On December 18th, 2020, the official announcement from Li Auto stated that the cumulative delivery of vehicles has exceeded 30,000 units, and it only took 12 months and 14 days since its first delivery, making it the fastest among new car manufacturers.

However, this news was not the biggest hot topic in the automotive industry that day. On the same day, Dongfeng’s sub-brand Voyah released the first mass-produced car, the Voyah FREE, which is also a model that focuses on extended-range technology.

On one hand, one model represents a delivery record, on the other hand, the industry welcomes a new entrant, and extended-range technology becomes a hot topic again.

Is there a way out for extended-range technology?

Actually, there have always been many voices in the industry who deny the value of extended-range technology. During a media seminar held by Volkswagen in September of this year, Feng Sihan, CEO of Volkswagen China, said:

“From the perspective of an individual vehicle, extended-range electric vehicles have some value. However, from the perspective of the entire country and the world’s environmental protection, this is the worst solution.”

“The ultimate goal of developing electric vehicles is to reduce carbon emissions. However, if fossil fuels are used to generate electricity, then there is no need to do so.”

His comments show that Volkswagen takes a negative attitude towards extended-range technology, as they believe that it is inefficient and not environmentally friendly.

At the same meeting, Volkswagen China’s R&D director Widmann also expressed his skepticism about the extended-range route:

“Even for individual vehicles, extended-range electric vehicles have little significance. We researched the feasibility of extended-range electric vehicles several years ago, and now discussions on this technology are completely outdated.”

In fact, from a technical perspective, extended-range is not a high-tech or high-difficulty technology.

Powertrains with both range extenders and electric motors are often considered to be inefficient, complex, and unnecessary weight.

However, two advantages of extended-range technology should not be overlooked. One is the 100% electric drive, which can bring a nearly pure electric driving experience.

The second advantage is that although the range extender generates electricity through fuel, the internal combustion engine, which is decoupled from the drive system, can work in the most efficient range as much as possible without being limited by the vehicle’s driving conditions.

Under low-load conditions, this allows the energy required for driving to still have high efficiency even after one conversion.After the opinions from the Volkswagen conference were released, the voice saying “range extender is not the way to go” became louder. After this, Li Xiang himself made the following response.

There were also media (Kickstart) who did the final test, with a total of about 180 kilometers driven in both high-speed and city driving. The ideal ONE’s comprehensive fuel consumption rate for range extender was 6.56 L, and the Q7 eTron PHEV’s fuel consumption rate was 7.77 L, with the ideal ONE having a slight advantage.

After feeding power to the heating system, the ideal ONE’s power has decreased somewhat but still has 185 kW and remains electrically driven. By comparison, the PHEV Q7 eTron, after being powered for heating, behaves almost like a fuel-driven vehicle with a more general experience.

It should be pointed out that the difference in fuel consumption between the two is not actually that great, and the ideal ONE has a curb weight that is 215 kg lighter than the Q7 eTron. This comparison is not intended to demonstrate that the ideal ONE is stronger than Audi, but to prove that at least there is no disadvantage to the range extender compared to PHEV when used on a daily basis.

Leaving aside the question of superiority and inferiority, at least this result shows that Volkswagen’s belief that range extenders are not environmentally friendly, not necessary, and outdated is biased. Regardless of the bike’s experience or energy consumption, range extenders are meaningful and valuable.

However, Chen Jian is a mountain, and Volkswagen executives and technical experts have already expressed their views on range extenders, let alone ordinary people. Nevertheless, under the debate, the national policy has already taken a stand.

Policy Focus

On October 20th of this year, the General Office of the State Council issued the “Development Plan for the New Energy Vehicle Industry (2021-2035)”, which stated in the first paragraph of the document:

“Developing new energy vehicles is the only way for our country to move from a car country to a car power, and it is a strategic measure to deal with climate change and promote green development. Since the “Energy-saving and New Energy Vehicle Industry Development Plan (2012-2020) ” was issued by the State Council in 2012, our country has adhered to the pure electric drive strategic orientation. The development of the new energy vehicle industry has achieved tremendous achievements, and has become an important force in the transformation of the world’s automobile industry development.”

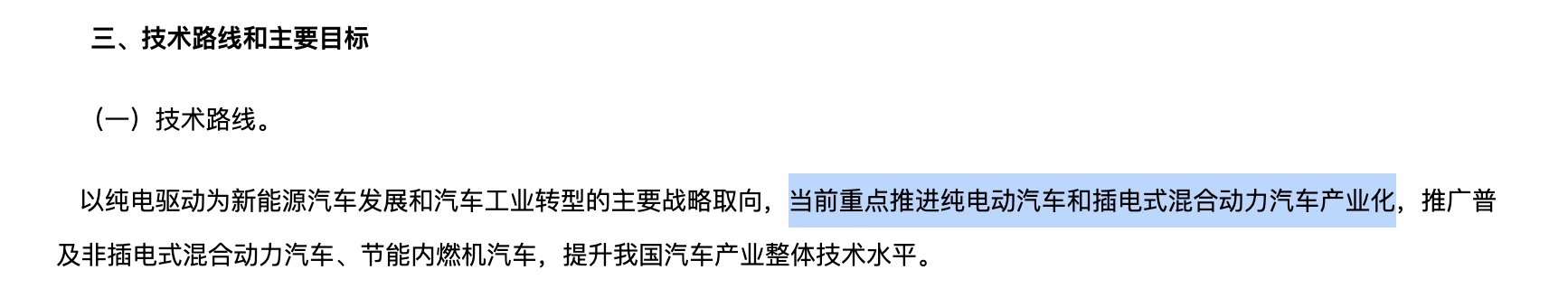

In the old version of the “Energy-saving and New Energy Vehicle Industry Development Plan (2012-2020)”, the country proposed a guiding direction of “currently promoting the industrialization of pure electric vehicles and plug-in hybrid vehicles” in the choice of technical route.

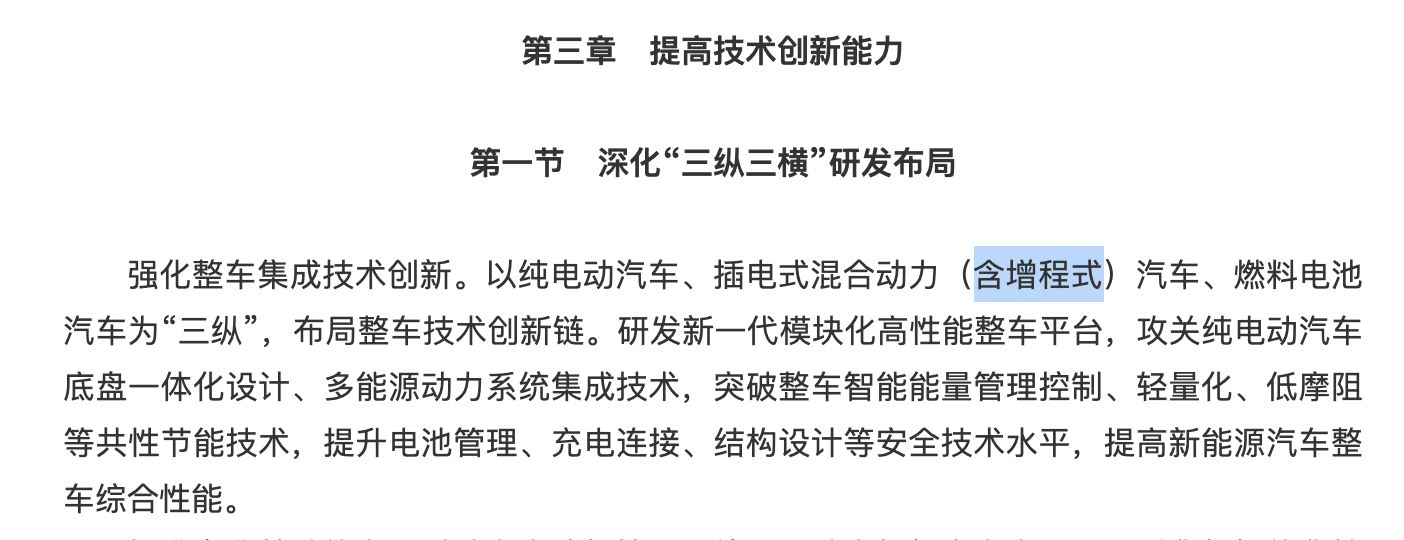

In Chapter 3 of the latest “Development Plan for the New Energy Vehicle Industry (2021-2035)”, the content of “Plug-in Hybrid” has been modified to include “Extended Range”.

Combined with the content of “Pure Electric Drive” mentioned earlier, this adjustment can be regarded as a formal endorsement by the state for the extended range route in the policy. Although the directional content has few words, it can be seen that the state supports extended range technology and its impact will be significant.

Blueprints for Extended Range

Electrification is the trend, but objectively, no technology is perfect. Choosing a technology route will have advantages and disadvantages.

As a high-end electric vehicle brand that Dongfeng Group has high hopes for, LanTu’s choice of technology route must have been carefully considered.

Pure electric is good, but not convenient enough

LanTu CEO Lu Fang mentioned LanTu’s extension plan in an interview after the new car launch event: “Under the current policy and legal conditions, as traditional fuel car engines become smaller and their performance decreases, while users continue to demand better vehicle performance and quality, LanTu hopes to solve these contradictions with high-power electric drive. However, charging inconvenience and energy supplement inconvenience often follow. Therefore, we have developed an extended range electric solution to let users truly have a worry-free drive experience.”

“Charging inconvenience and energy supplement inconvenience” are some of the driving forces behind LanTu’s plan for extended range. By the end of 2019, less than one-quarter of households in first-tier cities in China had access to charging facilities, and the ratio of public charging stations to the number of new energy vehicles was 1:17.1.

In November of this year, China’s new energy vehicle sales reached 180,000 units, a year-on-year increase of 128.6%, but this growth still only accounts for 8% of total vehicle sales. Although the driving range of electric vehicles has been increasing and charging facilities have been growing in number and speed, objectively speaking, compared with traditional fuel vehicles, the single-charge driving range of pure electric vehicles is still not long enough, and more importantly, the charging system is not as convenient as refueling.

This has made extended range technology a suitable choice for users of traditional fuel vehicles transitioning to electric vehicles, giving those who have range anxiety and are unwilling to choose pure electric vehicles a “half-step” experience towards electrification.## Lynk & Co and NIO

As practitioners of extended-range vehicles, Lynk & Co and NIO have come under the same roof. In an interview with reporters, Lu Fang was asked, “Lynk & Co FREE has a 1.5T four-cylinder engine and front double-wishbone independent suspension, making up for the shortcomings of NIO ONE. Is NIO ONE a direct competitor?“

Lu Fang replied, “We are not competitors with NIO ONE. We are comrades-in-arms with all new energy vehicle companies in the same battlefield, and our common goal is to continuously transform traditional fuel vehicles into new energy vehicles and actively promote the development of the electric vehicle market.”

Li Xiang also expressed his views on Lynk & Co’s entry into the extended-range market.

It can be seen that both parties have a shared perspective on this issue. In the current stage of incremental market development, focusing on one’s own strengths is more effective than blindly trying to compete with others.

However, a comparison of the two much-discussed SUV models can still be made.

The Lynk & Co FREE has dimensions of 4905 * 1950 * 1690 mm and a wheelbase of 2955 mm. The NIO ONE is 5020 * 1920* 1760 mm, with a wheelbase of 2935 mm.

Although both are medium-to-large sized SUVs, the more square shape and longer, taller body of the NIO ONE makes it look more imposing. The Lynk & Co FREE is wider, lower and shorter, with a visual effect that is more compact and sporty. There is already a significant difference in appearance between the two models.

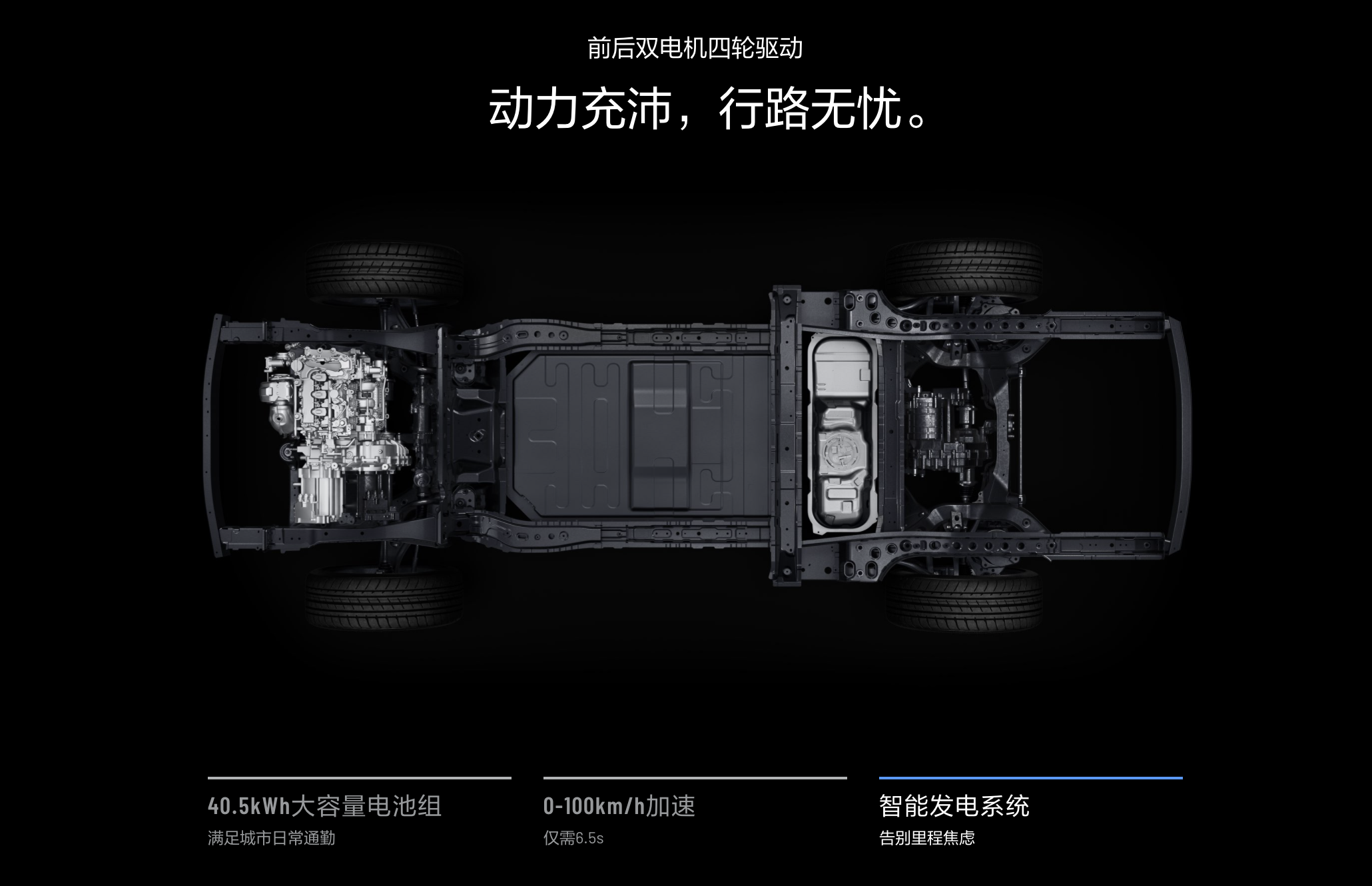

Regarding the powertrain, this difference is further amplified. The Lynk & Co FREE has front and rear dual-induction electric motors, with a total power of 500 kW, maximum torque of 1000 N·m, and a zero-to-100 km/h acceleration time of 4.6 seconds, with a top speed over 200 km/h.

The Li Auto ONE is equipped with front and rear permanent magnet motors, with a total power of 240 kW, maximum torque of 530 N·m, 0-100 km/h acceleration time of 6.5 seconds, and a top speed electronically limited to 172 km/h. As for the range extender, the Li Auto ONE is equipped with a 1.2T 3-cylinder range extender, while the LiangDao Free comes with a 1.5T 4-cylinder range extender.

As can be seen from the powertrain comparison, the LiangDao Free adopts an induction motor that emphasizes explosive power and performance, while the Li Auto ONE emphasizes energy efficiency with its permanent magnet synchronous motor. The former has over twice the power output of the latter and is equipped with a larger displacement and more cylinders in the range extender. The 0-100 km/h acceleration is also under 5 seconds, which undoubtedly provides a stronger and more exhilarating driving experience.

However, emphasizing performance also means making certain compromises in energy efficiency. The Li Auto ONE is equipped with a 40.5 kWh battery pack, with a pure electric range of 180 km under NEDC test conditions. The LiangDao Free has a 34 kWh battery capacity with a pure electric range of 140 km under NEDC test conditions. Simply calculated, the Li Auto ONE’s energy consumption under pure electric conditions is 22.5 kWh/100 km, while the LiangDao Free’s energy consumption is 24.3 kWh/100 km.

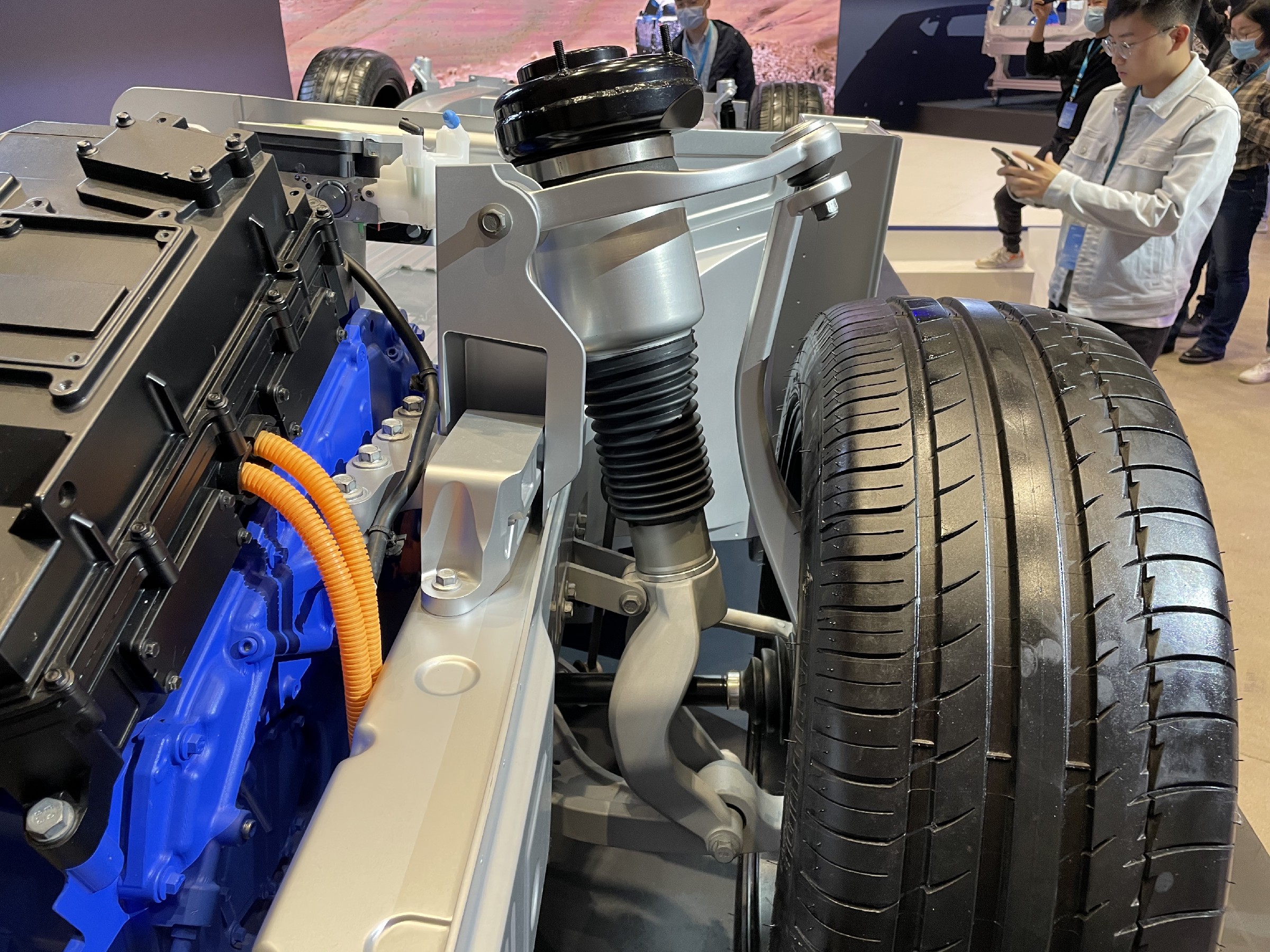

In terms of suspension, there are also significant differences between the two vehicles. The Li Auto ONE adopts a front MacPherson suspension and rear multi-link configuration, while the LiangDao Free uses a front double wishbone suspension and rear multi-link configuration. Moreover, on this basis, the LiangDao Free is equipped with a height-adjustable air suspension, which is superior in configuration and functionality.

Another important difference is that the LiangDao Free is a 5-seat vehicle, while the Li Auto ONE has 6 seats. Lu Fang said that the 5-seat configuration is a layout that consumers demand more strongly, and the LiangDao Free is a vehicle that can make everyone in the car sit comfortably.

After experiencing the LiangDao Free’s real car, I have to say that its space is indeed very spacious, with a nearly 3-meter wheelbase, and the experience of the front and rear seats is excellent. The Li Auto ONE, on the other hand, is more geared towards a family-oriented vehicle, accommodating three rows of passengers, and thus placing more emphasis on providing ample space for everyone in the car.

In fact, the aforementioned differences between the two vehicles are also related to each other. The Li Auto ONE’s MacPherson front suspension and coaxial motor structure reduces the intrusion of the front compartment into the space of the car, which brings many benefits to the design of the third-row seating.## Translation in English

Voyah FREE is more focused on the performance and driving experience. That’s why it doesn’t care about the third row and instead uses a more space-occupying suspension structure and a front compartment powertrain. The remaining space can still create a luxurious two-row, five-seat vehicle.

As both of them are extended-range cars, Ideal ONE emphasizes on economic practicality to meet the travel needs of the whole family.

Voyah FREE is more focused on the high-level and luxurious feel that comes with powerful driving experience.

In terms of product positioning, the two are far apart, but they both provide distinct options for users who favor extended-range vehicles and are promoting the transformation of fuel vehicles to new energy vehicles. Lu Fang used “comrades” to describe the relationship between the two companies, which I think is fitting.

Beyond extended-range for Voyah

Voyah Automobile is a Dongfeng sub-brand and a central enterprise. This special identity has also raised many questions about Voyah’s entry into the high-end new energy field. Everybody wants to do high-end things, but it’s not easy. In an interview, a reporter asked, “Is Voyah’s development choosing the Red Flag model or the NIO model?”

Voyah CBO Lu Xin said: “Speaking of the market, copying is not successful. Only by creating your own unique advantages and distinctive personal labels can you possibly be recognized.”

Lu Fang also said that the best mode is the one that suits Voyah the most. For example, Voyah believes that focusing on services and doing direct sales can promote its better development.

In Voyah’s current plan, 40 direct experience stores will be established nationwide in 2021. In addition to establishing experience centers in commercial areas, Voyah plans to establish service centers near users’ living areas.

In response to the question “Voyah Experience Center, is it a cooperative mode, a self-built mode, or an upgrade using the Dongfeng brand system?” Lu Xin replied: “The core of the brand experience center is direct sales.” However, in the initial stage, due to industry access qualifications, some business will cooperate with particularly mature and high-end brands to meet the high-standard and good requirements of users.”

This move clearly shows that Voyah is learning from new forces in user operation logic, but it lacks relevant experience and qualifications, so it is not fully direct-selling in the initial stage. Lu Xin’s words also show that Voyah’s foray into this new field is cautious.

I think this caution is understandable because Voyah is a central enterprise and high-end positioning. Every step at the beginning will have far-reaching effects on the brand, and the cost of making mistakes is very high.

During the interview, the media also asked how Voyah could “borrow Dongfeng”.

Lu Fang believes that Dongfeng, with its mature supplier system and years of experience in car making, is a powerful help for the development of Voyah. Dongfeng has given Voyah more authorization internally, allowing Voyah to have a lot of autonomy in decision-making, which has brought many benefits to the management of the company.

Lu Fang believes that Dongfeng, with its mature supplier system and years of experience in car making, is a powerful help for the development of Voyah. Dongfeng has given Voyah more authorization internally, allowing Voyah to have a lot of autonomy in decision-making, which has brought many benefits to the management of the company.

In addition to technology and strategy, Dongfeng has also provided Voyah with significant financial support. Currently, Dongfeng is preparing for an IPO, while Voyah plans to go public on the Science and Technology Innovation Board.

In conclusion

2020 is an important year for the new energy industry. Under the economic pressure brought by the epidemic, some people have left, while others have been reborn. In this year, Tesla’s market value surpassed Toyota, igniting the enthusiasm of investors around the world for new energy investment.

In China, Li Auto went public in the United States, BYD’s market value exceeded 500 billion, and NIO staged a comeback and surpassed SAIC in market value.

Electrification and new car manufacturing have become the trend of the times.

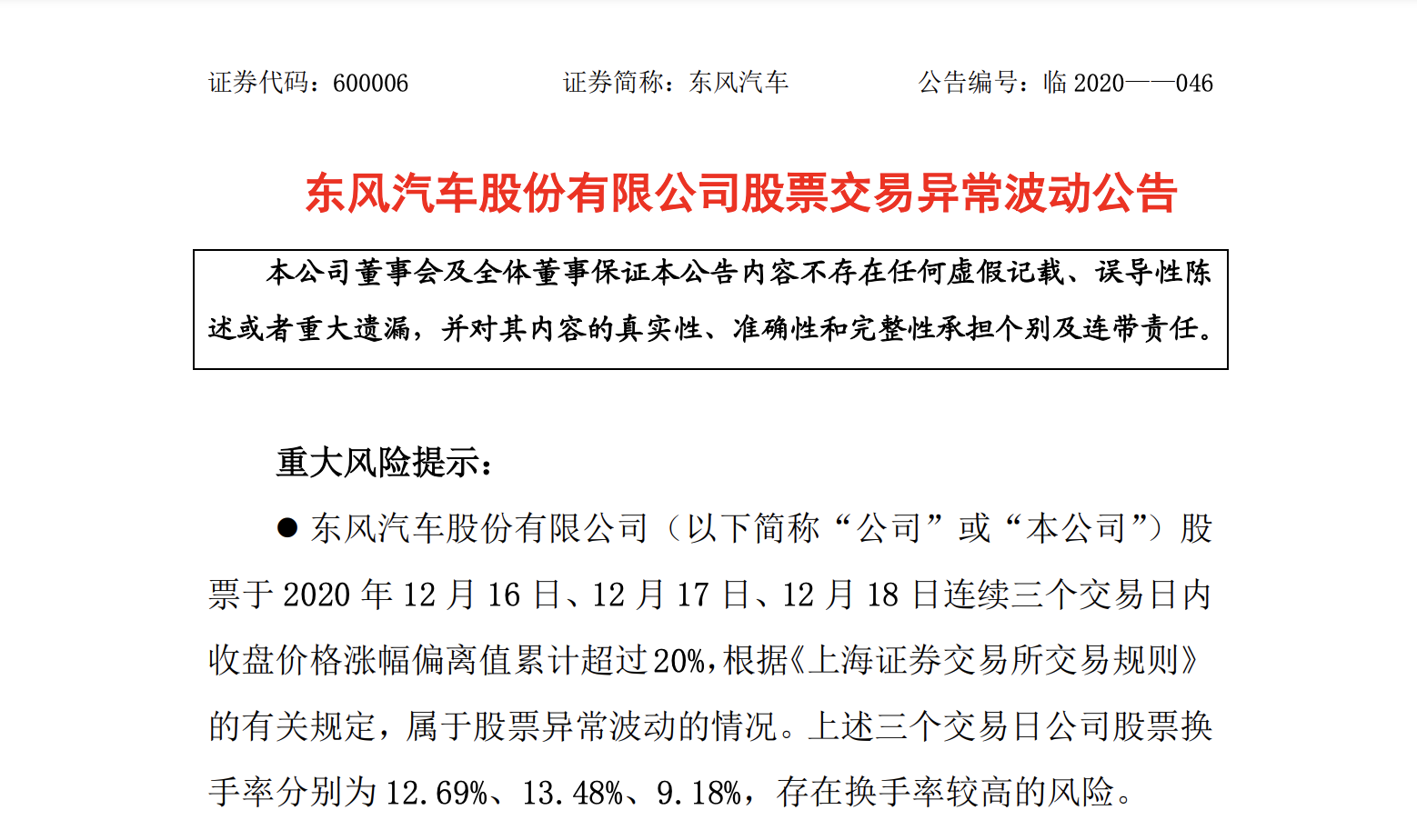

On December 21st, the third day after the Voyah press conference, Dongfeng’s stock price rose to the daily limit for the 5th time in 6 days. Two days ago, due to the huge increase, Dongfeng even issued a special announcement: “After self-examination, the company’s current production and operations are normal, and there has been no significant change in the internal and external operating environment.”

At the press conference, Voyah officially revealed that the price of the Voyah FREE will “not exceed 400,000 yuan”, and the official price of the vehicle will be announced near the Shanghai Auto Show next year.

On the day of the interview, Voyah had already received more than 25,000 pre-orders for the Voyah FREE, which exceeded their original expectation. But I understand that there is still a conversion rate issue for the 25,000 data after the vehicle is put on the market. Compared with the capital frenzy, consumers will be more rational.

The sale of 30,000 units of the Li ONE made the market realize the feasibility of extended range. The addition of Voyah to this camp has strengthened the strength, and with the extended range, Voyah is also on the road to establish its own brand.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.