On August 15th, WM (Weima) finally announced the “Customer Care Plan”. After the launch of the 2019 520 km version of the WM EX5, WM introduced an equity upgrade plan for old users. For the first batch of old car owners who supported WM by giving money and votes in 2018, this plan is particularly attractive.

For WM, the feedback from old car owners on this plan is also crucial. As we all know, NIO’s 60% battery upgrade plan has caused controversy among the old car owner community, and XPeng’s new car launch has directly led to rights protection incidents in various places. As one of the leading new car-making forces, WM’s equity upgrade plan cannot afford to be flawed.

Now let’s take a look at it together.

Cash vouchers, Care+, and Battery Pack Paid Upgrades

To get straight to the point, WM’s “Customer Care Plan” for old users is divided into three parts.

Cash vouchers are the most straightforward. Old car owners can receive cash vouchers for free to exchange for WM’s new cars. The cash voucher benefits for EX5 300, 400, and 500 models are 5,000, 10,000, and 20,000 yuan, respectively. The most important point of this policy is that it can be transferred to others, which means that even if old car owners do not have the need to change cars, cash vouchers can still circulate freely on the market as a car purchase quota.

For old car owners who have only purchased cars for a year, I think most users hope to get some benefits but have no need to change their cars. This cash voucher can be considered.

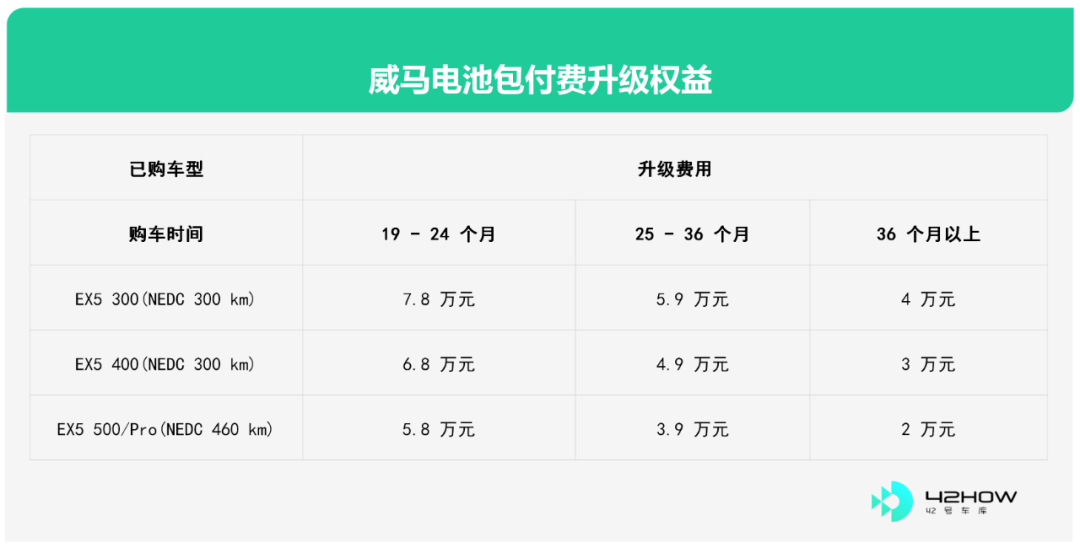

The second one is the battery pack paid upgrade that WM has been hyping up for a long time.

The battery pack upgrade was explained in detail in our previous “WM’s Iteration Plan”. As early as the end of July, WM’s Vice President of Strategic Planning, Lu Bin, confirmed that they would launch a battery pack paid upgrade service for old car owners. Below is the final confirmed paid upgrade plan, with the highest upgrade cost (from NEDC 300 km to 520 km) of 78,000 yuan. It is understood that the cost of battery upgrade is high, including the cost of new battery packs and the recycling of old battery packs, which leads to a comprehensive cost of over 100,000 yuan.

If you have owned the EX5 500 for more than 36 months, the upgrade cost will be reduced to 20,000 yuan. In any case, WM is the first to guarantee user rights in the form of battery pack paid upgrades. For this, I would like to say that it is not so easy to change the battery pack of a vehicle, and the technical support behind the battery pack is actually WM’s early platform capability.

On September 21, 2016, Shen Hui, founder of WM Motor, announced the 128-product plan for WM Motor. Built around a core architecture, the plan includes 2 complete vehicle platforms, STD and PL, and will launch at least 8 intelligent electric vehicle models. Meanwhile, WM Motor has consistently pursued a square-shaped technology route with high-voltage power batteries, without switching to cylindrical or soft-pack routes.

Ultimately, WM Motor achieves the same battery module specifications as the old battery pack while achieving higher energy density. This is the technological basis for WM Motor to implement battery pack payment upgrades.

As for why the highest paid upgrade rate is set at CNY 78,000, VP of WM Motor, Lu Bin, has explained that there is not much value in using the old battery pack replaced, and the cost of the new battery pack is currently high, leaving little room for WM Motor to maneuver. We believe that the released battery replacement pricing is carefully considered by the manufacturer, with the aim of making maximum concessions to meet the needs of users.

The last feature is WM Motor’s Care+ value preservation and repurchasing rights. The name Care+ reminds me of this:

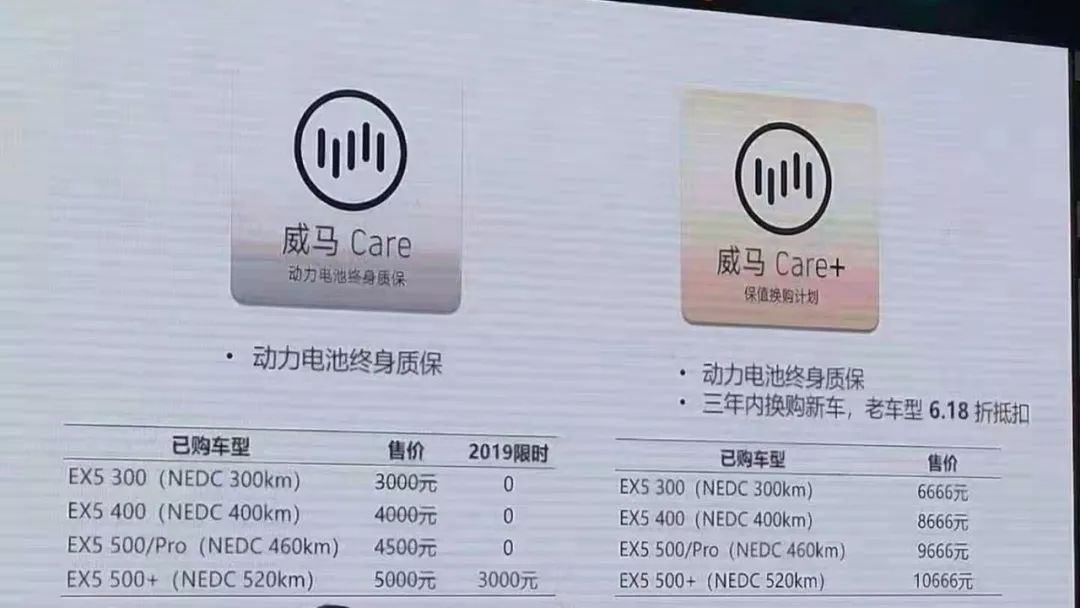

WM Motor’s value preservation plan is divided into Care and Care+. Here are the differences between them.

Let’s take a closer look at Care+. Care+ covers a lifetime warranty for the power battery and a right to repurchase new vehicles at 61.8% of the original price within three years at 6.18% off the base price. According to WM Motor, WM Motor will work with value preservation service providers and insurance companies to evaluate the residual value of the power battery, and as long as it is a non-operational C-end vehicle, it can be replaced at 61.8% of the base car price (optional parts are replaced at 50%), and a WM Motor new car can be purchased by paying the difference within three years of the purchase invoice.

In fact, Tesla has also launched a similar plan. On April 3, 2015, Tesla launched a 3-year, 50% buyback scheme, provided that the owner chooses financial services with a loan exceeding 60% of the car price and a loan term of no less than 36 periods. Comparing with WM Motor’s Care+, which requires an independent payment of CNY 6,666-9,666, the service content also changes from a 50% resale to a 6.18% repurchase + lifetime warranty of the power battery.

I would like to talk more about WM Care+. Unlike XPeng’s 3-year 60% price reduction only for a specific group of users, WM Care+ is a long-term benefit for all users. It fundamentally solves the contradiction between the rapid development of electrification technology and the low-frequency, high-value transaction of cars.

I would like to talk more about WM Care+. Unlike XPeng’s 3-year 60% price reduction only for a specific group of users, WM Care+ is a long-term benefit for all users. It fundamentally solves the contradiction between the rapid development of electrification technology and the low-frequency, high-value transaction of cars.

Before WM, why did users of NIO and XPeng complain? Essentially, it was due to the fact that new models with innovative technology were released to the market, and this technology was not available in the older models, leading to a decrease in residual value. Compared to new models, old models have weaker performance in terms of range, degradation, depreciation, etc., resulting in less competitiveness and lower resale value in the second-hand car market.

WM Care+ is like a lock, locking in the residual value rate at a level similar to that of joint-venture conventional fuel vehicles, ensuring customers will not suffer a loss.

From the industry’s perspective, as pure electric vehicle technology iterates rapidly, all new car companies are trying to solve the issue of residual value. For example, NIO’s battery swapping structure, Tesla’s Autopilot update, etc. are all essentially providing “hardware iteration” capabilities on key areas of performance to ease the anxiety of old customers. The launch of WM Care+ not only solves customer anxiety but also raises the industry’s standard for user benefits.

For consumers, this is undoubtedly good news, and the fiercer the competition among car companies, the more they will benefit.

For WM itself, since the launch of the first EX5, there have not been many negative news items. Instead, it shows the company’s sincerity in addressing customer needs, as demonstrated by its lifetime quality assurance, cash vouchers, battery swapping fee upgrades, and 38% price reduction for residual value.

As mentioned earlier, the various customer concerns in today’s pure electric vehicle market are largely due to the immaturity of the industry chain. At this juncture, every new car company is an explorer. WM’s User Care Program is inherently balancing commercial operations and user experience on the premise of commercial feasibility.

A healthy industrial chain is not only forged by technical progress, but also by new forms of services such as WM’s exploration, which is worthy of encouragement and support from both the industry and consumers.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.