Image source wallstreetpr

General Motors, which has been in existence for 112 years, has experienced ups and downs throughout its history. It surpassed Ford to become the largest automaker in America and remained the world’s largest automaker for decades. However, it also experienced the Great Depression and the baptism of World War II, and was also hit hard by two oil crises. Later, it filed for bankruptcy protection due to the double blows of the subprime and oil price crises.

Regardless of prosperity or decline, General Motors has experienced every critical moment in the automotive industry.

Now is a critical moment for the company’s transformation towards electrification and intelligence.

At this point, General Motors began to shrink its market.

Putting fewer eggs in fewer baskets

On February 16, local time, General Motors issued a statement to accelerate its transformation in international markets.

General Motors Official Statement

The statement stated that General Motors will reduce sales, design, and engineering businesses in Australia and New Zealand and phase out the Holden brand by 2021, with a focus on General Motors’ specific businesses.

In addition, General Motors has signed a binding term sheet with Great Wall Motors to purchase its Rayong factory in Thailand.

By the end of 2020, Chevrolet will withdraw from the Thai market.

So, what is the purpose of all this? In General Motors’ own words, it is to improve cost-effectiveness and take action in markets where sufficient returns cannot be obtained.

However, this is not General Motors’ first move to cut international businesses. As early as 2015, General Motors announced its withdrawal of the Chevrolet brand from Europe and announced its exit from the Russian market in the same year.

In 2017, General Motors sold its Opel and Vauxhall subsidiaries and withdrew from the South African and other African markets. Since then, the company has also decided to withdraw from the Vietnamese, Indonesian, and Indian markets.

From giving up Europe to now Australia, New Zealand, and Thailand, General Motors has been retreating in international markets all the way.

So the question arises, is General Motors’ international business really that bad? To seek the truth, I examined General Motors’ financial reports in recent years.

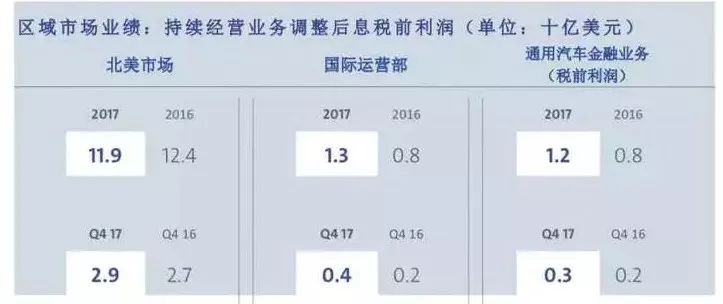

Performance of General Motors International Market in 2017

Performance of General Motors International Market in 2018

Performance of General Motors International Market in 2019

After checking the table, the answer is obvious – the presence of General Motors in the international market is relatively low.

Looking at the table, General Motors’ pre-tax profit for the international market from 2016 to 2019 was $800 million, $1.3 billion, $400 million, and $200 million, respectively. Except for the sudden increase in 2017, it was decreasing year by year.

Also, notice that there is “pre-tax profit” before profits. What is pre-tax profit? As the name suggests, it is the profit without deducting interest or income tax.

If we look at General Motors’ autonomous driving subsidiary, Cruise, its pre-tax profit has been rising gradually since 2017, from $600 million to $700 million, and then to $1 billion. If we compare it with the North American market, General Motors’ presence in the international market is even lower.

Therefore, a financial question is raised – why not invest the cost of the international market into Cruise, or the high-quality market with a large share such as North America? Because no matter future trends, or in terms of revenue, it appears to be a good deal.

However, speaking solely in terms of data seems pale, and delisting is indeed a big deal, so I checked the official statement.

Internal Factors of Factories

Let’s not focus on the distant future, but instead take a look at the General Motors’ Rayong plant in Thailand.

On February 17th, the official website of Great Wall Motor published “Great Wall Motor and General Motors Co Ltd signed an agreement on the acquisition of Rayong production facility in Thailand”. It immediately stirred up discussion in the industry.

Aerial view of the Rayong plant Source: Great Wall official website

In response, General Motors stated that after a detailed analysis of the future production capacity of the Rayong plant, it was concluded that its low factory utilization and expected output make it difficult to continue in the future.Without local manufacturing in Thailand, Chevrolet cannot create competitive conditions in the country’s new car market, so General Motors decided to withdraw Chevrolet from the Thailand market.

Moving on to Holden, some of you might be hearing about this brand for the first time. Holden’s ties to General Motors date back to 1926, when GM entered the Australian market. In 1931, GM acquired the Holden company. In 1944, GM decided to expand Holden into a full-fledged manufacturing base. And in 1948, the first products were launched at the Holden factory in Australia.

But even with more than 160 years of history, this brand (which has long made more than just cars) ultimately fell apart after withstanding the test of time. Following General Motors’ announcement, Holden also posted the news on its official website the next day.

In the statement, Kristian Aquilina, Interim Chairman and Managing Director of GM Holden, said, “Holden has had a special place in our country since it began as a saddlery business in 1856. Unfortunately, all the hard work and talent of the Holden family, our employees, our supporters, and our loyal suppliers have not been enough to overcome our challenges. We understand the impact of this decision on our people, our customers, our dealers, and our partners, and we will work closely with all stakeholders to ensure a dignified and respectful transition.”

From Kristian Aquilina’s expression, she also regretted this decision and the step was a last resort. But in the law of the jungle, Holden’s ultimate demise was inevitable.

Regarding the decision to close Holden, GM President Mark Reuss also stated that GM explored various options to continue operating Holden, but none overcame the investment challenges needed to support brand growth and provide economic conditions and investment returns for appropriate products that meet the highly dispersed right-hand-drive market.

To sum up, neither of these markets could deliver high investment returns, so abandonment became the only choice.

The strike is an indirect factor

Since we mentioned the issues of the factory itself, I think that GM’s labor cost issue also needs to be discussed because I believe that the reason for accelerating this event is related to the strike in 2019.

Let’s first look at the official GM message.According to the official statement from GM, impacted by the strike of United Auto Workers (UAW), GM factories in the United States have shut down for four weeks in Q4 2019. The wholesales have decreased by about 190,000 units compared with the previous year. The strike has caused a loss of $3.6 billion in adjusted pre-tax profits and a $5.4 billion decline in adjusted automotive free cash flow for the year.

Undoubtedly, such losses are huge for GM.

Speaking of the strike, we have to talk about United Auto Workers (UAW), as it is the initiator of the strike. UAW was established in Detroit in May 1935.

Image from Reuters

Soon after its establishment, UAW organized two strikes, the strike of General Motors factory in Atlanta, Georgia, and the strike of GM factory in Flint.

Thereafter, UAW led strikes in various GM factories across the country, demanding higher wages and better benefits, as well as more say in GM’s management.

In UAW’s words, their goal was to fight for fair treatment, affordable health care, profit sharing, job security, and long-term employment opportunities for many temporary workers.

GM also responded in its official announcement: “Labor costs are our single largest competitive disadvantage… We pay approximately $8 billion per year more in wages and benefits than our foreign-based competitors who have manufacturing operations in the United States.”

Later, as we all know, GM filed for bankruptcy protection in 2009. Labor costs were one of the significant factors that led to GM’s bankruptcy.

Back to the 2019 strike, it had a significant impact on the US market, but we cannot estimate its direct impact on the international market. However, I believe there are still indirect impacts.

Simply put, the loss caused by the strike needs to be filled-one way or another. Either we add more or we subtract. In the current situation, it is hard to make up for the loss quickly. Therefore, it is easier to do subtraction.

So, selling unprofitable factories, such as those in Thailand, can help ease GM’s financial pressure in the short term, and it is a feasible method.

GM’s future focus

The question is, what areas will GM concentrate on after cutting off these international operations?First and foremost is the hottest field of new energy and intelligent vehicles.

Mary Barra, chairman and CEO of General Motors, said, “We are restructuring our international business with a focus on markets where we have the right strategies to drive strong returns and prioritize global investments that will drive future mobility, particularly in the areas of electric and intelligent vehicles.”

In terms of electrification, General Motors currently has the BOLT EV, Changchun and Weilan, and is deploying Hummer, which is returning through pure electric power (whether it will be named Hummer is currently unknown).

In addition, in terms of intelligence, Cruise, General Motors’ self-driving subsidiary, unveiled a self-driving vehicle named Cruise Origin last month.

Picture source: Cruise

According to the latest report from The Detroit News, the last Chevrolet Impala will roll off the assembly line next week at the Detroit-Hamtramck Assembly plant, paving the way for the next phase of the plant: electric vehicles.

The report showed that instead of engines and gearboxes, electric motors and battery packs will replace them. By the second half of 2021, the plant will produce GMC’s Hummer electric vehicles, followed by the self-driving electric vehicle Origin.

In addition, the $2.2 billion investment in the plant will begin in March. General Motors said the upgrade will include a full upgrade of the final assembly area as well as paint and body workshops. Upgrades include new machines, conveyors, controls, and tools.

Picture source: The Detroit News

In terms of electrification and intelligence, General Motors has not further disclosed its final answer, only stating that it will increase its investment in electric vehicles in the future. However, the specific focus on electric first or synchronous advancement is still relatively unclear. This brings us to another automaker, Volkswagen Group.

This is in line with the minutes of a meeting last time CEO of Volkswagen Group, Herbert Diess. Both General Motors and Volkswagen emphasized the acceleration of electrification and intelligence, and the need for a quick transformation. But Diess has made it clear that Volkswagen’s goal is intelligence and transformation towards technology.In this meeting minutes, Diess stated that “in the future, cars will become the most complex, valuable, and suitable internet device for the public in the world. By then, we will spend more time on cars than we do now, and perhaps the time will increase from one hour a day to two hours. It will no longer be a simple gray box, but will be more comfortable, warm, and most importantly, it will be more connected than it is now, and will have more functions.

In the car, we will continue to be online, generate more data than smartphones, and be able to obtain more information, services, security and convenience from the internet. A connected car will double the time we spend online. The car will become the most important mobile device.”

Leaked meeting minutes from online

From Diess’s words, we can hear Volkswagen’s determination in terms of smartness, which also indicates that this trend is irreversible.

Secondly, Diess also cited Tesla, saying that “If we realize this, we also understand why, from an analyst’s point of view, Tesla is so valuable. We, Volkswagen, also want to achieve this goal. But the biggest question is, are we fast enough? Honestly, maybe not, but this problem is becoming increasingly important. In fact, if we continue to develop at the current speed, the situation will become very tense.

The era of traditional car manufacturers has ended.”

In other words, the automotive industry is already undergoing reshuffling. If the decision-making goes slightly wrong, perhaps it will fall into the abyss. So, how can traditional car manufacturers not be anxious?

In addition to investing in electrification and intelligence, Steve Kiefer, Senior Vice President of General Motors and General Motors International President, also stated that these decisions were based on General Motors’ announcement in January to sell its Talegaon factory in India. “Major restructuring actions will be implemented in South Korea and investment and continuous optimization of the South American business.”

Steve Kiefer also stated that the advantageous positions in General Motors’ international core markets are: South America, the Middle East, and South Korea.

By now, you should have noticed that General Motors is not thinking about closing all international markets as soon as possible, and wants to retain profitable areas.

In addition to implementing plans in international core markets, Julian Blissett, Senior Vice President of General Motors International Operations, also stated that General Motors will continue to optimize partnerships in growth markets such as Uzbekistan by transferring assets and building strong supply chains to reduce costs.Julian Blissett said, “In small markets such as Japan, Russia, and Europe, we will compete for market share by selling profitable high-end imported cars (with the support of lean General Motors structure).” Therefore, it is clear that General Motors is good at doing business. Although it has withdrawn from many international markets, it has effectively retained profitable core markets while also selling profitable high-end imported cars in some small markets.

For General Motors, this strategy is not a matter of life and death but a way to take the essence while discarding the dross.

Now, let’s briefly discuss the possibility of General Motors’ successful transformation. During the Great Depression from 1930-1934, General Motors took a series of measures, including cutting production, selling non-essential assets, reducing salaries and staff, and cutting dividend payments. Even in the worst economic environment of 1932, when the auto industry was in recession, General Motors remained profitable due to its financial and operational controls. However, today’s General Motors and the times are different, and only financial and operational controls are no longer enough to support General Motors’ successful transformation. At this time, focusing on technological research and development has become an essential road for everyone in the long run.

In terms of research and development, General Motors is also focusing on technology, abandoning the European diesel route, reducing the weight of PHEVs, and focusing on pure electric vehicles and autonomous driving. This means that General Motors has returned to the old-fashioned emphasis on research and development during the prosperous period, adjusting its direction in a timely manner when facing a turning point in the development of the times.

At this time, General Motors also timely teamed up with Honda to jointly develop battery cells and other electric vehicle components. Its subsidiary, Cruise, also worked with Honda to build self-driving vehicles. Mary Barra also stated that from an engineering design perspective, this cooperation will save General Motors a lot of money and generate economies of scale.In addition, profit maximization is universal in the automotive industry. Although this seems capitalist, only by solving pain points can a company stand undefeated. Universal’s determination can be seen from their decision to temporarily give up some international markets. It’s better to suffer one big loss than many small ones, and they’ve stopped pursuing diversified operations excessively. Instead, they concentrate their efforts on technology and high-quality markets, which is a wise choice.

More importantly, I don’t think General Motors will be stupid enough to make the same mistake twice. The bankruptcy in 2009 taught General Motors a lesson, and they learned how to control costs.

So, is there a good chance of General Motors’ successful transformation? I think it’s half and half. It’s okay to cut unnecessary investments during periods of special circumstances and increase investment in research and development, as well as cooperate with top-notch technicians. However, the ultimate product is a crucial factor.

Currently, General Motors’ performance in electrification and intelligentization is somewhat disappointing. Looking at their products, except for the ones mentioned, General Motors does not have a core competitive model. Therefore, whether General Motors can produce unique products in the next few years will become an important indicator of their successful transformation.

Final Thoughts

Looking at the entire electric vehicle industry, we can’t avoid the issue of endurance and intelligentization. For now, the endurance issue needs to be resolved, and so does General Motors. But solving the endurance issue simply replaces the traditional fuel vehicle with another energy form. In the long run, the fundamental factor in disrupting the automotive industry is intelligentization.

Volkswagen’s Diess has given his answer: cars will become the most important mobile device.

In his conference notes, one sentence stands out: “I remember one time when I hired a Nokia employee. I hired hundreds of them and asked them to explain to me how they lost to Apple. The logic was: we have 43 different phones that can meet every user’s needs. No one wants a touch screen. You have to charge your iPhone at least once a day, while Nokia’s battery can last for one week. Nokia has created a lot of records, but it’s dead.”

Therefore, intelligentization is crucial in the future.

So, is General Motors ready?

Authored by: Bai Long

Edited by: Da Ji

Markdown English Text:

Markdown English Text:

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.