WM Motor faces a new fire incident

WM Motor, which ranks among the top four new Chinese car manufacturers, was involved in a series of “clear” and “mysterious” electric vehicle fire incidents, which swept across the entire network on October 28. The process of the incident and the companies involved, such as WM Motor and ZTE Energy, are clear, but the cause of the incident has become dramatic amid the tug-of-war between the two.

These series of events may have a bigger and deeper impact on China’s new energy vehicle market than we think.

The story started from WM EX5, which exploded and caught on fire.

The exploding WM

Whenever WM Motor becomes popular, “accidents” seem to be related. In the past month, such incidents have become more frequent, with four reported car fire incidents from mid-September to now, one of which even caused an explosion after catching on fire in Beijing.

Let’s briefly review WM’s four reported fire incidents based on media reports:

- On September 23, a WM EX5 caught on fire on the streets of Wenzhou. No open flames or explosions were found in the report, but a large amount of smoke and a stinging smell of burning were observed at the bottom of the vehicle.

- On October 5, a parked WM EX5 caught on fire while stationary on the side of the road in Shouwu, Fujian. The fire started at the rear of the car and spread to the entire vehicle, causing it to be completely destroyed.

- On October 13, another WM vehicle caught on fire while charging in Shouwu, Fujian. At the time of the incident, the remaining battery power of the car was over 90%. It should be noted that the two vehicles involved in the accidents in Fujian were from the same batch of vehicles purchased by a local taxi company from WM and were just put into use.

- On October 27, a WM EX5 caught on fire and exploded at the Institute of Mechanics in Haidian District, Beijing. According to eyewitnesses, the WM EX5 caught on fire when it was stationary and not charging. Shortly after catching on fire, the vehicle exploded.

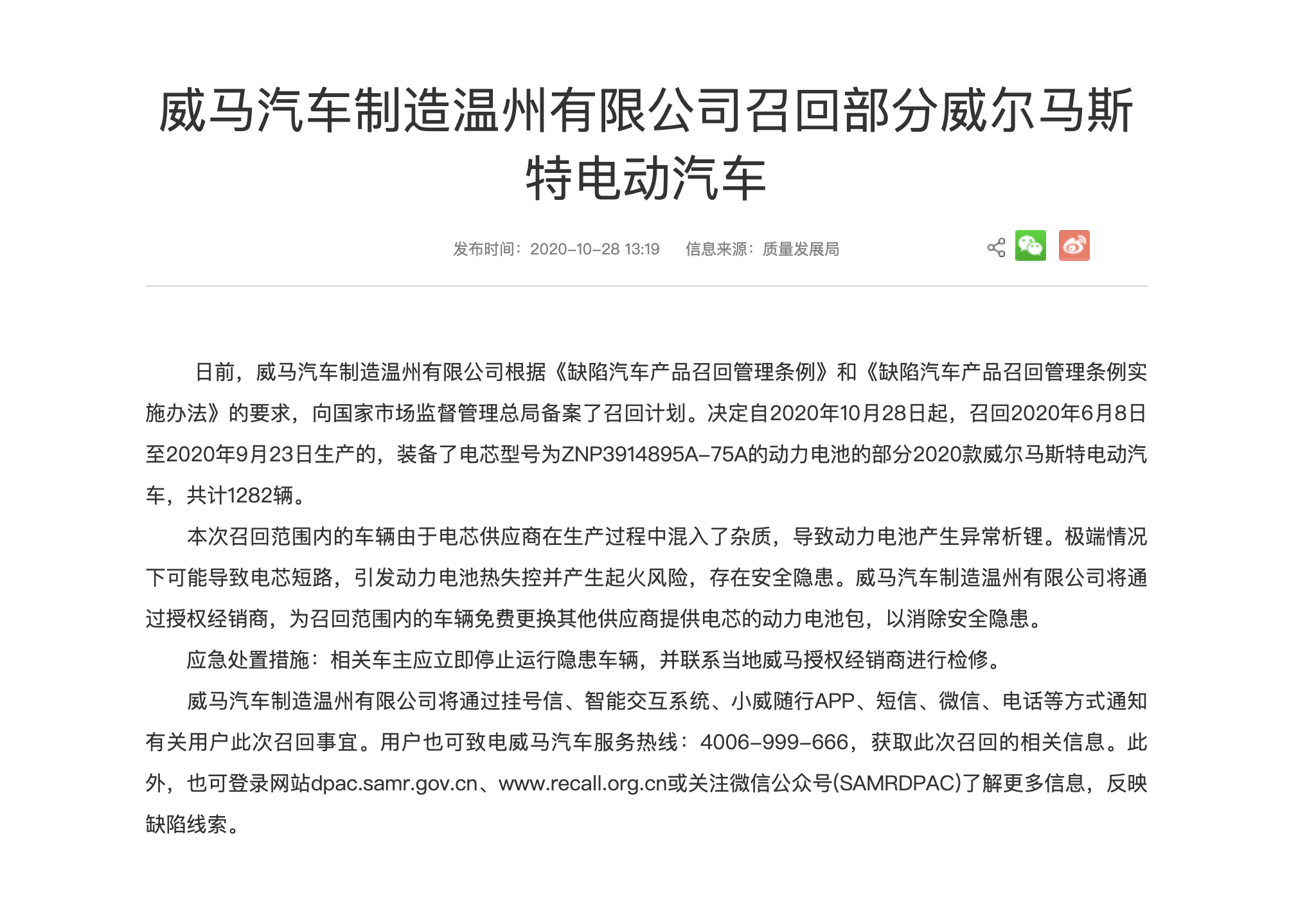

After a series of events, WM Motor released a statement on October 28 at 9 am confirming the veracity of the accidents, and in the afternoon at about 1 pm, it released the recall information on the vehicles.

In the recall announcement, NIO stated that, “starting from the day of the announcement, 1,282 units of the 2020 NIO electric vehicles manufactured from June 8, 2020, to September 23, 2020, with battery cell model of ZNP3914895A-75A will be recalled.”

In the recall announcement, NIO stated that, “starting from the day of the announcement, 1,282 units of the 2020 NIO electric vehicles manufactured from June 8, 2020, to September 23, 2020, with battery cell model of ZNP3914895A-75A will be recalled.”

The stated reason for the recall is that, “due to impurities in the battery cell during the production process by the cell supplier, the power battery may generate abnormal lithium deposition. In extreme cases, it may cause short circuits in the cells, triggering thermal runaway of the power battery and posing fire hazards, posing safety hazards.”

In other words, the battery defect is the main cause of the accidents. Unlike other electric vehicle fires, NIO clearly pointed out that the reason for the recall was due to a battery issue, which also brought NIO’s battery supplier, CATL, to the surface.

Interestingly, CATL does not agree with NIO’s explanation of the fire incidents.

According to CATL’s announcement, “In the fire incident that occurred in Shaowu City, Fujian, the vehicle did indeed use CATL batteries, but the cause of the fire is still being investigated in cooperation with NIO. The vehicle involved in the fire and explosion incident of the Beijing EX5 on October 27 was not equipped with CATL batteries.”

In other words, out of the four vehicles that caught fire, two were equipped with CATL batteries and the other two were from other suppliers.

Thus, although the entire event process is clear, several questions have arisen. First, why were there impurities in the cells? Second, what kind of supplier is CATL and why did NIO choose it? Finally, what impact will this event have on the market?

The ambiguous “spontaneous combustion” reason

Compared to the event itself, I am more concerned about the cause of the event. Battery safety is a perennial topic and one of the key points we focus on in electric vehicles.

NIO’s investigation results indicated that there were impurities in the battery cells, rather than the trivalent material formula. Therefore, it can be concluded that this problem may have occurred in the production process.

NIO’s statement uses the term battery cells, rather than the battery system, which is quite interesting. Because there are generally two modes of cooperation between automakers and battery suppliers. One is that the battery company directly supplies individual battery cells to the automaker, and the automaker packages them into Packs. The other is that the supplier provides the entire battery pack to the automaker for installation.

NIO’s battery pack is produced at its own Wenzhou factory, so this part of the process is controlled by NIO.

Before, BMW recalled 1,800 PHEV models. After BMW’s investigation, it was found that the battery insulation film was pierced due to the presence of welding slag in the battery system, and the supplier was Samsung SDI.

So, as I understand it, the welding slag of Samsung SDI appears on the pole ears during the laser welding process of individual battery cell modules. If this is a soft pack battery, the welding slag will penetrate the insulation material over time and cause a short circuit.

This welding slag is more likely due to the process problems that occur when each single battery cell is connected during the grouping process.

Every link in the cell manufacturing process may bring impurities into the cell. If viewed from this perspective, it is worth discussing the areas of the battery system that are prone to impurities. The battery system has an extremely complex processing process. The battery, module, and pack (including BMS and high-voltage connections) are the key areas.

Among them, the production process of the cell and module is a high-incidence area. In terms of single cell impurities, they may appear between the inside of the cell and the packing shell.

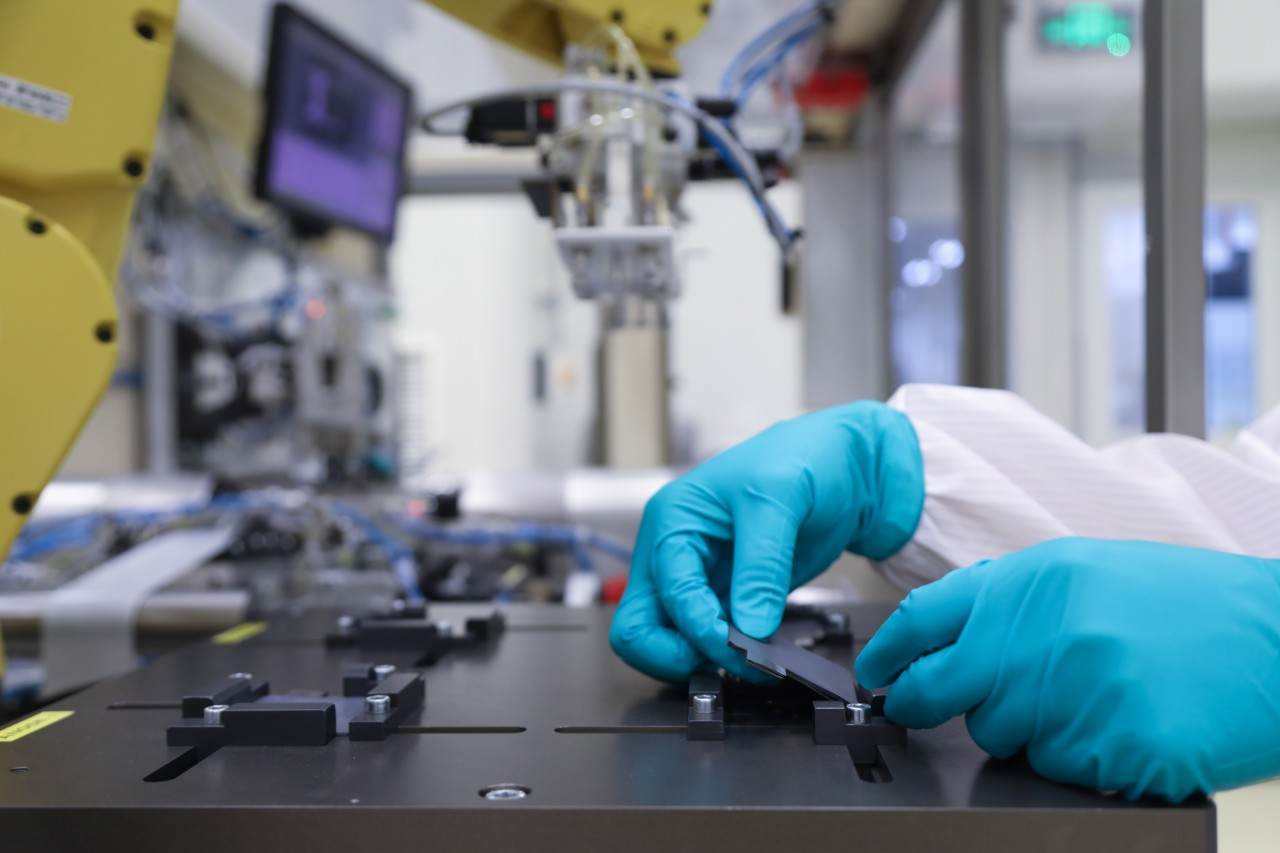

The internal space of the cell is an area where impurities can sneak in during the material, coating, winding, or lamination process, and the impurities inside the cell often cause lithium ion decomposition and thermal runaway during charging and discharging.

Between the cell shells, when the pole ears and safety valves are welded, welding slag may appear, and welding slag may pierce the insulation film after a long time, causing fire. It should be noted that the production process of the cell requires highly dust-free management, which is often one of the technical strengths of suppliers.

For the module, impurities tend to appear between single cells during grouping. For example, if every slice of bread is compared to a single cell, stacking every slice of bread together forms a bag of bread, which is actually a module. The problem often appears here. Every single cell needs to be dust-free, otherwise, impurities will rub against each other and penetrate the insulation material over time.

Also, when each cell is grouped into a module, the pole ears need to be welded. If welding slag enters the system, it will also cause insulation anomalies. This aspect needs to be determined based on whether the supplier or the automaker itself is making the module, to identify responsibility.Therefore, although WM claims that impurities were found in the battery cells, it is difficult to determine whether it is a problem with the supplier or the manufacturer’s production process. However, I received information from a source close to the incident who stated: “It can basically be confirmed that this is a problem on the supplier side.”

In other words, it is possible that the problem is still with the individual battery cells, and further investigation is needed to determine which stage is specifically responsible for this issue. However, both car manufacturers and suppliers can take a few steps to prevent particle impurities:

- Trace the root cause and fundamentally reduce the risk;

- Strengthen the dust-free management of the factory to reduce the chances of impurities entering the battery cells;

- Establish enterprise-level detection and validation processes above the national standards to reduce the risk of repeated incidents;

- Both suppliers and car manufacturers should improve their technical processes.

Overall, WM’s battery validation efficiency is very high judging from the speed of the investigation. The entire response process has not been delayed, and the company has promised to replace Ningde Times’ batteries directly. However, WM still faces a potential threat. If the explosion of the vehicles in Beijing is not caused by batteries from CATL, but the investigation still attributes the cause to battery problems, the scope of the issue may be broader.

WM’s supplier selection strategy may have hurt itself

This includes two parts: WM’s battery supplier strategy and CATL, the battery supplier.

Take CATL as an example. Have you ever heard of this battery supplier? Here’s a brief overview:

Brand

CATL, a subsidiary of ZTE, was founded in 2016.

Products

Square aluminum shell ternary batteries, with production products including 75 Ah and 51 Ah power batteries.

Matching with WM

CATL’s battery matched with WM’s EX5 is the 75 Ah ternary 622 product, with a cell energy density of 215 Wh/kg.

Matching with car manufacturers

WM, Geely, Zhengzhou Nissan, Hanteng, and Zotye.

Capacity

Production capacity of 1 GWh, with an expected production of 4 GWh by the end of 2021, and plans to achieve 8 GWh by 2023.

I asked a senior engineer from a large battery manufacturer about some information regarding CATL. His response was: “Typical miscellaneous army. Have they gone through the entire development and verification process of the battery? The production process of the power battery is not that simple. Although the market has dividends, it’s not something that everyone can do. Now that something has happened, it’s not good.”

I asked a senior engineer from a large battery manufacturer about some information regarding CATL. His response was: “Typical miscellaneous army. Have they gone through the entire development and verification process of the battery? The production process of the power battery is not that simple. Although the market has dividends, it’s not something that everyone can do. Now that something has happened, it’s not good.”

In other words, in the eyes of their peers, this “miscellaneous army” has become one of the main suppliers for WM Motor. According to GGII data, in June, CATL supplied 525 WM EX5 cars with an installed battery capacity of 27.4 MWh, in July they supplied 705 vehicles with an installed battery capacity of 37 MWh, and in August the figure reached 816 vehicles with an installed battery capacity of 43.01 MWh.

From this, it can be seen that CATL’s share in WM Motor’s supply system is very high. Another detail is that after WM announced a recall, someone on social media said: “CATL has already disbanded on-site and had difficulty in operating the company“, which seems absurd.

However, I obtained information from sources close to CATL, who stated that “CATL was already in financial trouble before working with WM, and their financial problems were worse than they are now.”

This means that CATL is not the best choice for suppliers in terms of either technology or corporate stability due to their financial woes.

But why did WM choose them? I think there are two reasons:

The first is that WM enjoys priority in production capacity.

The second is that the price is cheaper.

This can be traced back to WM’s positioning in the middle to lower end of the market with relatively low car prices. If they want to achieve profitability, cost reduction is inevitable, and the battery is a major cost. Therefore, how to reduce the cost of the battery is a key decision for WM.### Translation

First, let’s take a look at the battery module design of WM Motor. WM uses the VDA standard battery module strategy. Many people mistakenly assume that VDA is a type of battery cell name, but it is actually an abbreviation for the German Association of the Automotive Industry. The VDA standard is a series of cell size standards launched by VDA based on the phenomenon of numerous power battery cell dimensions in the market at that time.

There are several benefits to standardization:

- Uniform specifications will bring economies of scale to reduce costs;

- Battery module standardization can be achieved based on standard-sized battery cells;

- Different cell manufacturers can produce batteries with unified specifications, providing OEMs with multiple choices and further reducing the cost of the entire vehicle;

- Standardized sizes bring enormous benefits to product updates and can be directly replaced without long-term preparation of spare parts for old models.

This is what we usually call VDA battery cells, and standardized modules developed on this basis are called VDA modules. Simply put, on the same car, different suppliers can achieve seamless switching of modules. The battery of XPeng P7, for example, is customized for Ningde Times, and the battery is not available to other car manufacturers and other suppliers cannot supply XPeng.

And the purpose of WM Motor’s approach is simple, to flexibly adjust suppliers to obtain bargaining power. It is well known that Ningde Times’ batteries are currently among the most recognized in the industry, but also among the most expensive.

The price of ternary 622 is roughly 1,000 yuan per kilowatt-hour, and the WM EX5 with a NEDC range of 400 kilometers exceeds 52 kilowatt-hours. That is to say, the cost of the battery alone exceeds 50,000 yuan, and WM may find it difficult to negotiate prices with Ningde Times. WM’s positioning is in the medium- to low-end, and reducing costs is a necessary choice. At present, it is still a critical period for WM’s sprint to the Sci-Tech Board, and both sales and profitability are necessary conditions.

According to insiders, “using batteries from other brands can reduce prices by about 20% to 30%.”

It can be seen that in order to increase sales, especially launching low-priced operation versions, WM Motors can only reduce procurement prices. Although using standard modules to reduce costs and improving bargaining power with suppliers is no problem, there are not many suppliers that meet these conditions for WM’s choice, and they are mostly third- or fourth-tier battery suppliers such as CATL. Although WM has obtained low costs, it also has to bear the uneven technical skills of suppliers.

The battery market will converge towards quality companies

In the short term, the spontaneous combustion incident will certainly have a significant impact on WM, and consumers will certainly be scared. It is unclear whether it will affect the listing.The investigation result of the Beijing WM Motor accident will have a long-term impact on WM. If the battery is from CATL, WM only needs to replace it and strengthen user education. But if the battery is not from CATL, there will be three consequences:

- The consumer’s mistrust in WM cars will increase.

- If the investigation result is not about the battery but other reasons, WM will have to inspect more vehicles.

- The recall will cost WM more than 100 million yuan to fix this mistake.

For battery manufacturers, CATL will immediately be removed from the WM supplier list and gradually exit the market. This is because no OEM will take a risk to purchase a lower-quality but cheaper battery.

For other battery manufacturers, top battery manufacturers will be more preferred by the market, including car manufacturers and consumers. Consumers will deepen their choice of battery suppliers, and battery quality and brand advantages will stand out. Similarly, OEMs will make significant balance in cost reduction and supplier selection.

In commenting on the WM incident, a manager of a domestic battery company in China made a sharp point on social media:

“The WM incident will become a turning point for China’s new energy market to shift from policy-driven to market-driven. Consumers will quickly become mature and OEMs will have to tilt the bargaining power of battery procurement to the preferences of end consumers. They will have to be more cautious in choosing batteries, rather than choosing based simply on low cost and relationships.”

This is the depth of the impact of this event on the market. Quality manufacturers will regain the market dividends that should have belonged to them. In the future, electric vehicles will generate a corresponding premium due to the battery brand, and the battery brand will also penetrate deep into the minds of consumers due to the car brand.

In conclusion, the WM recall is different from NIO’s recall earlier. Back then, the market was immature, and consumers instinctively gave enterprises some expectation space. Even if the adjustment did not affect the market, NIO’s sales were not affected as of now.

However, now the situation has changed. Compared to before, the market has some maturity, and consumers have requirements for new energy products. Any problem now will weaken the consumer’s confidence in WM’s products. Fortunately, WM responded quickly, and OEMs could face the problem squarely after it appeared, which is worth encouraging.

Based on the recall materials, the problem lies in the process because the involved battery technology is relatively mature. Therefore, it is not due to immature battery technology (unlike NCM 811). From this wave of battery quality incidents, there are three things that I think Chinese companies should learn from:1. Traceability is crucial: From materials to battery cells and on to vehicles, traceability of the entire process is essential.

- Process control is of utmost importance: For battery cells, once the technology has matured and the materials are problem-free, the process becomes the biggest root cause of cell quality issues. This area is relatively weak for the entire domestic industry.

- Be prepared for battery recall due to thermal runaway: Thermal runaway in batteries is an industry-wide challenge. Monitoring at the battery system level is essential.

If the quality incidents of battery cells spread, this will have an extremely negative impact on the entire new energy industry, exacerbating consumers’ concerns about the safety of electric vehicles.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.