Introduction

It is highly likely that Apple will enter the smart car field, and foreign media have reported on Apple’s cooperation with Hyundai. DongAIlbo, a South Korean media outlet, reported (along with Bloomberg and other media) that Apple has invested 4 trillion won (approximately 3.6 billion U.S. dollars) in Kia as a start to cooperate in the production of electric cars with Kia (producing Apple cars at a car manufacturing plant in Georgia, USA). The core of the report is actually that Apple is building new models based on its system on the Electric-Global Modular Platform (E-GMP), which is Hyundai’s dedicated platform for pure electric cars. I think there are two reflected issues in this report:

1) Apple may focus on the cabin and autonomous driving, as well as the integration of vehicle networking and back-end, including the three electric parts, which have become common technologies;

2) In the current fiercely competitive global electric vehicle market, Hyundai’s differentiation is not particularly clear compared to other carmakers, purely based on three electric technologies and platformization. And in terms of autonomous driving, Hyundai is relatively conservative.

Hyundai’s Autonomous Driving Strategy

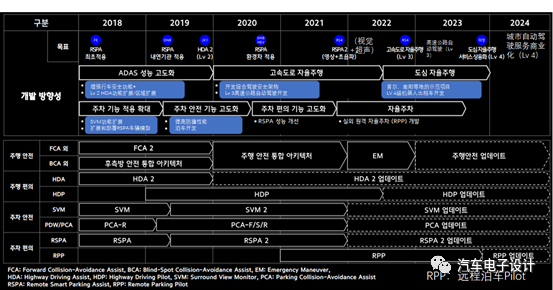

On December 10th, Hyundai’s IR document was in Korean (자율주행 기술 개발현황), and the overall strategy described in this document is as follows: Based on safety policies, Hyundai will develop individual functions such as FCA, BCA, HAD, HDP, SVM, PDW/CA RSPA, and RPP. In principle, it will gradually introduce autonomous driving content for L3 highways from 2020 (development) to 2022 (gradual introduction). Relevant work for L4 direction will be tested in some areas of Seoul in mid-2022. Note: Hyundai’s introduction pace is slower than that of several luxury car companies.

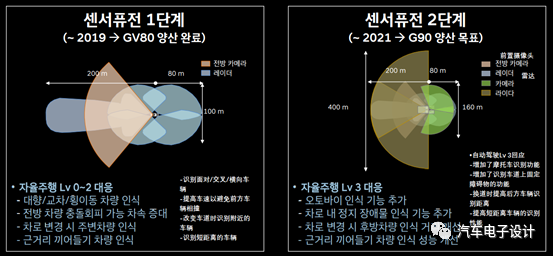

On the perception side, L2 and L3 have adopted front cameras and millimeter-wave radar, with the addition of front Lidar and rear vision in L3.

On the perception side, L2 and L3 have adopted front cameras and millimeter-wave radar, with the addition of front Lidar and rear vision in L3.

L2 object recognition: vehicles/pedestrians/two-wheeled vehicles/fixed small obstacles; short-distance interruption/lane change assistance/improvement of steering performance/road environment awareness/lane/parking lines/road markings/parking space lines/traffic lights; improving own vehicle positioning and driving/parking space recognition performance.

Compared with cameras/lidar (point cloud), L3 improves recognition accuracy/shape of external objects; enhances driving/localization performance through recognition of fixed obstacles/road boundaries; increases detection range and full-range detection; identifies distant targets and previous vehicles, as well as recognizes one’s own vehicle by recognizing surrounding buildings and structures.

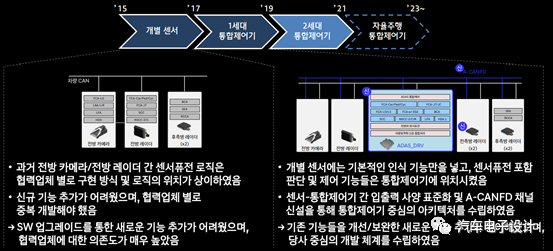

Like all car manufacturers, Hyundai imported ADAS domain controllers from distributed systems. Single sensors only have basic recognition functions, including sensor fusion judgment and control functions, which are located in the integrated controller. Input/output specifications between standardized sensors, integrated controllers, and CANFD channels have been established, and a centralized architecture with integrated controllers as the center has been created.

Like all car manufacturers, Hyundai imported ADAS domain controllers from distributed systems. Single sensors only have basic recognition functions, including sensor fusion judgment and control functions, which are located in the integrated controller. Input/output specifications between standardized sensors, integrated controllers, and CANFD channels have been established, and a centralized architecture with integrated controllers as the center has been created.

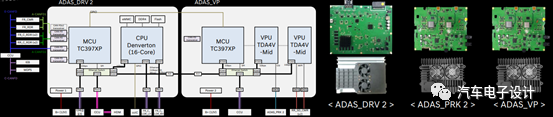

Here is a simple architecture of the Hyundai ADAS domain controller.

We can see that Hyundai has done a lot in the development of three-electric technology and the overall vehicle platform. That’s why we are willing to cooperate with them.

However, based on the next stage of continuous volume increase and the increase in the added value of electric vehicles, Hyundai Motor clearly lacks in the field of intelligence, and currently has not found a suitable partner to make up for this area. At present, major automakers around Toyota (a series of Japanese friends), GM (Honda and Microsoft and other technology companies), Volkswagen (Ford’s friends), Mercedes-Benz and BMW are burning a lot of money and need to maintain the volume of electric vehicles continuously.

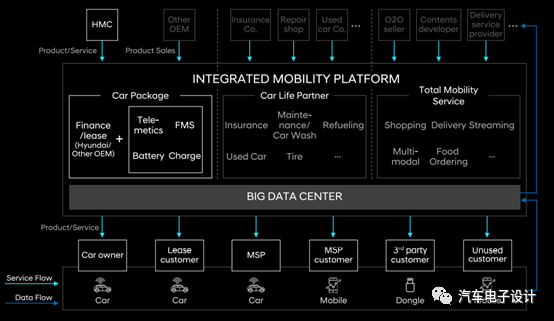

From the introduction of cooperation with Apple, there will be many changes that must be accepted, especially in the field of intelligence. Currently, if Hyundai Motor cooperates successfully, it will be the first company willing to open an open platform to assist the development and integration of new technologies. If this path is successful, more players who specialize in technology development could be involved in this field, and even low-market value car companies can be acquired as subsidiaries and then gradually separated. This is the process of fragmentation and differentiation.

Conclusion

In my opinion, the outlook for the automobile industry in the US stock and A-share markets this year is primarily driven by the optimism for new forces and the differentiation of some traditional companies. However, not all of these companies will have a good future, and the most important thing is still the forces behind it (IT technology companies dedicated to autonomous driving and intelligence on a global scale) driving this change. Traditional car companies like Hyundai Motor are slow in certain aspects. To complete their plans, they may need to release considerable dominance to find their future positions in intelligent cars (open platforms and OEMs to ensure that they are still there).

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.