If the 18th Shanghai Auto Show is to be defined, it might be the first car show in history where electric cars took the spotlight. Not only did veteran EV manufacturers like Tesla and BYD unveil competitive products, but many other carmakers also introduced pure electric cars with NEDC range of over 600 km and 0-100 km/h acceleration in 5 seconds.

The gradual competitiveness of electric cars compared to fuel-powered ones is largely thanks to the improvement in battery energy density. However, it’s widely known that energy density and thermal stability are the two contradictory aspects of power batteries. It’s a challenge that the whole industry is faced with to achieve balance between energy density improvement and thermal stability enhancement, to avoid tragedies caused by spontaneous combustion, as well as concerns of future consumers.

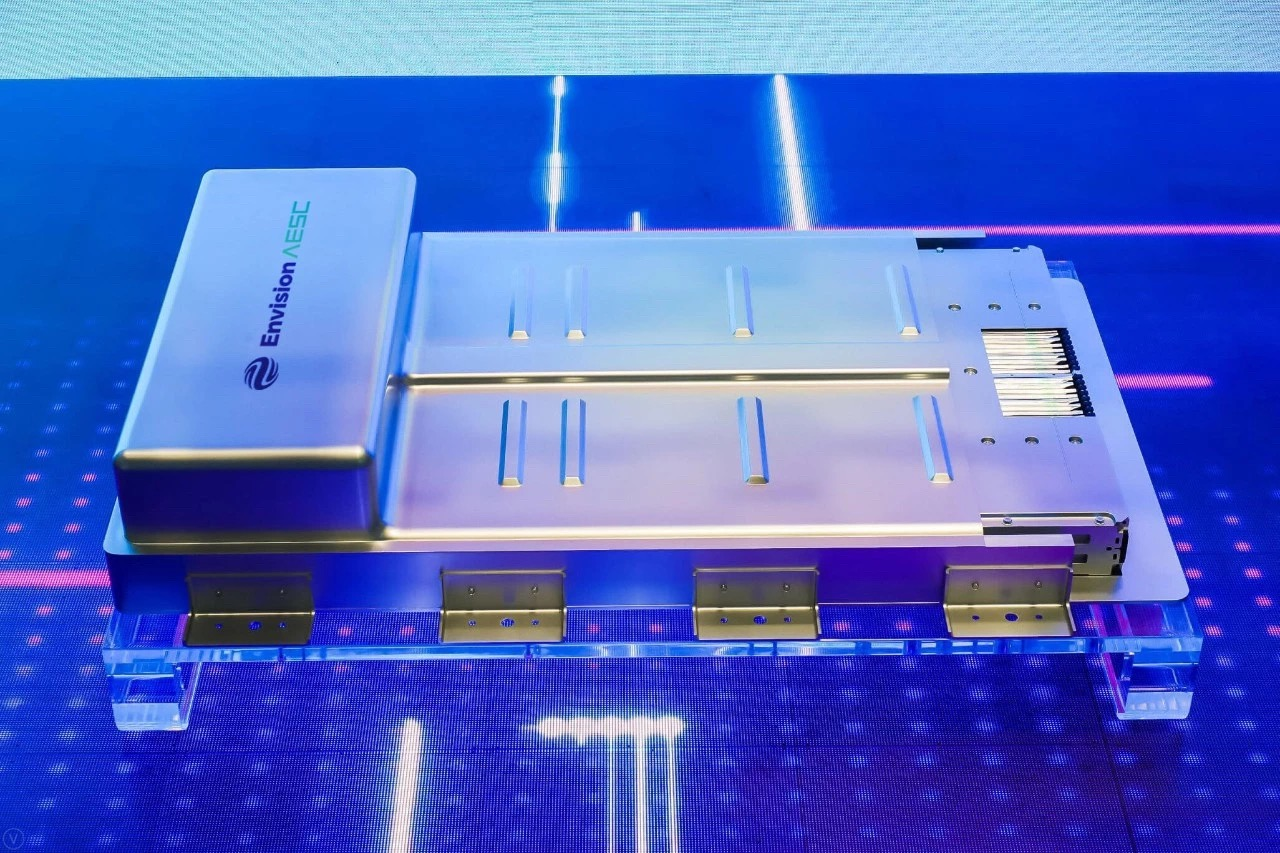

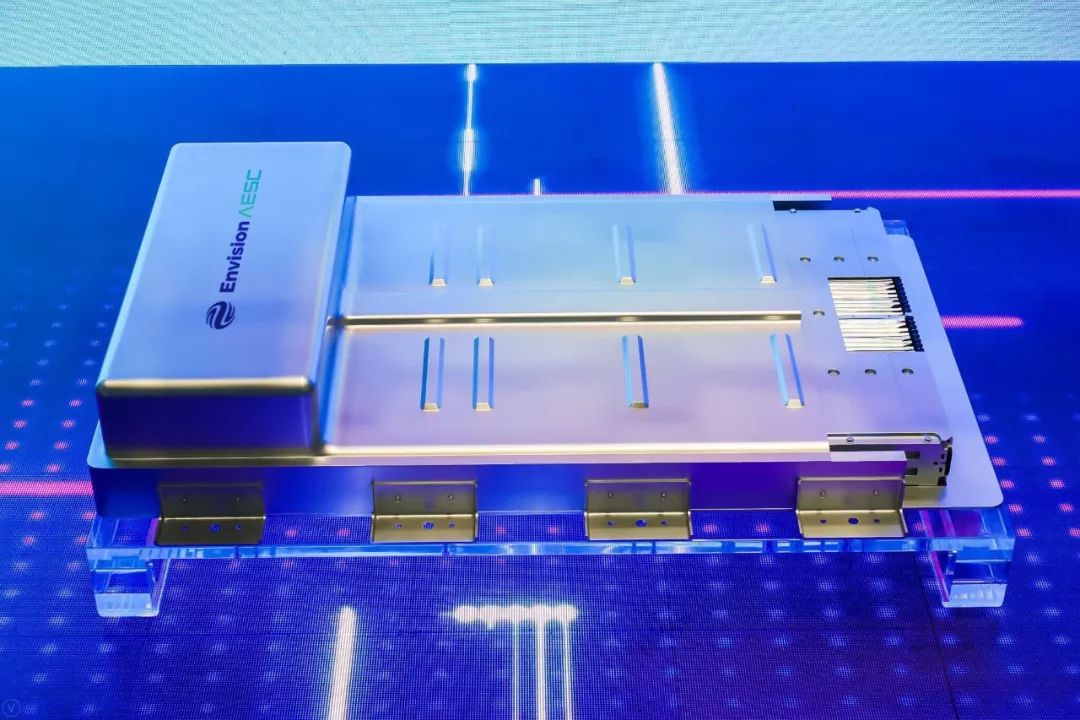

On April 17th, AESC Vision unveiled its new Gen-5 811 AIoT power battery during the Shanghai Auto Show. As a veteran player in the industry, AESC is starting anew in the world where electrification is becoming mainstream. With most people focusing on battery energy density, at the press conference of the auto show, the most often mentioned word by AESC is “safety”. They believe that safety is the “grey rhino” for the future development of the electric vehicle industry.

AESC: A Power Battery Company Born within a Veteran Automaker

Before introducing the details of this new product, it’s necessary to briefly introduce AESC Vision itself.

AESC stands for Automotive Energy Supply Corporation. In July 2009, a joint venture between veteran Japanese automaker Nissan and Japanese electronics company NEC was established, creating AESC which is responsible for the research and development as well as the manufacturing of vehicle-grade power batteries. Its business includes the research and development and manufacturing of battery electrodes, cells and modules, as well as pack development and manufacturing.

So, is the combination of Nissan and AESC similar to the alliance between Tesla and Panasonic? Not entirely.

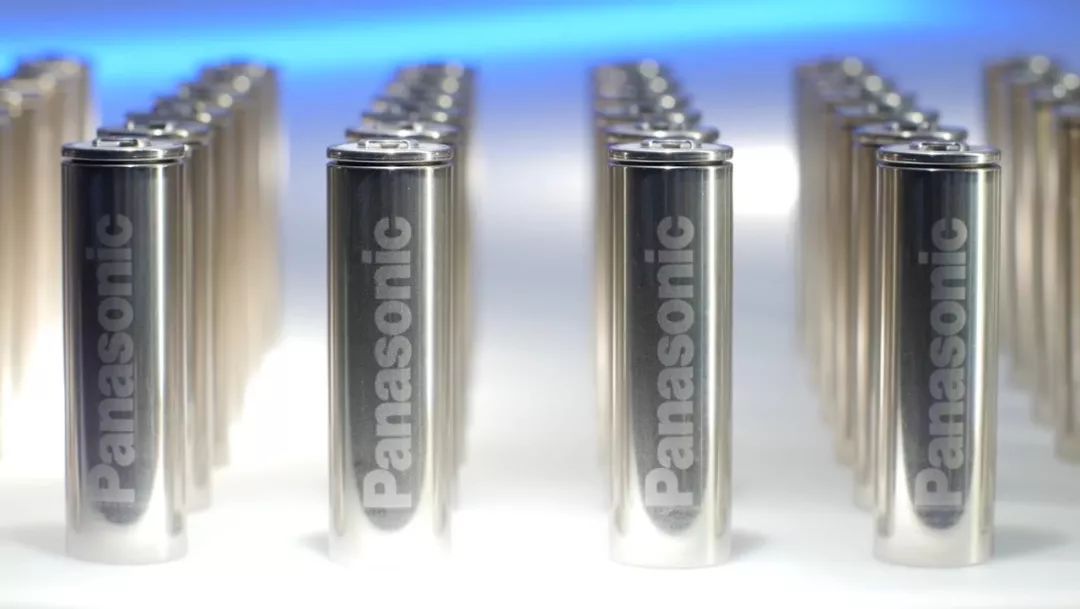

The 18650 cells that Tesla used in the early days were not originally designed for electric vehicles, and Tesla and Panasonic made extensive improvements in research and development, and testing to pass the battery pack limit test of SAE and the United States Federal Motor Vehicle Safety Standard (FMVSS) tests.

AESC, on the other hand, was established with the goal of producing vehicle-grade power batteries from the outset.With the launch of Nissan Leaf in 2010, AESC began to grow rapidly. By 2014, AESC had become the world’s second largest manufacturer of power batteries, with a 21% market share, second only to Panasonic. Over a nine-year period, AESC provided power battery solutions for Nissan’s 430,000 electric vehicles.

It can be said that AESC entered the power battery market at the right time, but during its later development, its deep ties with Nissan actually hindered its ability to expand its market size quickly.

AESC’s Dilemma and Breakthrough

Before being acquired by Envision Group, AESC was already finding it difficult to establish a foothold in the power battery market. Before 2019, AESC had three major production bases worldwide, located in Tennessee, UK, and Kanagawa, Japan, with a combined capacity of 7.5 GWh, while Panasonic had already pushed its capacity to 23 GWh in 2018. Larger economies of scale bring about significantly reduced costs, which can give a significant advantage in market competition.

In January 2017, Tesla announced the production of 2170 batteries based on the 811 formula, which would bring higher energy density and lower cobalt content, boosting cost reductions on the one hand, and improving product competitiveness on the other.

In December 2016, then-chairman of the Nissan-Renault Alliance, Carlos Ghosn, complained that AESC was unable to provide “power batteries that are competitive in price”. It should be noted that Elon Musk and Panasonic had already invested $4.5 billion in building a super factory in Nevada, and that the huge scale and aggressive deployment of new technologies have contributed to the constant improvement of energy density and cost reduction. However, overall, Nissan’s attitude towards AESC was that the cost of supporting a power battery company on its own was too high. Therefore, AESC became Nissan’s choice, through open OEM cooperation and cost reduction through expanded capacity.

Let’s take a look at Envision’s breakthrough.In April 2019, Envision announced the acquisition of the controlling stake in AESC’s power battery business in Japan, the U.S., and the UK, as well as the full ownership of NEC Energy Devices’ battery electrode production business. Envision Fund holds 80% of the new company’s shares, while Nissan holds 20%. Having stable-demand OEM partners is essential for power battery manufacturers.

Envision can be understood as a digital energy company with software and hardware layout in wind power, photovoltaics, charging, energy storage, and the Internet of Things. According to the official definition, Envision’s intelligent IoT system EnOS™ has connected 120 GW of energy terminals and 50 million smart devices worldwide. The algorithmically unified energy dispatch ensures dynamic balance of energy supply and demand, creating synergistic value.

At the Shanghai Auto Show on April 17, Envision AESC CEO Masashi Matsumoto announced the production capacity plan for Gen-5 811 AIoT power battery: The energy density of the 811 formula battery exceeds 300 Wh/kg, and Envision AESC has conducted multiple safety tests on it.

After completing the acquisition of AESC, Envision AESC established a manufacturing factory in Wuxi, Jiangsu Province, China, with a designed capacity of 20 GWh/year, and equipped with the most advanced Gen-5 811 AIoT power battery production line in the industry, which can support the battery supply for over 400,000 new energy vehicles annually.

As Envision AESC is no longer constrained by Nissan, it now has the conditions to supply power batteries to third-party car manufacturers. Therefore, continuing to increase investment in R&D, perfectly replicating the product quality management system, and rapidly expanding the production capacity scale with the new factory layout are the keys to Envision AESC’s breakthrough.

Envision AESC’s Market Competitiveness: Safety + Intelligence

In 2018, the global top three power battery manufacturers were CATL, Panasonic, and BYD, with market shares of 21.9%, 21.4%, and 12.0%, respectively. Panasonic’s success originated from its early binding with Tesla, and the aggressive investment and R&D deployment of both companies. How did CATL and BYD surpass old-school power battery companies such as Samsung SDI and AESC?Apart from new energy vehicles, China also has subsidy policies for local power battery companies. This invisible hand directly promotes pure electric vehicles such as Mercedes-Benz EQC and Audi e-tron to switch to local battery suppliers in the process of domestic production. On the other hand, subsidies have significantly reduced the market competitiveness of purely overseas suppliers, including AESC, in the past few years.

But things are changing. On the one hand, the newly acquired AESC has become a globally oriented Chinese company, and on the other hand, the three South Korean power battery giants LG Chem, Samsung SDI, and SKI have established R&D centers in China. They are returning to the market because subsidies based on power batteries are declining and will be completely phased out by 2020. The invisible hand is withdrawing, and pure technology and products have become the core of competition.

“China doesn’t lack an electric car manufacturer, but lacks a battery company that can provide ultimate safety and high intelligence. This is our philosophy. Especially, battery safety is the biggest ‘grey rhino’ in the electric car industry. Farasis AESC will maintain an ultimate safety record of ‘zero major accidents’ through smart IoT technology, so that everyone and every family can ride electric cars with peace of mind.” Zhang Lei, CEO of Farasis Group and executive chairman of Farasis AESC, said to Garage 42 during an interview at the auto show.

In short, safety and intelligence are the two major competitive advantages defined by Farasis AESC for itself.

The Leaf equipped with AESC battery has been running all over the world for more than 9 years, and there are very few public reports on major crash and fire accidents. Now, Farasis AESC is about to put into production Gen-5 811 AIoT power battery. How does Farasis AESC ensure battery safety?

Farasis AESC’s executive vice president, Watanabe Yasuharu, expressed their exploration of battery safety from two aspects.

The first point is the safety considerations in the design and production of batteries. Starting from the three stages of battery core, module, and packaging, the balance of reliability, life performance, and internal resistance is achieved.

For example, if the BMS fails during the charging process, it is easy to cause problems with battery safety. Therefore, when encountering overcharging situations, it is necessary to strictly control the heat generation between the electrode and the electrolyte.How are these issues solved? Farasis AESC has improved the thermal stability of the positive electrode material and increased the heat resistance of the separator. Additionally, the company has added special chemical substances to the electrolyte to prevent overheating on the electrode surface, ensuring safety when the battery is overcharged.

Dr. Lin Yuchun, head of the Farasis AESC China R&D Center, discussed the work they have done on the upcoming Gen-5 811 AIoT power battery. Simply put, Farasis AESC’s silicon-carbon 811 battery improves high-voltage compatibility with the electrolyte by changing the surface structure of the NCM811 positive electrode material. This addresses two major safety concerns: controlling gas generation and reducing heat dissipation.

Farasis AESC has added additives to the 811 surface to increase system stability. The raw materials need to be tested multiple times to verify material stability. During the research and development process, the priority is to ensure the electrochemical reaction stability, gas production stability, and thermal stability of the material’s chemical structure. The materials must not decompose at higher temperatures in order to provide safety performance.

At the module level, Farasis AESC designed the battery cells for the Nissan Leaf to have a small amount of heat production during charge and discharge processes, with low temperature rise during cycling, and controllable heat dissipation when grouped together. In addition, Farasis AESC has upgraded the battery’s cooling system, providing various customizable solutions based on previous experience in producing multiple types of batteries and simulation verification capabilities.

For the Gen-5 811 AIoT battery system, Farasis AESC proposed customizable solutions: if high-power charge and discharge are required for the vehicle design and there is more heat generation, Farasis AESC will work with the automaker to design a customized thermal management system for the battery pack.

From a battery management system (BMS) perspective, Farasis AESC controls the boundary conditions strictly by defining clear and precise lithium precipitation windows and heat loss boundaries through extensive testing and validation. BMS will strictly control the two ends of li-ion precipitation and thermal runaway to ensure that there are no thermal runaway risks. This type of control has been proven to be effective in Nissan Leaf.

Secondly, Farasis AESC has introduced the concept of AIoT by connecting numerous sensors to the battery to obtain data on battery usage, input and output current, environmental temperature, environmental vibration, travel distance, location address, and other data, and analyze this data using AI.The analysis results of the data can not only trace and verify the advantages and disadvantages of the battery design scheme, but also connect the data to the future renewable energy network, output experience and data in energy system management, and ultimately form an ecological closed loop. This is why the future AESC has added intelligence to its defined competitiveness, in addition to safety.

What puzzle does Future want to complete by acquiring AESC?

Why does Future want to acquire AESC?

Zhao Weijun, the executive director and China business leader of Future AESC, once said that while everyone is concerned about kWh in the field of power batteries, Future is more concerned about kW.

Before acquiring AESC, Future’s innovative EnOS™ IoT operating system under the Future Intelligent segment had completed the integration of existing businesses such as wind power generation, solar power, energy storage, and intelligent buildings to achieve intelligent control and coordination. With the acquisition of AESC, Future has initially completed the closed-loop ecology of energy production (generation), energy carrier (power batteries and energy storage), energy supply and demand allocation (supply-demand balance matching during energy peak and valley periods through big data cloud), and energy consumption (user side).

This is an industrial layout in the sense of upgrading. For example, based on this system, ordinary power batteries can not only serve as a “charging treasure” for balancing the power grid consumption but also avoid the fate of being scrapped and dismantled after the vehicle is scrapped by applying the vehicle-grade batteries to the energy storage field, enabling the battery to perform its function for a long time.

This is the underlying logic of Future’s consistent investment in AESC, and also the ultimate imagination of Future AESC.

No wonder, after the acquisition of AESC, some media judged that this is a company directly competing with Tesla’s strategic layout because they both focus on electricity and energy.

Of course, the Future AESC cannot see that far-reaching future for now. The first step now is to seize the opportunity of subsidy withdrawal, while maintaining the record of “zero major accidents”, to quickly increase production capacity and occupy the market.

* An Overview of SK Innovation’s Global Battery Layout

* An Overview of SK Innovation’s Global Battery Layout

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.