Ideanomics Filed IPO Prospectus to SEC with Ticker “LI”

On July 10th, US time, Ideanomics submitted its IPO prospectus to the US Securities and Exchange Commission (SEC) with ticker “LI”, without disclosing the price range or issuance quantity. The disclosed $100 million fund is a placeholder and not the final fundraising target.

Before delving into the purpose of the listing, let’s take a closer look at the data disclosed in this prospectus.

Extremely Efficient Fund Utilization

In December 2019, Ideanomics delivered a total of 973 vehicles with a revenue of CNY284.367 million and total sales cost of CNY284.462 million, resulting in a gross loss of only CNY95,000.

In Q1 2020, Ideanomics delivered a total of 2,896 vehicles, generating revenue of CNY851 million and sales cost of CNY783 million, resulting in a gross profit of CNY68.288 million with a gross profit margin of 8%.

The cost of bills of materials (BOM) is closely related to the production volume of vehicles. A high production volume not only gives car manufacturers stronger bargaining power in the supply chain, but also effectively reduces production costs.

Looking back at Q2 2020, with deliveries of 6,604 vehicles, Ideanomics is expected to raise its gross profit margin again if it maintains the current sales cost. This is a proud achievement for a new car manufacturer that has just started mass production.

Substantial Cash Flow

Since its angel round financing in October 2015, Ideanomics has completed a total of eight rounds of financing. As of March 31, 2020, Ideanomics held CNY1.054 billion in cash and cash equivalents (approximately $148 million), and CNY2.351 billion in fixed deposits and short-term investments (approximately $332 million), totaling CNY3.4 billion (approximately $480 million).

As of June 2020, after the D round financing led by Meituan with follow-on investment from CICC Capital and Li Xiang, Ideanomics has over $1 billion in cash on hand.Here is not trying to emphasize the strength of ideal financing capability, but rather to highlight the precision with which Ideal Automobile manages its finances. According to my rough calculations, Ideal Automobile has accumulated only about 2 billion dollars in financing.

Huang Mingming, the founding partner of Mingshi Capital, which has been investing in Ideal Automobile since the angel round, revealed in an interview with 36kr:

Every round of financing for us is not easy, even the C-round financing led by Wang Xing, we had to approach many institutions first.

This means that Ideal Automobile has been in operation for 5 years and has delivered 10,473 vehicles, achieving a positive gross profit with very little capital. According to Li Xiang’s own data disclosed on WeChat moments, it took a total of 1 billion dollars from establishment to achieving positive gross profit. Additionally, Ideal Automobile holds a considerable amount of cash.

All of the above data reflects Ideal Automobile’s extremely high efficiency in using funding, which is closely related to Li Xiang’s management philosophy and thinking.

Precise consumer positioning and product positioning

This is an advantage that Ideal Automobile wrote in its prospectus.

After conducting detailed surveys of hundreds of Ideal car owners, we found that there is a high consistency between the actual users and target users of Ideal ONE.

Most Ideal ONE users are families with two children who prefer self-driving trips. These users’ core requirements are a large three-row and six-seater space, no mileage anxiety, and a pure electric and intelligent driving experience. Ideal ONE has perfectly attracted its target users with its high value for money and comprehensive experience advantages.

At this point, the most confusing aspect is how to view Ideal’s range-extended electric vehicle technology.

In terms of energy utilization efficiency, pure electric vehicles are the first choice to answer the first principle and satisfy a more convenient driving experience than fuel vehicles and hybrid vehicles. However, besides the development stage of the electrochemical technology route, new energy vehicles must answer the question of environmental adaptability. Here, this includes both the environmental adaptability of the energy use scenario and the public’s acceptance process.

For a simple example, for a user who likes both the pure electric driving experience and self-driving trips, the reason for choosing Ideal rather than other pure electric models may be “less complicated.”

At this transition point from fuel vehicles to electric vehicles, the most suitable power structure that Ideal Motors has experimented with is “range extension”. Ideal’s product positioning is a progressive innovation choice that takes both technological development and environmental adaptation into account.It must be emphasized that the market acceptance of the range-extending technology route must be based on two conditions that can be achieved by a 40-degree battery: NEDC 180 km range and lower battery cost. This is like when we talk about pure electric vehicles, we cannot conclude that pure electric vehicle models are not feasible if electric vehicles with a range of only 200-300 km do not succeed. If we have dug a well 99 meters deep, it’s just one meter away from success.

Amidst the halo of Tesla, all investors love to hear the story of “China’s Tesla”, but Li Xiang has declared: “This car is not for VC, not for investors. I want to create a car that Chinese people are willing to use and can afford.”

For a new car manufacturer that requires significant funding, it’s commendable to ignore the attitude of the capital market and insist on creating a car that meets the needs of users based on user demand.

Considering the characteristics of China’s market – densely populated and lacking in parking space – not everyone can have a home charging pile like the people of California. The experience of using public charging piles still cannot meet user expectations.

In addition, even if batteries are stacked, the actual full-charge range of electric vehicles can only reach around 500 km, while gasoline-powered vehicles can easily reach 700-800 km, and the charging efficiency is also unbeatable by electric cars in the current stage.

According to a report from CIC, although the cost of lithium batteries has decreased significantly from $855/kWh in 2010 to $166/kWh in 2019, it still accounts for 40% of the total vehicle BOM cost, which is very unfavorable for the vehicle gross profit, except for Tesla of course.

Therefore, from user experience to user demand, to BOM cost, for users with long-distance travel requirements, there is a predictable growth window period for range-extending electric vehicles.

According to the same CIC report, the overall sales compound annual growth rate of mid-to-large-sized SUVs was 11.2% from 2016 to 2019, and is expected to reach 13.5% from 2020 to 2024, significantly higher than other types of SUVs.

In a mid-to-large-sized SUV market with continuous sales growth, the IDEAL ONE has verified the consumer demand matching from 0 to 1 and achieved the delivery of the first 10,000 vehicles that new car forces must achieve.

The question to be answered next is how to expand.

Expansion, Expansion, Expansion

With $1 billion in cash flow, 8% single-vehicle gross profit, and delivery of 10,000 vehicles, why does LI still need to go public?Apart from the exit of old shareholders and the realization of employee stock options, what Ideal has to face is the eternal problem of expansion that every company faces.

In the prospectus, Ideal Motors revealed that it plans to launch a full-size SUV with a new generation of range-extended systems in 2022. In order to meet the needs of more consumers, it will also introduce mid-size and compact SUVs in the future.

In other words, Ideal’s only reliance in the next 2 years will be on the ONE model, and it is too early to discuss the sales of the next full-size SUV in 2022.

Many people may say that Ideal’s possible risk is having a single model.

If we take the perspective of traditional automakers, this is indeed a problem.

Let’s take Tesla for example, currently, only the Model 3 is supporting Tesla’s sales, while sales of Model S/X are insignificant compared to that of Model 3.

Evidently, compared to traditional automakers, Tesla’s models are also quite “single”, so a single model is not the core problem, as long as it becomes a hot seller, that’s enough.

Looking at the sales of Ideal ONE in the past few months, as the backlog of orders is gradually cleared, Ideal ONE’s sales have been declining for two consecutive months since May. Does this mean that there is a growth bottleneck for “Ideal ONE with accurate consumer positioning and product positioning”?

From the current insurance data, in cities such as Shenzhen, Shanghai, Suzhou, Hangzhou, and Chengdu, the sales volume of Ideal ONE in some months has exceeded that of the 7-seater SUV market leader Highlander. Li Xiang himself stated in an interview at Hupan University:

The market share in a city is 8 times different with or without Ideal Motors stores, which means that physical stores can greatly improve car sales, so we need to expand our channels. The number of stores opened has been changed from 20 per year to 60 per year.

From this, it can be seen that in order for a new car brand to expand its territory, in addition to strong product power, the expansion of offline channels is also essential.

However, in this regard, Ideal’s strategy is slightly conservative. As of June, Ideal had only 21 stores nationwide. Although Ideal has tried to reach more users through online channels, cars are still products that rely heavily on experience, and there are many links between product information, order placement, and delivery that must currently be completed in stores or delivery centers.

Evidently, due to the insufficient offline channels, Ideal ONE’s sales have also been affected to a certain extent.As the number of stores increases, can sales break through quickly? We will analyze this based on the results of the next quarter.

Betting on Autonomous Driving

What is the ideal risk?

The positioning of Ideal ONE is very clever. It is the only product that offers a spacious, pure electric driving experience with no range anxiety, qualified assisted driving, and outstanding intelligent vehicle performance. Although it does not have an absolute long version, it is sufficiently balanced.

This is the biggest advantage of Ideal ONE, but also a hidden risk. The advantage is that there is no absolute opponent in terms of comprehensive experience, but the disadvantage is that the single functional feature of Ideal ONE does not have an absolute leading edge.

When traditional automakers gradually realize this market gap, what can Ideal do to guarantee its position?

Ideal must quickly occupy the market within the two to three year window period for extended range vehicle models. Looking into the future five to ten years, or even longer, Ideal has bet on autonomous driving as its key core technology.

In an Autohome live broadcast, Li Xiang revealed that the purpose of selling cars is to get a ticket for autonomous driving by 2025.

The achievements and planning in the intelligent field are important reference factors for Ideal’s market value ceiling after its listing, which directly affects whether LI AUTO is a car company or a technology company.

Recently, the software crisis of Volkswagen spread throughout the auto industry, while the discussion behind the sofware crisis focused on the organizational structure reform of the Volkswagen system.

90% of Volkswagen’s software is outsourced, and the final ID.3 has “huge software vulnerabilities”.

New car manufacturers like Ideal are fortunate to have avoided the organizational baggage of traditional car companies from the beginning, and have created an autonomous driving team that reports directly to the CEO from scratch.

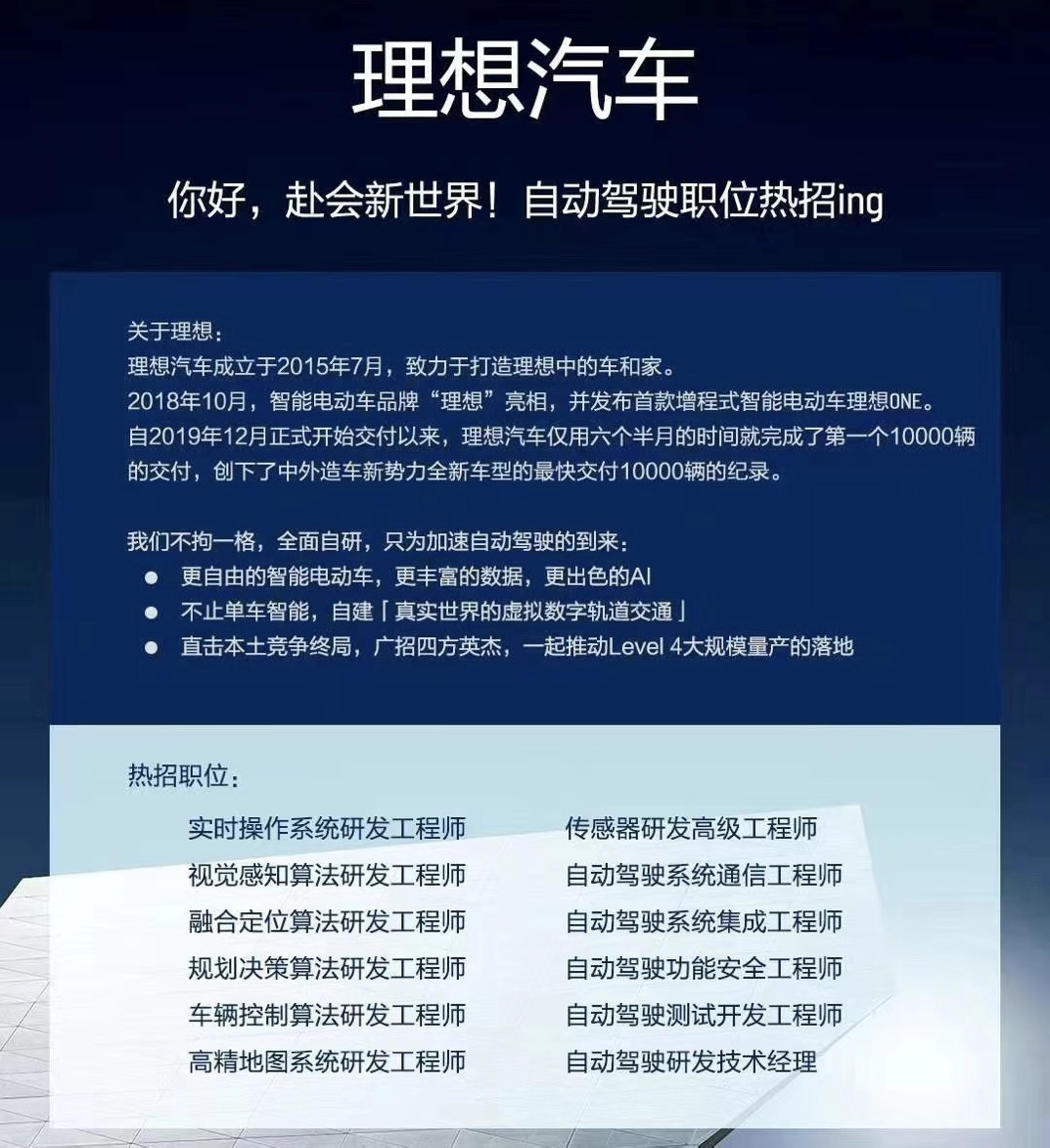

However, unfortunately, in this prospectus, Ideal did not mention the layout and planning of autonomous driving. But on the afternoon of the day the prospectus was released, Ideal officially released a job poster about autonomous driving.

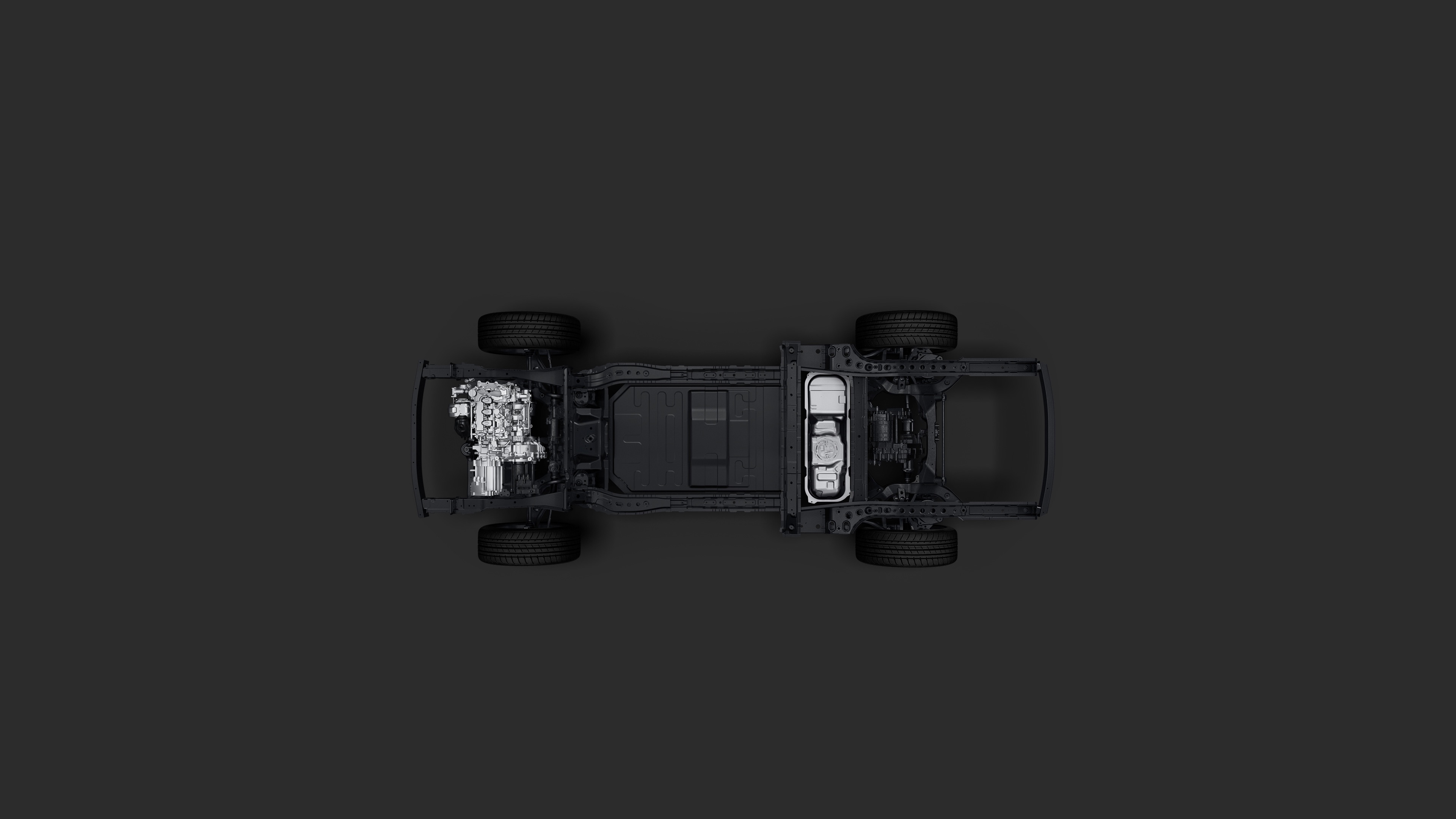

The current assistance driving hardware of Ideal ONE achieves L2-level assisted driving with 1 monocular camera + 1 millimeter-wave radar + 12 ultrasonic radars. In our ADAS evaluation, this car achieved good assisted driving experience with relatively simple hardware.

However, the relatively simple hardware architecture also limits the imagination space for the future.

Based on the information previously revealed by Ideal, the next generation of models will be equipped with 8 high-definition cameras + 5 millimeter-wave radars + high-precision map basic hardware, realizing autonomous driving paths similar to Tesla, but Ideal adds high-precision map data on the basis of single vehicle intelligence.

From the performance of the Ideal ONE, it is good at using relatively mature hardware architecture to achieve delicate user experience. However, by only using mature hardware architecture, Ideal will lag behind its peers in terms of user recognition, which is a problem for Ideal in the field of autonomous driving. In this case, should Ideal continue to catch up the gap in user experience, or should it be more adventurous in developing scenarios?

Secondly, from the perspective of hardware architecture, the current mainstream focus is on single-vehicle intelligence, and perception mainly depends on visual cameras. However, so far, no company using visual perception has truly achieved FSD function, even Tesla, which is at the forefront. In addition, relying on visual perception requires extremely high computing power for autonomous driving chips, and currently, no company’s autonomous driving chip can achieve a balance between computing power, power consumption, and cost.

Finally, in terms of the team, Mercedes-Benz has chosen to cooperate with NVIDIA, and NIO has chosen to rely on Mobileye while North American autonomous driving departments are also recruiting new talent. The team led by Li Xiang of Ideal Car does not have a luxurious lineup, and Li Xiang once said, “In the first stage, we recruit talented people who believe in you, and in the second stage, we recruit top talents who believe in you.”

Therefore, what we expect next is whether Ideal will use its current lineup to create a future of autonomous driving or whether well-known experts will join them.

Conclusion

Wang Xing, who owns 23.5% of Ideal’s equity and is also known as the best commentator in the automotive industry, once wrote on Fanfou:

Unless there is a big accident, Ideal ONE should become the first model among new car manufacturers to deliver over 100,000 vehicles.

On the day when Ideal released its prospectus, Li Xiang changed his personal WeChat profile picture which was used for many years.

And you, do you believe in Ideal’s ideal?

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.