Tesla has been rewriting the rules for the battery industry. As we approach Tesla Battery Day in April, more and more information is being revealed that points to two things:

1. Tesla plans to produce self-developed batteries, which means that its long-time partner Panasonic may gradually be phased out.

2. Tesla is developing more and more breakthrough battery technologies, which could lead to revolutionary products in the future.

As the world’s largest pure electric vehicle manufacturer and sales company, Tesla delivered a total of 367,000 pure electric vehicles in 2019, with a cumulative installed capacity of over 22 GWh of power batteries.

According to statistics from South Korean company SNE Research, the global lithium-ion battery shipped in 2019 was 116.6 GWh, which means that Tesla’s battery usage accounts for nearly 20% of the world’s total battery shipments.

Therefore, any adjustments Tesla makes to its strategy will have a considerable impact on the entire industry.

A Company with “Continuously Leading” Battery Technology

On February 11, 2020, Tesla CEO Elon Musk revealed on Twitter that Tesla will hold its “Battery Investor Day” in April at the Giga New York factory.

According to Electrek, Tesla is expected to unveil power batteries with higher energy density, longer service life, and lower cost at this year’s “Battery Investor Day”. Therefore, after a four-year pause, Tesla’s battery technology will soon enter a new round of iterative upgrades.

Looking back, in late 2016, Tesla and Panasonic jointly developed the 2170 battery cell, which was first unveiled in 2017 and put into production in Model 3 long-range rear-wheel-drive models, achieving a NEDC range of 664 km.

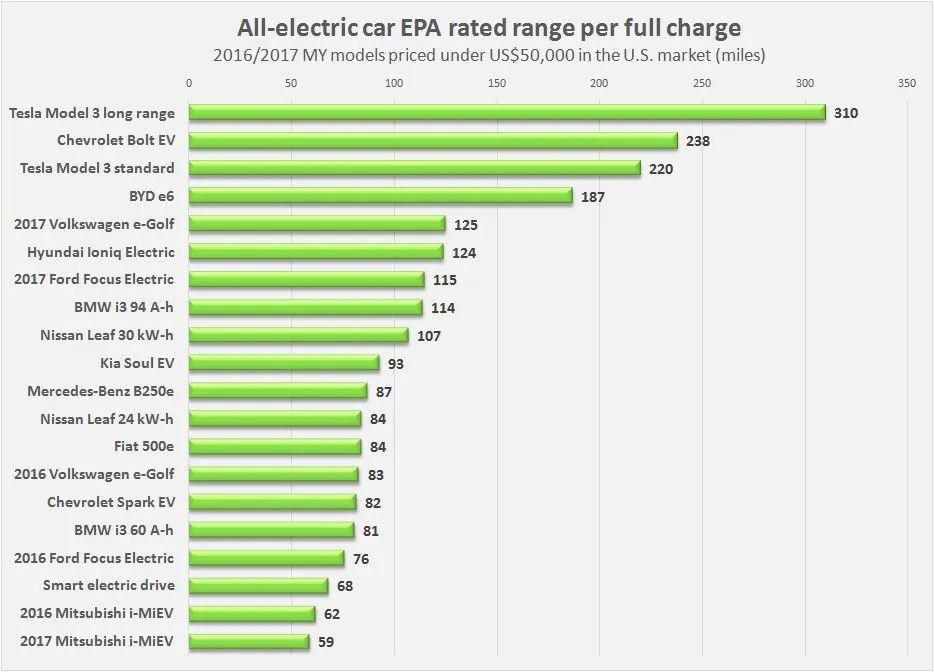

This is the New Energy Vehicle Model Catalogue for the 12th Batch of Vehicle Purchase Tax Exemption issued by the Chinese Ministry of Industry and Information Technology in October 2017. From this table, we can see that at the time of Model 3’s mass production and delivery, few domestic pure electric vehicle brands were able to achieve a NEDC range of 200-300 km, and the best was only 400 km, a gap of more than 60\%.If you think the delivery of the Model 3 in China is not relevant, we can look at the American market during the same period. According to the EPA range statistics report published by the US Department of Energy in 2017, Tesla Model 3 with a range of 310 miles significantly surpassed the second-place Chevrolet Bolt with a range of 238 miles.

Then the question is: how many years does Tesla’s technology level surpass the industry standard? In September 2019, GAC New Energy officially released the NEDC range 650 km Aion LX, which is outstanding. XPeng, NIO, WM, BYD, Roewe and other brands of NEDC range over 600 km models, the delivery time of mass production is basically in the second half of 2020 to 2021.

If we look at the international market, BMW’s i4 concept car, unveiled at this year’s Geneva Motor Show, is expected to be in production in 2021 with a WLTP range of 600 km.

So even if we conservatively estimate, Tesla’s technology level surpasses the industry standard by around four years. If you think this example is not enough, let’s go back four more years. In 2012, Tesla officially began mass production and delivery of the Model S, with a total of two versions available, 60 and 85, corresponding to EPA ranges of 208 miles and 265 miles. At that time, there were hardly any pure electric cars on the market, and the Nissan Leaf’s EPA range was only 121 miles. Model S can be regarded as the first long-range pure electric vehicle for commuting, which subverted everyone’s perception of the range capacity.

Four years before that, Tesla released the Roadster sports car, which was the first to use Panasonic’s 18650 battery as the power battery, stuffed a 53 kWh battery pack into a Lotus-based body, and achieved an EPA range of 231 miles, becoming the longest range pure electric sports car in the world at that time.

Through these cases, it can be seen that Tesla’s technological level is about 4 years ahead of the industry mainstream level, and updates and iterates every 4 years.

Tesla can always use more advanced technology at the first time, which is forward-looking or even industry-changing from a later point of view.

In 2008, Tesla first used Panasonic’s 18650 lithium-ion battery cells as the power battery for vehicles. After experimenting on the Roadster, it began to be used on a large scale in the Model S.

With the advantage of the energy density of lithium-ion batteries, the cruising range of Tesla Model S is significantly ahead of pure electric vehicles using lithium iron phosphate and lithium manganese batteries as power batteries in the same year.

At that time, in the eyes of outsiders, the lithium-ion battery used by Tesla was just a battery used in consumer electronics, which did not meet the requirements of vehicle regulations and had a much shorter cycle life than lithium iron phosphate batteries.

However, Tesla cleverly managed the more than 6000 battery cells with advanced BMS, and the greatly improved cruising range also avoided the shortcoming of lithium-ion batteries in cycle life.

It can be said that Tesla successfully used the advantages of lithium-ion batteries and avoided the disadvantages through technological means.

After Tesla first tried lithium-ion batteries, the industry gradually began to change its views on lithium-ion batteries. The energy density threshold in China’s new energy subsidy policy is also constantly increasing, and the policy is used to guide automakers to abandon lithium iron phosphate and switch to lithium-ion batteries.

This is the first time that Tesla has led the entire industry to change its technological route.

In 2016, Tesla introduced a brand new 2170 lithium-ion battery. The proportion of “nickel” in the positive electrode material increased significantly, while the proportion of “cobalt” decreased significantly. The proportion of “nickel” in the positive electrode material reached 90\%, while the mainstream level of the industry in 2016 was only 40\%.

Higher proportion of “nickel” can increase the energy density of the battery cell, but brings the downside of poorer thermal stability, and a low “cobalt” content can significantly reduce the material cost of the battery cell, but brings the downside of lower fast charging speed.However, from the results, it can be seen that Tesla has successfully utilized the advantages of high energy density and low cost by overcoming the drawbacks of the high energy density 2170 battery cells through methods such as arranging longer liquid cooling circuits, reserving pressure relief holes, and setting fuse protection devices for individual cells in the Pack.

This is another case of using technical means to avoid drawbacks and utilize advantages.

The development direction of passenger car power batteries is also to increase the proportion of “nickel” to improve battery energy density and achieve longer range, from 111 to 442, 523, 622, 811, but Tesla has achieved this in one step.

It can be seen that Tesla has been breaking the industry’s physical cognition and leading the industry’s development. Since the plan for using lithium iron phosphate batteries was exposed by Tesla, some manufacturers have been considering switching from ternary lithium to lithium iron phosphate, showing the tremendous influence of Tesla.

Tesla leads in both technical indicators and technical routes, and the reason why Tesla has the ability to continuously lead the industry is its continuously increasing proportion of self-development.

The penetration rate of Tesla’s self-development is continuously increasing

On the Model S, Tesla used Panasonic’s 18650 battery cells and independently completed the Pack encapsulation.

On the Model 3, not only is the Pack encapsulation technology Tesla’s, but the 2170 battery cells are also jointly developed by Tesla and Panasonic and produced at Tesla’s Gigafactory 1.

Reviewing Tesla’s moves in the electrochemical field reveals that Tesla has been exploring the core technology of battery cells.

On June 16, 2015, Tesla CTO JB Straubel and Tesla’s chief battery scientist Kurt Kelty visited Dalhousie University and signed a cooperation agreement with Jeff Dahn’s research group, which officially began in June 2016.

At this time point in 2015, the Tesla Model S had been on the market for less than three years, with a global sales volume of only 50,000.The exclusive cooperation agreement between Tesla and the Jeff Dahn Research Group is a partnership in which Tesla provides the Jeff Dahn Research Group with a huge amount of research funding for a period of five years. In exchange, the Jeff Dahn Research Group is responsible for researching lithium-ion batteries with higher energy density, lower cost, and longer lifespan for Tesla.

Jeff Dahn himself is a professor at Dalhousie University’s Physics, Atmospheric Science, and Chemistry Departments, with a focus on researching lithium-ion batteries. He has published over 640 papers and has 65 patents granted or pending, and he is recognized as one of the pioneering developers of the lithium-ion battery. The Jeff Dahn Research Group, which currently consists of 31 people, started researching the physical and chemical properties of energy storage materials in 2008 (primarily in the field of lithium-ion batteries), with the goal of lowering the cost of electric vehicles and energy storage applications by improving battery energy density, safety, cost, and durability.

Jeff Dahn has stated that their goal is to produce something meaningful, rather than just publishing papers in journals like Nature.

Regardless of their research philosophy and goals, they align well with Tesla’s needs, which is why in 2015, Tesla CTO JB Straubel and Jeff Dahn embarked on their successful partnership. Tesla has not been disappointed with the five years of funding support, as the Jeff Dahn Research Group has made breakthroughs since the beginning of their collaboration. In February 2019, the group filed a patent for a new technology that enables faster charging and discharging speeds, longer lifespan, and lower cost.In a paper published in The Journal of the Electrochemical Society in September 2019, Jeff Dahn’s research group revealed that the team has developed a battery with a lifespan of over 1.6 million kilometers.

In addition to the 5-year partnership reached with Jeff Dahn’s research group in 2016, in February 2019, Tesla announced the acquisition of Maxwell at a premium of 55%, a company that has two core technologies: dry electrode technology and supercapacitor technology.

The benefit of dry electrode technology is that it can increase the battery energy density by 10%, reduce the cost by 10%, and improve battery production efficiency.

For users, the actual benefit is longer range at a lower price.

Supercapacitors are a type of energy storage device that can meet short-term high-power charging and discharging and are suitable for use in extreme climate conditions. This technology perfectly complements the shortcoming of traditional lithium-ion batteries. Although current lithium-ion batteries can basically meet daily usage needs, for Tesla’s Cybertruck and Semi, this technology is essential to meet a wider range of usage needs.

Tesla’s survival way is to maintain its leading advantage in the three-electric-technologies field by increasing the penetration rate of self-developed technology by four years ahead of the industry. Tesla, as a new force in carmaking, must seize the opportunity to stand on the same starting line to survive, even with its inferior overall vehicle manufacturing experience compared to traditional automakers.

To have a head-to-head battle with traditional automakers, Tesla must hold onto its core differentiation point in battery technology and maintain leadership.

If there is not enough investment in R&D, the product’s ceiling can only depend on the supplier’s capability, as evidenced by the many new electric car makers in China.

Without self-developed battery technology, Tesla would have long since disappeared into the masses.

Now Tesla’s self-developed battery technology is not enough to meet its development ambitions. Tesla hopes to produce its own batteries.On February 26th, according to Electrek, Tesla has built a trial production line for electric cells at its Fremont factory, as part of a secret project codenamed “Roadrunner.” The goal of this project is to use the “machine that makes the machine” strategy to mass produce cheap batteries.

Moreover, our sources indicate that Tesla’s Shanghai Super Factory has signed a supply agreement with an electric cell manufacturer, which does not rule out the possibility of self-production of electric cells at the Shanghai Super Factory in the future.

From an outsider’s perspective, it seems that Tesla has always maintained a good partnership with Panasonic. However, the collaboration between the two has not always been smooth sailing.

At the beginning of their partnership, the relationship between Tesla and Panasonic was certainly amicable as Tesla had demand, and Panasonic had technology.

As Tesla’s sales continued to rise, so did their demand for batteries. In order to meet the supply of 2170 motor cells, Tesla proposed the concept of the Gigafactory and partnered with Panasonic to build Gigafactory 1 in Nevada. Tesla managed and provided land and plants while Panasonic manufactured lithium-ion batteries. Both parties invested jointly.

Gigafactory was a good thing, as large-scale production could meet the demand for 2170 cells needed for the Model 3, and could also lower production costs.

However, as Tesla’s sales continued to soar, the conflicts between the two intensified.

On the Tesla Q4 2018 earnings call, Elon stated that the biggest constraint on Model 3 production was the lack of production capacity of the Gigafactory cells. Panasonic, in turn, froze its investment in Gigafactory 1, worried that Tesla would fail to achieve its sales targets.

The two also had some management disagreements, with Elon advocating for nanomanagement, refining, quantifying, standardizing and streamlining all work as much as possible. However, Panasonic was used to letting its subordinates solve problems on their own, without having to push every problem up to higher levels.

Due to Tesla’s price pressure, Panasonic found it difficult to make a profit, while continuing to invest heavily in the Gigafactory production lines. As a result, Panasonic’s lithium battery business is still in an overall loss-making situation.

The disagreements between Panasonic and Tesla over production capacity and cost have become increasingly serious. While Tesla’s goal is to increase production while reducing costs, Panasonic stands between Tesla and that goal.

Tesla is likely to kick Panasonic off the team in order to achieve its own goals, as Tesla now has the capital. There are similar instances that can be found in Tesla’s history.In the first generation of Tesla vehicles equipped with Autopilot, Tesla used visual perception chips from Mobileye Q3. However, as Tesla’s ambition further expanded and the demand for computing power increased, Tesla replaced it with the Drive PX2 central processing chip from NVIDIA in vehicles equipped with Autopilot 2.0.

With each iteration of Autopilot upgrade, Drive PX2’s computing power can no longer handle Tesla’s eight simultaneous video stream processing. What would Tesla do when there is no automatic driving chip on the market that meets its requirement?

Tesla will build its own.

Hardware 3.0 chip was born.

In addition to acquiring Maxwell in 2019, Tesla also acquired a Canadian battery manufacturing equipment company, Hibar Systems.

What’s more interesting is that the legal representative of Hibar Systems’ wholly-owned subsidiary in China, Ningbo Haiba Precision Machinery Co., Ltd., is Tesla’s China Region President, Zhu Xiaotong.

Tesla’s R&D personnel have repeatedly recruited battery design and testing personnel on LinkedIn, stating, “Join us quickly for lithium-ion battery manufacturing technology!” and “Develop world-class battery manufacturing technology to achieve the next generation of low-cost, high-performance electric vehicles and energy storage products.”

This is Tesla’s attitude towards suppliers: when you can meet my needs, we can work together happily, but when you gradually limit my development, I will give up our cooperation at any time.

From Pack’s self-research to cooperative development of battery cells, and to independent research and development of battery cells, Tesla’s self-research penetration rate in core technologies is continuously increasing. If Tesla’s competitors have not yet realized the importance of self-research, they are destined to become Tesla’s followers.

Tesla has had a significant impact on the development of the entire supply chain. According to the reliable source from the 42nd Garage, Tesla hopes that its cooperation with CATL will increase the production speed of the CATL production line by 20%, improve the battery capacity by 20%, reduce the price by 20%, and further push down the prices of positive and negative electrode materials, electrolytes, and separators in the upstream supply chain.Ningde Times has always been a dominant player in the face of domestic car companies as the largest battery manufacturer in China by shipment volume. However, it made concessions when facing Tesla, not because Tesla was strong, but because Tesla had a large demand.

In 2020, Tesla’s Shanghai plant is expected to produce approximately 100,000 vehicles. Ningde Times has been supplying batteries for the Standard Range Plus Model 3 since July this year. By simple calculation, Tesla’s demand for Ningde Times’ batteries can reach 2.6 GWh (50,000 vehicles x 52 kWh = 2.6 GWh) this year alone, and this is only half a year’s statistics.

In contrast, a new car company with an annual sales volume of 15,000 vehicles requires less than 1 GWh. When Tesla has a large enough volume given to Ningde, this is good news for Ningde Times. The constantly expanding production capacity can effectively reduce costs through economies of scale. After reducing costs, this is a great benefit to the business.

It can be said that while meeting its own needs, Tesla has also driven the development of the battery supply chain. According to a small rumor, the Chinese government provided Tesla with a loan of 5 billion RMB for building a factory in China, and one of the conditions was that vehicles produced by Tesla’s Shanghai factory must use China’s local supply chain.

Tesla mentioned this point at the delivery ceremony of the first batch of China-made Model 3 vehicles. Currently, the localization rate of Tesla’s domestic parts is only 30%, which will reach 70% in mid-2020 and achieve a 100% localization rate by the end of the year.

In conclusion, Tesla can maintain sustained leadership, not by luck or coincidence, but because Elon Musk set clear strategic goals and slowly approached them in accordance with the first-principles approach.

Furthermore, Tesla’s core decision-makers have comprehensive thinking and judgment capabilities across engineering, technology, product and market. At the beginning of the company’s establishment, they built a complete system centered on the core strategy from product strategy, technology research and development, production to channels and markets.

If you only focus on some detailed technology to look at Tesla’s company, you may not have a comprehensive understanding. Only with the idea of “promoting the world’s transition to sustainable energy” can you put together all of Tesla’s initiatives and present the complete blueprint of Tesla in front of you.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.