The power battery industry appears calm on the surface, but it is actually surging with hidden currents. The competition between domestic and foreign power battery companies has become more direct due to gradually opening policies.

According to the data on the global power battery enterprise market share in the first half of this year compiled by SNE Research from South Korea, CATL dropped from first to second, with a market share of 23.5%, and LG Chem (referred to as LG below) rose to first place with a market share of 24.6%.

This is also the second time LG has surpassed CATL this year. As early as the first quarter of this year, LG had already surpassed CATL with a market share of 27.1%.

The situation in the first quarter was largely due to the impact of the domestic epidemic on CATL. However, the domestic epidemic has been stabilized since March, while the impact of the foreign epidemic is expanding. Based on this situation, it was thought that CATL would return to first place, but LG has once again defended its position.

Between the ups and downs, on the one hand, it reflects the changes in the overseas power battery market, and on the other hand, it can also sense the changes in the domestic market.

Let’s take a look at whether LG’s lead is sustainable, the potential risks of CATL, and whether CATL can return to the top from the changes in these power battery companies.

The data is not optimistic

On August 26th, CATL released its financial report for the first half of 2020, showing that CATL’s operating income was RMB18.829 billion, a year-on-year decrease of 7.08%; the net profit attributable to shareholders of the listed company was RMB1.937 billion, a year-on-year decrease of 7.86%.

Regarding the decline in performance, CATL pointed out in its report that due to the impact of the macro-economy caused by the new crown pneumonia epidemic and the severe decline in market demand, the production and sales of new energy vehicles have decreased significantly, leading to a reduction in the sales of the company’s power batteries.

The decrease in income corresponds to a decline in installed capacity. First, let’s take a look at SNE Research’s statistics on the installed capacity of global power batteries in the first half of the year.

| Battery Manufacturer | Installed Capacity | Proportion |

|---|---|---|

| LG Chem | 10.5 GWh | 24.6% |

| CATL | 10 GWh | 23.4% |

| ———— | —————— | —— |

| Samsung SDI | 2.6 GWh | 6.1% |

| Panasonic | 8.7 GWh | 20.4% |

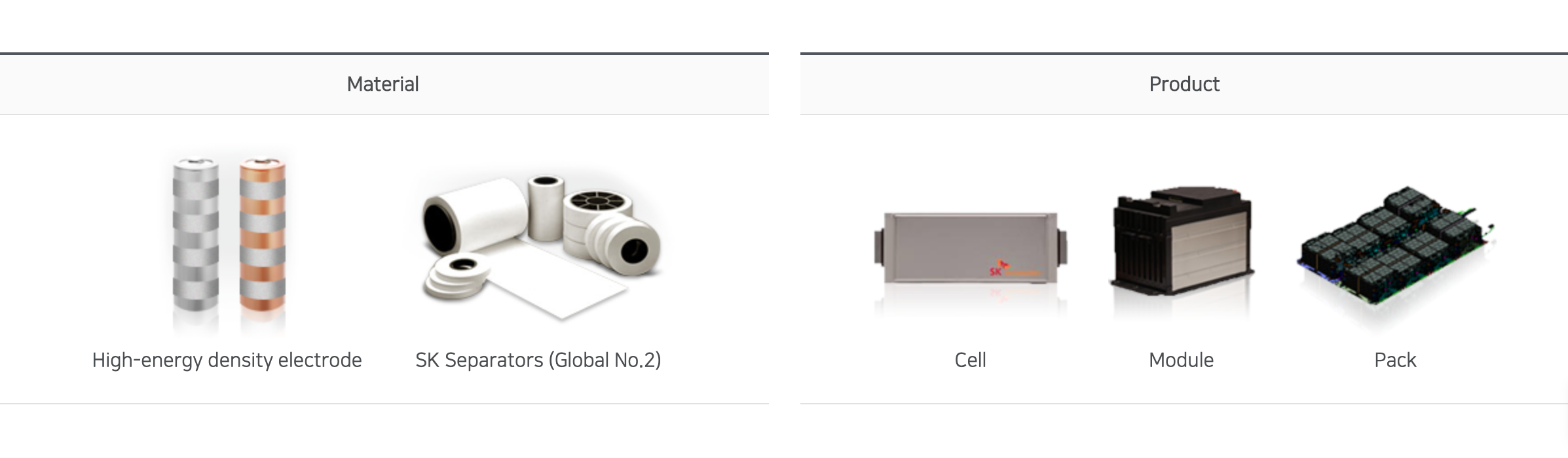

| SK Innovation | 1.7 GWh | 3.9% |

| BYD | 2.6 GWh | 6.1% |

| Total | 42.6 GWh | – |

According to statistics, the total installed capacity of the three major power battery companies in Korea, LG, Samsung, and SKI, is 14.8 GWh, almost twice as much as the same period last year, and their combined market share has increased to 34.5%.

However, the installed capacity of major power battery companies in China and Japan, including CATL, BYD, Guoxuan High-tech, and Panasonic, has all declined to different degrees. CATL’s installed capacity in the first half of the year was 10 GWh, a year-on-year decrease of 28.1%.

Samsung and SK Innovation ranked fourth and sixth in installed capacity with 2.6 GWh and 1.7 GWh, respectively. LG’s installed capacity in the first half of the year was 10.5 GWh, an increase of about 82.8% compared to the same period last year.

In terms of global vehicle manufacturers’ installed capacity, Tesla is still the core guarantee for LG’s increase in installed capacity.

According to GGII data, the installed capacity in China in the first half of the year was not optimistic.

| Battery Manufacturer | Installed Capacity | Share |

|---|---|---|

| CATL | 5.75 GWh | 43.6% |

| LG Chem | 2.51 GWh | 18.9% |

| Panasonic | 0.36 GWh | 2.7% |

| BYD | 1.97 GWh | 14.8% |

| CALB | 0.76 GWh | 5.7% |

| Guoxuan High-tech | 0.48 GWh | 3.6% |

| Lishen | 0.23 GWh | 1.7% |

| EVE Energy | 0.19 GWh | 1.4% |

| Tianjin Lishen | 0.14 GWh | 1.0% |

In the domestic market, Ningde Times still sits firmly in the first place, but the situation has quietly changed. In the first half of 2020, only LG, Aviation Lithium Battery, Panasonic, and Tafel achieved a year-on-year growth among the top 10 companies in the Chinese market, and other companies all declined to varying degrees.

Foreign battery companies LG and Panasonic have achieved a significant increase in installed capacity in the Chinese market, driven by Tesla and Toyota’s delivery volume, and are now among the top ten power battery companies in China.

LG has surpassed BYD in the domestic market, ranking second. From this, we can see that foreign power battery companies are accelerating their penetration into the domestic market after China’s policies have gradually opened up.

The impact of this has two aspects. The first is that LG, which has technical advantages, will further erode the market share of Ningde Times in the high-end power battery market. The second is that after LG accelerates the construction of factories in China, it can further form an advantage in price, which will shorten Ningde Times’ advantage in pricing.

This “give and take” is not a good thing for domestic giant Ningde Times. Let’s take a look at the impact on Ningde Times.

Ningde Times is becoming “dangerous”

The power battery industry is quietly undergoing changes, and commercial rules determine that the game is generally between the first and second places in an industry, and in the power battery industry, undoubtedly LG and Ningde Times.

And it is precisely because foreign battery manufacturers are accelerating their penetration into the domestic market that Ningde Times, as the number one domestic manufacturer, has to be vigilant.

This is easy to understand, because its market share is being further eroded, and the possible consequence is that the market for power batteries that Ningde Times opened up earlier may become a wedding dress for its competitors.

Previously, Ningde Times Electric was moving too smoothly. Although the company itself was quite impressive, it took advantage of relevant policies to constantly improve its technology and expand its market, and eventually grew rapidly into a giant in the battery industry, achieving the top spot in the global market. However, in terms of power battery technology, it is not easy to catch up with decades of technology accumulation in just a few years.

However, foreign manufacturers only show us the changing pattern of power batteries, and some dangerous signals of the problems that Ningde Times Electric faces itself have begun to become apparent.

Several points can be analyzed as follows:

European and American markets are releasing car models, and Ningde Times Electric’s global layout may be in trouble

The amount of cars sold forms the basis of how much power battery suppliers produce. When discussing the decline in power battery installation due to market conditions, the epidemic is an undeniable factor, but not the root cause. The reason for LG’s growth is because of the increase in sales volume from Tesla and the European market.

On August 21, Ningde Times Electric Chairman Zeng Yuqun called on people at the blue-book conference on new energy vehicles to “not make Chinese new energy vehicles get up early only to arrive late” because Europe surpassed China in the first half of 2020 to become the world’s largest market for new energy vehicles.

Looking at the current layout, nearly 96% of Ningde Times Electric’s revenue comes from domestic sales and the proportion of overseas revenue is very low. This means that Ningde Times Electric can only be deeply bound to the development of China’s new energy vehicle market.

In contrast, LG’s battery supply for Tesla Model 3, Renault Zoe EV and Audi e-tron, which had the highest sales volumes of new energy vehicles in Europe during the first half of the year, has far exceeded Ningde Times Electric. Among them, Renault Zoe alone sold 36,506 units, which is about 3,000 units more than Tesla Model 3.

The latest Renault Zoe is equipped with a 52 kWh battery, which means this car needs nearly 2 GWh of power batteries in the first half of the year alone in terms of sales volume.

However, Ningde Times Electric’s main customer in Europe, BMW, cannot bring about qualitative changes in Ningde Times Electric’s product sales.The biggest difference between CATL and LG is that although both emphasize globalization, CATL’s supply in Europe is not very high. Although CATL’s customer base is truly global with clients such as BMW, its main supply market is still in China, and in North America, CATL has almost no market share. In other words, CATL’s continuous global dominance is actually more reliant on a single domestic market.

As for LG, it supplies power batteries to Hyundai, Kia and other automakers in Korea, GM, Daimler, Ford, Chrysler and other automakers in the United States, Tesla, Geely, SAIC, Great Wall and other automakers in China, and Volvo, Renault, Audi, and other automakers in Europe. The key point here is that LG’s market distribution is relatively even globally, and LG has begun to penetrate the domestic market, whereas CATL’s position in overseas markets is not as firm as LG’s.

Domestically, power battery safety is highly valued by automakers, and the majority of automakers understand the pros and cons of not being able to control core components. Therefore, diversified battery suppliers are inevitable. As we mentioned above, CATL’s market share overseas is actually very limited. In terms of the domestic market, CATL is still the undisputed leader, but it cannot be compared with the market environment of two or three years ago. Before 2018, CATL’s orders were queued up at the door. However, now that the technologies and production capacities of other power battery manufacturers have become stable, automakers have more choices.

For example, Tarform, a new player this year, supplies batteries to NIO, but NIO also has CATL as a supplier. Comparing the monthly sales of NIO and Tarform breaking into the top ten power battery suppliers, it can be seen that Tarform’s proportion within the NIO system should be much higher than that of CATL.The choice of power batteries for GAC Motors is also changing. GAC’s battery suppliers can be divided into three stages. As early as 2018, GAC’s pure electric products chose CATL’s battery cells, while PHEV used Wanneng 123’s battery cells. In 2019, GAC switched PHEV’s battery cells to CATL. In 2020, GAC introduced Funeng and AVIC, and started to adopt a split supply mode on Aion S.

As a result, the supply proportion of CATL in Aion S and Aion V has declined. Currently, Aion LX is the only model exclusively supplied by CATL. Therefore, the battery supply pattern of mainstream domestic automakers is changing. After introducing Funeng and AVIC, CATL’s supply proportion will surely decline gradually.

Moreover, it’s learned that there may be more than one automaker doing this. As a result, CATL’s true pressure in the domestic market will double, mainly in several aspects. One is that the proportion of battery supply to automakers will be diluted. If there are no new cooperating automakers or models, CATL’s shipment volume in the future may be diluted. Another is the joint venture factories between CATL and automakers may not be built on schedule. The joint venture factory with GAC, which was expected to start construction in October last year, has no news so far. Finally, the second and third-tier battery manufacturers that have been invested in by large manufacturers will rely on the products of large manufacturers and start to mass produce power batteries.

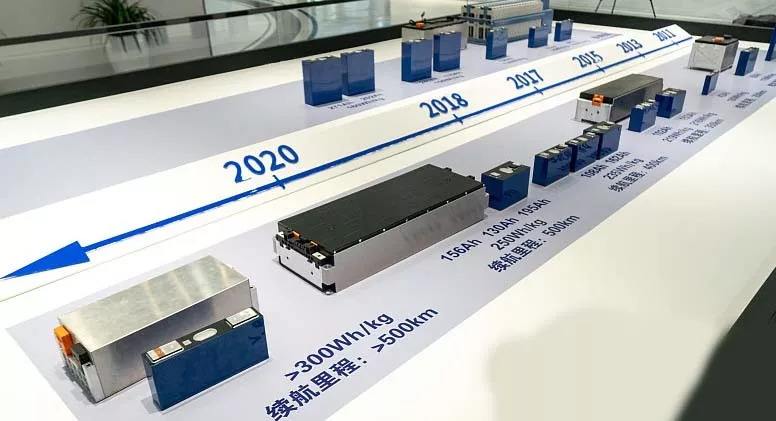

CATL’s advantage in production capacity has not fully transformed into technological advantages. No one can deny the success of CATL, which caught up with the demand boom of domestic power batteries. The reason why CATL is able to iterate quickly in battery cell technology, energy density and production process is ultimately due to the absolute lead over competitors in production capacity. As early as 2017, CATL’s Huduong factory had a production capacity of 15 GWh, and Xining, Qinghai had a production capacity of 2 GWh. By 2019, CATL’s total production capacity had reached 58 GWh.# The 2017-2019 Period was the Peak of Battery Demand for Domestic Automakers

During the 2017-2019 period, domestic automakers had the strongest demand for batteries, with only CATL being able to handle the orders. Relying on scale advantages, CATL almost exclusively enjoyed the first wave of domestic power battery dividends.

As demand decreased and policies were relaxed in 2020, foreign power battery manufacturers began to eye the Chinese market. For CATL, upgrading their technology to sustain competition in the next phase is crucial.

This is not an easy task for CATL, as increasing production capacity can be achieved in the short term with money, whereas technology has a much higher degree of uncertainty. Recently, we learned from sources close to CATL that they are “adjusting the research and development focus of their 811 batteries, instead primarily shipping 523 batteries with 811 as a secondary focus. Some manufacturers have also started to switch from 811 to 523 batteries.” If this is true, it would mean that CATL’s marketization process for 811, which cost them tens of billions of yuan, will be stalled.

Once the news was released, we immediately contacted the relevant department heads at CATL to verify the information. Their response was “rumors, would they believe me if I said China was giving up the Beidou satellite system?” Although the news was confirmed to be a rumor, discussion regarding the 811 battery continues to circulate.

We speculate that it is not CATL abandoning the 811 battery, but rather automobile manufacturers reviewing the product and switching to 523 batteries. After all, the stability of 811 has its natural limitations. Although the 811 battery has a huge advantage in improving energy density and reducing cost, the performance of power batteries’ cycle life, safety, and rate capability will all be weakened as the nickel content in high nickel ternary batteries increases.

According to surveys conducted by SNE Research, as the capacity of power batteries increase by 10%, the cycle life is reduced by about 20%, the charge and discharge rate drops by 30-40%, and the temperature of the battery core will rise by about 20%.

Therefore, compared with the potential danger of spontaneous combustion, automobile manufacturers tend to choose a safer and more stable solution. After all, if anything goes wrong, the public will only look to the OEM for protection.

If some carmakers initially were unwilling to use 811, these automakers that consume existing 811 battery orders mean that the incremental growth of CATL’s 811 would peak, and the existing inventory of 811 can only respond according to changes. Although this behavior of carmakers brings supply loss to CATL, it is acceptable. However, if it causes further shrinking of CATL’s technical advantages in the field of battery cells, it will be difficult to recover.

Fortunately, the CTP technology at the process level is a technical advantage of CATL. The trend of battery pack is to use large module solutions. Other top battery manufacturers at home and abroad also intend to upgrade their technologies. But it is probably difficult to make disruptive changes in the short term.

CTP technology is currently the most effective method for CATL to increase energy density while ensuring safety. Except for 811, CTP may be the best solution to deal with LG 712 battery cells.

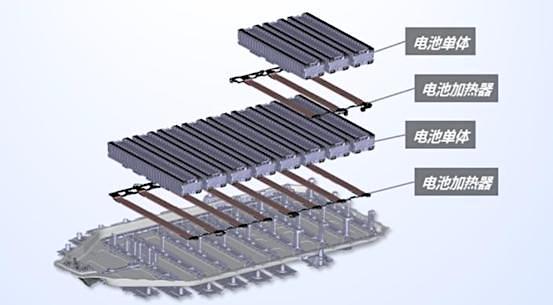

Recently, CATL also announced a new technology called CTC (Cell to Chassis).

This technology has not yet disclosed many technical details, but from the known information, it integrates the battery cells and the chassis together, and also integrates the entire architecture of the three-electricity system, which is quite similar to CTP in terms of technical principles. Both reduce middleware to improve battery integration efficiency.

However, there are several issues with this technology:

-

Battery manufacturers need to participate deeply in vehicle design, and it is unknown whether automakers can open up in this regard;

-

Integration means that after an accident, it cannot repair or replace the faulty module alone, which increases the cost of maintenance;

-

The automaker needs to adapt to the new CTC technology and adjust the vehicle architecture, leading to an increase in the development cost of the vehicle as a whole.

Of course, the biggest advantage of this technology is that it can make the overall cost of electric vehicles the same as that of fuel vehicles. If this can be achieved, it will be the beginning of the complete elimination of fuel vehicles by electric vehicles.

Moreover, we learned from CATL that besides traditional ternary lithium-ion batteries and solid-state batteries, they are also developing a kind of lithium-ion battery without nickel, cobalt, or manganese, which is named as metal-free battery or transition metal-free battery. This battery is currently in deep research and will be disclosed at a suitable time.

Moreover, we learned from CATL that besides traditional ternary lithium-ion batteries and solid-state batteries, they are also developing a kind of lithium-ion battery without nickel, cobalt, or manganese, which is named as metal-free battery or transition metal-free battery. This battery is currently in deep research and will be disclosed at a suitable time.

However, it’s a pity that the CTC technology mentioned above will not be applied until at least 2030, and there is no concrete timeline for solid-state or metal-free batteries.

From the above three points, it is evident that CATL has started to show signs of tension. In overseas markets, CATL currently has a slight disadvantage compared to LG, but it’s not significant. However, in the domestic market, it seems that CATL’s dominance will remain unchallenged in the short term.

Judging from the timing of subsidies for car companies in Europe, it is unlikely that CATL will surpass LG in terms of shipments in the second half of the year. However, the real increase in shipments by automakers cooperating with CATL will begin around the second half of the year, so there will be variables in the long term.

I believe CATL’s biggest advantage lies in its continuous investment in advanced technology research and development. At present, the material technology of power batteries has become a bottleneck for the industry. CATL has CTP in terms of technology, and it’s also constantly deepening its research and development in the field of battery material technology, such as cobalt-free battery, metal-free battery, and solid-state battery. Above all, CATL has ample funds to invest in developing technologies.

The Confidence of CATL “Remains the Same”

From the current size of CATL, the fluctuation of its shipment volume with LG in the short term may continue for a period of time. However, as foreign-funded battery manufacturers complete their capacity building in China, CATL will become more passive.

Does this mean that CATL is vulnerable to foreign companies? Of course not.

CATL’s main partner automakers will fully increase shipments in the next 1-3 years, and by 2024, CATL’s production capacity will reach 240 GWh. As a traditional technology manufacturing industry, the scale advantage will always be an advantage-unless someone could surpass it. Therefore, in this regard, CATL will have sufficient competitiveness.

For foreign battery manufacturers, they have not been able to enter the Chinese market due to policy reasons in the early stages. Therefore, the capacity and price they supply to the domestic market may not have true competitiveness compared with domestic companies. As mentioned above, it’s difficult for CATL to make breakthroughs in the battery material level, and the same applies to LG.

According to the announcement of CATL, it can be seen that CATL has invested in Canadian North American Nickel, North American Lithium, and Australian lithium mining company Pibara with a large proportion of shares in the upstream mineral sector of the battery. In addition, CATL has also established subsidiaries overseas, including the United States, Canada, Japan, and Europe.

Obviously, mastering the source of the industry can obtain higher discourse power, and integrating the industrial chain to further control costs and ensure the security of raw material supply is the goal of CATL. When the technology reaches the bottleneck of the industry, vertical integration of the industrial chain is to avoid potential risks in overall competition.

In conclusion, the pattern of the power battery industry will not change significantly in the short term, and the surge of new energy vehicles in Europe and the gradual opening of China will provide an opportunity for foreign battery companies to fight back. It depends on whether the opportunity can be grasped. For CATL, the situation where “I can walk along a big road” will no longer exist, and maintaining advantages and being alert to opponents is the right choice.

For CATL, there are three objective risks currently faced:

-

CATL’s global layout is in trouble and needs to be alert. Without a diversified supply of batteries, CATL’s ability to resist risks will be smaller than that of competitors;

-

The domestic market has begun to diversify the supply of batteries, diluting CATL’s share. This is something that CATL cannot control. Car companies hope to diversify the selection of suppliers to ensure supply security, while battery companies hope to occupy more markets. CATL can only strengthen its ties with car companies through joint ventures;

-

The transformation of CATL’s production capacity advantage to technological advantage is not thorough enough. Firstly, the production capacity advantage is in the manufacturing industry, especially in the growing manufacturing industry. Having production capacity provides opportunities for scale. However, the risk here is that competitors can quickly narrow the production capacity gap by expanding investment. If the technology cannot maintain balance with competitors in the competition, the uncertainty factor for itself will increase.

For CATL, the situation of “lying and winning” may never return. At present, CATL’s market share worldwide is not much different from LG. This wrist can still continue to compete.However, CATL remains the leader in the domestic market, and its leading position is well-established as it holds almost half of the domestic market share in the field of power batteries. China, as the world’s second-largest market for new energy vehicles, has unlimited potential in the future. If CATL can cultivate the domestic market well, it is enough to make its competitors jealous.

Therefore, CATL needs to be fully prepared to enter the market competition. This time, it is going to compete barehanded, without any one-sided policy support or subsidy. CATL is determined to continuously improve itself through internal efforts.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.