Introduction

Today, my social media feed was overwhelmed by the news of the establishment of Shanghai Yuanjie Fund, with a total investment of 5.399 billion yuan from SAIC Group, Zhangjiang Hi-Tech, and Hengxu Capital, and an additional 1.8 billion yuan from Alibaba’s special investment fund. The fund aims to develop a high-end intelligent pure electric vehicle project (provisionally named IM Motor) in Pudong, with a rumored initial financing round of around 10 billion yuan, aiming to create a car company similar to Tesla in the luxury electric vehicle market. In this article, we briefly discuss the trend and some insights on this high-end electric vehicle market, so that we can safely go to work tomorrow.

Why Everyone is Doing High-End Electric Vehicle Now?

This high-end transformation process began in 2019. FAW’s Hongqi, Dongfeng’s Voyah, Changan’s cooperation with Huawei for high-end cars, BAIC’s ARCFOX, and Geely & Great Wall’s previous work on high-end gasoline vehicles, Lynk & Co and WEY, are all following the trend of brand upgrading. Why did state-owned companies like Geely and Great Wall work on gasoline vehicles, and not jump into electric vehicles? There are two main reasons:

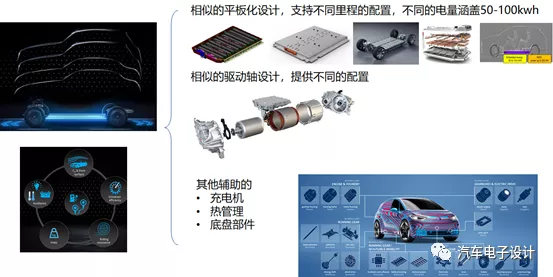

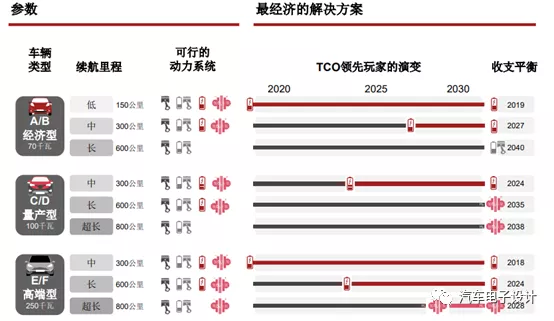

1) At present, there is a huge potential growth in the electric vehicle market, especially with the broad market scope that has been opened up by companies like Tesla. Increased investment in electric vehicles is required in various aspects of the industry. Before focusing on creating high-end pure electric brands, each company has established their own electric vehicle platform, which shares some common parts.

2)Refusing to make the shift to electric vehicles is not advisable given current market feedback. It appears that investors do not believe that gasoline-powered vehicles have a future. Although there is evidence to suggest that previous advancements have produced some positive results, in terms of the private electric vehicle market in 2020, results have been mixed. In China’s current market, the concept of electric vehicle technology has become a common platform. See the figure below.

Figure 2. Common Technology and Differentiation Aspects of Electric Vehicles

In conclusion, this round of high-end branding is based on platformization. Companies are seeking resources to provide high-quality solutions, elevate the price, and maintain product gross profit, while at the same time the new carmakers E. g. NIO and Li Auto, are making some interesting attempts. Moreover, companies can support the differentiation of electric vehicle platforms, which can also gradually expand volume downwards. In powertrain technologies for high-end electric vehicles, high endurance and high power are considered as the two main criteria.

## Strategic Allies in Smart Cars

## Strategic Allies in Smart Cars

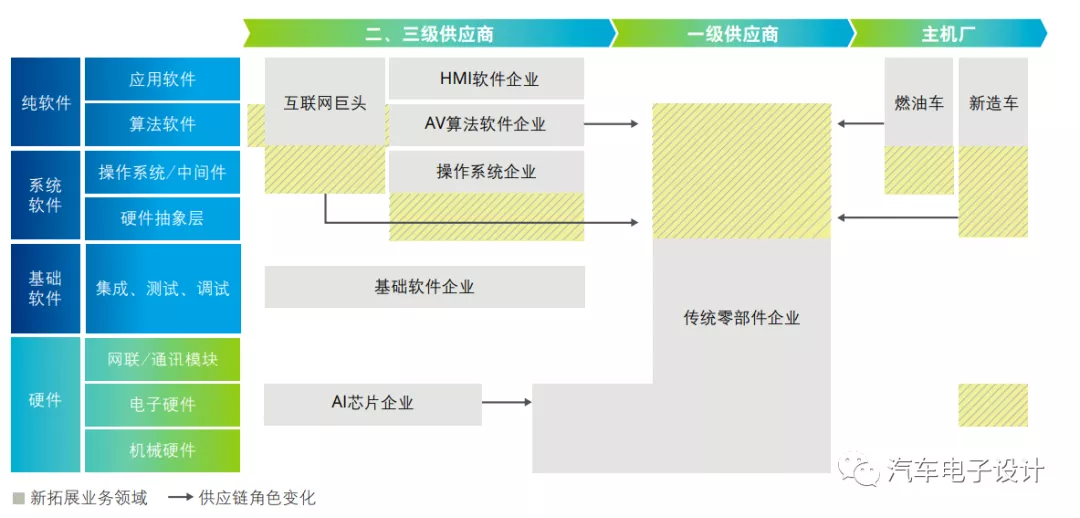

As mentioned above, the differentiation of electric vehicles themselves is not yet clear in the future. Therefore, we see the shadows of China’s outstanding IT and information technology companies in the fierce battle of the automotive industry. Tencent has invested in Tesla and NIO, while Alibaba has continued to cooperate with SAIC and supports XPeng. Huawei is a partner with Changan and BAIC, and Meituan is still idealistic. Baidu’s WM Motor may need some time.

In a sense, we can see that Chinese vehicle companies are not working alone in the process of electric vehicles turning to informatization. In this round of strategic alliances, having a good circle of friends is crucial for the following reasons:

1) The intelligence and autonomous driving of vehicle enterprises require a large amount of electronics, IT, and software technology. Traditional vehicle companies themselves find it difficult to accumulate resources in this area. To stand out, they need to leverage a lot of force.

2) The current round can not only shorten the distance to Tesla, but also overturn traditional automotive companies in Europe, America, Japan, and South Korea. This interdisciplinary integration, which is a lucrative business from the perspective of both automotive and IT industry players, is making a great deal from the software level.

The biggest feature of this new vehicle manufacturing round is the large amount of resources invested. As private electric vehicle consumption opened up in 2020, there was a phase of success with some top new vehicle manufacturers slowly stabilizing, and traditional independent brands on the other hand really changing their attitudes, unwilling to be caught in a dilemma. They are actively investing in the necessary areas.

As for the latest release of Zhijun Auto, it currently appears to be departing from the operation mode of state-owned vehicle enterprises and building a more open capital structure. The information available today should just be the first round, with more disclosures expected in early 2021.

Conclusion

In 2020, the entire global automotive industry basically reached a consensus on electric vehicle supply-side reform, which is very interesting. As far as independent brands are concerned, who can build a high-end electric vehicle brand is the key to victory in the next 10 years.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.