✉️Follow us on Weibo @42Garage for instant updates

Add WeChat ID “nopanic42” and join our community group for discussions

The new year has started and Tesla’s production capacity is once again causing concern.

A series of doubts have arisen, with sales in the European market plummeting and the sales of Model S and Model X experiencing a sharp decline, while the production of Model 3 has failed to show any significant increase.

Tesla seemed to feel the heat as public criticism continued to mount. Last Sunday, they finally provided an explanation, stating that due to factory upgrades, the production line at Fremont had been out of operation for five consecutive days last month.

According to Bloomberg, in an email statement Tesla said, “Our Model 3 production plan includes periods of planned downtime in both Fremont and Gigafactory 1. These periods are used to improve automation and systematically address bottlenecks in order to increase production rates.”

Conclusion: Q1 2018 is almost over but Tesla has yet to overcome its production bottleneck. The claim made during last year’s Q4 financial report conference, that Model 3 would reach a weekly production of 2500 units by the end of Q1 2018, is likely to be empty talk.

We believe that many Tesla fans will not be satisfied with having heard only this conclusion. Let’s gossip a little about the stories behind the continuing production concerns of Tesla Model 3.

Story 1: The crazy things done to monitor production capacity

Since the birth of the automobile, no car company’s production capacity has garnered as much unprecedented (perhaps never-to-be-repeated) attention as Tesla has with its Model 3.

This only goes to show how important Tesla and its Model 3 are in the field of electric and even conventional vehicles. Since the delivery of Model 3, which attracted 500,000 orders, began in July last year, it has been under close monitoring by a range of heavyweight media and some highly enthusiastic (yes, highly enthusiastic) fans, all concerned about its production capacity.

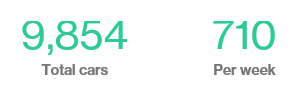

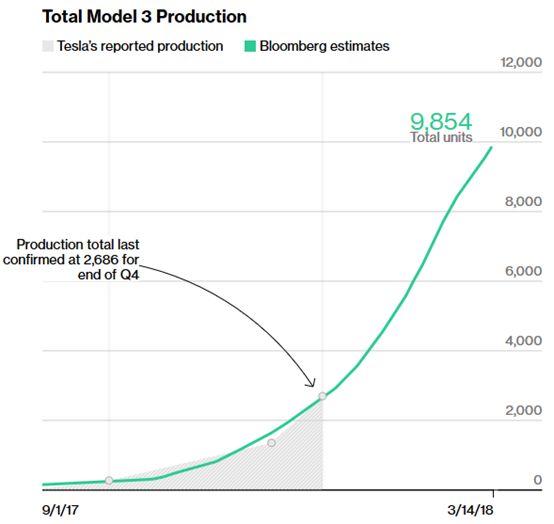

Over the past six months, there has been constant news coverage, and even Bloomberg has joined in, building a production forecasting model for Model 3. By using federal vehicle identification data, Bloomberg estimates Tesla’s weekly and cumulative production of vehicles. They even wrote an article specifically about this model, which, in simple terms, involves sending VIN code data requests via the website of the US National Highway Traffic Safety Administration, as well as searching for VIN code information on social media to build the model.

Here are the numbers as of today:

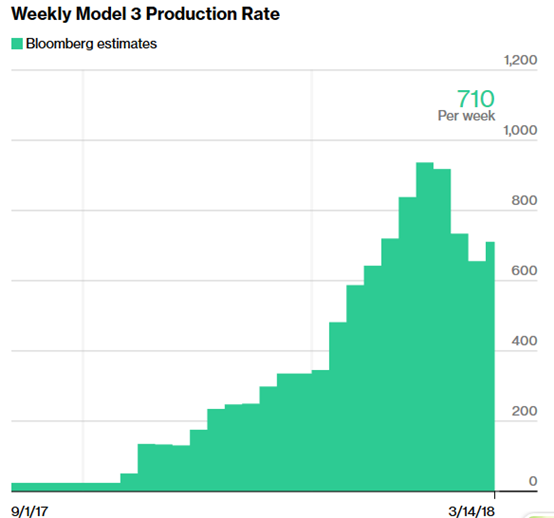

It has risen slightly compared to last week, with the weekly production capacity seen at a meager 655 units.Although there has been some improvement, the data is still disappointing. It seems to be indicating a gap in production capacity compared to the expected output rate of one Heavy Falcon.

From the model, it can be seen that since late February, the weekly output has been in a vertical decline, which signals a clear slowing down or stopping of the factory production line.

If it is indeed true, as discussed in the last earnings call, that Tesla’s own team had to take over since the outsourced supplier’s production line was unable to handle mass production, and that they plan to redevelop an automated production line in 6 to 9 months, then the disappointing weekly output number for the first quarter is understandable. Actually, even more distressing is the danger of Model 3 continuing to sink into production hell in the following quarters, according to this explanation.

As for whether the new production line can handle mass production, this will only be proven by the numbers. For customers, whether they can endure the wait depends on how deep their love for Tesla is.

Speaking of customers, Tesla Model 3 has also shown us what true love for a car looks like. Yes, they are the high-energy super fans we mentioned before, who have been searching for Model 3 production information with all their might. Some people release spy drones at the Tesla factory in Fremont, California, or try to unlock secret information with satellite images. Some people make predictions on social media using transportation data or delivery pictures.

The head of an investment institution sent employees to visit the Model 3 sales center in Marina del Rey, California to track vehicle statistics. He tracks Model 3 delivery information on Twitter and Facebook, uses public posts to find evidence of new car owners, and signs contracts with customers across the country to learn who has received Tesla’s congratulatory email.

And there are even more extreme cases. A data analyst at a start-up built an automated system to collect people’s VIN registrations and acted as a hacker to obtain registered VIN data from the National Highway Traffic Safety Administration website. His fully automated system even comes equipped with a Twitter bot, @Model3VINs, which alerts its 1,700 Twitter followers when Tesla registers additional VINs.## Story 2: Can Production Transfer Ease the Urgency?

Tesla has perfectly executed the strategy of “domestic delivery before international delivery” for the past two months, as seen from the sales data from various markets.

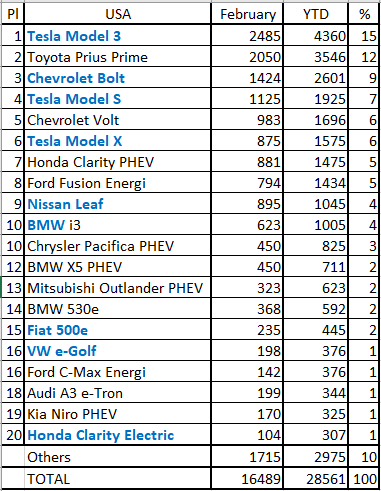

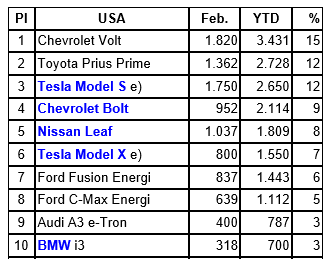

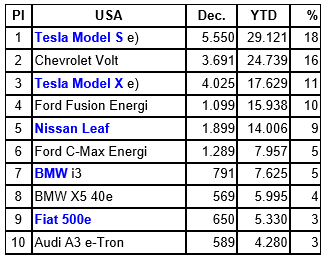

Shown below is the sales ranking for Battery Electric Vehicles (BEV) + Plug-in Hybrid Electric Vehicles (PHEV) in the US market for Feb 2018 and for Jan-Feb 2018 respectively:

Tesla Model 3 has surpassed its competitors since Jan 2018. Compared with the sales of the same period last year, Model S and Model X were not leading at that time. However, since Mar 2017, Model S has maintained the first place on the sales ranking list.

In 2017, Tesla’s domestic market share was held by Model S and Model X while the Model 3 took over since the beginning of this year. Although the sales performance of Model S and Model X did not decrease substantially, they maneuvered to Model 3, confirming the rumor that Model S and Model X’s production capacity was transferred to Model 3.

If this is true, then in the domestic market, Model 3 has become the leader and Model S and Model X maintain the same ranking as last year. What about other markets?

The European market needs special consideration.

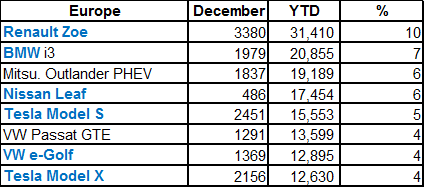

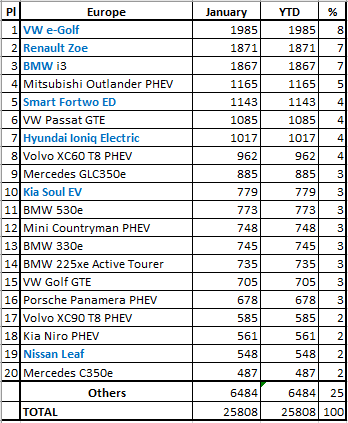

The following are the sales ranking for electric vehicles in Europe for 2017 and Jan 2018, respectively:

From January this year, both Model S and Model X have been offline.

At the Geneva Motor Show, traditional European automakers surrounded Tesla and were secretly happy.

Although the data from all European countries in February has not yet been fully released, except for around 400 units sold in Norway and the Netherlands, there is still no trace of Tesla’s sales in other countries.

Is this because the production capacity dilemma forced European traditional automakers to taste the long-lost sweetness? It has to be said that in terms of electric vehicle models on the market, BBA is really leaving Tesla far behind.

I don’t know how Tesla and Musk are considering, but from this data, it can be seen that Model 3 is indeed too important for Tesla. It is the best-selling electric vehicle in the world that Tesla spent 3.5 billion U.S. dollars on and Musk is confident to build.

Although this move guarantees the strong footing of Model 3 in the domestic market, I don’t know how investors feel about Tesla’s loss of other markets.

After all, this kind of robbing Peter to pay Paul is not a long-term solution, and can only hope that Tesla’s new automated production line can be completed and put into operation within a limited time. If there is no progress after 6 or 9 months, investors will inevitably be collectively silent.

2018 is indeed a crucial year for Tesla. Starting from the first quarter, Tesla made a heavy bet. If the Model 3 production capacity can climb smoothly as stated in the last quarterly report meeting, Model 3 will definitely dominate from this year. If not, those luxury traditional automotive brands will probably laugh at the sky. Musk has reneged on production capacity issues several times. I don’t know if he will make it or break it this time.

Voiceover: 2018 is truly the “make it or break it” year for Tesla.

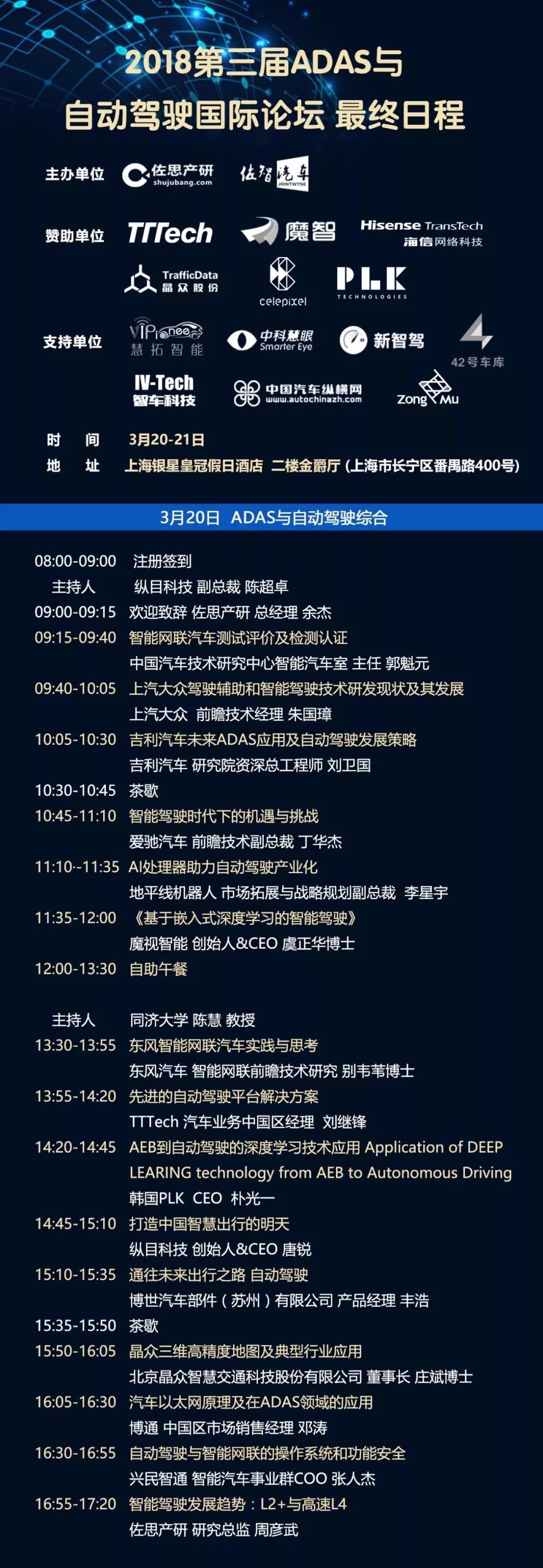

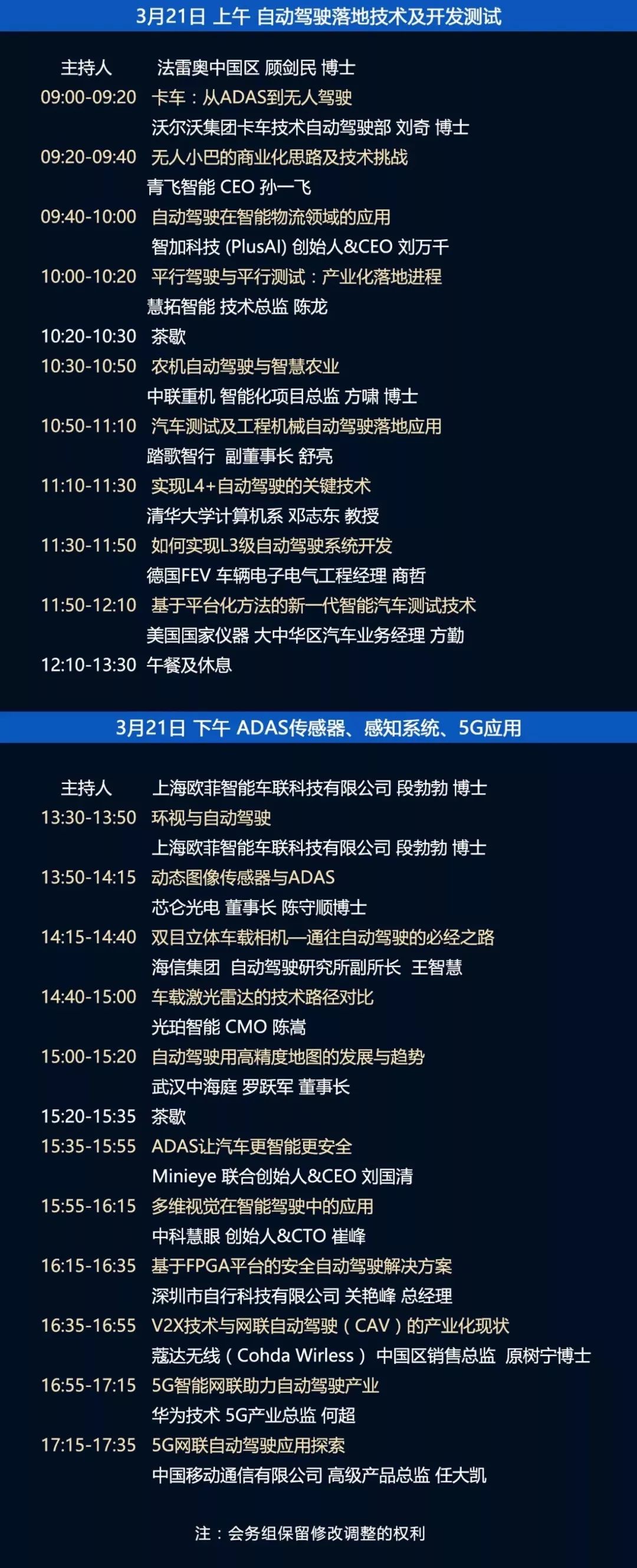

To register, please contact:

Shanghai-Zhao Zhifeng 18702148304

Beijing-Zhang Yafei 13716037793

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.