No one will forget the year 2020.

The year 2020 was a year of vigilance for human beings on Earth. In this year, we guarded the most important line of defense for human health. It was also a year of breakthroughs in new energy markets. Whether it was the price reduction of Tesla, the high stock prices of new forces, or the attack on the A00 market sales, it left us with too many memories.

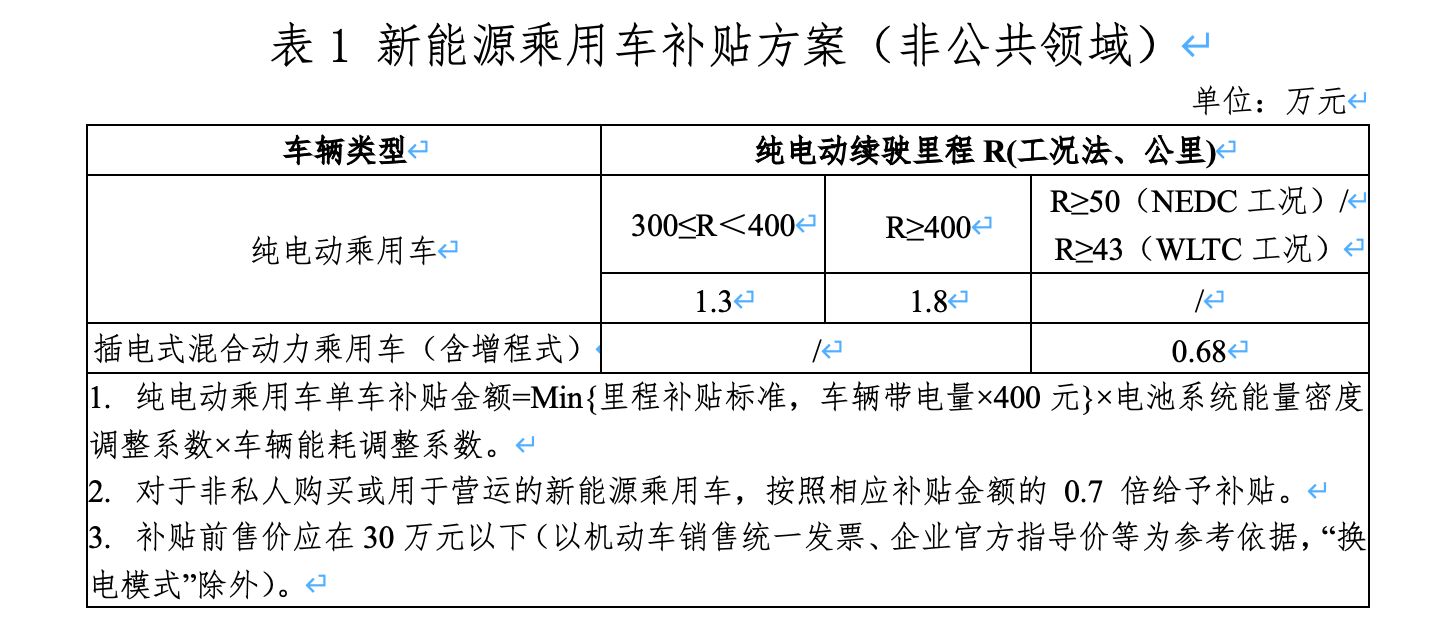

On the last day of 2020, in the afternoon of December 31st, the Ministry of Industry and Information Technology brought the final heavyweight news. The subsidy policy document for new energy vehicles in 2021 was released, with unchanged subsidy technical indicators and thresholds, and a 20% decrease in subsidy amount. The specific information is as follows:

- Pure electric vehicles with a range of 300-400 km will be subsidized with RMB 13,000, a decrease of RMB 3,200 from last year;

- Pure electric vehicles with a range of 400 km or more will be subsidized with RMB 18,000, a decrease of RMB 4,500 from last year;

- The hybrid vehicle model with a pure electric range of 50 km or more will be subsidized with RMB 6,800, a decrease of RMB 1,700 from last year.

According to the information announced at the beginning of 2020, the subsidy for new energy vehicles will continue to decline by 30% next year.

With the continued decline in subsidies, the dependence of electric vehicles on policies for their price has become lower and lower, which also means that the price of power batteries has gradually decreased to a reasonable level.

However, the product strength still needs to be improved. When electric vehicles completely break free from policies (license plates, etc.), they can still maintain a high growth trend, and the day when electric vehicles are popularized is not far away.

Here, we also take the opportunity to look at what has happened in this industry in 2020 and how far we are from popularization.

The “Three Kingdoms” of the automotive industry

If the automotive industry is divided into three categories according to energy structure, then the situation is the “three kingdoms” of fuel, plug-in hybrid, and pure electric.

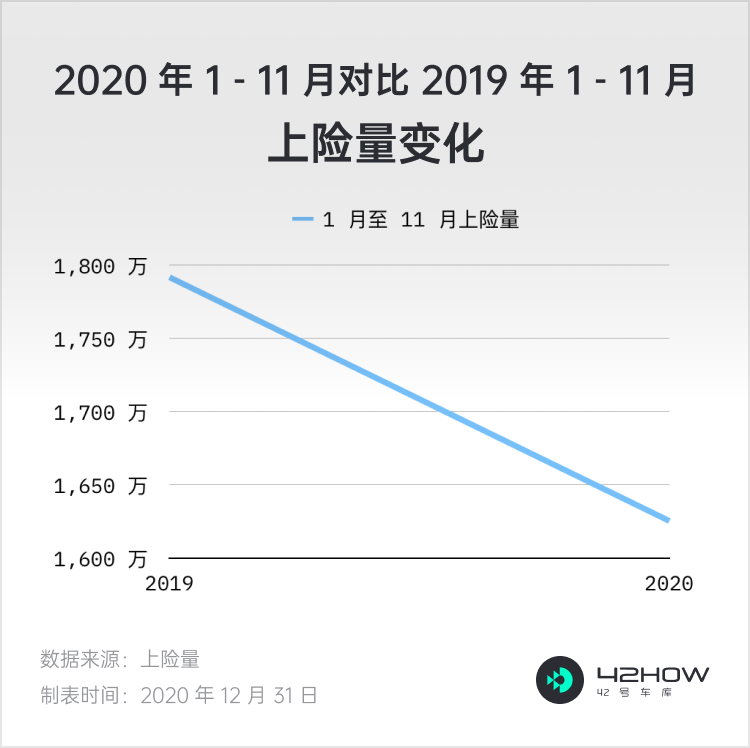

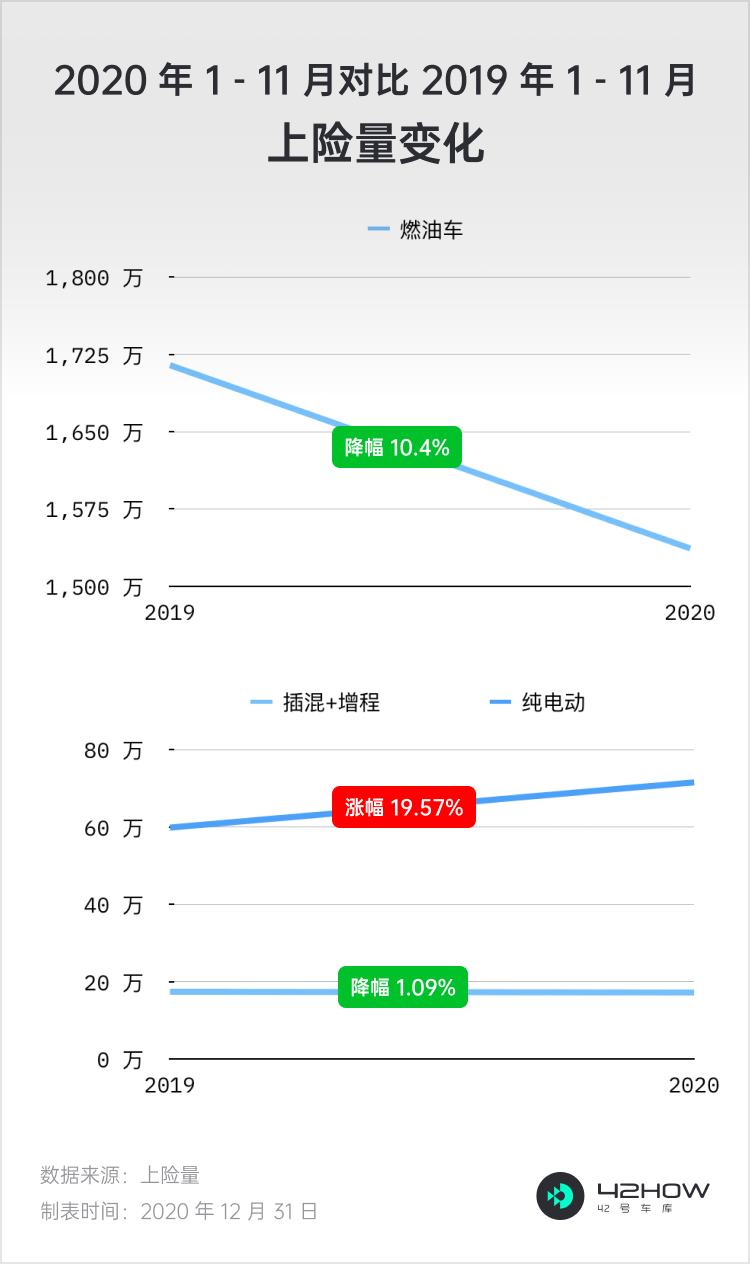

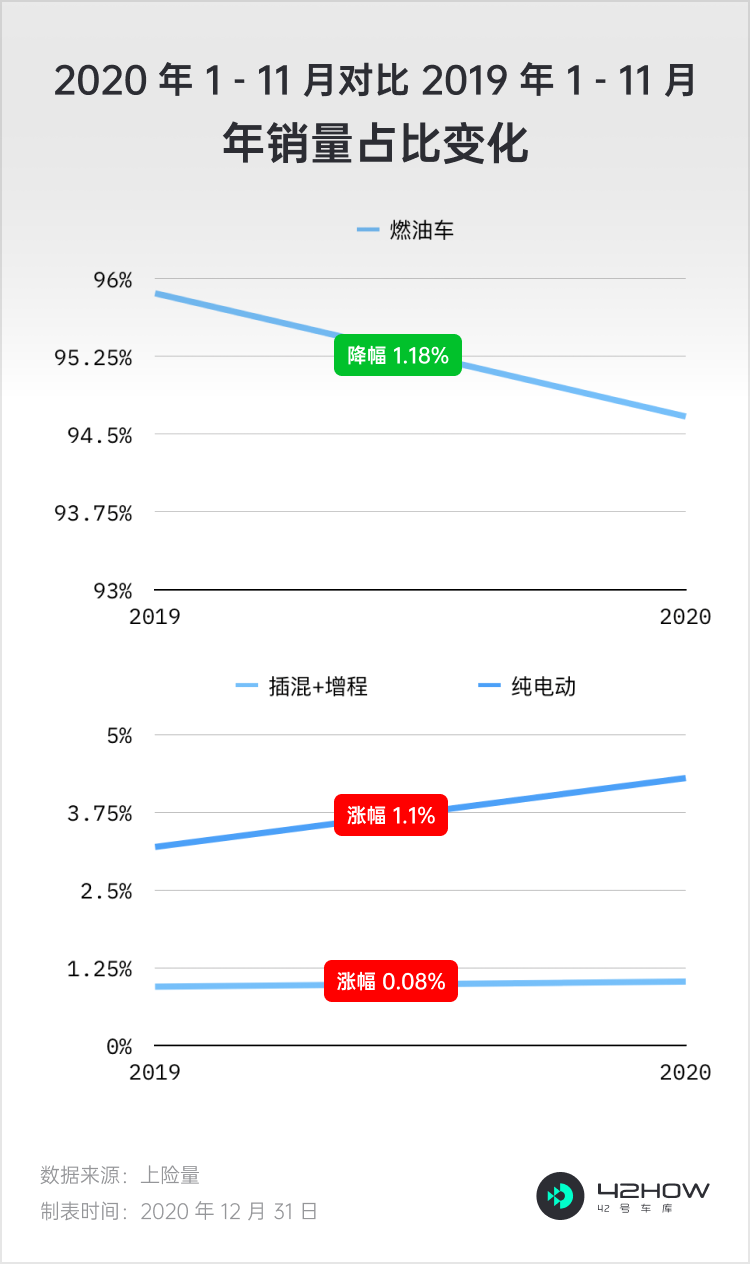

Firstly, let’s review the national vehicle insurance data of these “three categories” in the past two years. It should be noted that all the following data compares January-November, 2019 and January-November, 2020.

From the chart, it can be seen that due to the outbreak of the epidemic, slow economic growth, and the saturation of the domestic automobile ownership, the amount of insurance for this year’s automobile market has decreased significantly compared to last year. As of November 2020, the total number of insured vehicles decreased by 16,640,580, a decrease of 9.28% from the same period last year.

The most serious decline occurred in the market for fuel vehicles, which decreased by 1,779,314 units, with a sharp decline of 10.378%. Plug-in hybrid models fell by 1,897 units, with a decline of 1.09%. The only exception was pure electric vehicle models, which increased by 117,153 units year-on-year, with a significant increase of 19.57%. To be frank, in an environment where the overall market is declining, the rise in pure electric vehicle models can be considered “one shining star”.

The most serious decline occurred in the market for fuel vehicles, which decreased by 1,779,314 units, with a sharp decline of 10.378%. Plug-in hybrid models fell by 1,897 units, with a decline of 1.09%. The only exception was pure electric vehicle models, which increased by 117,153 units year-on-year, with a significant increase of 19.57%. To be frank, in an environment where the overall market is declining, the rise in pure electric vehicle models can be considered “one shining star”.

Looking at the market penetration rate, although the number of fuel vehicles insured has dropped the most this year, “a live camel is still bigger than a dead horse”. As of now, the market share of fuel vehicles is still at 94.67%, a year-on-year decrease of 1.18%.

Plug-in hybrid vehicles have the smallest market share, currently at 1.03%, an increase of 0.08% from last year. The current market share of pure electric vehicles is 4.3%, an increase of 1.1% year-on-year. From the overall market point of view, fuel vehicles are still the mainstream, although the rise of pure electric vehicle models is impressive, the market base is not large enough, so the market share is not high.

Looking at the percentage of consumer end-users, fuel vehicles and plug-in hybrid vehicles are generally above 90%, so there is no need to say more.

It is worth mentioning that this year, the number of insured pure electric vehicles sold to C-end customers increased from 389,447 units to 589,876 units, with a C-end user share of 83.14%, an increase of 15.32% compared to 67.82% last year. This also indicates from another perspective that pure electric vehicle models have been adopted by more consumers this year.

In addition, there is a very interesting phenomenon that although the total sales volume is declining this year, the average transaction price of vehicles is increasing. The average transaction price of fuel vehicles increased from 157,500 yuan last year to 180,100 yuan this year, and the average transaction price of pure electric vehicle models increased from 159,800 yuan to 179,400 yuan this year.

The only exception is plug-in hybrid vehicles, which decreased from 220,200 yuan to 219,200 yuan. Considering the sales volume and price of each type of vehicle, it should be the large shipment of BYD and Roewe models that affected this change in data.## The Electrified Cars That Stand Out

When looking at the data of the overall market, we can see that the increase in average transaction prices for cars indicates that although the current market demand for vehicles is decreasing, consumers’ purchasing power is actually improving, meaning they have higher demands for the quality of cars.

In terms of electric cars, they have also divided the marketplace into three distinct price ranges: below 100,000 RMB, between 100,000 RMB to 200,000 RMB, and above 200,000 RMB.

Firstly, taking the market for cars priced over 200,000 RMB, as of November 2020, Tesla’s bestselling Model 3 has delivered 111,645 vehicles in China. NIO has delivered 36,721 vehicles, while Li Auto Ideal ONE has delivered 26,498 and Xpeng P7 has delivered 21,341 vehicles.

Among the popular electric cars priced between 100,000 RMB and 200,000 RMB, the number of cars covered by insurance are: BYD Qin EV (21,313), GAC AION S (44,876), WM EX5 (13,484), and Xpeng G3 (9,948).

Regarding the popular electric vehicles in the A0 and A00 markets, Eulai Black Cat has 35,303 cars covered with insurance, BYD Yuan EV has 11,087, and the pre-sales coverage of ZERORUN T03 was 4,995 vehicles starting from May. Not to mention the leader of the pack, Wuling Hongguang MINI EV, which has sold over 80,713 vehicles in just six months since its pre-sale in June.

The consumer group for the price range of cars above 200,000 RMB mainly consists of those who have “upgraded” or “added on” to their cars. For this particular consumer segment, car manufacturers need to provide electric vehicles that not only offer structural changes in terms of energy sources, but also enhance the overall driving experience through smart technology in order to highlight their competitive advantages.

As for the A0 and A00 markets, which consist of first-time buyers and repeat customers, the enormous success of the Wuling Hongguang MINI EV and Eulai Black Cat is evidence of a strong market demand for this segment.

Compared with the past, there has been a significant rise in demand for cars in the price range between 100,000 RMB to 200,000 RMB. This is because more and more car manufacturers are targeting this market segment, as it is the largest battlefield in the automobile consumption market.Although the “threshold for buying a car” has come down, the overall performance is not as dazzling as the over 200,000 yuan range. The reason behind this is due to different consumer demands in different situations and consumption phases.

In the scenario of first purchase, most users prioritize meeting the family’s transportation needs, and tend to lean towards traditional fuel-powered vehicles for their power supply, which is different from users in the “replacement” or “additional purchase” scenarios who have higher demands for the product experience. There is a significant difference between these two groups of users.

In other words, standing firmly in the 100,000-200,000 yuan “household” market segment is the true indication that electric vehicles are widely accepted by the public. However, the sales situation of electric vehicles in this huge segmented market is not particularly optimistic.

The government’s “dual credit policy” is also driving the transformation of automobile enterprises towards new energy. Currently, the price of new energy credits, which is “in short supply”, continues to rise and has exceeded 3,000 yuan per point.

The high price has prompted many traditional auto companies to invest in electrification. Even if the newly produced new energy vehicles have no profit margin, they still have to persevere for the sake of credits.

Taking the Wuling Hongguang MINI as an example, according to insiders, based on the current production capacity, the cost of materials and transportation for one car is about 9,000 yuan in deficit. According to the credit formula, producing one NEDC range of 170 km for Wuling Hongguang MINI EV can obtain 2.84 new energy vehicle credits. Combined with the price of new energy credits exceeding 3,000 yuan per point, this can barely break even.

Domestic brands make a collective effort, luxury brands warm up, and joint ventures are still absent

The new energy market structure in 2020 has very obvious characteristics. Domestic brands are making significant progress in electrification, and traditional brands outside of the new forces are also beginning to enter the new energy market.

Nine well-known car companies, including BYD, SAIC, Geely, Dongfeng, Great Wall Motor, GAC, FAW, BAIC and Changan, have all laid out corresponding plans in the new energy field, and their products are becoming more widely available on the market.

In terms of major moves, this year Geely launched the SEA architecture designed for electric vehicles. Geely plans to develop electric car models from A to E grades on this platform. The first mass-produced car born on the platform is the Lynk & Co Zero. Official data shows that this car has an NEDC range of over 700 km, and can accelerate from 0 to 100 km in less than 4 seconds.

Great Wall has chosen a hybrid route, and this year launched the HEV+PHEV hybrid powertrain, which is capable of covering the A to C grade product lines. The technology structure adopts a low-speed power increase and high-speed direct drive method similar to the Honda i-MMD, and corresponding consideration has been made in energy consumption and power for all driving scenarios.# Electric Vehicle Brands and Technologies Are Evolving in China

Automakers such as BAIC, SAIC, GAC, and Dongfeng have established their own electric vehicle brands, which are all positioned to move upmarket. FAW is also moving upmarket by launching a flagship electric model, the E-HS9, under its Hongqi brand.

Luxury automakers have shifted from testing the waters to a more definitive push into the electric vehicle market in 2020, as they have become more aware of the growing trend and increasing pressure from Tesla. Each automaker has clarified its electrification product roadmap.

Mercedes-Benz plans to launch eight EQ series models by 2022. Three of them, EQA, EQB, and EQE, are scheduled to be produced in China in 2021. The flagship EQS will begin production in Germany next year with a WLTP range of over 700km. BMW has launched the iX3 to fill the gap in its pure electric portfolio and will soon release the iX, a mid-to-large sized SUV that is entirely independent from its traditional internal combustion vehicle lineup. Audi has included the Q4 e-Tron and e-Tron GT among its upcoming models.

In contrast, there is a noticeable gap among traditional Chinese auto manufacturers. Japanese automakers, in particular, have been relatively inactive in the pure electric market in 2020, with only Nissan’s Xuan Yi Pure Electric, Toyota’s CH-R EV and Yize E, and Honda’s X-NV Pure Electric being available as “special models.” Other overseas markets have the Mazda MX-30 Sporty EV Crossover and Honda Urban EV, but overall they are still lagging behind in terms of product lineup development.

However, the recent entry of Volkswagen’s ID brand and Toyota’s PHEV models have helped close the gap in the Chinese market for electric vehicles.

The development of electric vehicle technology shows a variety of emerging trends, such as the rise of extended-range electric vehicles.

In the old version of “Energy Saving and New Energy Vehicle Industry Development Plan (2012-2020),” the government emphasized “the current focus on the commercialization of pure electric vehicles and plug-in hybrid vehicles” as the guiding direction for technology development.

On October 20, 2020, the State Council issued the “New Energy Vehicle Industry Development Plan (2021-2035)”, which added the phrase “including extended-range” to the section on plug-in hybrid vehicles in chapter three. This is the first time that the government has specifically mentioned extended-range technology in relevant policies.On December 18th, IDEAL Automotive announced that its cumulative deliveries had surpassed 30,000 units, taking only 12 months and 14 days, making it the shortest time for a new energy vehicle start-up company to achieve such a milestone. In the SUV new energy vehicle market, IDEAL ONE has been on top of the sales charts for three consecutive months from September to November, indicating that the extended-range model has gained consumers’ recognition to some extent.

This year, the extended-range lineup has also welcomed a heavyweight participant. On December 18th, Voyah, a high-end electric vehicle brand under Dongfeng Group, released its first mass-produced model – Voyah FREE. As the first model of the brand, Voyah FREE provides both extended-range and pure electric options. However, the promotion has placed a greater emphasis on the extended-range version, targeting zero anxiety. The new model will also be delivered starting in the third quarter of 2021.

The addition of this new member has not only strengthened the extended-range market, but also provided further supplementation to the hybrid technology route.

Energy supplementation system is being truly valued

With this year’s charging piles being included in the national new infrastructure, public charging piles have been growing rapidly across the country. As of November, the average monthly increase of public charging piles is 17,000 nationwide, with a total increase of 320,000. The total number of charging piles has reached 1.539 million and increased by 31.1% year-on-year. In addition, according to data from the State Grid, in the first half of 2020, the power consumed for charging new energy vehicles reached 700 million kWh, an increase of 6.4% year-on-year.

However, compared with more than 5 million new energy vehicles, the ratio of vehicles to charging piles is about 3.24:1. Thus, more efforts need to be made in the infrastructure of energy supplementation.

In addition to the supportive electricity pricing policy for charging and replacing electric vehicles, the government has started to shift its subsidies from “purchasing behavior” to “energy supplementation system construction” in the new energy vehicle industry.

Taking the city of Wenzhou as an example, on December 23rd, the Wenzhou Government provided subsidies for completed and normally used charging piles, providing a subsidy of RMB 250 per kilowatt for DC piles and RMB 100 per kilowatt for AC piles. In terms of operational subsidies, the actual charging quantity is used as the criterion and charging infrastructure operators are granted a subsidy of RMB 0.1/kWh.

In addition to the government’s promotion of this matter, car companies have also been active.

Tesla has built more than 620 Supercharging stations, matched with more than 710 destination charging stations, covering more than 290 cities. Moreover, it has invested RMB 42 million to build a charging pile factory in Shanghai, planning to produce electric vehicle charging piles in China starting in the first quarter of next year, with an expected annual production of 10,000 charging piles.

This year, NIO deployed more than 50 battery-swapping stations, reaching a total of 172. In 2021, it plans to deploy another 200 battery-swapping stations, and 78 new charging stations were added this year, reaching a total of 100 stations.In earlier September, NIO announced its new Power Up Plan, offering a total of 100 million yuan in subsidies and deploying a total of 30,000 destination DC chargers.

In the fourth quarter of this year, XPeng completed the construction of 670 charging stations across 23 provincial-level administrative regions and 100 cities in just 95 days, providing users with lifetime free charging.

Meanwhile, Volkswagen, a traditional automaker, partnered with CAMS to establish 255 charging stations in 16 cities across the country, with a total deployment of over 1,000 DC charging piles. All of this is just the beginning for the electric vehicle market.

Capital is Accelerating the Maturation of New Energy

The stock prices of Tesla and the top three new forces, NIO, Li Auto, and XPeng, have catalyzed the breakthrough of new energy vehicles at the maximum rate.

In 2020, describing new energy vehicles as a “windfall” in the capital market is not an exaggeration. The reason for the appearance of this “windfall” is the value consensus formed by primary market investors. As the capital market has always been “the early bird, catching the warm spring water,” we have reason to believe that the trend of stock prices to some extent represents the trend of the future.

Let’s review the stock price trends of new forces and related industrial chains from January 1st to the last day of 2020:

- Tesla: from USD 84.9 to USD 694.78, an increase of 730.42%

- NIO: from USD 4.1 to USD 48.38, an increase of 1103.48%

- Li Auto: listed in the US on July 30th, from USD 15.5 to USD 29.06, an increase of 152.7%

- XPeng: listed in the US on August 27th, from USD 23.3 to USD 42.29, an increase of 181.93%

- CATL: from CNY 106.99 to CNY 343.77, an increase of 223.76%

At the same time, power battery companies such as Contemporary Amperex Technology and Microvast, as well as upstream and downstream supply chain companies such as Enjie, Ganzhou Gelin, Shengxin Lithium, and Hanrui Cobalt, all performed well.

Whether there is some “bubble” in the stock price or not, new forces of carmakers and the industry chain have generally been recognized by the capital market this year, and this is a fact. Behind this, the relationship between the performance of new forces of carmakers’ historical high-end delivery this year and consumers’ stronger purchasing confidence is determined by mutual support.

With the help of capital, new forces of carmakers have more than CNY 20 billion in cash. For companies with ideas and execution capabilities, capital support can help them achieve great success in their future development.

Tesla in 2020: A New Stage from 10 to 100

This year is the official takeoff of Tesla, with the company achieving unprecedented highs in both consumer and capital markets.The hot sales of Tesla’s main model, Model 3, have entered a new stage with the completion and mass production of the Shanghai factory. As of November, the cumulative sales of Model 3 in China since its first break of 10,000 in March have reached 116,119, firmly sitting at the top of China’s new energy vehicle sales list. As of November, the global sales of Model 3 have reached 300,488, also ranking first on the global new energy vehicle sales list.

Another high-potential model, Model Y, officially began delivery in the United States on March 13 and is still in the capacity climbing stage. Its cumulative sales as of November were 63,775.

Including Model S/X, Tesla’s new energy vehicle sales reached 407,710 in November. However, this data is still far from the target of 500,000 deliveries set for 2020, and it seems to be a considerable challenge. However, according to calculations by Twitter user Troy Teslike, Tesla’s Q4 production will reach about 183,000, exceeding the goal of 500,000.

Tesla, with its soaring sales in 2020, is also preparing intensively for the next stage. First, it will continue to increase production. The construction of the Shanghai factory’s Phase II went smoothly this year, and it is expected to have a total production capacity of 550,000 vehicles per year in 2021, while the current three-shift capacity of the Shanghai factory is 250,000 vehicles per year. The newly added production capacity is mainly for the Model Y, and its domestic version was listed in the national directory of the Ministry of Industry and Information Technology on November 30.

The construction of Tesla’s Berlin factory in Europe has not been as smooth as last year’s Shanghai factory, but there are no major problems with the plan to complete production next summer. The new factory will also produce the Model 3/Y, which has the greatest demand, with a corresponding production capacity of 500,000 vehicles per year. The Texas factory, which will be used to produce CyberTruck, started construction in May.

On the technological side, Tesla also released a new generation of 4680 batteries and integrated CTC chassis this year, continuing to expand its leading edge in the three-electric field. The Model S plaid with the next-generation chassis has an EPA range of a stunning 520 miles.

Tesla’s neural network-based assisted driving system also received a significant upgrade this year and can achieve the “strongest single-car intelligence” by completing unprotected left turns, automatic avoidance of oncoming vehicles, and driving on sections without lane markings. The FSD Beta began small-scale push testing in the fourth quarter, and if progress goes well, it will begin large-scale push in the first quarter of next year.Tesla’s stock price skyrocketed under a series of favorable news this year. On June 10th, Tesla’s stock closed at $1025.05 per share, with a total market value of $190.122 billion, surpassing Toyota’s total market value of $181.2 billion and becoming the world’s largest automaker by market capitalization.

In Q3 financial report, Tesla achieved profits for four consecutive quarters, with an all-time high overall gross margin of 23.5% and a single vehicle gross margin of 27.7%. The automotive business profit reached $2.105 billion. Musk also expressed his feelings of “I’ve never felt more optimistic about Tesla than I do today” during the conference call.

On December 22nd, Tesla was officially included in the S&P 500 Index. By the end of 2020, Tesla’s market value had reached $658.582 billion, more than three times that of Toyota.

Until the last day of 2020, Tesla still faced various challenges such as production capacity, local government policy restrictions, and new car landing, and its proportion in the global automotive market cannot be considered as a giant. However, this was the year when Tesla went from 10 to 100, and the next step would be faster expansion and growth. Such expansion also affects the further development of the global new energy market and smart cars.

The European New Energy Market has slightly overtaken China

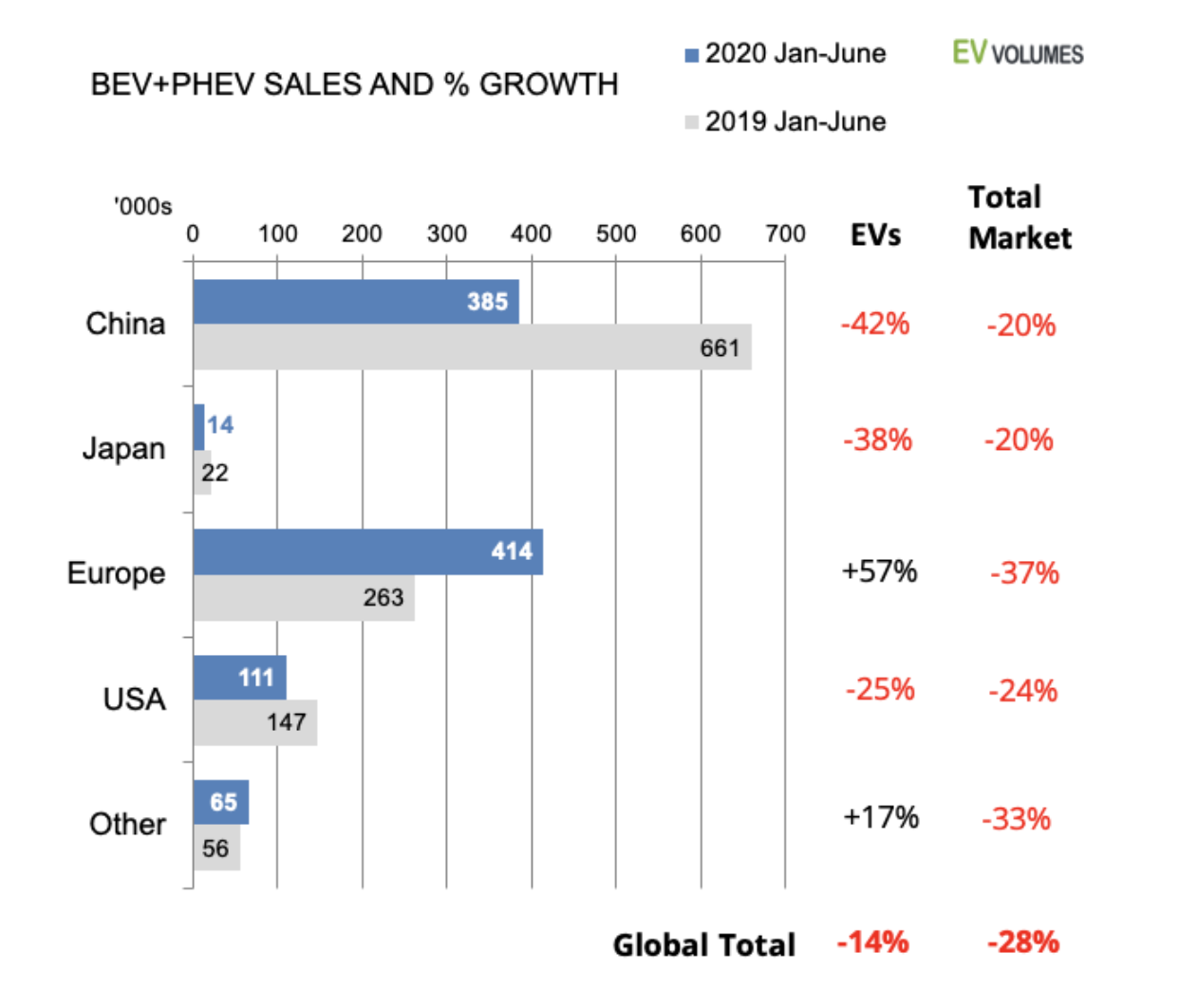

Affected by the epidemic, global civil car sales fell 28% YoY in the first half of 2020, while new energy sales fell 14%.

In the Chinese market, car sales in the first half of the year fell by 20% YoY, but new energy sales fell by 42%. In Europe, on the other hand, while the overall passenger car sales fell by 37%, it ushered in a new energy growth of as much as 57%.

Between the two situations, in the first half of the year, Europe’s accumulated sales of new energy vehicles reached 414,000 units, slightly surpassing China’s 385,000 units.

However, with timely prevention and control of the epidemic and rapid economic recovery, the new energy market in China has also rebounded rapidly. According to data from the Ministry of Commerce, China’s cumulative wholesale sales of new energy from January to November reached 1.109 million units, with a YoY growth rate of 3.9%, turning positive for the first time.

The new energy growth momentum in Europe this year will remain fierce in the second half of the year. The new car registration volume information statistics of EV Sales showed that Europe’s cumulative registration volume from January to November reached 1.085 million units, still slightly ahead before the results for December coming out.However, there are also significant differences in the top-selling models in the two markets under the data. In China’s top 20 new energy vehicle (NEV) sales, there are 16 pure electric vehicles (EVs), three plug-in hybrid electric vehicles (PHEVs) and one extended-range vehicle (ERV), with four hybrid electric vehicles (HEVs) selling 83,000 units in the top 20. In contrast, Europe’s top 20 consists of 12 pure EVs and eight PHEVs, with the eight HEVs selling a total of 178,000 units. This shows that European consumers are more accepting of HEVs.

In terms of size, China’s top 20 NEV sales as of November include seven A0 and A00 class cars, which sold a total of 236,000 units. In Europe’s top 20 list, there are six A0 and A00 class cars, selling a total of 194,000 units. Both regions show a strong enthusiasm for electric vehicles, especially for affordable options.

Governments in both China and Europe offer favorable policies for NEVs, including purchase or replacement subsidies. For example, in Germany, there is a subsidy of €9,000 for pure EVs priced over €40,000 and €7,500 for those priced below that threshold, which is equivalent to a subsidy of around RMB 320,000 and a final cost of RMB 248,000. Other countries such as France, the United Kingdom, and Italy also offer subsidies of thousands of euros.

The large subsidies in Europe could be seen as a critical stimulus for the surge in NEV sales this year. Furthermore, the EV charging infrastructure for personal use in Europe is more friendly compared to China, and European consumers who generally favor small cars can quickly switch to NEVs for commuting needs. For consumers in countries like Norway and Iceland, environmental issues play a high priority when choosing a car, thus NEVs meet their value orientation.

It is the combination of these and other factors that lead to the surge in NEV sales in Europe. In November, the overall NEV market penetration rate in Europe was 16%, with Norway’s rate reaching a staggering 79.9%. After November, Europe’s accumulated NEV penetration rate also broke through 10% for the year. In contrast, China’s November NEV penetration rate was 8.6%, and the accumulated penetration rate for the year was 5.9%.

Chinese auto companies that actively embrace electrification should see this point, especially with China’s strength in NEV products. Going abroad and competing in the European market is a viable option. SAIC Motor, XPeng, NIO, Aiways, and other companies have already started doing so, which may be the beginning of Chinese auto brands expanding their influence.

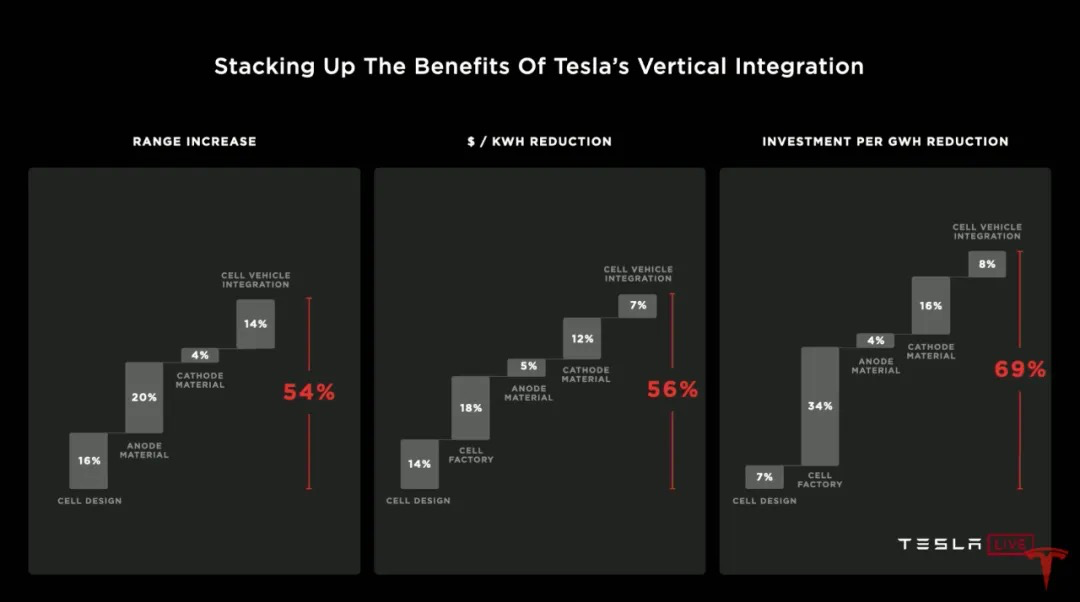

Finally, let’s talk about the cost of batteries, which is the cornerstone for sustainable and rapid development of the industry.As a leader in the industry, Tesla announced at Battery Day in September that the cost of its latest 4680 battery could be lowered by 56% at the current cost of power batteries. If calculated at the current Tesla battery price of $110/kWh, the price of the battery is expected to drop to $50/kWh in the era of 4680 cells.

As a result, Tesla will launch a pure electric vehicle priced at less than $25,000 in three years.

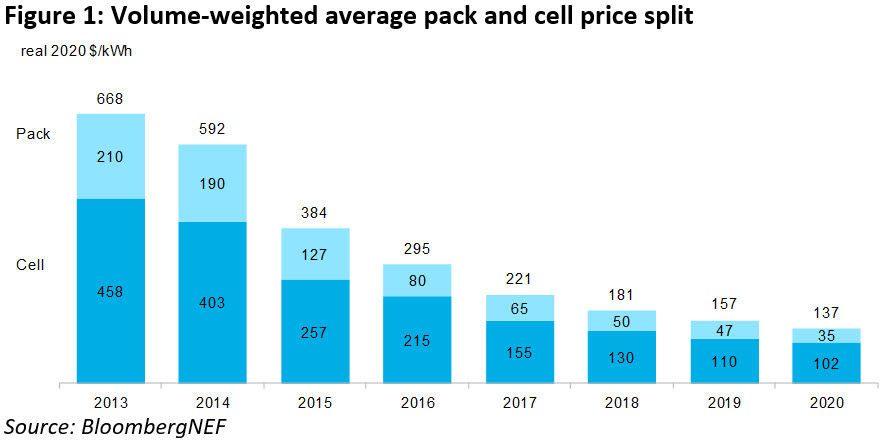

If you think this data is too aggressive, let’s take a look at Bloomberg’s prediction for future battery prices.

According to Bloomberg’s statistics, battery pack costs were about $137/kWh in 2020, down 13% from 2019. The price of the cell is $102/kWh.

BNEF predicts that battery pack costs will drop to around $100/kWh by 2023.

This price point is the industry’s recognized price point for electric vehicles to be cost-competitive with gasoline vehicles.

James Frith, BNEF’s energy storage research director and the main author of the report, said, “It will be a historic moment when the battery pack is below $100/kWh.”

Moreover, according to our research, even if raw material prices return to the high point of 2018, it will only delay the time for battery pack costs to fall to $100/kWh by two years and will not have a significant impact on the industry.

Now more and more battery factories are starting to invest in positive and negative electrode materials, and even directly acquiring related mines, so their adaptability to changes in raw material prices has become stronger.

This means that in the process of development, power manufacturers have become increasingly adept at controlling raw material prices, the integration of the industry has become higher, and the continuous decline in battery pack prices has become an inevitable trend.

Conclusion

In 2020, WeChat launched the “crack” emoji, which, like the world’s common sense, was cracked. In contrast, the intelligent electric vehicle market has witnessed an unprecedented “consensus” to promote a better travel life for human beings.

Breaking through the constraints means change. When Tesla plans to create the world’s strongest supercomputer for iterative assisted driving software, when NIO uses BaaS and an entire energy system to dispel users’ concerns about buying electric cars, when Ideal focuses on user value to open up new fields of increasing stamina, and when XPeng achieves a 93.2% voice interaction rate surpassing mobile phones, we see an industry full of vitality, imagination, and passion.“`markdown

No matter whether the changes come from external factors or internal factors, we should all give our blessings to this world.

Because every one of you who sees this has worked hard this year.

Happy New Year.

“`

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.