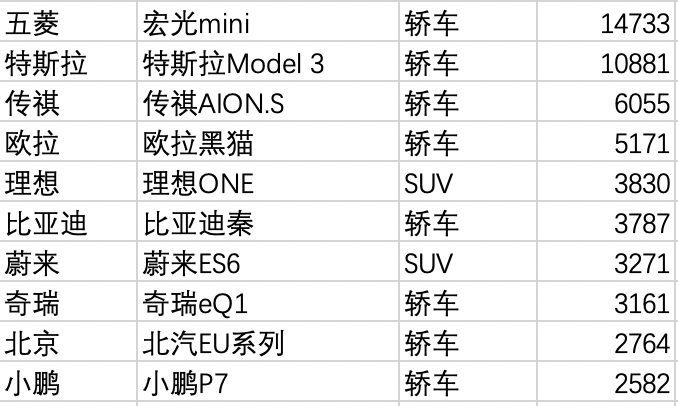

In the previous months, the best-selling electric car was the Model 3. However, this month, the Wuling Hongguang MINI EV surpassed the Model 3 by 3,852 units.

The Wuling Hongguang MINI EV has truly broken the conventions. Previously, the sales of A00-level small cars like this had mainly concentrated on third- to fifth-tier cities. Nowadays, not only does Shanghai sell a lot of these cars, but my colleague even saw them in Tibet during the National Day holiday.

The sales of Model 3 were stable in September, maintaining around 10,000 units sold, which is a bit less compared to the end-of-quarter surge in sales. However, after the big price cut on October 1st, it is foreseeable that the delivery volume in the last three months of the year will reach a new high.

The delivery volume of the GAC New Energy Aion S is also good this month, doubling from around 3,000 units to 6,055 units.

The new forces of car manufacturing, NIO, Li Auto, and Xpeng, have all set new records in their delivery volume. Li ONE leads with 3,830 units, followed by NIO ES6 with 3,271 units, and Xpeng P7 with 2,582 units.

Li ONE has nothing to say about its stable increasing sales, as the number of stores increases.

NIO’s production capacity is basically at full capacity, with ES8 and ES6 selling well. October is also the month when EC6 starts large-scale delivery. As for EC6’s delivery volume, it seems to depend more on how much production capacity the factory can allocate.

Also on October 12th, NIO’s lifetime battery replacement service officially ended. It was said that more than 2,000 orders were placed on the last day. Therefore, October is still a month where NIO’s sales depend on production capacity.

The delivery volume of Xpeng P7 reaching 2,582 units is not easy (including one of mine 😎).

On the one hand, Xpeng’s first car G3 was priced at around RMB 150,000-200,000, which helped establish the brand tone of Xpeng. There will be a relatively lengthy process to break through again.

As Xpeng’s second car, P7 directly increased the price range to RMB 250,000-350,000. It used to worry that the process of moving towards the high end would be difficult. Judging from this month’s delivery volume, it has clearly succeeded halfway.

On the other hand, the model and price range of P7 not only have a competitive rival like Model 3, but also BYD’s fist product, Han EV. The price range of these three models totally overlaps. In such a competitive environment, Xpeng P7’s delivery volume this month is obviously a good achievement.In October, there is an 8-day small holiday. Therefore, compared to September, it’s very likely that there will be a certain decline in sales in October. However, aside from this objective factor that will also affect the entire auto market, for XPeng P7, October has 1 positive and 1 negative aspect.

The positive aspect is that XPeng will hold its Smart Day on October 24th. If there are enough eye-catching new technologies on this day, it can definitely have a certain promotion effect on sales.

The negative aspect is that, after the price reduction of the Model 3 on October 1st, its price is highly overlapping with P7. For P7, it has already entered the stage of completely competing in product strength, without too many price advantages.

What will be the performance of the emerging automakers and Tesla in October and will there be any changes in the rankings? Everyone can make a guess in the comment area without any prize.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.