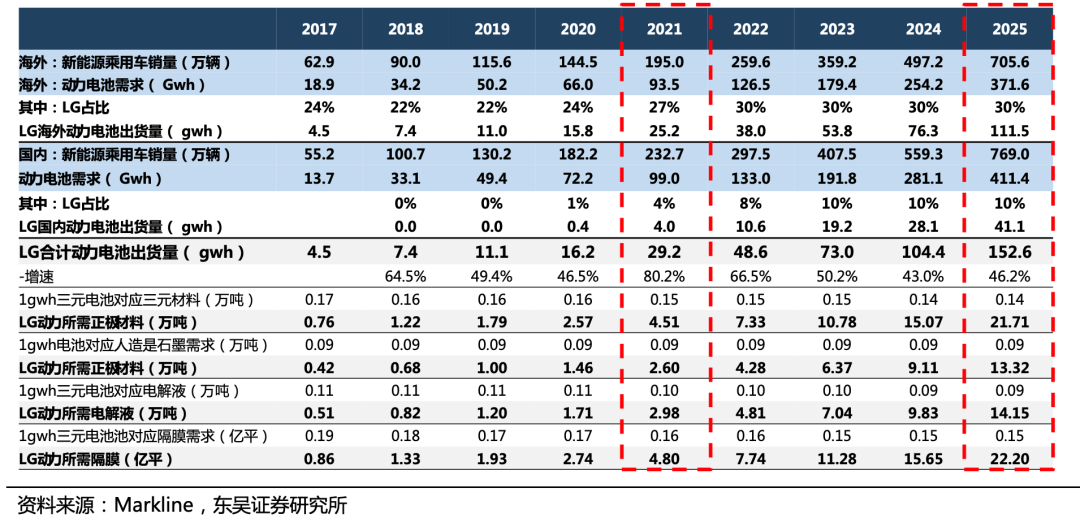

LG has been under pressure from Panasonic and CATL in the automotive battery industry in recent years. Due to the impact of the Korean market ban, LG missed the dividend of the Chinese power battery market. In addition, LG has not secured Tesla as a customer in the international market.

However, the situation suddenly reversed in 2020. According to a report released by SNE Research, a South Korean research and consulting firm, in the first quarter of 2020, LG surpassed Panasonic and CATL in installed capacity to become the world’s largest battery manufacturer.

Despite the impact of the pandemic on the production and sale of new energy vehicles, LG was able to surpass its two strongest competitors in the first quarter. LG’s installed capacity increased significantly from 2.5 GWh in the first quarter of last year to 5.5 GWh in the first quarter of this year, a year-on-year increase of 120%.

LG understands the importance of networking and establishing connections in the industry. According to the report, LG has expanded its global market share from 10.7% in the same period last year to 27.1%, ranking first in the world for now. The second and third largest battery manufacturers in the market are Panasonic and CATL, with market shares of 25.7% and 17.4%, respectively.

In the first quarter of last year, CATL was the world’s largest battery manufacturer with a market share of 23.4%, followed by Panasonic with a market share of 22.9%, and BYD with a market share of 15.1%. LG had a market share of only 10.7% and ranked fourth.

Although there have been some minor conflicts between Panasonic and Tesla, their cooperation has nonetheless provided a core foundation for Panasonic to occupy a place in the top three of the market.Compared to the past, LG has been performing sluggishly in recent years, it has failed to break into the Chinese market, and lacks support from car companies with large shipment volumes. Although LG is still a leading player in power battery technology, it has yet to make significant market breakthroughs.

For Korean power battery companies, they cannot allow themselves to be left out. In August 2019, Tesla announced that it would purchase batteries from LG for its locally-manufactured Model 3, which caused a stir in the market. This meant that Panasonic was no longer Tesla’s only battery supplier and that LG had officially entered Tesla’s supplier list.

Power batteries are the core components and not front-end products. Without the support of powerful car companies, LG can only watch others make money and suffer from idle anxieties.

First of all, just having Tesla as a customer already makes LG much better off. LG mainly supplies parts for Tesla’s locally-manufactured Model 3 and Model Y.

Sales of Tesla’s locally-manufactured Model 3 in March has already reached 10,160 units, while sales in April, according to the data from the China Passenger Car Association (CPCA), amounted to 3,635 units. Although the number declined from March, it is important to consider that the long-range models were officially released in April and many standard-range versions were upgraded to long-range versions. Moreover, subsidy policies also have an impact on sales.

However, it is foreseeable that sales will grow in May and June, boosted by the long-range versions and end-of-quarter sales.

If we add the Model Y, which will be delivered in Q1 of 2021, LG’s shipments are expected to increase significantly. Moreover, according to Tesla’s tone, the Model Y is expected to start delivering in Q4 of this year, and for LG, the growth in the Chinese market will be almost synchronous with Tesla’s, so LG only needs to ensure sufficient production capacity and wait for the demand.

But Tesla is not LG’s only business partner. Apart from BMW, almost all mainstream car companies have become LG’s customers, including Hyundai, Kia, General Motors, Ford, Chrysler, Volkswagen, Audi, Daimler, Renault, Jaguar, and more.

The major demand for electric vehicles comes from Renault, General Motors, Hyundai and Kia, Jaguar Land Rover, Mercedes Benz, Audi, Porsche, and Volkswagen, and LG supplies these cooperating companies worldwide. Volvo and Ford also reached cooperation with LG this year and LG mainly supplies batteries for their products in China.## The Advantage of Competitiveness in Quality and Price Makes LG Beloved by European and American Automotive Giants, and Its Batteries Have Been in Short Supply

At the same time, the market share of LG, along with two other South Korean battery manufacturers, Samsung SDI and SK Innovation, rose from 16.4% in the same period last year to 37.5% in the first quarter of this year, an increase of 21.1 percentage points. Samsung SDI and SK Innovation ranked fourth with a share of 6% and seventh with a share of 4.5%, respectively, in the first quarter.

Because the battery subsidy policy has not yet been fully withdrawn, LG is still waiting for the right opportunity to fully enter the Chinese market.

From the perspective of the automakers that LG mainly supplies, in the short term, LG’s obvious strategy for power batteries is to use the European and American markets as a springboard to vigorously seize market share.

Crazy Factory Construction and Active Preparation

Winning customers is the first step, but building factories and increasing production capacity to meet demand is equally important. It is easy to understand that demand and supply must be met simultaneously. At present, the demand for automakers is certain, but if the supporting production capacity cannot keep up, it will be ruthlessly replaced.

Previously, due to the shortage of LG’s power batteries, Jaguar announced the temporary closure of its I-PACE production line in Graz, Austria from February 17th.

Audi postponed the delivery of its first electric car, the e-tron, and originally planned to produce 55,830 e-trons in 2019, adjusting the production capacity to 45,242 by early 2020.

Mercedes-Benz cut its 2020 production target of the first electric SUV EQC from 60,000 to 30,000. Although it had hoped to sell about 25,000 EQCs in 2019, only about 7,000 were actually produced.

It is obvious that the production of these three models has been forced to reduce due to the shortage of LG chemical power batteries.

Tesla chose LG and CATL as the suppliers of batteries for the domestic Model 3 and Model Y in order to ensure the supply safety of core components and seek cost reduction since Panasonic’s production capacity cannot meet the high growth of Tesla.

Although the relationship between Tesla and Panasonic is becoming somewhat delicate, it can be seen that LG’s choice to expand production capacity at this time is to take absolute market initiative before electric vehicles reach a high production volume.

Now let’s take a look at LG’s current and planned production capacity. LG’s current power battery production bases mainly include Ulsan, South Korea, Michigan, USA, Nanjing, China, and Poland.

LG’s Wujiang plant in South Korea has a production capacity of 5 GWh and mainly supplies domestic automakers such as Hyundai and Kia; the Nanjing plant has a planned production capacity of about 35 GWh and targets the Chinese market; after additional investment, the planned production capacity of the Polish plant will be increased to 70 GWh, targeting the European market and supplying Volkswagen, Daimler, BMW, etc.; the United States plant has a production capacity of 2 GWh and supplies American automakers such as General Motors and Ford.

By 2023, LG’s planned production capacity will reach 112 GWh.

However, the consumption of LG’s production capacity by its large customer, Volkswagen Group, has already put immense pressure on its production capacity.

Volkswagen plans to build 33 models based on the MEB platform by 2025, and achieve an annual output of 1 million MEB platform models in 2025.

As for the Chinese market, Volkswagen plans to deliver 300,000 new energy vehicles in China in 2020, and this number will increase to 1 million by 2025.

By 2029, Volkswagen will launch 75 pure electric models and 60 hybrid models, and the global sales of electrified vehicles is expected to reach 26 million units in 2029.

This means that Volkswagen must have battery production capacity to meet the needs of 26 million vehicles by 2029. According to calculations of 60 kWh per vehicle, Volkswagen’s own consumption is expected to reach 1,200 GWh at that time.

According to reports, LG will invest KRW 3 trillion this year to develop its production facilities, including expanding the production line of the Polish plant. It plans to increase the annual battery production capacity from 100 GWh to 120 GWh by 2021, which is expected to supply the needs of 2.4 million electric vehicles.

According to a report published by Wood Mackenzie in April, the global sales of electric vehicles in 2019 were 2.2 million units, and sales in 2020 are expected to decrease by 43% to 1.3 million units.

Despite the sluggish performance of the global automotive market, this does not stop LG’s expansion and continued large-scale investment.

In this way, the production capacity of battery factories in various regions of the world is allocated to each automaker, forming a solid supply-demand relationship with the automakers while investing in expanding the factory construction.LG is deepening its ties with car companies. Earlier, LG officially disclosed that it invested KRW 2.7 trillion in December last year and established a joint venture with General Motors to gain dominance in the US electric vehicle battery market. In addition, LG is also partnering with Hyundai Motor Group in South Korea to establish a battery factory and teaming up with Tesla to capture the mainstream Asian market. In Europe, LG has firmly grasped Volkswagen and locked in the ticket to the European market. Although LG has planned to increase production capacity, there are still many challenges in terms of the construction period and battery supply.

In 2020, LG continuously invested and expanded production capacity in its Polish factory to meet the demands of Europe. According to the SNE Research report, LG’s production capacity ramp-up plan is: 10 GWh in 2019, 20 GWh in 2020, and 40 GWh in 2021. By early 2022, it will achieve a capacity of 70 GWh. Assuming that the demand is divided into categories of 50 kWh, 70 kWh, and 90 kWh per single electric vehicle battery, the new car volume corresponding to a production capacity of 10 GWh is 200,000, 140,000, and 110,000 units.

That is to say, based on the existing production capacity of 17 GWh, the phased bottleneck of LG’s production capacity will be reached in 2020, when it will ask three Korean banks for USD 500 million to support its global factory construction. These three banks will support LG’s overseas production facilities related to power battery investment during the period from 2020 to 2024.

This is very interesting, a typical counter-attack case. Although last year LG’s battery installation volume ranked behind Ningde Times and Panasonic BYD, with the popularity of the MEB platform electric vehicles and the electrification transformation of other cooperative automakers, LG is very likely to become the future battery hegemon. It’s worth noting that in China, LG is still one of the suppliers of domestically made Tesla.

LG’s involvement in power batteries is not too late, but compared with domestic manufacturers, it’s early to be up and early to bed. Besides expanding the “circle of friends” and increasing global production capacity, let’s continue to see LG’s counterattack journey.

03 LG Sweeps European and American Orders

LG started as a chemical product company. In 1996, it started to research lithium batteries. At that time, Japanese enterprises such as Sony and Sanyo were world leaders, while LG was only a rookie company that had not yet fully familiarized itself with the supply chain.

At the beginning, LG attempted to cooperate with Japanese companies such as Hitachi for technology. However, because of the government’s protection of technology, LG was rejected at the beginning. Even battery manufacturing equipment and related materials were also protected.Cooperation failed, so LG had to choose self-research. It wasn’t until 1999 that LG successfully mass-produced the first lithium-ion battery after more than three years of research and development, which also marked the rise of Korea’s lithium battery industry.

However, at that time, LG’s lithium batteries were mainly used in the industrial and consumer electronics fields. With the maturation of lithium battery technology and the increase of energy density, packaging methods have also evolved from cylindrical to prismatic and then to pouch.

In addition to the consumer market, Korean companies were the first to see the potential of the blue ocean market for automotive power batteries.

As early as 2000, LG established a power battery research base in Michigan, USA.

The landmark event for LG’s entry into the power battery field was the victory over A123, an American company, in 2009 with its manganese oxide lithium-ion pouch battery, which became the sole supplier of the General Motors Chevrolet Volt battery.

The following year, LG signed an EV battery supply cooperation agreement with Ford, taking big steps into the automotive power battery industry.

Since receiving orders from General Motors, LG has been expanding in Europe and America since 2012, gaining the trust of major manufacturers such as Kia, Hyundai, Renault, and Ford. This is similar to when CATL became a supplier for BMW, and once a top-tier enterprise opens a door for you, it leads to all the opportunities.

Later, LG also received orders from Volvo, Jaguar, Audi, Porsche, Chrysler, and Volkswagen, almost sweeping all manufacturers’ orders, and gained an unprecedented voice in Europe and America.

This year, Volkswagen has faced many rumors of a “relationship” with SKI, with rumors even circulating that Volkswagen was about to establish a joint venture battery plant in Germany. Battery industry insiders have revealed that LG was on the verge of suspending battery supplies to Volkswagen, which shows that LG is not weak but rather strong, and after withdrawing from the Chinese market, LG has launched a counterattack focusing on Europe and America.

Conclusion

LG’s intentions are already very clear. Although there are restrictions in the domestic market, as long as it can be done elsewhere before policies decline, LG intends to deeply bind with automotive companies, vigorously seize market share, and form a scale barrier. Once the production and sales of new energy vehicles are released, early-matured battery suppliers will have inherent advantages.

CATL still should not be underestimated. Currently, CATL has taken the “big order” for the Tesla Shanghai plant from LG. In February of this year, CATL also announced that it had become Tesla’s power battery supplier in China.

Previously, LG was Tesla’s supplier for the Shanghai plant, and the domestically-manufactured Model 3 used LG’s NCM (nickel-cobalt-manganese) 811 cylindrical ternary lithium battery.

With a profit margin of over 30%, which is much higher than the profit margin of less than 5% for whole vehicle parts, CATL will not allow its competitors to grow unchecked, and the competition will become even more intense in future.To increase negotiating power and profit margin of whole vehicles, many car manufacturers spare no efforts in investing heavily in setting up power battery layout.

Tesla’s self-developed battery continues to accelerate, and in 2019, Toyota announced the establishment of a joint venture for vehicle-mounted batteries with Panasonic, and Volkswagen announced the construction of a power battery factory in Germany. In March of this year, Volvo’s first battery assembly line in Belgium was officially put into operation.

In addition, Chinese self-owned car companies, such as BYD with 5 battery factories and Geely with two battery factories, will also be put into operation this year.

From all of these, we can see that although there is a saying that Chinese, Japanese, and Korean power batteries stand in the long run, future real confrontations will most likely take place among Chinese and Korean enterprises.

Written by DeLu

Edited by DaJi

You may find these helpful as well

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.