Introduction

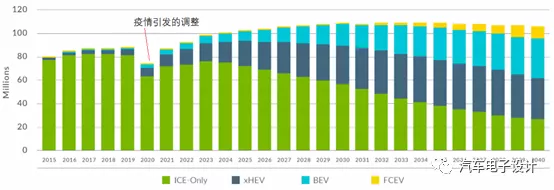

In 2019, the global sales of electric vehicles were approximately 2.2 million units, a year-on-year increase of 10%. The market share increased from 2.1% to 2.5%, and the penetration rate continued to increase. Looking at various markets around the world, Europe sold 563,000 electric vehicles in 2019, an increase of 47% YoY, a historical high. Due to the driving force of policies in European countries and the driving force of the EU’s new carbon emissions regulations, the market for new energy vehicles in Europe is gradually developing.

For China, the global policy on new energy vehicles relies on the support of massive domestic resources and continues to clarify the requirements of the “New Energy Vehicle Industry Development Plan 2021-2035”. Under the transformation of the automotive market, governments around the world are promoting the promotion and use of new energy vehicles. By 2035, the market penetration rate of new energy vehicles worldwide will reach about 50%.

Development Direction of Batteries

First of all, let’s talk about the demand for cobalt. When Elon Musk talked about the evolution from NCA to cobalt-free in the next generation, everyone was puzzled. When Volkswagen and BMW personally investigated the battery materials, it involved the image problem of new energy vehicles in Europe and the United States and was also something that needs to be overcome when development reaches a certain stage. Cobalt is a metal resource that is scarcer than lithium, and batteries are the largest downstream field, with cobalt consumption accounting for 44% and 77% of global and China respectively.

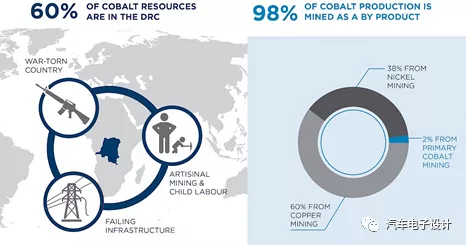

When European countries began to set the timeline for the ban on fuel vehicles, they also continued to emphasize considerations regarding battery resources. If you cannot control a material, the price of this material will lose control. The distribution of global cobalt metal reserves is very uneven, and resources are mainly concentrated in three countries: the Democratic Republic of Congo, Australia, and Cuba, which account for half of the reserves. Europe, China, and the United States, the three main markets for electric vehicles, currently do not have many cobalt mines.

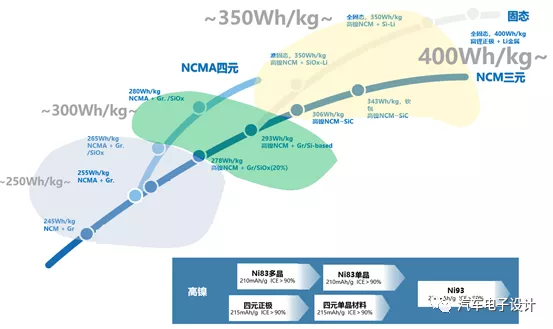

Therefore, cobalt-free, as an ultimate goal, also expresses the urgency of demand-side automotive companies to get rid of resource constraints. As an important element in the positive electrode material of power batteries, cobalt can not only stabilize the layered structure of the material but also improve the material’s cycling and rate performance.Global battery suppliers and automakers are exploring various ways to reduce the amount of cobalt in ternary batteries. As shown in the figure below, we previously knew about the routes of NCA with less cobalt, NCM ternary, and NCMA quaternary, combined with an improved anode, continuously improving capacity and energy density, and then achieving higher energy density and cost from the electrochemical system, with the expectation of mass production of next-generation solid-state batteries in 5-10 years.

Note: In this direction, domestic alternatives that do not consume cobalt materials without pursuing volumetric energy density are provided due to the support of technology like lithium iron phosphate. This treatment based on process improvement can have a high possibility of being locally applied, such as in the 2B travel field. However, the ceiling is evident for long-term development.

What was discussed at the Bee-battery launch event?

This Bee-battery energy launch event was quite interesting and mentioned several points:

“Xuanliang Guo, Academician of the Korean Academy of Engineering/Korea Hanyang University Professor/International Expert in Cobalt-Free Cathodes”

Firstly, regarding materials, Bee-battery uses cobalt-free NMX materials with two elements that have larger chemical bonds to replace cobalt and stabilize the oxygen octahedral structure by doping these elements into the materials. Then, single-crystal technology and nano-networking coating are used to achieve stable structure and reduce the side reaction of the positive electrode materials with the electrolyte, resulting in a long service life design. The latter two aspects are actually similar to the direction that Tesla is taking.

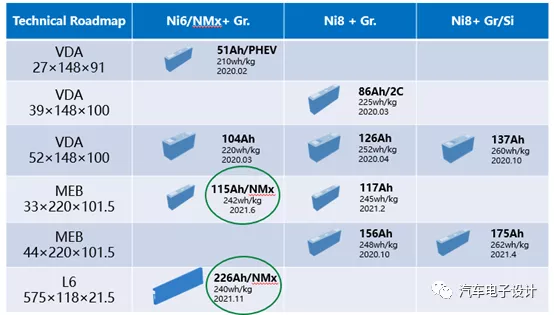

This kind of material is used in product combinations with high nickel materials. From my personal perspective, it is more like an optional path. It can be applied to 126Ah cells that are twice as thick as VDA, as well as 156Ah and 143Ah cells for MEB specifications. That is, in the chemical system that Bee-battery has established, the product contains three different chemical systems of NCMA, NMX, and NCM high nickel, starting from middle nickel.

At the press conference, the two valuable products worth highlighting are:

The first optional product announced is the MEB 1.5 times thicker cell made in June 2021. The cell has a capacity of 115 Ah, slightly less than the high nickel cell with a capacity of 117 Ah, but it employs a high-voltage system to maintain consistent energy and achieve energy density at the level of high nickel cells. It is designed for over 1 million kilometers of use.

Note: I have some opinions on the use of current batteries. The conversion here needs to consider the attenuation of a single vehicle’s endurance multiplied by the cycle number plus the calendar life. Tesla’s claim of one million miles has raised the threshold for battery companies, and it’s not polite to call it “long-life battery cells” without achieving this level.

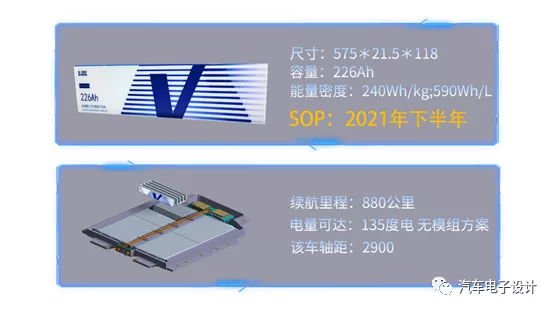

The second product is an L6 cobalt-free long cell with a thickness of 21.5 mm and a length of 575. It seems to be a combination of several 590 soft pack cells packaged together. Honeycomb Energy has partnered with Great Wall Motors, and the NEDC range is aimed at 880 kilometers, and it’s expected to be on the market in the second half of 2021.

Note: This size and specification cannot be avoided, and high-nickel materials can also be used inside.

The release date of May 18th is interesting. Honeycomb Energy released its cell product before Tesla’s Battery Day, which happened after the announcement of their cobalt-free cell last year, and showed that they’ve already produced it. From my perspective, Honeycomb Energy has expanded its pathway further after being targeted by European car companies last year.

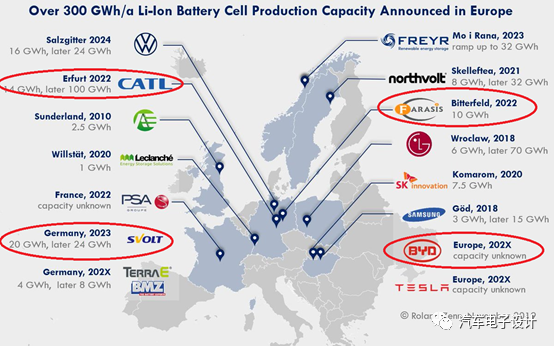

Honeycomb Energy was originally part of the Power Battery Division of Great Wall Motors, and was established in Changzhou, Jiangsu (built in three phases) with a planned production capacity of 18 GWh, and it’s looking to go further into Europe. The European battery factory plans to invest 2 billion euros and expects to have a production capacity of 24 GWh. The Phase One project began in 2020 and is expected to be put into production by the end of 2022. The Phase Two project will be operational in 2025. This press conference is aimed not only at domestic customers, but mainly at European automakers. Currently, four Chinese power battery companies are preparing to invest in Europe, and the early phase is to export China’s capacity and then build a factory.

Conclusion

Both cobalt-free batteries and high-nickel batteries are currently available options for power battery enterprises. The former technology was pioneered by CATL in a category that has gained significant attention. In the future, we need to compare it with Tesla’s Battery Day event.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.