety.

“In general, the lifespan of an electric vehicle is more than ten years. The lifespan of the aluminum-plastic film of soft-pack batteries has not been verified, and it is uncertain whether the grouped batteries can reach the lifespan of the whole vehicle”, said the responsible person.

(2) Imperfect supply chainThere are also concerns about the supply chain security of soft pack batteries from some companies. Mr. Zhang, the battery chief of a certain automaker, said that due to the differences between the soft pack route and the mainstream route in China, some raw materials and production equipment still have relatively single procurement channels, mainly aluminum-plastic film, lithium battery production equipment, and a small amount of auxiliary materials. If there are problems with relevant suppliers, it will have a certain adverse effect on the production and operation of battery companies, the construction of production lines, and the supply stability of automakers.

According to public information, domestic enterprises account for 7%-8% of the total demand for aluminum-plastic film, and most of them rely on imports. The Chinese market is almost divided among four companies, namely, Japan’s DNP (about 50%), Japan’s Showa Electric (20%), Japan’s T&T (10%-15%), and South Korea’s Kolon (about 9%).

China has also acquired relevant patents and production lines for aluminum-plastic film through acquisitions. In 2016, Xinyuan Technology invested 9.5 billion yen to acquire T&T and entered the aluminum-plastic film business, obtaining factories and related assets, as well as exclusive licenses for all patents and proprietary technologies in China and non-exclusive licenses in Japan.

However, Xinyuan Technology’s aluminum-plastic film business progress is not smooth, and its market share is shrinking due to slow release of production capacity.

It can be seen that there are not many aluminum-plastic film companies that are recognized by soft pack battery companies and have production capacity in China. In the eyes of automakers, the supply of upstream raw materials for batteries is risky.

(3) Low grouping efficiency

Low grouping efficiency is one of the shortcomings of soft packs that automakers and system integrators often mention.

In their view, CTP (cell to pack) has become the mainstream trend of development, and the soft pack structure is not strong enough, so the module cannot be removed.

Mr. Liu, the head of a certain battery system integrator, has a similar opinion to the above view of a new force automaker. Mr. Liu believes that from the perspective of grouping, soft pack batteries are relatively soft, so they need to install many plastic brackets outside the battery cells, which wastes a lot of space and has a lower grouping efficiency.

Mr. Liu believes that car companies with higher cost requirements are unlikely to use soft pack batteries.

(4) Difficulty in making large-capacity cells

The capacity of soft pack battery cells cannot be too large. Due to the limitations of the aluminum-plastic film, the thickness of the battery cells cannot be too large, and can only be compensated for in length and width. Cells that are too long or too wide are difficult to fit inside the battery pack.

An executive of a new force enterprise said that he found that the length of the soft pack battery cell reaches its limit at about 500-600mm. If it is longer, the production process will not be able to cope, and the throughput rate will drop significantly.

Soft pack batteries are limited in thickness by the aluminum-plastic film, so they can only be constantly extended in length and width to increase battery capacity, or use positive electrode materials with higher nickel content to increase chemical activity to improve single cell capacity.

In terms of integration efficiency and cell thickness, square hard-shell batteries are superior. Therefore, automakers prefer square batteries more.

The decreasing importance of soft pack batteries in the international market

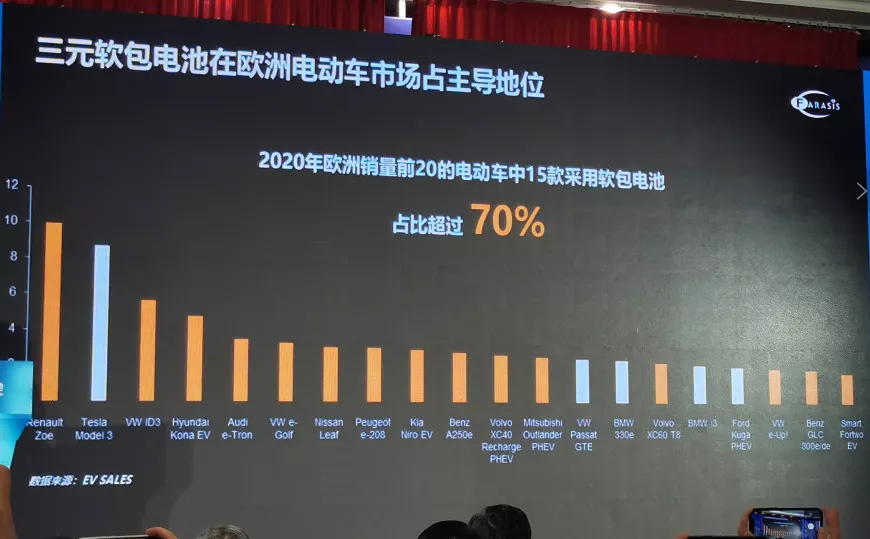

Although soft pack batteries are not popular among domestic automakers, they are still widely used in international automakers.According to EV sales data, 15 out of the top 20 best-selling new energy passenger cars in Europe in 2020 were equipped with soft-pack lithium-ion batteries, accounting for a staggering 75% of the market share.

Internationally, there are a large number of vehicle models that use soft-pack batteries. Incomplete statistics show that more than 30 vehicle models are equipped with soft-pack batteries.

The following are foreign vehicle manufacturers and models that use soft-pack batteries.

However, the high proportion of soft-pack batteries also poses many challenges. For example, the massive recall of LG battery cells, the intellectual property dispute between LG and SKI, and Volkswagen’s preference for pouch-shaped batteries have all had an impact on the market share of soft-pack batteries.

(1) Massive recall of LG power batteries

In October 2020, Hyundai announced a global recall of 76,000 Kona electric vehicles due to the risk of battery cell fires caused by LG Chemical, the supplier of the battery cells.

As a result, Hyundai initiated a global recall of around 82,000 electric vehicles.

On March 5, 2021, Korean business magazine Businesskorea reported that Hyundai and LG Chemical have agreed to split the cost of replacing the batteries for the recalled 82,000 EVs in a 3:7 ratio. The recall is estimated to cost KRW 1.4 trillion (approximately RMB 8 billion).

On November 13, 2020, General Motors announced a recall of 68,677 Bolt electric vehicles because they too used the LG Chemical batteries.

The overpriced recalls not only damaged LG Chemical’s reputation, but may also negatively impact the Hyundai Motor Group’s 2025 strategic plan.From the perspective of battery procurement, Hyundai Motor no longer chooses LG Chem as its first choice in 2020. For example, Genesis, a high-end brand under Hyundai, uses SKI’s battery solution for its first pure electric G80 EV; for the E-GMP electric platform battery supplier, multiple candidates have been selected. The first batch of batteries for models based on the E-GMP platform will be supplied by SKI, the second batch will be supplied by LG Chem and CATL, and the third batch is reportedly to be chosen between SKI and Samsung SDI.

In February of this year, it was reported that CATL won a battery order worth billions from Hyundai Motor. The latest news shows that BYD will provide blade batteries to Hyundai starting from 2022 and has already set up a project team for Hyundai.

After the LG Chem recall incident, it is clear that the benefits are also being reaped by two square battery giants in China.

(2) The long-lasting patent dispute between LG and SKI

The “tear-off” between the two major soft pack giants has also affected the supply of car companies.

South Korean battery manufacturers SKI and LG Chem have been “tearing off” for nearly two years due to disputes over power battery intellectual property rights.

The final result is that the U.S. International Trade Commission (ITC) issued a 10-year embargo on SKI, prohibiting the import of some lithium-ion batteries into the United States.

The ITC’s sanctions may seriously affect the development planning of electric vehicles of Volkswagen and Ford in the United States.

Earlier, Volkswagen and Ford warned that legal disputes between South Korean battery manufacturers could interrupt the supply of key parts for electric vehicles.

It can be seen that the dispute between the two soft pack battery giants has a great impact on the development planning of car companies, and car companies inevitably have doubts about their supply security.

(3) Volkswagen standardized cell using square batteries

While the two giants were in trouble, their patrons — Volkswagen — planned to switch suppliers.

At the recent Volkswagen “Power Day,” Volkswagen stated that it hopes that 80% of the models under the group can apply standardized cells, and 20% of the models can use non-standardized battery designs, which can achieve economies of scale.

From the press conference, Volkswagen’s standard cell selection is a square cell, which is a benefit to many Chinese power battery manufacturers. Especially for CATL, which has been deeply cultivating square cell batteries in the industry, it is also an important supplier of Volkswagen and very likely to be a beneficiary.

According to Reuters, Volkswagen has decided to achieve a major change in its battery supply chain within two years. According to the current battery technology strategy of this German manufacturing giant, Korean battery suppliers will largely be excluded from the new procurement list in the future.From recent media reports, Volkswagen is deepening its cooperation with Ningde Times. Reuters reported that three informed sources revealed that Volkswagen Group is planning to abandon cooperation with South Korean chemical companies LG Chem and SKI and shift towards more of Ningde Times’ products. A report by Yonhap News Agency on March 16 also had a similar statement. On the evening of March 16, Volkswagen Group CEO Diess also said in an interview with Chinese media, “We have had a lot of cooperation with Ningde Times, as well as maintaining cooperation with CATL, to obtain more battery sources.”

Ningde Times is sure to receive more orders. Currently, Ningde Times is also building a power battery factory in Germany, and may directly supply to Volkswagen in the future.

Undoubtedly, LG Chem’s situation has brought positive effects to Chinese battery companies and the square battery market share.

Does the soft pack still have a future?

People may wonder if the soft pack still has a future.

To judge the future of soft pack batteries, we need to understand the advantages, solutions to weaknesses, and attitudes of domestic battery companies towards the soft pack. After all, most companies do not have a preference for technical routes, and they do not reject the soft pack as long as they can do it well.

(1) High energy density, good safety, low internal resistance, and flexible design

First, high energy density. GGII data shows that the average energy density of three-element soft pack power batteries produced in the industry has reached 240-250Wh/kg, while the energy density of three-element square power batteries of the same material system is 210-230Wh/kg. The energy density of single soft pack power battery cells for three-element is 10%-15% higher than that of three-element square power batteries on average.

Taking Funeng Technology as an example, it has achieved 285Wh/Kg soft pack lithium-ion power battery industrialization.

Secondly, good safety performance. Under the aluminum-plastic film soft pack packaging, if the soft pack power battery under the same material system of three-element undergoes thermal runaway, gas will generally be released to dissipate heat. Square and cylindrical batteries, on the other hand, use hard-shell packaging and will cause explosions due to the inability to release heat with higher internal pressure.

In addition, square and cylindrical batteries produced by winding production process are more prone to uneven internal temperatures and stress distribution, especially at the winding and bending areas, thus causing safety hazards.

Third, three-element soft pack power batteries have large capacity and low internal resistance, which provides superior electrochemical performance. Due to the low internal resistance of three-element soft pack power batteries, self-discharge and heat generation are greatly reduced, improving battery rate performance and cycle life.

Fourth, at the cell level, the size and shape of three-element soft pack power battery cells are flexible, and companies can customize according to their own product design and customer needs. At the module and battery pack level, the space layout of three-element soft pack power batteries is more flexible, can be rectangular or T-shaped, and can meet the space requirements of more car models for power batteries.## (2) Group efficiency optimization and localization of aluminum-plastic film supply

In terms of group efficiency improvement, lightweighting, and process, Zeng Xiangbing, the head of the battery system department of Chery New Energy Automobile Technology Co., Ltd., proposed some suggestions.

Regarding group efficiency, Zeng Xiangbing believes that the layout space of the battery cells and the boundaries of the vehicle space should be made more standardized, and there should be no wasteful space left. In addition, the integrated large module technology should be adopted. If the energy density of the battery is increased, the overall efficiency will be greatly improved.

Regarding lightweighting, design, process, and material can all be optimized. For example, designing flat or hollow plates can reduce weight. Composite materials and lighter and stronger PCM materials can be used. The use of a magnesium-aluminum alloy for the lower shell will increase strength.

In terms of process, all connections are tanned and laser-welded, and adhesive structures can also be used. For example, the body of the small ant car is made of aluminum alloy and is glued. The density of the structure is lighter than that of metal, which can improve material properties.

Regarding aluminum-plastic film, Chinese suppliers are also rapidly rising.

In recent years, domestic aluminum-plastic film has continued to be updated and improved in equipment, technology industry, and materials, and product consistency, quality, and electrolyte resistance have all achieved significant development.

For example, Mingguan New Materials Co., Ltd. obtained a patent for aluminum-plastic film products in 2010, and now has 100 patents. Since 2017, Mingguan has shipped aluminum-plastic film products with zero accidents.

However, Mingguan has limited production capacity for aluminum-plastic film and is very cautious about expanding production. Yan Hongjia explained, “We have to consider the issue of consistency of our products. That is to say, if you can only produce a few thousand square meters, any product that has not been continuously produced for millions of square meters cannot guarantee consistency.”

When Mingguan believes that the technology is mature enough, it will start large-scale production. Currently, Mingguan is undergoing IPO and plans to raise 80 million yuan for a 10 million square meter lithium battery aluminum-plastic film expansion project.

As more and more enterprises participate in the production of aluminum-plastic films, and technology continues to mature, supply issues are expected to be resolved quickly.

(3) Chinese battery suppliers layout soft pack batteries

Whether this route has prospects depends on whether anyone is laying out and the status of the enterprises laying out?

Currently, leading Chinese power battery companies, CATL and Guoxuan High-tech, are both laying out soft pack batteries.

CATL has been supporting soft pack batteries since 2019, with installed capacity steadily increasing and jumping to the top of China’s soft pack market in June 2020.Last year, CATL ranked fifth among Chinese soft pack manufacturers with an installed capacity of 380.5 MWh, surpassing traditional soft pack enterprises such as Wanxiang, Thunder Sky, and CALB.

2020 Soft Pack Battery Installation TOP10

Recently, Daimler has reached a cooperation agreement with CATL again. Based on the information currently known by industry insiders, the future cooperation between the two sides will mainly focus on soft pack batteries.

In addition, Guoxuan High-tech also has soft pack battery production capacity layout, which mainly supplies Volkswagen. It is understood that Guoxuan is stepping up the construction of soft pack battery production capacity, such as building a 5GWh lithium iron phosphate soft pack battery cell production line for Wuling; the soft pack production line for Volkswagen will also be put into operation in 2022.

Although it is difficult to determine the market share of soft pack batteries in the future, it is certain that with more and more square battery enterprises entering the field of soft packs, the technology maturity of soft pack batteries will become higher and higher, and their market share will be significantly increased. Perhaps in the future, the market share will only be second to square batteries, becoming the second largest packaging form of power batteries.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.