“Not being new retail is not the issue, it’s that your retail is not working.” This is one of the most famous quotes of Jack Ma, which applies to the hard times of the automotive industry. In 2019, many car companies had a rough year, but some still managed to do better under the difficulties.

As being in the vortex of the changing times, every car company cannot stand aloof from their surroundings. Either they’ll be swallowed by the current and become historical or they’ll adapt to the development of the era and make proactive changes.

The automotive industry is going through a reshaping unseen in the past century, different from the previous corporate transformation, “it was more like choosing between walking in the center or on the side of the predetermined path, but this time it’s the path that has come to a fork, and how to choose has become the key to the survival of automotive enterprises, reflecting the company’s determination,” according to an article.

Traditional leading car companies have difficulty transforming, and waiting without transformation might lead to a suicidal outcome. Facing the challenges, Volkswagen chose to embrace the difficulties and will succeed or fail trying.

In 2019, Volkswagen announced that it would invest €60 billion in electric and digital fields in the following five years, thereby opening a new era of intelligent electric vehicles. And in 2020, Volkswagen’s “bold gamble” seems to have paid off. Recently, Volkswagen Group held a global media communication conference online to report its business situation in 2019. The official described it as “a very successful year,” causing many car companies to feel slightly sour since not many had a good 2019.

Volkswagen is still the money-making machine

The official phrase “2019 was a very successful year” is not empty words. In 2019, the global automotive market contracted nearly 4\%, but Volkswagen Group delivered 10.97 million vehicles worldwide, with a YoY growth of 1.3\%.

Due to its reputation of understanding Chinese consumers, Volkswagen also owes its growth to Chinese consumers. In 2019, the Volkswagen Group delivered 4.23 million vehicles to the Chinese market, and its market share increased by 1.4 percentage points, accounting for 20\% of the global market share.

In terms of revenue, the operating income in 2019 reached €252.6 billion, a growth of €16.8 billion compared to €235.8 billion in the previous year, realizing a 7.1\% increase despite the diesel emissions scandal fine, and the net cash flow of the auto sector reached €10.8 billion.

In terms of sales volume, Volkswagen has surpassed its old rival Toyota. However, Volkswagen is still slightly weak in terms of profit.Here is the translated text in English Markdown with HTML tags included:

After attending the Volkswagen Media Communication, the core points of this meeting can be summarized as follows:

-

A total of 4.23 million vehicles were delivered to the Chinese market in 2019. The Chinese market increased by 0.6%, with a market share of 20%, which is the largest proportion that Volkswagen holds in the global market.

-

In 2020, ID.3 and ID.4 will be available, along with Skoda, Seat, and other pure electric cars that will be mass-produced.

-

Although the epidemic has affected the release of ID.3 this summer, the electric release is imperative.

-

ID.4 will be produced overseas first, and Volkswagen will also build a battery factory in the United States.

-

The Volkswagen MEB platform has started mass production, and all its brands will use it according to the plan. Volkswagen will increase its priority in investing in electrification in the future.

-

Porsche is the profit champion of the Volkswagen Group, and Taycan has already received 15,000 orders.

-

The e-tron has sold 32,000 units, surpassing Tesla and becoming the first in high-end electric cars in Germany and Norway.

-

Group sales revenue was €252.6 billion and net profit was €14 billion after tax, with a tax rate of 23.6%.

In fact, as long as the giants are determined, it is not difficult to turn the big ship around.

Why Volkswagen can do it

In the face of electrification and intelligence, even Volkswagen is starting to panic. Finding its own rhythm is the first step for Volkswagen to move forward. All car manufacturers in the world know that they will eventually move toward electrification, but they did not expect electrification to come so rapidly.

Unlike General Motors, Ford, and other car manufacturers, Volkswagen did not rush to bet on any particular field. Instead, it continuously optimizes traditional businesses and explores the direction of future development in the process. Becoming a technology company is Volkswagen’s expectation for its future.

For an enterprise like Volkswagen to move towards electrification and intelligence comprehensively is not an easy task. The “TRANSFORM 2025+” strategy was born from this. In fact, Volkswagen’s thinking is simple: how can it enhance its core traditional business in the current stage, achieve maximum profits, and continue to increase investment in corporate transformation is the key.

According to the data disclosed by Volkswagen, what is the first thing Volkswagen needs to accomplish in the first stage of the “TRANSFORM 2025+” strategy?Cost saving, By controlling personnel and supply chain, Volkswagen plans to achieve a cost reduction of 3 billion euros per year. Although 10.9 thousand jobs were reduced due to personnel adjustments, Volkswagen created more than 4500 jobs due to the deepening of electrification and digitization. Therefore, the layoffs are not simply to reduce personnel, but also accompany structural adjustments.

Optimizing product structure, Volkswagen is the most successful player in multi-brand strategy. With the overall market declining, Volkswagen’s core brand delivered 6.3 million vehicles, mainly driven by growth in segment models, especially in the high-profit SUV segment with T-Cross, T-Roc, and Atlas. Tiguan’s efficiency exceeded 700,000 vehicles, once again becoming one of Volkswagen’s best-selling products worldwide. Another of Volkswagen’s top 10 best-selling automotive products worldwide is the Golf.

Increase bestsellers to improve the profit margin of individual products, Volkswagen has expanded its investment in SUV models worldwide. The number of SUV models increased from 4 in 2016 to 14. According to Volkswagen’s official website in Germany, SUVs currently account for 37% of the market share in Europe, and even more than 50% in the United States. By adjusting product portfolios and consistent cost management, Volkswagen has made good progress in transforming its businesses in Europe, North America, and China.

At this point, it seems that Volkswagen is still focusing on traditional models and businesses, and this is also the strategic core of Volkswagen at this stage to achieve sustainable development and profitability improvement. As they say, “An army marches on its stomach,” and comprehensive electrification does not mean risking the foundation of the company’s blood supply.

Volkswagen’s Multi-brand Strategy Brings a “Rich Harvest”

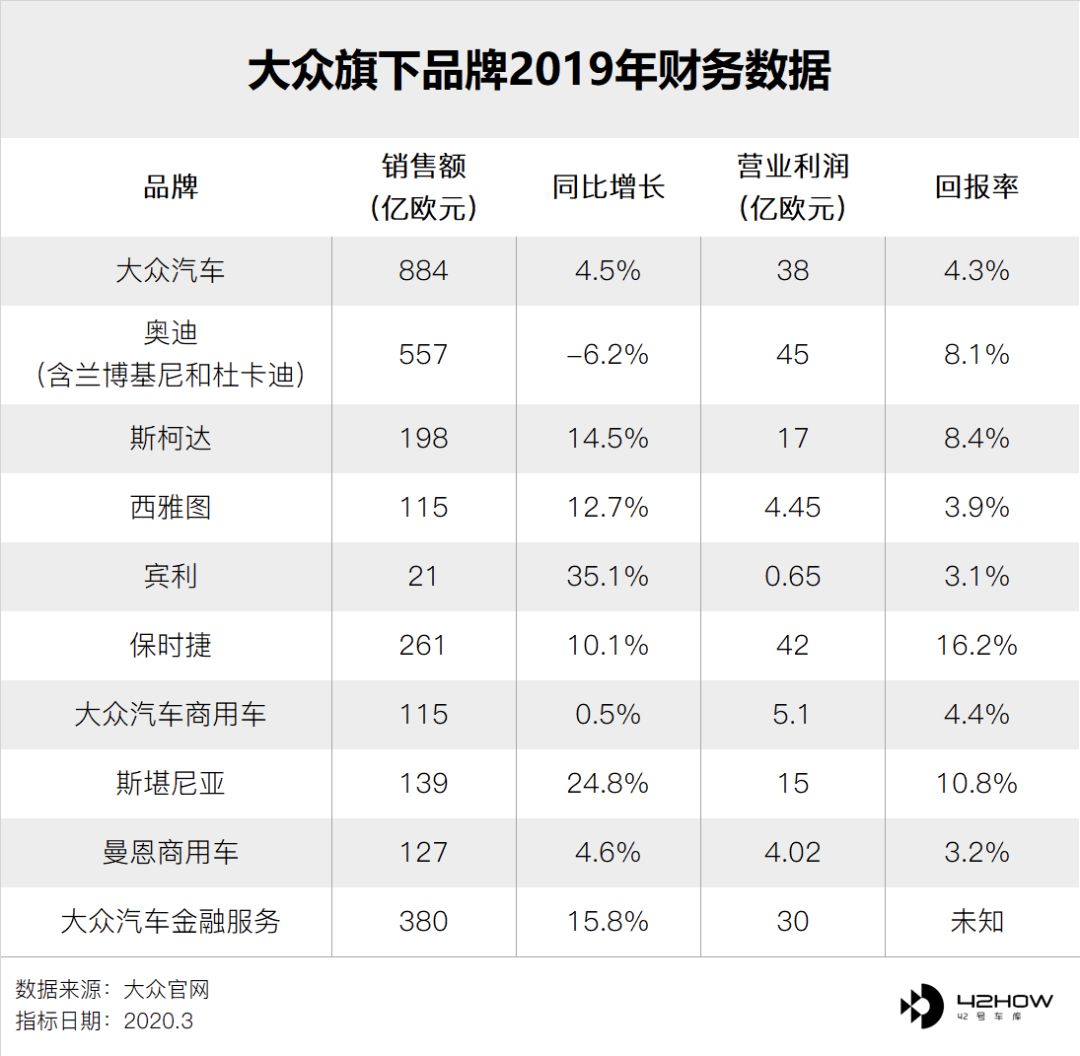

According to official financial data from each brand disclosed by Volkswagen, the company’s multi-brand strategy has flourished, with sales revenue and operating profit of each brand showing overall improvement. The multi-brand strategy has always been Volkswagen’s core expertise, and this time each brand has also demonstrated enormous potential.

Volkswagen is still the backbone of the Volkswagen Group, achieving sales revenue of 88.4 billion euros in 2019, a year-on-year increase of 4.5%, with operating profit not including special project expenses of 3.8 billion euros. However, fines and other special expenses resulting from the “Dieselgate” scandal have also brought considerable pressure to Volkswagen.

Porsche, as one of the three pillars of the Volkswagen Group, is the profit cow of the entire company, which is not noticeable without data. In 2019, Porsche delivered 280,800 new vehicles with sales revenue of 26.1 billion euros, a year-on-year increase of 2.4 billion euros or 10.1%.Moreover, Porsche’s brand profit reached as high as 4.2 billion euros, winning the champion within Volkswagen Group, and the benefits of brand elevation were obvious with such high product profit margins.

Regarding Audi, the sales revenue in 2019 was 55.7 billion euros, which decreased compared to the previous year, and the operating profit was 4.5 billion euros.

In fact, it is easy to understand the decline of Audi.

Firstly, Audi undertakes the main research and development tasks of the Volkswagen Group, and the successful research and development of these technologies will be either promoted upwards or delegated to other brands, with cost increases proportionally reducing profits.

Secondly, Audi was impacted by the restructuring of the group’s multi-brand sales companies. Lamborghini and Ducati were also placed under the Audi brand, but these two brands did not make much profit.

With the cooperative efforts of each brand, the real driving force has started to show. The fundamental reason why Volkswagen is different from General Motors and Ford is that Volkswagen’s traditional automotive core business has not slowed down.

Audi has gradually implemented the “Redesigning Audi’s Future” strategy, insisting on developing electric vehicles and intelligent network connection, providing the most powerful electric vehicle product portfolio in the high-end market competition environment, and selling one million electric vehicles annually in the next ten years. Creating an open digital ecosystem and sustainable development business model. Audi will likely become the technology leader for Volkswagen’s luxury brands.

Seat will establish unique competitive advantages, positioning itself in the entry-level market for young people, emphasizing the brand uniqueness of Seat, and globalizing its business, redesigning its business model, creating an organizational structure and processes that can quickly adapt to environmental changes, maintaining its market share in the young European market. Unfortunately, at the media conference, VW said that its entry into China would be delayed for Seat due to the epidemic.

Porsche will implement the “Shape the Future of Sports Cars” strategy. While maintaining sustainability, it will combine the brand’s history and value with innovative technologies, including electric vehicles and intelligent network connectivity to create unique future sports cars, achieving value growth and sustainable development of innovative technologies. In fact, Volkswagen’s intention is very clear, which is to make Porsche the “Porsche” of the electric vehicle era.

Skoda will create innovative travel solutions for personal travel. Actually, I’ve always felt that Skoda’s positioning within Volkswagen is the most unclear, and its traditional products overlap with those of the Volkswagen brand. In future electric times, what role Skoda will play is not easy to determine, at least for now.In the Chinese market, Skoda’s recognition is not as good as Volkswagen, and according to official Volkswagen data, Skoda’s sales revenue in 2019 reached 19.8 billion euros, and the profit was 1.7 billion euros. Volkswagen emphasized that this is largely due to the Indian market. Will Skoda become the “Volkswagen” of China in the future?

German caution is perfectly reflected in Volkswagen, and the multi-brand strategy has not become a burden for Volkswagen, but has become a cash cow, which Toyota should learn from.

Volkswagen’s electric era in 2020

Volkswagen’s “throat-cutting sword” showed its power in the crisis moment, which is the traditional business sword. It should be noted that such achievements were obtained in 2019, which is a year of global automotive recession. Growth in adversity is the real strength.

Volkswagen’s second sword will also be completely unsheathed in 2020. This is also the beginning of the second phase of the “TRANSFORM 2025+” strategy, with a focus on electric vehicles and digitization.

And as the flagship of the Volkswagen Group, Porsche has once again proved its role. Porsche produced a total of 1386 Taycans in 2019 and had already received 15,000 orders and 20,000 pre-orders by the time of the financial report release. It is extremely difficult for Taycan, which was only launched half a year ago and has a price tag of millions.

At the 2019 annual performance conference, Porsche announced that from 2020 to 2024, the company will invest approximately 10 billion euros in hybridization, electrification, and digitization. And it will also expand the product supply in the field of electric vehicles.

Porsche will also launch Taycan Cross Turismo, a derivative model based on Taycan, and a pure electric version of Macan based on the PPE platform. This is also Porsche’s first pure electric SUV. By 2025, more than half of Porsche’s sales will be electrified vehicles.

Regardless of traditional or electrified models, Porsche is destined to be a “toy” for a few people. Audi e-tron will be much more affordable, and so far, the car has sold 32,000 globally, with a total output of 46,000. In Germany and Norway, it has surpassed Tesla and became the best-selling premium electric vehicle.## Volkswagen’s electrification strategy: MEB and PPE platforms

As a player in the automotive industry, Volkswagen must compete with other brands such as Audi and Porsche at the upper end of the market, as well as establish a foothold in the mass market. That’s where the ID series comes in – Volkswagen’s new line of cars built on the MEB platform. Although the ID.3 has not yet been released, Volkswagen has already received 37,000 orders, while the ID.4 is set to be produced overseas. In addition, Volkswagen is building a battery factory in the United States and remains committed to launching the ID.3 this summer despite the effects of the pandemic.

Volkswagen’s MEB platform has entered mass production and will be used by all of its brands in accordance with the company’s plan to prioritize investment in electrification. In November 2019, Volkswagen announced a €60 billion investment plan for the period 2020-2024. Of this investment, €33 billion will be allocated to pure electric vehicles, and €27 billion will be allocated to hybrid and digital technology. The company aims to launch 75 pure-electric vehicles and nearly 60 hybrid vehicles by 2029, with electric vehicle sales reaching 26 million and hybrid vehicle sales reaching nearly 6 million. Nearly 20 million of these electric vehicles will be produced using the MEB platform, and nearly 6 million will use Audi’s and Porsche’s PPE platform. The PPE platform is a luxury electric platform developed in collaboration between Audi and Porsche, and will be used in Porsche, Audi, and Bentley electric vehicles starting in 2022.

The MEB and PPE platforms represent a continuation of Volkswagen’s traditional platform strategy, which included the MQB and MLB platforms for traditional cars and the MSB platform for high-end vehicles. The MQB platform is used for compact and small cars, while the MLB platform is used for Audi A4 and above models. Similarly, the MEB platform is mainly used for Volkswagen’s middle and low-end brands, including Audi’s lower-end models. Unlike other automakers, Volkswagen continuously evolved its golf model for the MEB platform, while keeping compatibility across different vehicles to reduce costs and increase efficiency.

Volkswagen’s MEB platform has yet to fully showcase its capabilities, but with increasing production, it has the potential to change the game in the electric vehicle market. As the market shifts towards more mass production of electric vehicles, Volkswagen is poised to lead that change.According to the data on Volkswagen’s official website, Volkswagen has 400 charging stations in North America, second only to Tesla.

Advantages of Pricing Strategies, Pricing strategies are the final layer of paper that a car faces to consumers. It seems insignificant, but it hides the mystery. The price reduction caused by Tesla’s domestic production has affected the pricing strategies of new domestic car manufacturers. Combined with the decline in subsidies, the market will also undergo structural changes.

From the current selling prices and cruising ranges of various brands, a large number of models are concentrated in the price range of CNY 100,000 to 150,000 and cruising range of 300-400 km, as well as the price range of CNY 150,000 to 200,000 and cruising range of 400-500 km. There are few domestic cars above 200,000 yuan, only NIO. However, NIO is still facing the embarrassing situation of selling products without money.

Compared to MEB’s pure electric products, with reference to traditional model pricing, the pricing range will mainly be above 150,000 yuan, and the range of 150,000 to 300,000 yuan will be the core range of Volkswagen MEB, and there will be products based on PPE above this range.

The same price but with the option of Volkswagen will be a huge impact on personal family cars.

In addition to electrification, Volkswagen will also vigorously promote digitalization in the next few years.

The focus is on two core areas: the implementation of the digital transformation roadmap and the development of Car.Software business format.

The digital transformation roadmap is the follow-up plan for the brand to adapt to the digital era. In this way, Volkswagen will establish new digital skills and make the organization faster, more streamlined, and more competitive in all fields. According to the plan, up to 4,000 jobs will be lost in the administrative department by 2023.

At the same time, 2,000 smart R&D positions are planned to be added. A large part of the new job opportunities will be generated in the new Car.Software department. “Software determines success or failure.” This is the core point that Mr. Herbert Diess, CEO of Volkswagen, has previously stated. Volkswagen is transforming into a software-driven technology company.

In the new department, all software from the car operating system to the digital ecosystem to new mobile services is integrated into one ecosystem to provide users with a better experience.

In fact, Diess has praised Tesla publicly more than once. Strong players appreciate each other. Diess believes that Tesla is already a technology company rather than a traditional car manufacturer, while Volkswagen is still a car manufacturer.

Diess said that Volkswagen Group is transforming from a traditional car manufacturer to a company that produces self-driving and connected cars. Therefore, Volkswagen Group needs to master more software and electronic technologies to make Car.Software business more influential.The Car.Software business was launched in 2019 with a goal to recruit 10,000 experts to develop software for VW cars by 2025, and all Volkswagen Group’s cars will use the VW.OS operating system and Volkswagen Automotive Cloud. “The success of the Car.Software business will determine the future of the Volkswagen Group,” said Diess.

Even Volkswagen has such determination to transform.

In conclusion

If Volkswagen can be likened to a basketball player, then it is the one who can play from the 1st to the 5th positions. Volkswagen has shown very comprehensive capabilities.

From financial reports, it can be seen that Volkswagen is not simply pursuing sales volume in traditional business, but is focusing on maximizing profits. Achieving positive cash flow during the transformation process is a very important step for Volkswagen.

Volkswagen now has a clear understanding of the goals it wants to achieve, which include electrification and platform building. Most importantly, Volkswagen has found the position where each of its brands should be in the future. The article mentioned that Volkswagen hopes “Porsche will become the Porsche of the electric car era”.

If we simplify Volkswagen, we can see that the electrification era will change the form of energy used by cars and the way people travel in the future. However, no matter what form it takes, including Tesla selling vehicles, the unique circle structure of each brand has not changed so far.

The understanding is that if one day electric cars become the mainstream all over the world, but people’s diverse demands for electric cars do not change, Volkswagen and its mid- to low-end brands will still be used for family daily use, while high-performance electric cars like Porsche will still be in demand. So Porsche will still be “Porsche”.

This is the division of labor advantage of Volkswagen’s multi-brand strategy.

With the growth of traditional businesses such as the ID series and the electric series of Audi and Porsche, Volkswagen has made it clear to its competitors that the big ship is turning around but still a big ship. Although the software business is currently facing problems, this is only temporary for a company like Volkswagen.

Volkswagen understands consumers and is also good at winning their hearts.

Volkswagen CEO Diess has praised Tesla more than once in public occasions and has also indicated that Volkswagen will transform into a software-based tech company. This is where Volkswagen’s media strategy is particularly clever, as Tesla’s position in the industry is self-evident—especially in the US, where Tesla is almost synonymous with electric vehicles and is considered a tech company in consumers’ minds. Hence, over time, Volkswagen will also plant the seeds of a tech company in consumers’ minds.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.