Introduction

Rumors about Tesla’s new car priced at 160,000 RMB (25,000 USD) during the holiday season have been circulating. However, let’s take a closer look at the current situation of A-class cars, whose median price range is 120,000-180,000 RMB (15,000 USD), since this is the only sub-segment market that has experienced a downturn in 2020. Whether it is A-class sedans or A-class SUVs, consumers’ choices in 2020 were not particularly rational.

Why did the A-class car market decline in 2020?

As mentioned in the previous article, 2020 was the time when the private market began searching for products that met their needs. Many consumers started to choose the type of car they wanted to drive. This led to a very real problem:

1) The market for A-level cars is full of familiar faces, with a large proportion of A-level cars (sedans and SUVs) from both traditional automakers and new vehicle manufacturers being products that were previously launched. In recent years, the most important measure taken is to upgrade the powertrain, to increase the battery range and energy density of the batteries. The overall styling, interior and exterior decorations, and the level of intelligence are all based on small improvements made to the original fossil fuel models, which has led to significant problems.

-

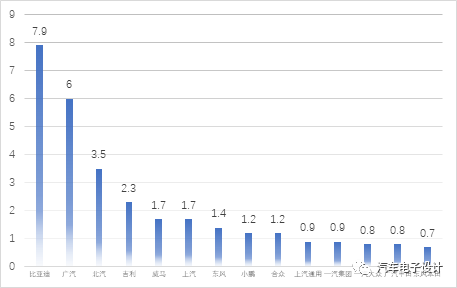

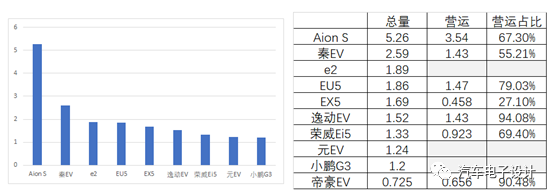

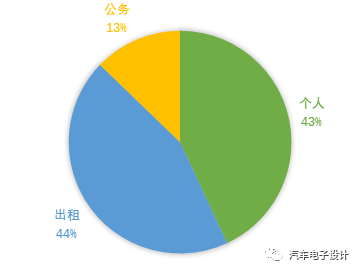

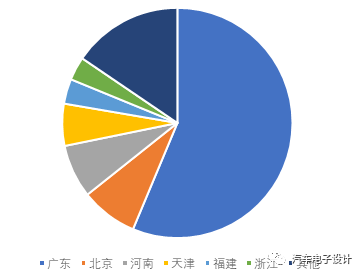

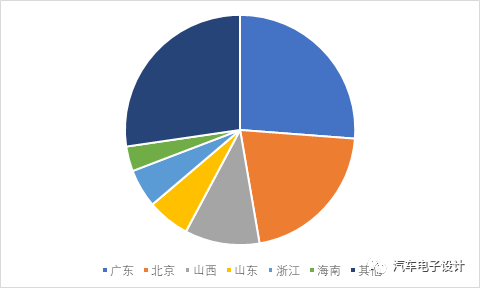

For this part of the models, the original intention was to develop private and operational (taxi + online car-hailing) models simultaneously. The Aion S, which ranked first, although only 52,600 units were insured, had 35,473 insured operational vehicles, accounting for 67.45% of the AION.S insured vehicles. In BYD’s Qin EV, out of 25,900 units, 14,332 were operating, accounting for more than 55%. The Changan Eado EV had 94%, and all 14,324 units were for operation. From the actual situation, the more operational vehicles there are, the lower the vehicle price will be, and the worse the continuity and expansion to private consumption will be. If the 46,000 government vehicles are added, it can be seen that consumers have too little impact in this regard, making it difficult to give sufficient feedback to automakers. Note: Qin EV and Qin Pro are calculated separately. The insured data for Qin Pro EV is 5,570 units.

-

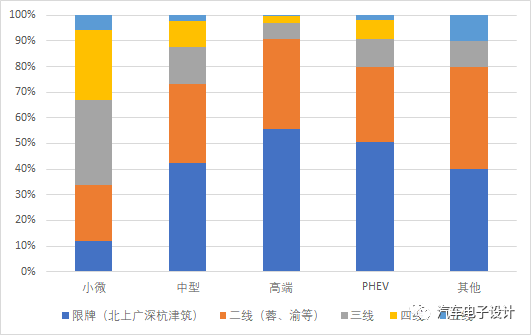

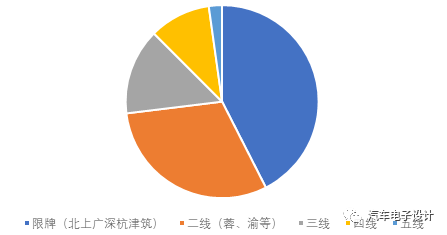

From a regional perspective, in the special environment of 2020, this type of model is very concentrated in certain areas, and the support of local areas is very obvious. There are significant differences in regional distribution compared to several Model 3s and typical models aimed at consumers.

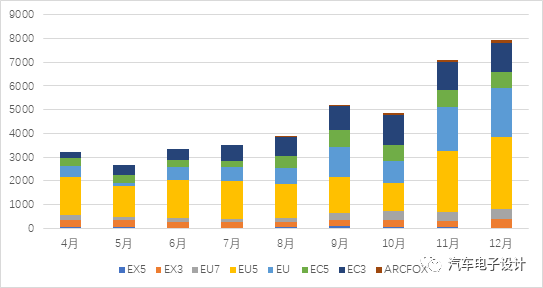

In this market, the situation for BAIC is quite typical. The demand for its EX series, which is for private use, is very limited as shown by the complete annual insureds of only 3,055 units for EX3 and a few hundred units for EX5. For smaller cars, EC5 had a demand of 5,237 units, while EC3 had 6,481 units. For the higher-end EU7, the market was completely closed, and the battery swap series EU only had around 10,000 units of insurance. Therefore, although BAIC started to gradually increase production in September, and achieved production of around 8,000 units in December, this figure is much lower compared to the previous year.

Therefore, we can elaborate on the outlook during this festival period:

1) This wave of domestic brands’ high-end pure electric vehicles is partly due to the transformation towards electric vehicle platforms and intelligentization, and partly due to an attempt to reconsider developing high-end vehicle models in a market-oriented manner under the existing model + sales network system. These models are essentially created according to the routines of some new car-making companies.

2) In the short term, the update rate of the A-class car market products is not so fast, such as AionS, a vehicle model that is still oil-to-electric, which has to wait for Aion V to iterate before adjusting to a pure electric vehicle platform. The implementation of this wave of platformization will still require 1-2 years. It is expected that the current pace may implement a round of innovation and replacement for A-class vehicles by 2022.

Conclusion

Currently, there are no particularly good new products. The focus of the 2021 EV models might still be on the larger ones above 200,000 yuan. This market is currently at a scale of about 400,000 yuan, and it is foreseeable to increase to the scale of 500,000-550,000 yuan with the demand for operation increasing in 2021. However, we cannot expect a significantly higher scale in 2021.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.