On October 6th, Mercedes-Benz held an online investor and analyst meeting and announced a new strategy.

During the meeting, Källenius admitted that “Mercedes-Benz has not yet fully released its potential in turning sales into profits. This is also the reason why Mercedes-Benz has changed its focus and launched a new strategy.” In other words, Mercedes-Benz has experienced a significant decline in both global car sales and profits.

Therefore, Mercedes-Benz must strike a balance between continuous investment in electrification and maintaining strong development in existing businesses.

Unlike its competitors, Mercedes-Benz’s new strategy emphasizes significantly “reducing costs and achieving profitability.” If we combine this with the statement earlier this year that “Mercedes-Benz loses 500 million a day” due to the pandemic, we have reason to believe that Mercedes-Benz is facing a severe financial crisis.

In terms of electrification, though Daimler and BYD have the joint venture brand Tening (an EV brand), and Mercedes-Benz has a strategic partnership with Geely in the Smart brand, “oil for electric” EQC has almost no presence in the market, suggesting that Mercedes-Benz’s own-brand electric products are considerably lagging behind.

Compared with BMW and Audi, Mercedes-Benz has only recently begun updating its electrification strategy. Therefore, let’s take a look at Mercedes-Benz’s current financial situation. Can its restructured technical path support its electric dreams?

Cost reduction and seizing opportunities to make money

If those who watched the online meeting might find an interesting point that “saving costs and increasing revenue” became a high-frequency word throughout the meeting, which is quite different from the “continuous investment and technological leadership” idea shown in similar strategies released by Volkswagen and BMW.

Enterprise structure optimization is a cost-reduction measure that every automaker is doing, but not many elevate it to a strategic pillar of the company, such as what Mercedes-Benz is doing.

Investments in electric vehicles are high. On the one hand, they need to build an electric car platform and iterate out popular models. On the other hand, they also need to develop the most competitive software and autonomous driving systems in the industry, – and all of this means a significant capital expenditure.

The strategic adjustment of a large company is never taken for granted. It must be based on the company’s business strategy. There are generally two reasons for a company to reduce costs and increase efficiency. One is that new business models require a large amount of funds, and the company needs to continue to invest heavily. The transformation towards electrification and intelligentization is a typical example. The second is that the company’s existing revenue is in crisis.

Obviously, for the first point, it is the investment logic of an enterprise facing the future. It is a “do or do” situation that even competitors cannot avoid. Mercedes-Benz’s approach is more like the second point. It is apparent that Mercedes-Benz encountered revenue problems.

At the beginning of the year, due to the epidemic, Mercedes-Benz’s statement “losing 500 million yuan a day” made the entire Daimler Group furious under the cold of the epidemic. When other companies were vigorously supporting the epidemic, it was indeed inappropriate for Mercedes-Benz to make such remarks. However, this is also the true portrayal of Mercedes-Benz.

Looking back at Mercedes-Benz’s financial data in the past two years, you will find that big companies may not be as “rich” as you might think.

In July 2019, due to the “airbag incident,” Daimler spent more than one billion euros to handle the vehicle recall, so the loss in the second quarter was a foregone conclusion. As expected, in the financial report released on July 24th, it showed that Daimler incurred a quarterly loss of up to 1.6 billion euros the highest in nearly a decade.

In September 2019, the impact of the “diesel gate” event continued to expand, and the German automobile management agency almost inspected all domestic car companies. For this reason, Volkswagen paid a price of about 2 billion US dollars, and Daimler was fined as much as 1 billion euros. At the same time, about 300,000 C and E-class sedans were ordered to be recalled.

Daimler’s net profit for the whole year of 2019 was 2.7 billion euros, a year-on-year decrease of 65% compared with 2018.As one of the most profitable luxury car brands on Earth, Mercedes-Benz has had its worst year in a decade in 2019, but note that it’s not over yet.

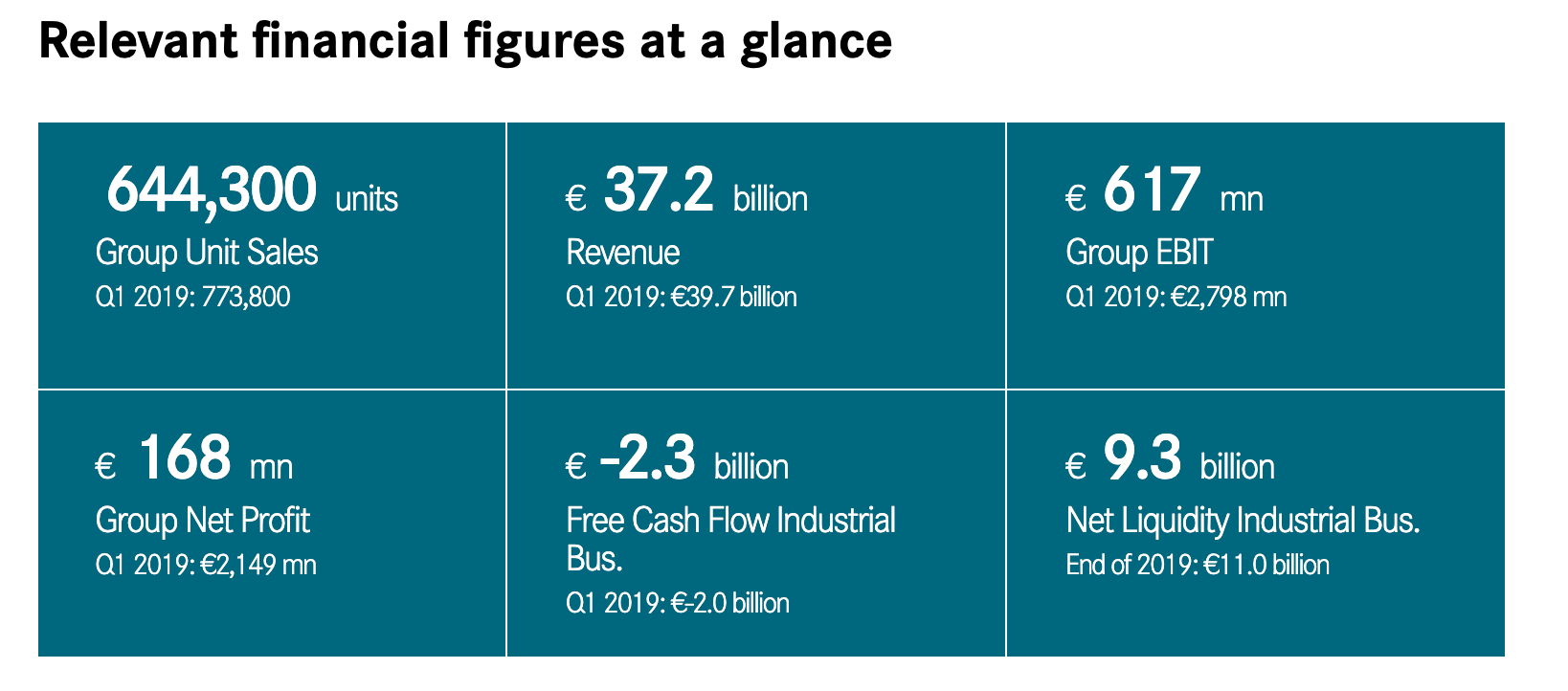

According to the Q1 2020 financial report, Daimler’s sales for the first quarter were 644,300 units, a decrease of 17% year on year; the company’s revenue was €37.2 billion, a decrease of 6% year on year; the adjusted net profit was €168 million, which was down 92% compared to €2.149 billion in the same period last year.

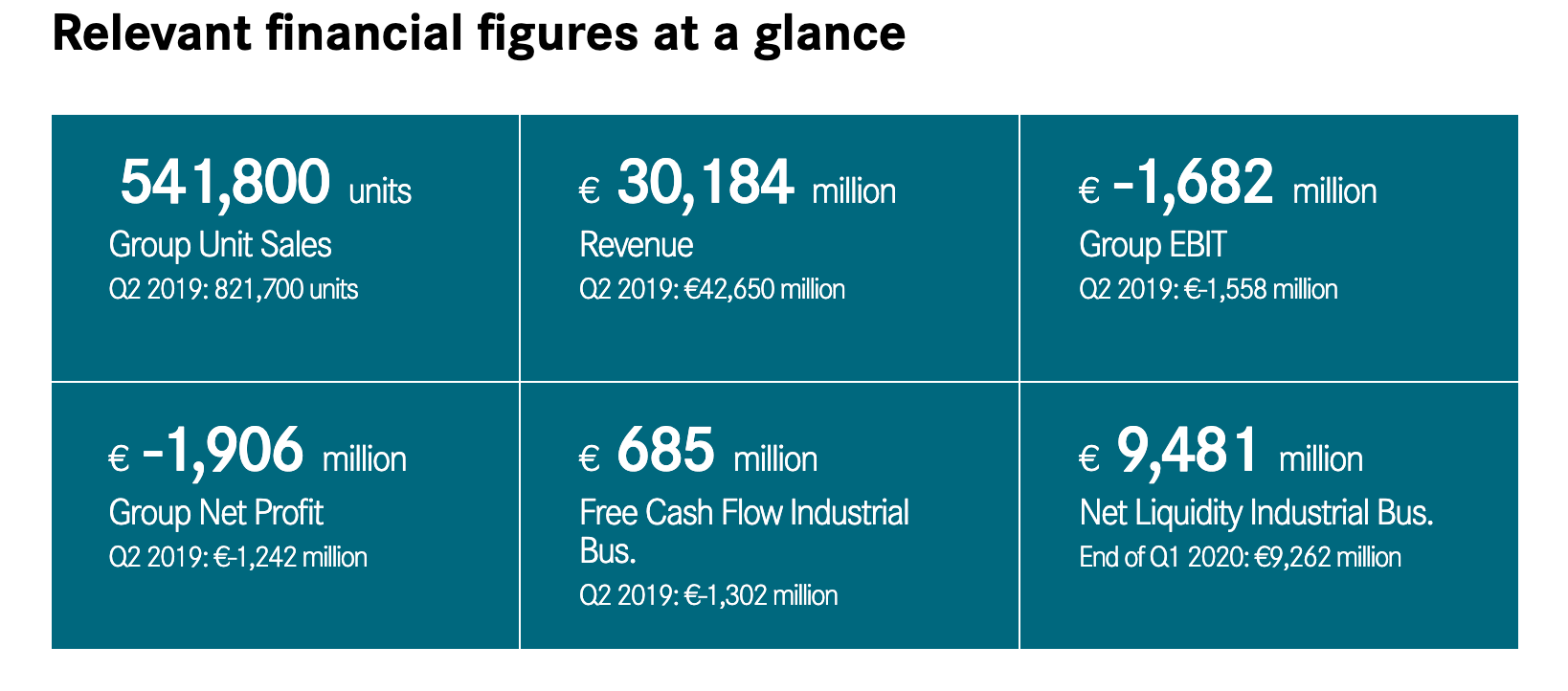

Daimler’s total sales for Q2 2020 were 541,800 vehicles, a 34% YoY decrease; the revenue was €30.2 billion, a 29% YoY decrease; the adjusted net loss was €1.9 billion.

As we mentioned earlier, Mercedes-Benz is indeed facing a financial crisis. In order to facilitate the smooth transition, Mercedes-Benz needs to make stronger changes to “cut costs and increase profits”.

Meanwhile, as the automotive industry is accelerating its transformation, it is foreseeable that the next decade will be the high period of R&D investment by Mercedes-Benz. Considering the company’s continuous efforts in electrification, it can be inferred that the R&D investment of Mercedes-Benz will not decrease.

Therefore, Mercedes-Benz plans to cut operating costs by 20% before 2025 and make significant adjustments to its existing product lines. Although this adjustment may involve the employment of tens of thousands of people, Mercedes-Benz must make a choice under the pressure of “airbag gate,” “diesel gate,” and “heavy R&D investment,” and that choice is to prioritize “cost reduction and efficiency enhancement” as a top-level strategic implementation.

# Mercedes-Benz’s full electric army

# Mercedes-Benz’s full electric army

In Kommenling’s words, “The process of transitioning to electrification is very painful, but in order to continue to succeed in competition, we must take corresponding actions to significantly improve our financial strength and ensure that the company smoothly transitions through difficult times.”

Transition is never a overnight process, especially for a giant enterprise like Mercedes-Benz. Ensuring its own financial health and increasing financial strength is the foundation for accelerating the transition to electrification. Isn’t “money” the beginning and end of all business activities? Therefore, strategies such as reducing costs and increasing efficiency are not problematic.

As of today, Mercedes-Benz needs to continuously create blockbuster products on the product side, and the EQC which relies on “oil to electric” conversion is almost unreliable. Mercedes-Benz needs to work on cutting-edge products and make significant adjustments to its product line towards electrification.

Specifically, Mercedes-Benz will launch four new all-electric products based on the upcoming large EVA pure electric platform. Among them, EQS is the first representative work of this electric platform and will be launched in 2021. Its WLTP endurance exceeds 700 kilometers. Next, EQE, EQS SUV and EQE SUV will be introduced one by one.

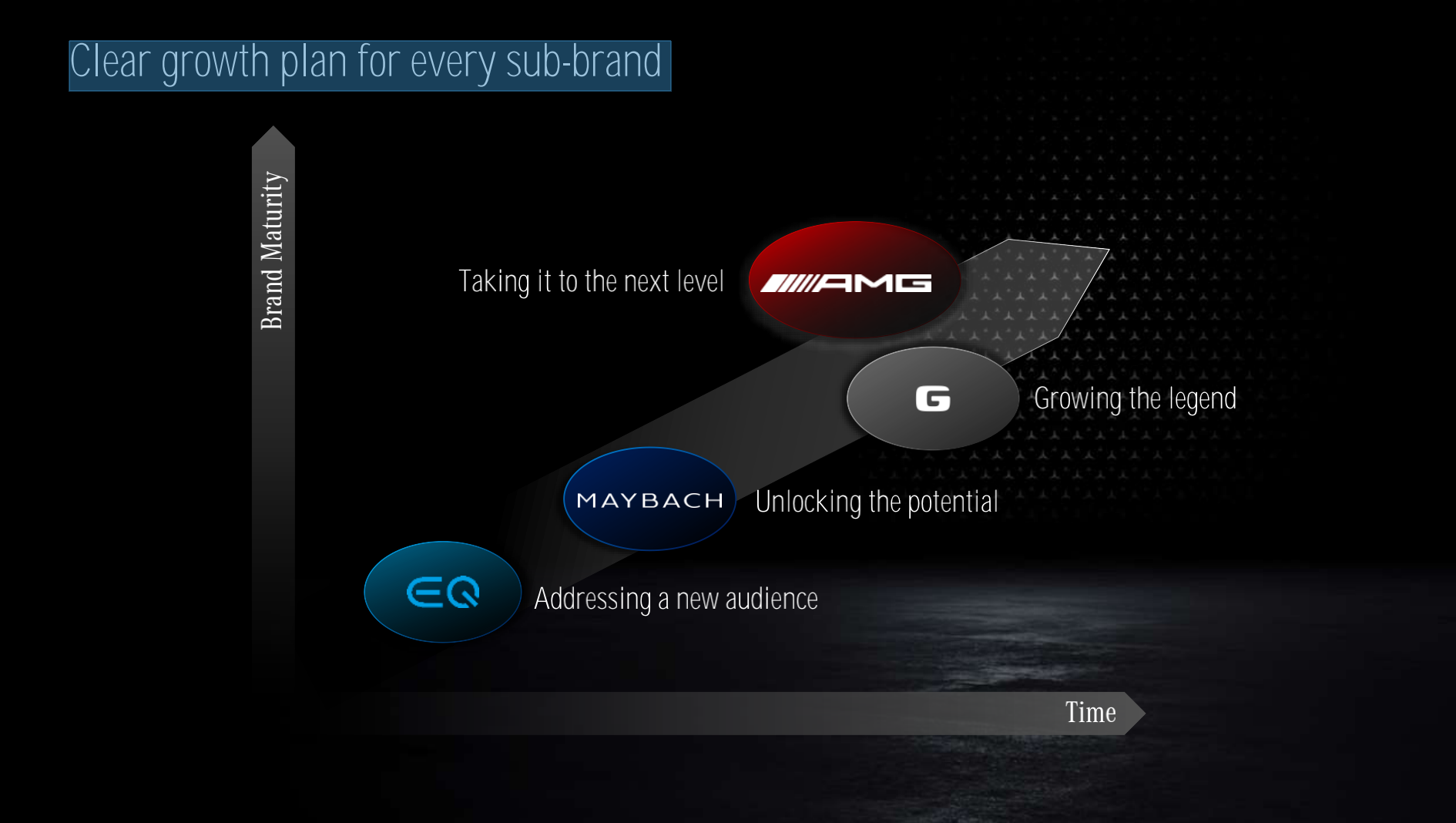

In addition, AMG, Maybach, and G-class will also provide electrified products, and in the future, there will not only be a four-cylinder G, but also an electric G.

Starting in 2025, Mercedes-Benz will launch entry-level and mid-size electric models based on the second exclusive electrification platform, the MMA platform, to further improve the electric product lineup.

In terms of electrification plans, by 2030, electric vehicles models will account for more than half of new car sales. By around 2039, the sale of internal combustion engines will be banned, and the number of traditional internal combustion engine models under the Mercedes-Benz brand will decrease by 70% in 2030.

From here we can see that Mercedes-Benz is no longer just testing with some of its car models, but is implementing electrification across all of its flagship models including the AMG and G series. This move is seen as a consensus with their German competitors, utilizing pure electric platforms to create products that better meet market demand.

What’s particularly interesting here is that Mercedes-Benz has launched two pure electric platforms for the first time, which is a change they’ve made clear after BMW’s wavering in the pure electric technology route, taking their own proprietary pure electric platform approach.

Pure electric platforms may not fulfill Mercedes-Benz’s dream.

Among the top three German automakers, Mercedes-Benz’s electric technology promotion lacks decisiveness and clarity. The EQ series almost wiped out Mercedes-Benz’s confidence in electric vehicles. Some data can be seen from the same 2019 pure electric SUV market, where the Audi e-tron sold about 26,721 units, Jaguar I-PACE sold about 20,055 units, and Mercedes-Benz EQC sold only about 2,013 units.

This is also an important reason why Mercedes-Benz has had to change, as the market has given the most direct answer.

Audi, under the Volkswagen system, has been the most firm and rapid in its transformation, with the MEB for the high-end and PPE for the low-end, a staunch supporter of pure electric platforms, with Audi playing a leading role.

Although BMW initially also had a compatibility platform strategy, after testing the i3, it also wavered in its pure electric technology route. The fifth-generation platform iX3 is already very close to pure electric platform, but it is still not quite thorough.

In comparison, although Mercedes-Benz also has a compatibility platform, its product strength and pricing strategy led to the failure of the marketing of the EQC.

The most important point of Mercedes-Benz’s new strategy is to streamline its technology route.

Mercedes-Benz has almost laid out a complete development path from hybrids to pure electric vehicles, ensuring that the product maintains its market competitiveness on one hand, and continues to stay ahead in competition in the next stage on the other hand.

The pure electric passenger cars that Mercedes-Benz already has include EQC, EQA, and EQB. EQC is already on sale, while EQA and EQB will be launched this year and next year respectively. These three vehicles are all based on Mercedes-Benz’s existing traditional gasoline vehicle platform, but based on the performance of EQC, it appears difficult for the whole EQ series to make a breakthrough in the Chinese market.”EVA” is a pure electric exclusive platform used for developing large-scale electric vehicles. According to the official statement, the first vehicle model, EQS, will be released in 2021 according to the S class definition. It is expected to have a WLTP range of 700km, equipped with 500kW fast charging, and may possibly use 800V technology. Future models such as EQE will also be developed based on this platform.

“MMA” is a pure electric platform designed for compact and mid-sized cars. This platform will mainly produce products to compete with the Model 3 and similar vehicles. In fact, this is the line of low-cost derivatives that Mercedes-Benz wants to develop on the basis of the EVA platform. This means that MMA will be defined based on EVA’s experience, so EVA needs to first gain market recognition, otherwise it may bring greater resistance.

I personally support the path of pure electric exclusive platforms. But can Mercedes-Benz completely change its situation in the field of electric vehicles through this platform strategy?

From Mercedes-Benz’s platform planning, it seems that for a considerable period of time, Mercedes-Benz will focus on high-end electric vehicle products in the field of pure electric vehicles. This also corresponds to one of the six major pillars of Mercedes-Benz, which is “strengthening the luxury brand positioning”.

Currently, there are not many disclosures about EVA’s technology. But based on the current pace of competition in the market, it is estimated that mass delivery of EQS, which is positioned at the S class level, will not be achieved until at least 2022. Therefore, if Mercedes-Benz wants to enjoy the brand dividend in the era of electrification, EQS and EQE need to prove whether they can continue the glory of this level in the field of fuel vehicles.Moreover, there is no specific launch time for MMA, meaning it is a “futures” product. It is worth noting that the market this platform faces is the largest mid-range market, and Mercedes-Benz is currently using an “oil-to-electricity” platform in this market. The limitations of the oil-to-electricity platform are very high, and the entire vehicle engineering tuning is very difficult to change. However, Tesla, Volkswagen, and new car makers have proven through practice that the pure electric platform has better scalability and cost reduction advantages.

However, Mercedes-Benz still insists on using traditional platforms for new energy vehicles, which can be explained by two reasons:

-

Mercedes-Benz only adopts a pure electric platform for large cars, which is determined by its positioning as a high-end luxury brand. High-end products have high profit margins, and selling one can be equivalent to selling ten, but can Mercedes-Benz ensure a large sales volume of its products?

-

Mercedes-Benz is very optimistic about the retention time of fuel vehicles, and in the short term, the sales volume of Mercedes-Benz’s mid-to-low-end products still relies on oil-powered cars. This can be seen from Mercedes-Benz’s strategic planning time. Volkswagen expects that 75% of its new car sales will be electrified by 2030. BMW plans to achieve electrification for all of its products by 2025, while Mercedes-Benz’s sales of new electric vehicles will only reach 50% by 2030. Compared with its competitors, Mercedes-Benz is relatively conservative in this aspect.

Mercedes-Benz’s current strategy can be summarized into three points:

-

Look forward to the future and play well with electric and digital cards.

-

Based on the present, strengthen the product portfolio and positioning, leverage the potential of sub-brands (AMG, Maybach, G-Class, EQ electric series), optimize the balance of sales, price, and channel combination, and improve the marginal revenue of existing and future product lineups.

-

Focus product development resources and capital on the most profitable market segments, as well as its most competitive niche markets, to ensure stronger structural profitability.

Overall, whether based on external market pressure or internal change, Mercedes-Benz has finally taken a substantive step towards electrification. However, the meeting did not indicate how Mercedes-Benz will push forward with specific quantitative criteria for this approach, such as expected vehicle sales volume, battery supply selection, etc.

Mercedes-Benz’s choice, let the future prove

Many people may wonder about Mercedes-Benz’s choice. To sum it up in one sentence, it is “both present and future.” This is not a bad thing, and it is still a common saying that the transformation of large companies cannot be done overnight. We need to take a more macro perspective to examine Mercedes-Benz’s competition in the entire automotive industry, and a more micro perspective to consider the difficulties it has encountered in this process.“`

In “The Innovator’s Dilemma,” there is a sentence that says, “Traditional businesses may die from path dependence, and disruptive innovation may disrupt the growth of traditional fields, but it may bring a new future to the enterprise.”

In “The Innovator’s Solution,” there is a similar sentence that expresses the same idea, “Innovation may lead to death, but not innovating is waiting for death. Instead of waiting to die out, it is better to strive in uncertainty and become the disruptor.”

In the past, our habitual thinking would make us believe that the above two paragraphs are completely correct, but they are not. Innovation requires courage as well as attention to detail.

“Transformational innovation is a career, not an action.” Behind Mercedes-Benz’s transformation are 300,000 global employees, hundreds of supply chain systems, and hundreds of thousands of dealers around the world. This is not a reckless boast that can succeed or fail. On the contrary, being conservative is worth praising from another perspective.

The challenges of electrification and achieving autonomous driving are common to the entire automotive industry, and Mercedes-Benz is also facing financial and research and development pressure. Mercedes-Benz’s logic is to take a foothold in the present and move forward in a healthy way.

“Now, the software and hardware architecture of cars is changing, and control over the product is changing,” and in order to continue to participate in the game, it may be necessary to invest the money earned before.

“From the new strategic content, Mercedes-Benz is actually trying to break free from the shackles of the ‘big company,’ but the final so-called success needs to be judged by the market. The platform is good, but hope is not just a paper tiger.”

“`

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.