In April 2020, NIO formally signed a contract with the Hefei government, receiving a financing of 7 billion yuan from strategic investors such as Hefei Construction Investment Holding (Group) Co., Ltd. After the successful deal, NIO published an article on its WeChat official account with a titled sentence that had been long kept in mind but was hesitant to say: “The past worries are gone, go ahead and buy it.”

This sentence was fully reflected in NIO’s delivery volume in May.

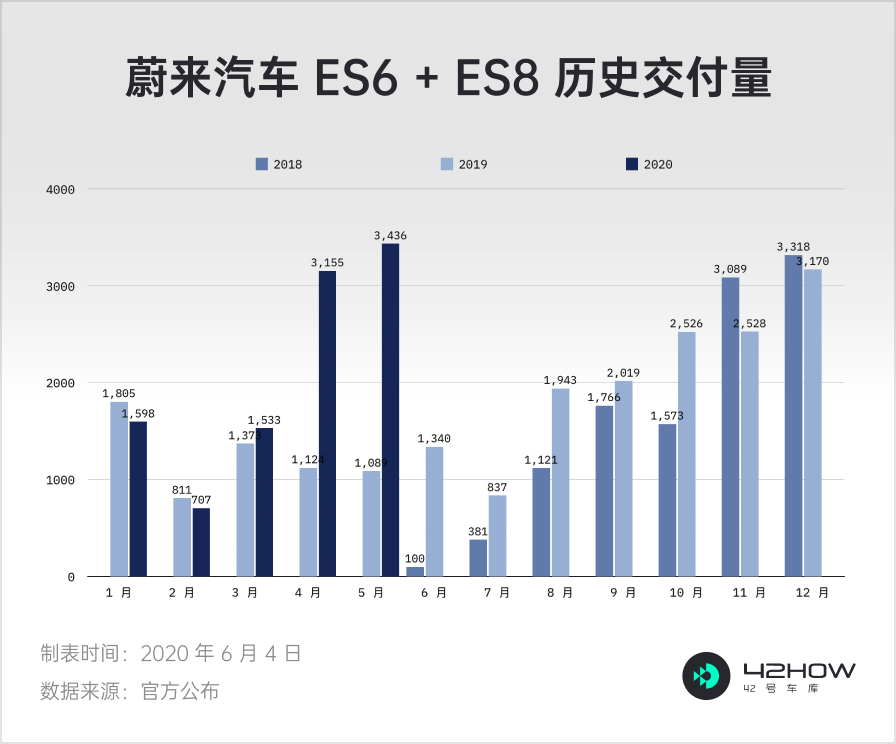

In May 2020, NIO delivered a total of 3436 new cars, including 2685 ES6 and 751 ES8, with a month-on-month growth of 8.9% and a year-on-year increase of 215.5%. The cumulative delivery volume in 2020 reached 10,429, and the cumulative delivery volume of the NIO brand reached 42,342.

No bankruptcy risk, customers can rest assured to make the purchase

The delivery volume in May 2020 is a milestone for NIO. It is the highest monthly delivery volume since NIO delivered cars in May 2018. The previous delivery record was 3318 in December 2018.

Although the two numbers do not have a big difference in numbers, they have fundamental differences behind them.

The 3318 in December 2018 was mostly supported by the backlog of orders after completing the capacity climbing, while the 3436 in May 2020 basically came from the new demand.

At the end of February 2020, after the Beijing Municipal Government issued 54,200 new energy vehicle purchase quotas, I interviewed many potential car owners who were holding cash for purchase but were hesitant to place an order for a NIO car because they were afraid that the company would go bankrupt soon after the purchase.

With the successful 7 billion yuan financing from Hefei, NIO no longer faces bankruptcy rumors and has obviously become more relaxed.

Of course, just having new financing is not enough. If NIO cannot achieve self-sufficiency, there will eventually be a day when the money is burned out. After struggling for more than 5 years, NIO is a step closer to achieving a positive gross profit margin. In the Q4 2019 earnings conference call, NIO expected to achieve a positive gross margin in Q2 2020 and a double-digit gross margin in Q4 2020.During the Q1 2020 earnings call, Li Bin reiterated NIO’s goal of achieving positive gross profit in Q2 and provided specific numbers of “bike-level gross margin exceeding 5%” and “corporate gross margin exceeding 3%”. The achievement of positive gross profit consists of two parts: higher sales and lower operating costs.

NIO delivered a total of 3,838 ES6 and ES8 in Q1 2020, and the expected delivery for Q2 is 9,500-10,000 vehicles. Even if calculated according to 9,500 vehicles, there will be an increase of more than 147% compared to Q1.

Combined with the expected delivery volume and gross margin, NIO is confident in achieving the goal of “bike-level gross margin exceeding 5%” and “corporate gross margin exceeding 3%” when delivering 10,000 vehicles in a quarter. In April and May, NIO delivered 3,155 and 3,436 vehicles, respectively. As of now, the total delivery volume for Q2 has reached 6,591 vehicles. If NIO can maintain the delivery volume of May in June, breaking 10,000 vehicles will not be difficult.

Higher sales mean that NIO has a stronger bargaining power when facing suppliers, including the main cost of electric vehicles, batteries. Even if each car is equipped with a 70 kWh battery pack, NIO’s demand for batteries in May has exceeded 240 MWh. Although there is still a certain gap from Tesla’s 580 MWh (April data), it is undoubtedly the first among the new car manufacturers.

According to our sources, NIO has reached an agreement with CATL, and the battery cost will be reduced from 1200-1300 CNY/kWh to 900+ CNY/kWh. This will greatly help to reduce the overall BOM cost of the vehicle and is highly likely to become the biggest boost for achieving positive gross profit.

Returning to the Q1 2020 financial report, two data points are noteworthy:

- The total loss in Q1 2020 was 1.69 billion CNY, a decrease of 40.9% compared to Q4, and a decrease of 35.5% compared to the same period in 2019.

- Sales and administrative expenses in Q1 2020 were 848 million CNY, a decrease of 45.1% compared to the previous quarter and a decrease of 35.7% compared to the same period in 2019.This means that NIO has transformed from a “rich second generation” who spent money extravagantly to an “economically practical man”.

In addition to these positive indicators, NIO has become the biggest favorite of current policies.

Continuous improvements, capacity bottlenecks?

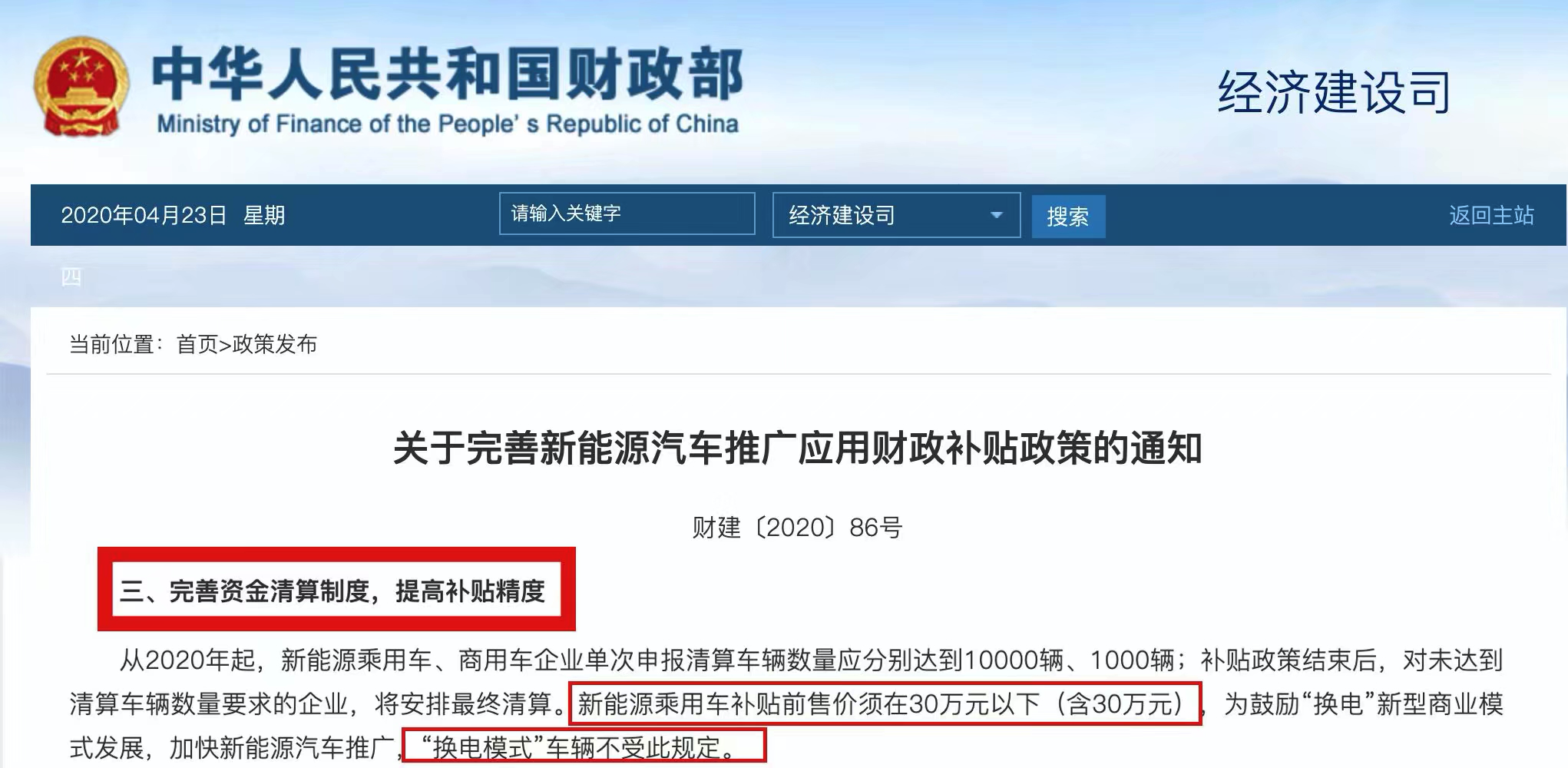

On April 23, the 2020 new energy vehicle subsidy policy was officially implemented, and one piece of information was particularly prominent: the pre-subsidy price of new energy passenger cars must be below RMB 300,000 (including RMB 300,000), in order to encourage the development of the “battery swapping” new business model, accelerate the promotion of new energy vehicles, and “battery swapping mode” vehicles are not subject to this provision.

But the story doesn’t end here.

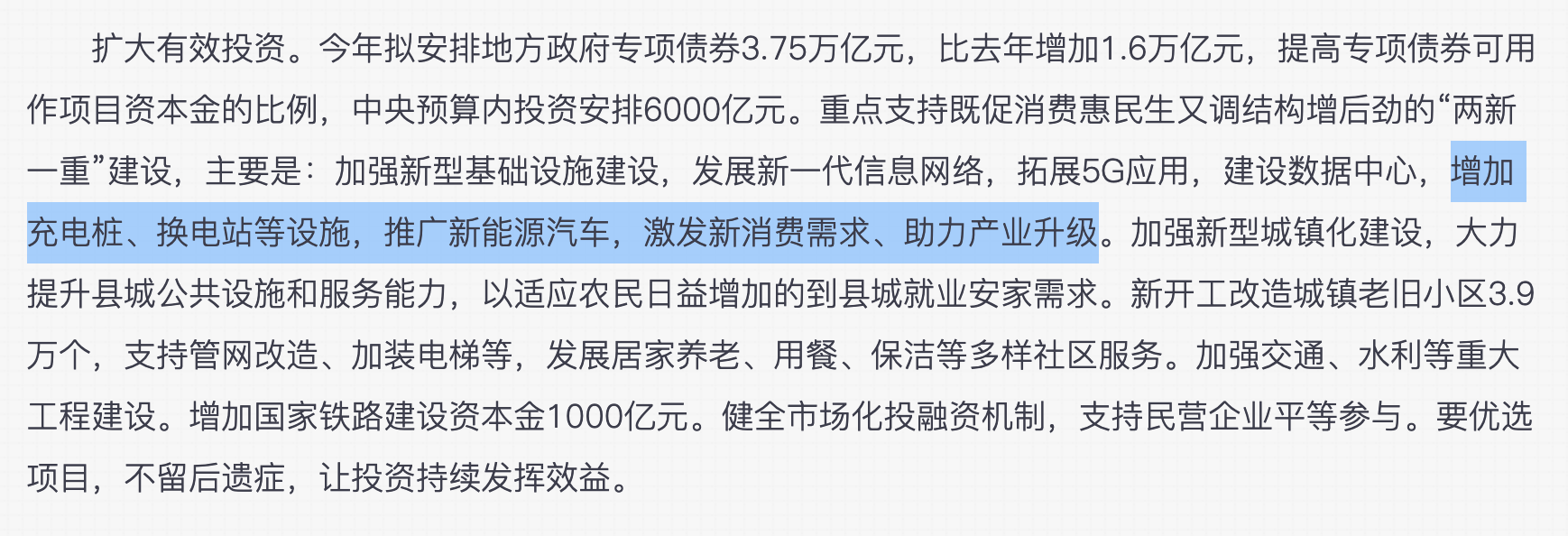

On May 22, Premier Li Keqiang, on behalf of the State Council, delivered the “Government Work Report” at the Third Session of the 13th National People’s Congress. The report emphasized supporting the construction of “two new and one heavy” projects that promote consumption, benefit the people, adjust structure, and unleash growth potential. Regarding the new energy vehicle industry, the most important thing is to increase charging piles, “battery swapping stations and other facilities”, and promote new energy vehicles.

To promote the popularization of new energy vehicles, the key lies in solving the energy supplement problem. Tesla’s approach is to promote self-built supercharger stations on a large scale, but limited by the bottleneck of battery fast charging technology, the country has turned its attention to the “battery swapping mode” with higher infrastructure costs but higher energy supplement efficiency. While developing fast charging technology and building charging piles, the promotion of battery swapping technology is also being simultaneously advanced.

At present, the vehicle companies that support battery swapping are mainly NIO and BAIC. The consecutive favorable policies have made NIO increasingly smooth on the path of battery swapping.

As of May 31, NIO has laid out 132 battery swapping stations in total. However, with NIO’s current total delivery volume of 42,342 vehicles, there is already a supply shortage situation in some hot spot regions. If NIO can maintain a delivery volume of more than 3,000 units per month in the future, the saturation of battery swapping stations will become higher and the supply-demand situation will become more and more severe.

However, NIO’s expansion speed in battery swapping stations is not fast. In the Q4 2019 earnings call, NIO revealed “In terms of the entire system and the investment in revolving batteries, because our user base is increasing, our investment in this area is about RMB 100 million in total scale.”For a single battery swapping station with construction costs exceeding ¥2 million, an investment of only ¥100 million can only increase several dozen battery swapping stations. Considering the following increments and the breadth of construction in the high-speed and hot spot areas, this number is not a lot.

During the progress, there will also face a large amount of site selection and land approval, regional transformer capacity expansion, and other issues. However, after the policy starts to improve, the obstacles to solving the problem may be completely different.

Although the government has not yet given a clear subsidy plan, we can try to explore it from several aspects.

The main resistance to promoting comes from two parts: high cost and a slow and complicated approval process.

The cost comes from two parts: one is the higher equipment cost; the other is the subsequent electricity cost. Although the electricity cost unit price is not high, it cannot withstand the increasing delivery volume.

If the government can provide some subsidies for construction and electricity costs during the laying process, bear some of the infrastructure costs, and provide some fast channels for land approval and transformer capacity expansion, the promotion of battery swapping stations may be smoother.

In addition, according to our understanding from NIO’s related staff, the cost of the second-generation battery swapping station is expected to drop below ¥2 million.

Returning to the “replenishment problem,” if the coverage rate of battery swapping stations in high-speed service areas and hot spots can be increased, the “replenishment problem” will be largely alleviated. On this basis, NIO’s excellent design, good service, rich configuration, and sufficient brand power are all bonus points, and the expected sales volume is certain.

However, in the Q2 2020 earnings conference call, NIO revealed that the factory’s current output is 4,000 vehicles/month, but there are some bottlenecks in the supply, so the output is currently limited to around 3,400-3,500 vehicles.

So, for NIO, the bottleneck of delivery volume seems to be output capacity in the near future.

Thus far, under the successive good news, NIO’s stock price has risen for five consecutive days and has broken through the highest point in nearly a year.

As for how the car runs, please scan the QR code for a test drive~

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.