Introduction

I have several friends who have worked hard in various directions at Qiantu Motor Company, but eventually they all gave up when they couldn’t hold on anymore, ranging from 5 years, 3 years, to 1 year. In fact, when reviewing the experience of Qiantu, we can see some problems and the ultimate fate of most new car companies in the future.

1) Money: Early-stage capital is willing to invest in new car manufacturing because they believe that China should also have a Tesla. Therefore, different levels of capital find different teams to invest in. This is the driving force for early-stage new car investment. Capital can choose internet-based teams (NIO, XPeng, Ideal, HumanHorizons), traditional automotive teams (WM Motor, Bordrin, Byton, Skywell, Hozon, Aiways, Yundu), and companies in the traditional supply chain (Qiantu, Yingshi).

Of course, there are also A00 mini cars for expansion (Zhidou, Kandi, Xinte, Leding, Yujie, Shikong), and the funds invested by capital here are limited. However, the support of local governments makes the distribution more dispersed, but the key is continuous financing and investment. Without money, nothing can be done.

2) Do everything right: In the new car manufacturing industry, we evaluate new car manufacturing companies based on several indicators because of the need for a large amount of resources. The first car must be manufactured and the supply chain must be connected, and it must obtain qualifications from the MIIT and the NDRC (this is just spending money, and it is not important when reviewing it now). The second car must be iterated and maintain continuous sales. And this can be broken down into various aspects. Whoever does not have mistakes will inevitably need more resources to make up for it through money and manpower.

3) Convergence of subsidies: We see that the key point is the convergence of new energy vehicle subsidies for passenger cars in 2019. This money was reduced from a maximum of 50,000 RMB to 25,000 RMB, and the subsidy for local governments was removed, basically blocking all roads that do not go high-end. Last year, A-level cars were mainly for 2B-end, but this year, Wuling’s car with a price of less than 30,000 RMB came on the scene, which can continue to sell cars for points. Low-end cars have no way to deal with this.

I think the problem with Qiantu is where these views are concerned. The two founding leaders had a dream of making high-end sports cars, focusing on high-end, and wanting to make parts such as carbon fiber, batteries, and power systems. This approach requires a lot of money. Previously, the parent company’s source of funds revolved around car design. After the target exceeded the scope, no matter how hard the underlying team worked, it couldn’t make up for it.

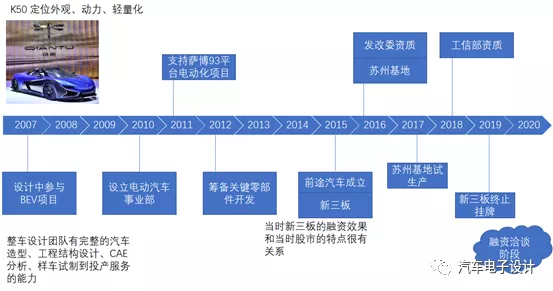

Review of Qiantu’s Takeoff Route

Qiantu started its vehicle business in 2015, obtained the national new energy vehicle production qualification from the NDRC in 2016, and obtained the new energy vehicle production qualification from the MIIT in 2018. In August 2018, it launched the K50 pure electric sports car. I personally think that due to the listing on the New Third Board, the overall financing channels were limited. The fundraising through this platform accumulated more than 2 billion yuan, which is a small amount compared to other companies in the same period. Qiantu’s approach is to spend less money.1)The human resources issue was addressed through a mechanism of sharing with the parent company, i.e. through internal extension. Similarly, the supply chain was selected through previous channels, and then self-invested in the three-electric and carbon fiber aspects. From an organizational structure perspective, one cannot say this method is flawed. There are also many overworked staff members, but the core issue is still the difference in resource investment and product positioning.

2)On August 8, 2018, K50 was officially launched with a post-subsidy price of 686,800 yuan. This car is defined based on its sports car exterior and power characteristics, and the market segment is actually quite narrow. The subsequent expansion plan is to use the K20 (a small car platform for a double-door, agile sports car) which is also purely sport-oriented. When answering the question of why we should buy it, we need to simultaneously possess a sense of luxury and an intelligent experience for substantial conversion. This is something that most front-end automotive people do not understand with regard to whom BEV sales are aimed at.

3)Offense and defense: So much needs to be done in the three-electric, core component, design, and complete vehicle aspects, with only so much resources, and I believe the biggest problem lies in the difficulty of trade-offs, and that a lot of money is continuously being burnt in vertical integration mode. So far, BYD has used a lot of resources on this road, and is gradually beginning to divest components. It is indeed too resource-intensive.

Here, we need to review the funding situation. Prior to entering the complete vehicle segment, Qianteng’s revenue exceeded RMB 40 million in 2014 (mostly from complete vehicle design). Since initiating Future Automotive business in 2015, Great Wall Huaqin has incurred increasing losses in the four years since being listed. Its net profit was approximately -21.75 million yuan in 2015, approximately -98.44 million yuan in 2016, and the loss reached 216 million yuan in 2017, finally expanding to 606 million yuan in 2018.

No matter how many angles you look at it, without funds, it is absolutely impossible to make a car. Without continuous investment, it is impossible to survive and gain customer recognition. Currently, only by gaining consumer recognition and maintaining sales, can we attract capital investment. In the end, Elon Musk’s halo owes a big part of its success to the ability to attract funds, and eventually gain recognition from institutions and the market.

Part Two: Qianteng’s Three-Electric System# Platform Design for the Future

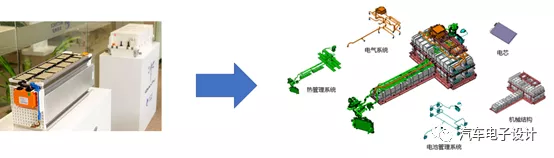

The platform design for the QINGTING electric vehicle is reliant on this sports car, so we can see that the entire system, especially the battery, can only follow the design of the unique battery system of the Audi concept sports car, as shown below. The previous soft pack route was abandoned for this design. One-third of the battery modules are stacked together, and we designed the battery system harness and internal BMS ourselves. The return investment ratio for this car, which is produced in the hundreds, is relatively low in this regard.

To cooperate with the pack production and corresponding work, there must be teams supporting the Beijing R&D team and the Suzhou factory. In 2017, I discussed this with Aledeep in the battery field. It was indeed difficult to do a good job in this area with limited resources. When it comes to this point, it’s not just a matter of not working hard.

Conclusion

QINGTING will continue to move forward, but due to serious funding issues in the past, many of my friends were unable to receive their salaries for more than six months, which is a test for their families. Sometimes, when the leader is good and the direction he or she is working towards is agreed upon, it’s not easy to cut losses. Some things are also not easy to explain in detail, so I’ll stop here for now.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.