“Whatever the people need, we’ll make it” is the sentence that impressed me the most during the epidemic period this year. From working overtime to manufacture masks during the epidemic to the flourishing of Wuling Glory in the post-epidemic street stall economy, Wuling always produces the products the people need at the most suitable time.

Are Elderly People Happy With Able-to-Plate Old Men’s Car?

In fact, at the beginning of Hong Guang Mini’s release, I was once pessimistic about the model. From the data point of view, the technical parameters of this model were completely regressive. Nowadays, the energy density of power batteries has been popularized to 180 Wh/kg. The 110 Wh/kg system energy density on Hong Guang Mini is a bit funny, and the NEDC range of up to 170 km also directly said goodbye to the national subsidy. Even the fast charging interface is not available, and it takes 6 hours to charge quickly, and 9 hours for slow charging at slow speed, which fully demonstrates the “electric daddy” nature.

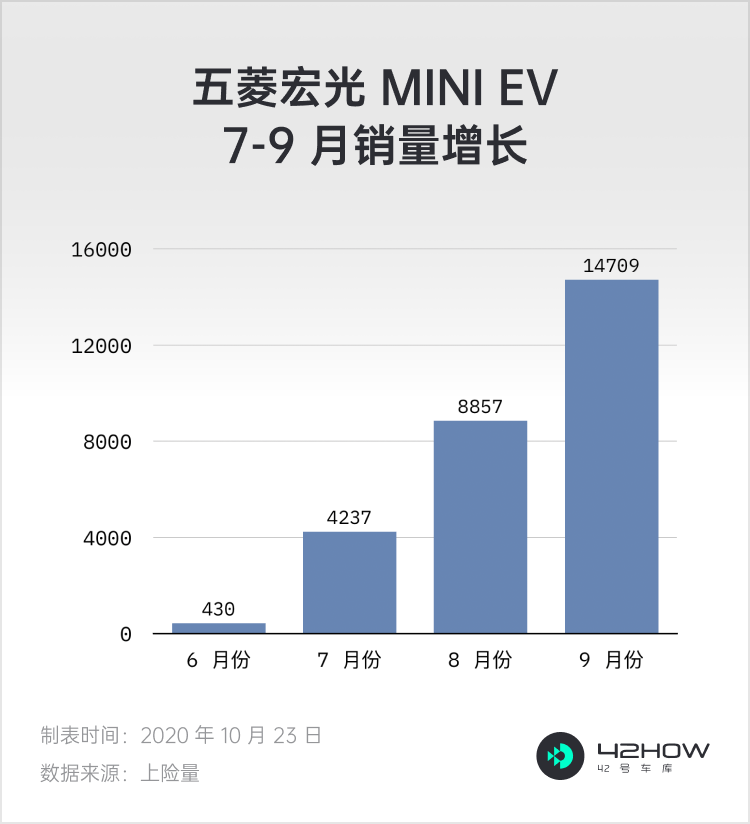

I once wrongly thought that the main impetus of Hong Guang Mini would be in cities with limited licenses such as Beijing, Shanghai, Guangzhou, and Shenzhen. However, due to the extremely low range performance and pitiful configurations, except for being cheap, the product performance is worthless. Its sales performance in first-tier cities will definitely not be too ideal. However, Hong Guang Mini started pre-sales on May 28th, and in June it achieved 430 units of sales. It was launched at the Chengdu Auto Show in July. 7 days after its release, its sales had reached 7348 units. 20 days later, the data rose to 15,000. In September, its sales exceeded 10,000 units and was still growing at a high rate. The contrast between imagination and reality really shattered my face.

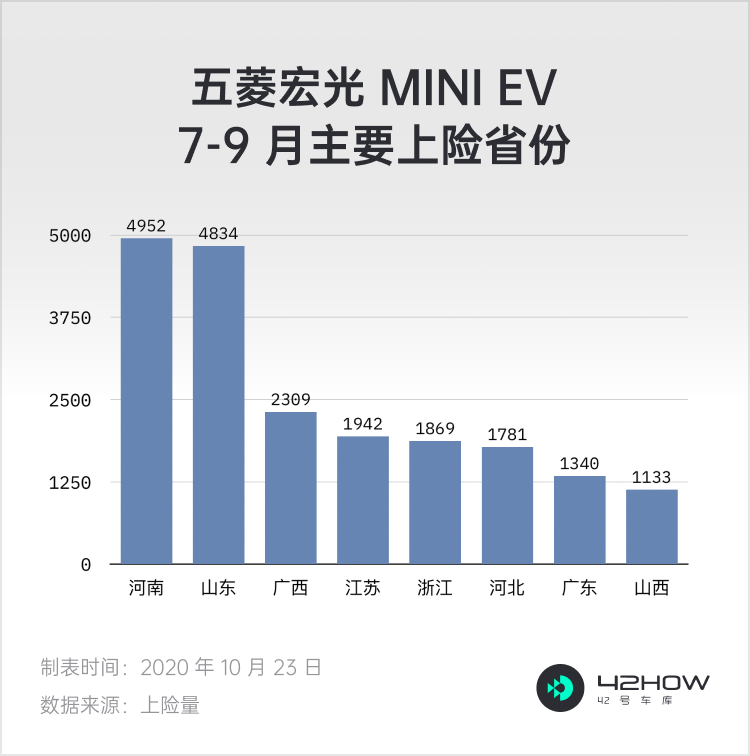

Touching my hot and painful face, I found that the main driving force of Hong Guang Mini is in the second-, third-, and fourth-tier cities, mainly in Henan and Shandong, which have always had strong demand for low-speed elderly cars.My friend in the automotive industry frequently travels to Shandong and describes that in the automotive city of Heze, Shandong, a four-wheeled car shell built on top of an electric assisted bicycle can cost over 40,000 yuan. The local residents have a simple demand for cars, preferring them to be cheap and easy to use. Despite being a regular automobile manufacturer, Wuling’s quality, craftsmanship, and safety are still very reliable compared to unknown workshops. The most important point is that the Hongguang Mini is a regular car that can be licensed and used on the road, and its arrival is a strong disruptor in the market of low-speed elderly mobility vehicles.

At the same time, I discovered that besides strongly promoting the Hongguang Mini in the elderly mobility vehicle market in Henan and Shandong, it also has a strong performance in second and third-tier provinces and cities. Since its launch, the Hongguang Mini has exceeded 1,000 units in sales in Guangxi, Jiangsu, Zhejiang, Hebei, Guangdong, and Shanxi. Compared to less than a hundred units per month in first-tier cities, it breaks my inherent knowledge that new energy vehicles should be hot sellers in first-tier cities.

Policies are the trend indicators

Years ago, with the strong financial subsidies and license plate restrictions, the new energy vehicle started to develop in its infancy. Careful analysis of the national subsidy policy, determining the production model, became an important task for automakers and the media. This type of inertia thinking led some automakers to be trapped in the mud of building cars for subsidies, unable to extricate themselves.

Especially in 2017, when the national subsidy policy began to examine energy density, unit energy consumption, and endurance range, the once popular phosphate iron lithium battery in the new energy vehicle market almost disappeared overnight. To comply with the subsidy policy, automakers replaced it with the more expensive, higher energy density, and lower unit energy consumption three yuan lithium battery. This change was very helpful in improving the data parameters of new energy vehicles, but it was not particularly friendly to production costs, and it also caused the price of new energy vehicles to remain high. Even under high financial subsidies, automobile manufacturers have launched superior new energy vehicles compared to the past, but in the passenger car market, they have only received lukewarm sales feedback.

The high cost of new energy component supply chain has made it common for the sale price of new energy vehicles to be higher than that of fuel-powered vehicles of the same model. The topic of how many liters of fuel can be added with the extra tens of thousands of yuan paid for a new energy vehicle has become an old topic. It seems that buying a new energy vehicle with a few tens of thousands of yuan extra is a “smart tax” passed on to buyers. Under the background where the main market has not yet been fully developed, there are indeed not many car companies that pay attention to the purchasing needs of new energy vehicles in the sinking market.

The high cost of new energy component supply chain has made it common for the sale price of new energy vehicles to be higher than that of fuel-powered vehicles of the same model. The topic of how many liters of fuel can be added with the extra tens of thousands of yuan paid for a new energy vehicle has become an old topic. It seems that buying a new energy vehicle with a few tens of thousands of yuan extra is a “smart tax” passed on to buyers. Under the background where the main market has not yet been fully developed, there are indeed not many car companies that pay attention to the purchasing needs of new energy vehicles in the sinking market.

The status quo of the sinking market

In recent years, as the growth rate of car demand in first- and second-tier cities has slowed down, tapping into the purchasing power of the sinking market has become a mainstream topic in the industry. For example, the current new energy vehicles focusing on the sinking market include Hongguang Mini, BYD e1, Chery eQ1, and Great Wall Ora Black Cat.

As for BYD e1, it is essentially the BYD F0 that was launched in 2008, which was converted into a pure electric vehicle. After subsidies, it is actually sold from 69,800 yuan, which is reasonable given its sales of 119 units in September and a total of 1,201 units sold as of September this year.

And the terminal sales of Chery eQ1 and Ora Black Cat are both good. As of September 2020, Chery eQ1 sold 19,402 units and Black Cat sold 21,744 units, which are both in the upper-middle level in the new energy market. Although they have different strategies and tactics compared with Hongguang Mini in the same sub-market, if Chery eQ1 and Black Cat mainly focus on the travel and commuting needs of urban young people, the mission of Hongguang Mini is to provide a pure commuting solution without any fancy features.

Compared with Black Cat and eQ1, Hongguang Mini did not consider the threshold of the national subsidy’s NEDC 300-kilometer cruising range. Based on a good understanding of the real usage scenarios of the target users, Hongguang Mini cut half of the cruising range and also reduced its price by half, with a terminal sales price of 28,800 to 38,800 yuan. It has taken sinking to the extreme. Compared with the fierce competition among Tesla, NIO, Xpeng, and Ideal in the technology field, this is another runway, namely to provide a safer and more economical way of transportation for rural residents in large courtyards. As for the comfort and technological features that increase the premium of a vehicle, they are all means for capitalists to make money, and they are burdensome in life. What their target users need is not poetry and a distant view but bread and milk.

ConclusionThe wind blows and even pigs can fly. When the wind subsides, it’s the pigs that fall. The conversation between Lei Jun and Jack Ma is actually a true reflection of the new energy vehicle market. After experiencing the baptism of the epidemic and the retreat of government subsidies, the ebb tide has taken away a wave of car companies that make cars only for the sake of policies. The reason why Wuling Hongguang Mini was born is ultimately because the top management of Wuling had a deep understanding of the needs of their own customer base.

To maintain the healthy development of the new energy vehicle industry, rather than relying on the abnormal growth caused by studying subsidy policies, we need companies like Wuling that possess the spirit of enterprise and have a deep understanding of the needs of their customers. We need to truly explore the happy points of people’s travel, make the cars that people need, and use hard power to compete against the traditional fuel vehicle market.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.