As promised earlier, the delivery of the WmAuto EX5 is scheduled for the end of September, which means we have actually achieved our delivery goal two days ahead of schedule!

On the evening of September 28th, Shen Hui, the founder, chairman and CEO of WmAuto Automotive, jokingly mentioned this at the WmAuto Product Delivery Conference.

What really made him ecstatic was another thing: when the board of directors took stock of the project operation progress of WmAuto team during the meeting, they reviewed all the key nodes since the establishment of WmAuto, and this year alone included the trial production vehicle, the start of pre-sales, the finalization of the test calibration, the landing of the new retail system, and the batch delivery. From project establishment to manufacturing, WmAuto has achieved all these goals precisely down to the month after 44 months of hard work.

For a new car company starting from scratch, achieving such results is not easy. When we compare the two camps of new car manufacturers and traditional car companies, the innovation capability and decision-making mechanism are always the focus of attention, but the precise management and control of research and development cycle required by the automotive industry project management are often overlooked. In this regard, WmAuto is qualified.

10,000 vehicles this year and 100,000 vehicles next year

Another highlight of the press conference is the delivery target mentioned in the title. Shen Hui stated in his speech that the delivery target of WmAuto is 10,000 vehicles this year and 100,000 vehicles next year.

Let’s put aside the target of 100,000 vehicles next year. There are fewer than 100 days left until 2019, and WmAuto’s confidence in facing the complex challenges involved in capacity climbing, logistics system construction, and channel delivery just in such a short time arises from where?

Lan Bin, co-founder and senior vice president of WmAuto, introduced that 100 days is the interval that the outside world can see, but in fact, WmAuto has spent three years to ensure the achievement of the “10,000 vehicles in 100 days” goal.

WmAuto did three main things, namely, information flow, logistics and capital flow. Information flow means that all user information is transmitted from online to offline, making WmAuto’s user center the touchpoint connecting WmAuto and users; logistics construction ensures that products are efficiently transferred from the factory-side to the delivery-side; capital flow is a more realistic issue, and 10,000 vehicles will generate tens of billions of capital flows. Especially for a new car manufacturer, it is important to ensure healthy and stable cash flow.

In fact, the work behind this project is far beyond imagination. The aforementioned information, logistics and capital are all basic work. To achieve the target of 100,000 vehicles next year, the initial product positioning of WmAuto EX5, the capacity of the Chinese pure electric vehicle market, the research and development of the product, the capacity, the reserve of the supply chain, the production rhythm, offline channel construction, all need to have a throughput capacity of 100,000 vehicles per year.

Lan Bin mentioned that starting next year, WmAuto will accelerate the signing of the Smart Partner Agreement, cover more cities, offer test drives and trials, and there will be more touchpoints connected with users.## Questions that Concern Users

Meanwhile, the delivery of EX5 in the B-end market will also begin. According to Lu Bin, the B-end market is “very, very large”. Even for WM, delivering to the B-end market would be a better choice – online car-hailing can achieve 15+ orders per day, which is far higher exposure for the WM brand than private cars.

10,000 vehicles this year, 100,000 vehicles next year, we wait and see.

Previously, the self-ignition of an EX5 prototype in WM Chengdu Research Institute had raised doubts and disputes between WM and the power battery supplier Gushen, as indicated by their “spit notice” (http://mp.weixin.qq.com/s?_biz=MjM5NTIyMjA2MQ==&mid=2656745685&idx=1&sn=cafbf5041c644e3ad63a04e4e8d759bf&chksm=bd55df978a2256819cef7f4e2e75ecbda2fb1a13f935ed82205032afea3025112ccaa368272c&scene=21#wechatredirect) respectively. Many WM users were also concerned about the safety of Gushen batteries.

The most crucial question is: how will WM respond to Gushen’s notice? Will WM open up different battery brands for users to choose in the future?

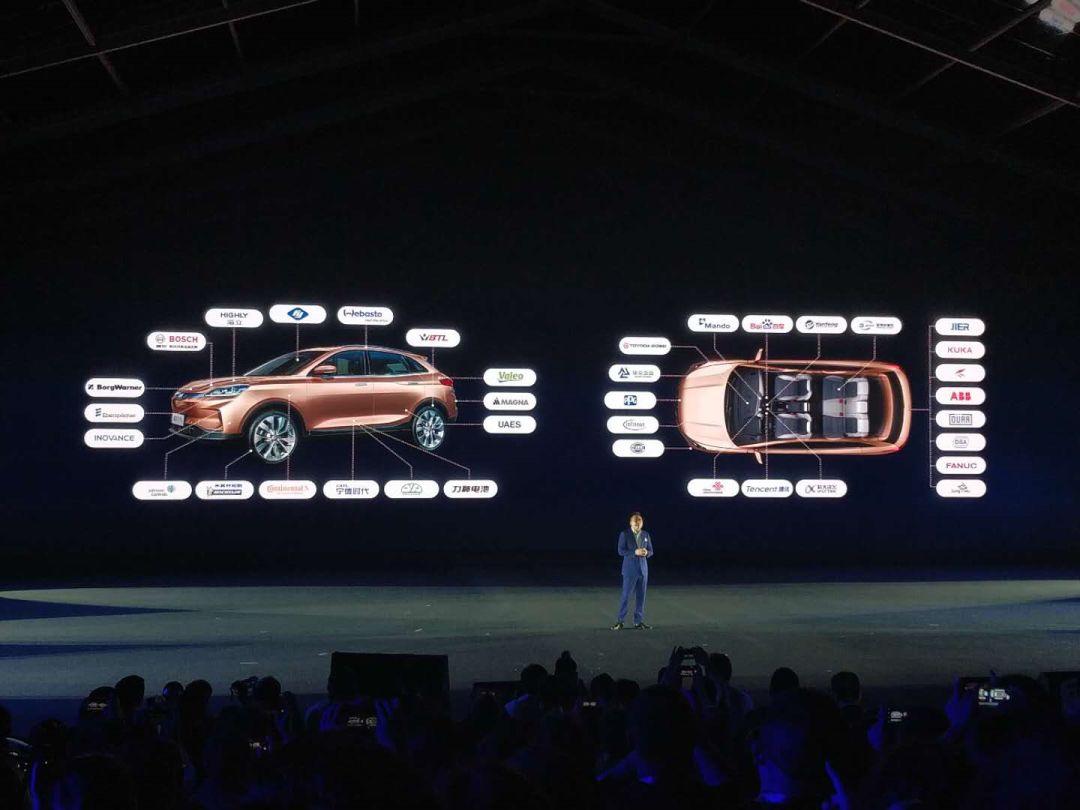

First of all, there are thousands of suppliers for EX5, including CATL, Lishen, Bosch, Valeo and so on. WM will communicate with suppliers included in the supplier directory of WM, and other companies would not have time to deal with it.

In other words, Gushen is no longer in the WM supplier directory, and the cooperation between the two parties has ended.

As for whether to open up battery brands, all first 120 EX5 vehicles that were launched last night use cells from CATL. WM will continue to introduce cells from Lishen and EVE Power of the same specification next year. However, iPhones have five battery suppliers, but Apple does not disclose different battery brands. This is not a solution to the problem. WM promises to take responsibility for the whole vehicle and for each part.

Actually, before starting the production, WM Motor needs to group the battery cells from CATL, Lishen, and EVE to form battery packs. WM needs to ensure consistency of the battery performance from these three different companies.

Actually, before starting the production, WM Motor needs to group the battery cells from CATL, Lishen, and EVE to form battery packs. WM needs to ensure consistency of the battery performance from these three different companies.

As of now, the deposit for WM’s online platform is 4016 units, and the total number of orders when booking was closed exceeded 11,000. The conversion rate of pre-orders from RMB 3,000 to 20,000 deposit reached 35%, and the conversion rate for 15 key cities deployed by WM’s offline channel “Smart Partner” exceeded 50%. According to the official selling price ranging from RMB 186,550 to 247,300 and the Beijing subsidy standard, the subsidized selling price is between RMB 112,300 and 164,800.

In an interview, Shen Hui mentioned that many comments that believe WM started a price war to disrupt the market are not accurate. In fact, WM already took into consideration the impact from the gradual reduction of subsidies when initiating the project for the EX5. Thus, they cannot have a strong policy-oriented product. Shen Hui believes that the EX5 has sufficient competitiveness even when subsidies reduce.

In addition, WM launched the WM MASTER user service rights for loyal customers, and over 100 loyal car owners who attended the press conference yesterday became the first batch of WM MASTER users.

The three benefits of the MASTER user services are:

- Lifetime warranty (except for easily damaged parts) for the vehicle and the three electric systems;

- Lifetime free data usage; and

- Lifetime warranty for the home charging pile under the WM MASTER user, and the right to update and replace the new type of home charging pile, including the charging pile and installation services, for one time.

Furthermore, the MASTER user service rights will not remain unchanged, but will be constantly upgraded and improved, and a promotion system will be introduced for all car owners at an appropriate time.

Why WM Motor?

On August 1st, He XPeng, the founder of XPeng Motors, mentioned in his WeChat Moments that “no new car company can deliver 10,000 units this year.” Li Bin, the founder of NIO, challenged him first and stated that he was willing to bet on a XPeng G3 and a NIO ES8 to see the results by the end of the year.

As new carmakers from the Internet compete with each other, WM Motor did not make any statement. Shen Hui said in an interview that “the biggest inspiration that the internet brings to WM is the user-centric thinking. WM cannot learn those marketing tactics that make a lot of noise.”

This is an interesting topic. It is well-known that the management team of WM has a very heavy traditional background in automotive engineering, and it is the combination of such background with effective decision-making mechanisms from a start-up company that makes WM able to achieve delivery.

The so-called user thinking is probably the chart below, as WM’s product development and improvement are completed through communication and interaction with the users. WM has also managed to meet the challenge from He XPeng in the last 100 days.

However, at the end of the article, I would like to raise a sharp question: Are so-called smart electric vehicles, represented by Tesla, essentially a fusion of traditional cars and the Internet for innovation? Is there only user thinking and operational value worth learning in the Internet industry?

On the WmAuto EX5, we see medium-to-good product power + competitive after-subsidy prices, but in the two major intelligent areas of vehicle systems ecology and intelligent driving, the product power of the EX5 is not very outstanding. Of course, as a car model with an actual selling price of between 110,000 and 160,000 RMB, it is reasonable for the EX5 project to not invest too much in the development of intelligence under cost pressure.

But it needs to be pointed out that from automakers such as SAIC BYD that rapidly launched new energy vehicle models, we can see that the new in the new vehicle camp is not new energy, but intelligence. And the intelligence of cars is a long-term investment in engineering and technical capabilities that is expected to accumulate from WmAuto.

Therefore, beyond the goal of selling 100,000 EX5 units, I look forward to the higher-positioned EX6 next year. Its level of intelligence will determine whether WmAuto is an electric vehicle company or a smart electric vehicle company.

- Diagnosing WmAuto: Is its trustworthy three-electric technology that catches fire before delivery worth it?* The Weima EX5 400 endurance test with stunning 1:1 performance

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.