Introduction:

- The “Data Intelligence Bureau” section is jointly launched by Garage 42 and SoCar Product Strategy Consulting and updated monthly. Special contributors to the section: Hu Jiahe, Co-founder of SoCar; Editor: Garage 42.

Summary:

-

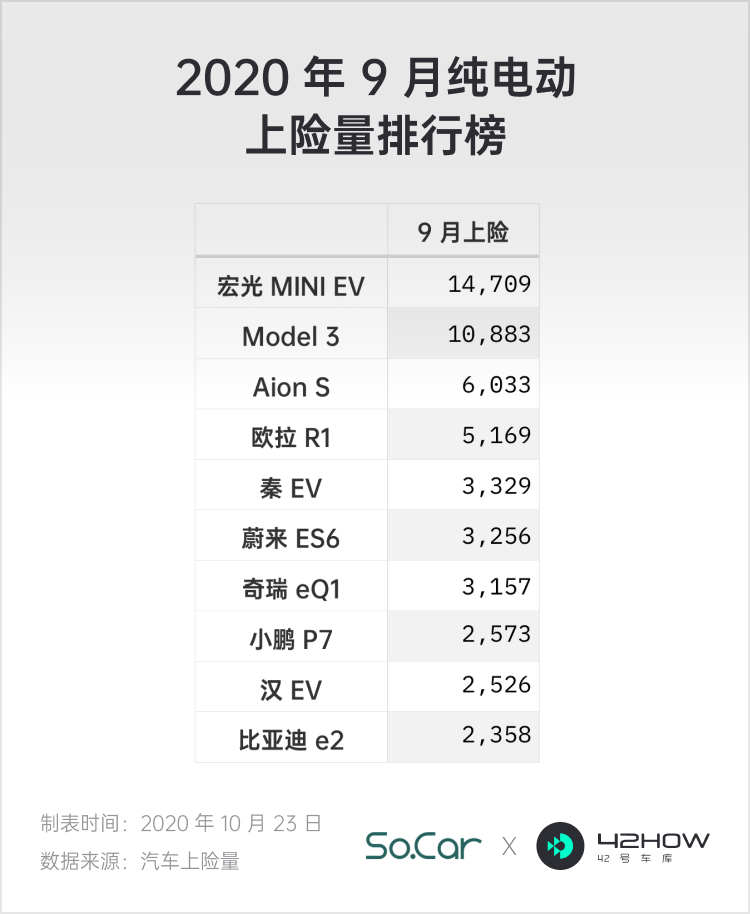

Wuling Hong Guang Mini EV, with over 14,700 units sold in September, became the top-selling pure electric car, pushing Wuling to the top spot in the pure electric vehicle market, above BYD and Tesla.

-

In the race track, NIO’s only challenger is itself.

-

XPeng Motors will deliver over 10,000 units of P7 in just 4 months, causing competition for Tesla’s Model 3.

-

Will the demand elasticity caused by Tesla’s price cut match that of BBA? There’s still a gap from Q3.

-

Ideal ONE dominates the 6-7 seater SUV market, surpassing oil-powered vehicles from other major brands.

Finally, the second Chinese pure electric vehicle, the Wuling Hong Guang Mini EV, has surpassed Tesla’s Model 3 in sales volume, recording over 14,700 units sold in September. Launched just three months ago and exclusively operating in the To C market, it has easily taken the top spot, leaving the Model 3 at second place with 10,883 units sold.

Six months after topping the charts, the Model 3 has been overtaken by this adorable mini car in absolute numbers, leaving competitors in awe.

The development of the To C market for pure electric vehicles has now reached a small climax, with the A00 micro car sector represented by Wuling, Ora, and Baojun on one end, and the high-price products represented by Tesla, NIO, and XPeng on the other end, both forming their own respective hotspots.

As the 2020 Q3 concluded in the bustling Beijing Auto Show, let’s review the TOP10 for September:

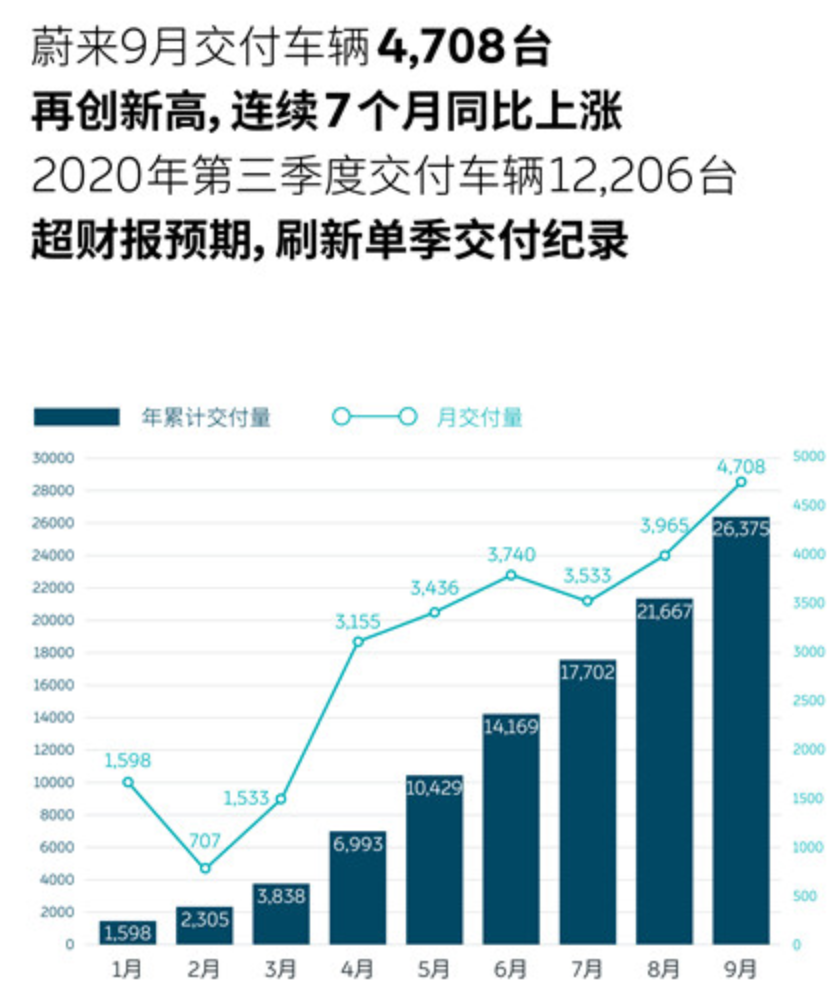

NIO: Galloping Ahead

In the third quarter, NIO “shareholders” had a reason to be happy.

Morgan Stanley’s price target of $40 further adds to the healthy growth of the resurrected Chinese luxury car brand.

The sales result speaks for itself.“`

With the push of NOP, NIO’s “Chinese Tesla” story is becoming more and more clear, and car owners’ high satisfaction and increasing reputation in society are laying an excellent foundation for the future of this brand.

From self-developed motor control at the beginning to the news of self-developed chips and even self-driving technology, NIO, as a “user enterprise,” is increasingly showing the attitude of a “technology company” in terms of technology.

And the somewhat outdated name of “automaker” has gradually become like a subsidiary relationship with NIO. Only Tesla, the pioneer, has achieved this.

When cute Nomi said “This parking space is too difficult” when backing up, the laughter of car owners and the rapid spread on the Internet represented the competition had been raised to another level.

At this level of competition, NIO’s only opponent is itself: continuous optimization of product BOM, continued convergence of electronic and electrical architecture with Tesla, continued expansion of battery swapping mode, launch and operation of sedan models… As China’s first to lead the way, people are becoming more and more confident in NIO’s exploration.

XPeng P7: Swift as The Wind

The time record for production of ten thousand units has been broken, P7: four months. Of course, because it is not completely direct sales, some production capacity has not been reflected in the insurance data.

XPENG has rapidly rolled out all aspects of P7 from mass production, marketing, sales, test driving events, etc. over the past four months.

Looking at the insurance data over the past four months, while climbing more “quickly” than NIO ES6, P7’s trajectory towards market maturity is also more stable than that of the Ideal ONE in the first half of this year.

As a contestant who specializes in killing Model 3, XPeng P7 provides similar model configurations and software features and product style that are more attractive and easier to be accepted by Chinese users, forming a benchmark with overlapping and different features.

Next, let’s talk about Tesla’s price cut. Is P7 the most direct panic-inducing party?

Perhaps, but P7 is also one of the drivers of the Model 3 price cut, which is a proof of strength.

Tesla: The Signal of Price Cut Transmission

If sales do not need stimulation, prices do not need adjustment. We can think of many supercars that have gone through their sales lifecycles while constantly increasing their prices.

The day Model 3 fell below 250,000 yuan, jokes aside, it was quite surprising.

“`## As the Headline Suggests

This month, not only did the Hong Guang Mini EV surpass Model 3 – as Tesla China only offers one car – but the Tesla brand was also overtaken for the first time by BYD in September. With its 12 electric car models, BYD surpassed Tesla’s total volume. Tesla’s pure electric brand crown has been taken down for seven consecutive months, ranking third.

If the victory of Hong Guang Mini EV is the ultimate definition of localized car scenes, then winning over a car that is ten times its price, like the Model 3, makes perfect sense. However, the second place, achieved by relying on the sales increase of Qin EV in operation, is not that exciting.

BYD’s first place in the pure electric segment is definitely the Han, which had 2524 units insured in September.

The P7, which exceeded 10,000 units of production in April, is also a tough competitor.

Is Han and P7 one of the factors that caused Tesla to reduce its price? The answer is almost certain.

There is only so much market share in the pure electric market. More players lead to more competition. Perhaps Tesla has an unparalleled brand status, but the final decision made by consumers will be based on rationality.

With the increase of features like wireless charging pads and electric tailgates, Tesla’s recent price reduction has greatly improved the product’s competitiveness, especially the long-range version which has improved compared to the previous Model 3. However, when the Han and P7 are put on the table, with their rich feature sets and more localized software capabilities… Is the price-reduced Model 3 only slightly reducing the “value for the money” gap between itself and its competitors?

Further upgrades for Model 3’s interior have also been revealed, including updates like double-layered glass and heat pumps. The gap between the “value for money” factors will be narrowed even more. But this also suggests that the level of competition for Tesla is being lowered.

The true game changer that will affect the market and enable Tesla to return to its own track is the newly announced, fully rewritten FSD version that’s ready to be released.

In the short term, there are no game-changer label for Model 3 that can be played in China, and the impact of FSD beta in the long run is yet to come. The adaptability of FSD in China is also closely related to policies, infrastructure, and other factors. It is not about the negative outlook but the fact that the opportunity window given to Tesla’s competitors is indeed widening.

In terms of brand awareness, Tesla in China is not as strong as one might think.Did you notice that in the third quarter after the recovery from the epidemic, Mercedes-Benz, BMW, and Audi went all out with their entire product lines, and their sales figures appear similar to those of joint venture intermediate products? Prices are also very firm. According to monitoring, the average discount rate for all BBA models in 2020 does not exceed 14%. Similar to Tesla, whose discount rate this time is around 10% (long-endurance) and 14% (standard-endurance), compared to 17% and 10% respectively at the beginning of the year. Will Tesla achieve the same effect as BBA this time?

Is it “retaliatory” consumption? Or is it demand backlog during the epidemic? Regardless of BBA’s third-quarter outbreak, as a high-end brand in people’s impressions, Tesla has not been able to enjoy similar market dividends.

What about after the price reduction?

For some cars, lowering the price does not necessarily lead to more sales. Obviously, this does not apply to Model 3. However, for Tesla, which completely transparentizes the price reduction action, the media’s frenzy far outweighs the benefits. The sales increase effect brought about by the price reduction will also become weaker as a result, and it will be a challenge for Tesla, which will maintain a monthly sales level of 10,000 units before the Model Y goes offline.

It has only been half a year, and the market changes so quickly.

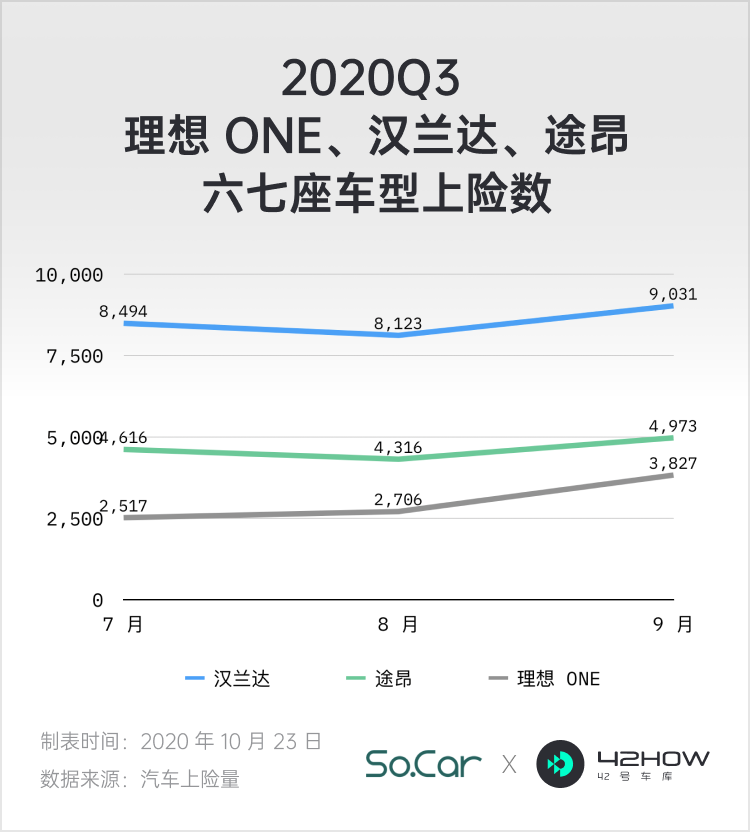

Ideals: Breaking the circle

ONE ranked first on the PHEV list, surpassing BMW 5 Series Le for the second time after August, and the relative lead has expanded to 68%.

The single-month best record of 3827 insured units allowed such a unique and controversial model to continue to prove itself. Unlike the ES6 and Model 3, ONE focuses on more segmented user needs and more typical scenarios, and it is somewhat similar to the success of the Hongguang Mini EV.

It makes people think of the SEV that was ultimately not pushed to the market.

If we focus on the six or seven-seat passenger car market, including SUVs and MPVs of all power forms, we can see the speed of this demand eruption, with SUVs being the most popular.

Among the six or seven-seat SUVs, the single-month and cumulative insured units in 2020 have exceeded those of the traditional brands in the same segment market, including three new and old four veteran generals, such as XT6, GLB, Highland, and Ruijie.

Apart from low-priced commercial vehicle models, the only two dominant players in the sub-segment market ahead of ONE are Highlander and Touareg, though there is still a significant gap in performance, the pursuit speed has not diminished.

Obviously, for the ideal customer, the PHEV market or even the new energy market is no longer interesting to them. The 30W level six-seven seat SUV market long dominated by joint venture oil cars where ONE is located is the real battlefield. Breaking through the new energy circle, ONE is probably the first to do so.

From a numerical standpoint, I think this is in line with the expectations of most people.

Beijing Auto Show and Data Observation Bureau

The recovery of the auto market in the third quarter ended with the closing of the Beijing Auto Show. Many products on display at the show were awe-inspiring. Here are a few observations:

Firstly, the state of new energy products has shifted from being concepts to mass production, and the signs of market share rising have been noticed by everyone. Whether it’s EQ series, iX3, e-tron, or common models like ID, Weilan, and Feista, the brand’s serious attitude has brought forward the enthusiastic market changes.

Secondly, local brands have an advantage in exploring the pure electric platform, three-electric technology, landing, and satisfying demand. After entering the mature stage, China’s new energy vehicles have entered the intelligent battlefield. Huawei’s booth was packed with people. Compared to the serious foreign brands at the beginning, the smart era belongs to Chinese users, and this is no longer a point to debate.

Thirdly, the second round of competition in the new car manufacturing industry has begun. The new forces are moving faster in intelligence, and their business models are more flexible and innovative. After the first round of killing, the remaining head companies are facing the second wave of challengers who have hit a milestone with new product production. Regardless of how people feel about the car, once it’s made, it cannot be ignored. Users’ expectations of product innovation have been further raised, and attracting attention is easy. Of course, filling the pit and digging for people is still necessary, and the real-sales will speak for itself.

Three echelons, three statuses, each with its own risks and paths.

To be honest, the momentum of new energy reflected at the Beijing Auto Show is aligned with the development results that this column has been waiting for.

I never thought it would come so fast.

As for the coming fourth quarter, the end-of-year exam is approaching, do you have any expectations or judgments you want to be verified? You can mark them in the comments, and we can evaluate them together at the end of the year.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.