The original article was first published on JSPAI and has been partially updated on its Zhihu column. Unauthorized reproduction is strictly prohibited.

In last week’s article, I countered one of the key points in Thomas Bartman’s article “Why Tesla Won’t Be Able to Scale” in Harvard Business Review.

Link:

Is Tesla the Biggest Bubble in History? – Refuting Harvard Business Review (Part I) – Independent Automobile Review – Zhihu Column

Today, let’s talk about product line layout.

Mr. Bartman believes that Tesla’s short product line is a disadvantage compared to competing brands with a prosperous population.

I believe that having a short product line is only a short-term disadvantage and could potentially be a long-term advantage.

Philosophical Considerations of Product Line Coverage

Hamlet once said, “Is it better to have 60 points or 100 points? That is a philosophical question.”

Most intuitive answers would say 100 points.

However, children who always score full marks are likely to focus overly on academics and have less potential in socializing, sports, art, etc. Flawless and perfect characters in literary works are often unpopular among readers – people prefer characters with flaws and radiance, which are more in line with human nature.

Therefore, I believe that product line coverage is a philosophical question: in different industries, different companies, and different periods of the same company, there is no absolute standard for the length (coverage) of a product line.

A low coverage of product lines usually means that most of the market share is not in your favor, which implies that a company lacks ambition.

But being too extensive is not necessarily good. Pursuing extensive coverage can easily lead to localized inefficiencies because no company is suitable for investing in all niche markets, and no brand image can truly carry all niche products.

In fact, in the automotive industry, the burden of investment is extremely high and efficiency is low, which has been a problem plaguing the entire industry.

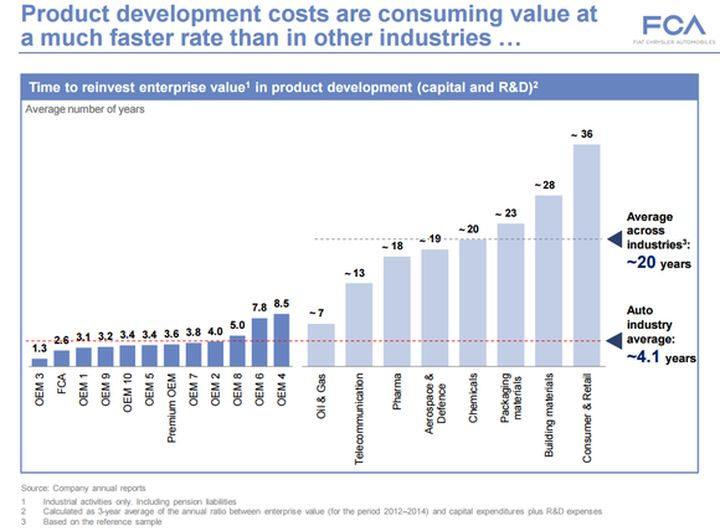

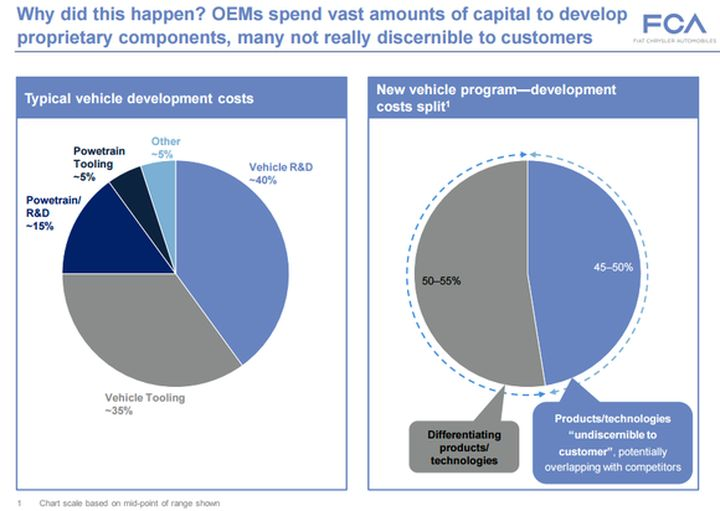

Here are two research reports from the Fiat & Chrysler Group, which show that:

The cost burden of product development in the automotive industry is extremely high compared to other industries.

Countless amounts of money are repeatedly spent on R&D and molds, much of which consumers cannot recognize. What is the difference between the 1.5T engines developed by General Motors and Ford?

In China, this is especially exaggerated. For example, Volkswagen launched Passat and Magotan, Bora and Lavida, Santana and Jetta at the same time. What is the significance to customers?

A Review of Tesla Product Line

Currently, Tesla only has one convertible sports car, Roadster, and one large sedan, Model S. The company is clearly stretched thin. However, a large SUV, Model X, will be released this year and a mid-sized Model 3 is expected to be launched within one to two years.

If we look at the 2015 market share of the Chinese luxury car market, the three sub-markets of large sedans, mid-sized sedans, and mid-sized SUVs can already cover one-third of the luxury car market.

(Based on the luxury car data from the first half of 2015: the market share of large sedans is 8%, mid-sized sedans is 21%, and large SUVs is 4%, all adding up to 34%. Taking Audi as an example, their representative models are A8 L, A4 L, and Q7)

In other words, roughly speaking, Tesla’s product line will cover one-third of the luxury car market within two years.

One-third of the market coverage is not too high. Considering that Tesla is still a rapidly growing company, this speed of increasing from an 8% market coverage to 34% is satisfactory. Especially when we take into account the production capacity plan: Tesla plans to achieve a global sales volume of 500,000 units in 2020, which is only equivalent to 30% of Audi’s global sales volume in 2014.

Some may cite BMW, Mercedes-Benz, and Audi as the three most successful automakers with almost 100% product line coverage.

Hmm, how should we respond to this? Let’s move on.

BMW Product Line Review

BBA’s product-line layout is similar. Here, we use BMW’s product line in the Chinese market as an example to explain.

BMW 1 Series: two-door coupe

BMW 2 Series: coupe, sports wagon, Gran Tourer, convertible

BMW 3 Series: 4-door sedan (standard and long-wheelbase versions), Gran Turismo, Touring, hybrid

BMW 4 Series: 4-door coupe, 2-door coupe, convertible

BMW 5 Series: 4-door sedan, Gran Turismo, Touring, plug-in hybrid

BMW 6 Series: 4-door coupe, 2-door coupe, convertible

BMW 7 Series: 7 Series, 7 Series hybrid

X Series: X1, X3, X4, X5, X6, X6 hybrid

Z Series: Z4 convertible coupe

i Series: i3, i8The BMW lineup consists of a total of 26 models (long wheelbase models are considered derivatives), excluding 4 hybrid products (which only count as changes in powertrain, and thus not counted as new models). And it doesn’t end there; rumor has it that BMW is developing even more new models, such as the X2/X9.

When it comes to sales percentage, just six models out of the 26 available in the Chinese market – the long/short wheelbase versions of the 3 and 5 Series, and the X1 and X3 – contribute to 75% of the sales. The efficiency of the other 20 models seems to be quite low.

So, what is the purpose of individualistic models that don’t sell well?

Some say that individualistic models exist to build a brand image. For example, when Nissan created the GTR to showcase its technological advancement, or when Ford introduced the Mustang to the Chinese market to promote its American spirit, it makes sense. And when BMW launched the new i-series to represent the company’s focus on new energy automobiles, it makes sense.

However, it’s hard to understand why BMW allows the 2 Series Active Tourer and 2 Series Gran Tourer to coexist, or allows the 3 Series GT and 3 Series Touring to compete against each other, or allows the X4 to suffocate between the X3 and X5. What kind of brand image does the X4 provide? All it does is make people think, “Wait, did they just cut an X6 in half?” And the fact that the BMW 4 Series already caters to a niche market, but is then divided into three different versions, the four-door, two-door, and convertible, is questionable.

This mindset of providing whatever products customers want, resembles Nokia’s heyday, and it’s hard to understand.

Let’s return to the essence of things and look at it from the consumer’s perspective. While the demand for products varies among individuals, it should be an enterprise’s ability to extract and summarize these demands and express them in a limited number of products. Apple has this ability, and it’s one of the critical reasons why their products leave a lasting impression compared to Samsung and HTC. Only those who can recite 30 decimal places of pi can figure out just how many types of phones Samsung and HTC have.

The product line arms race has led BMW, Mercedes-Benz, and Audi into a prisoner’s dilemma during this peaceful era.

“I have significant skills, but in this tournament, there is no guarantee that I will remain the best (the gap between the top three luxury car brands in global sales is not significant, and anyone has the opportunity to be the leader).”

“I still need to enhance my skills to reach the top (the temptation of being number one is too great).”

“But my Eastern and Western rivals are equally skilled and also working hard (BBA’s top-selling products are bloody battles with teeth interlocking).””New Jingwu” is said to have been published by Xinhua Bookstore. If I could be the first to learn it… Hahaha (mainstream product lines have already been covered, so BMW secretly launched the X6 in the new niche market.

I never thought that Dongfang Bubai and Xiduoyu also learned the “Nine Yin Zhenjing”. It seems that I need to continue to collect other martial arts secrets (BMW actually made an ugly new car X6 while I wasn’t paying attention. Are consumers crazy? The sales are surprisingly good. Alas, I have to release a GLE).

On the other hand, Audi has just launched the Q1, winning various awards and increasing sales by more than 100,000 units. I have to catch up with the GLA and make a CLA, which Audi hasn’t done yet. (20 likes for my own smart and witty thoughts in my heart).

This prisoner’s dilemma has made BBA’s product line longer and longer. In fact, the efficiency of many products has been low-the resources of some engineering, marketing, procurement, and operations have been wasted. The company cannot truly care about exploring and summarizing customer needs, and no longer believes in “born sparsely, live well for a lifetime”, but holds the attitude of “having a lot of children, regardless of east or west. “

What is relatively advantageous for BBA is that they happen to be the leading brand of luxury cars: Volvo, Land Rover, Cadillac are all waiting to be developed, Infiniti and Acura are not ripe yet, and Lexus is the closest to BBA, but it is only in North America. The powerful BBA sits on the bank, formulating the rules of the game, and other brands can only choose to follow suit.

In the case where the scale is far inferior to BBA, the strategy of chasing and betting always makes me feel a pessimistic feeling of “the wind is bleak and the water is cold.”

Cadillac product planning: Products are divided into two series, CT and XT, which are sedans and SUVs, respectively, and their product lines are expanded upward and downward, with a large number of models.

Land Rover product planning: Divide SUVs into three families-luxury, leisure, and functional, and significantly expand the number of models.

Volvo product planning: Divide products into three series according to size, namely 40/60 / 90, and create three versions of sedans, crossover vehicles, and SUVs, significantly expanding the number of models.

Who can be the terminator of the prisoner’s dilemma?At the end of this Huashan Swordsmanship competition, the outcome could be imagined – consumers in this world definitely do not need 200 luxury cars with different styles and designs, they are self-proclaimed unique but in fact, they are lazily repeating the same low-level development.

As challengers to second-tier luxury brands, they are powerless to break this prisoner’s dilemma because they are all blindly following the trend.

There may be only three possibilities to break this prisoner’s dilemma:

-

One day, Audi finally exhausts all the permutations and combinations of 26 letters and numbers between 1 and 9. The total number of models reaches 100, and it takes a 5-story dealership showroom to display them all.

-

A global economic crisis breaks out, and the recession affects the automotive industry. Everyone cuts costs by cutting off lengthy vehicle development projects.

-

A hippie who does not play by the rules comes forward and shocks everyone.

Now, the most qualified hippie is Tesla.

Because Tesla has no historical burden, and only has two vehicle models and two new vehicle development projects in its hands.

Because Tesla has an outstanding industry outsider boss who has succeeded in multiple fields, and lacks nothing in courage and innovation – and on Tesla, the spirit of individuality has been repeatedly proven:

In terms of channels, Tesla does not adopt the traditional dealership model, but instead establishes direct sales stores (even taking the auto dealership industry association to court in several states in the United States) to create a consistent customer experience as much as possible.

In terms of vehicle charging support, Tesla does not rely on the government, but instead builds its own charging facilities to improve the charging experience of car owners.

In terms of research and development, even with limited sales, Tesla makes forward-looking large-scale investments in battery factories, leading the progress of vehicle energy storage battery technology, seizing cost advantages, and creating more reasonable product prices in the future.

In terms of corporate financing, since its establishment, Tesla has continually used capital markets for financing, breaking new ground in the auto manufacturing industry. A large amount of funds ensure that Tesla does not become a slave to short-term profit indicators, and continually does what it thinks is right (Tesla recently announced its Q2 2015 earnings report, which showed a 24% increase in revenue from $769 million in the same quarter last year to $955 million, and sales have shown signs of significant growth. However, according to operating loss estimates, Tesla will lose more than $4,000 for every Model S electric car sold.)

In terms of marketing, Tesla is good at leveraging PR resources to carry out event marketing, avoiding throwing unemotional, random hard-sell ads on various media platforms.

While it cannot be determined, it is strongly believed that in terms of product-line planning, Tesla will also depart from the accumulated practices of traditional automakers, and focus all its energy on creating a lean and efficient product-line – using popular Chinese internet jargon, it’s called an explosive product strategy.

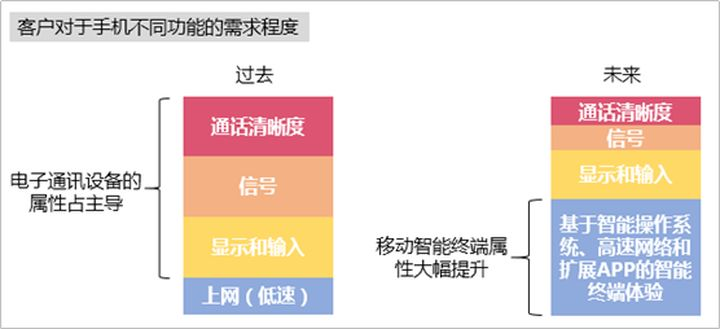

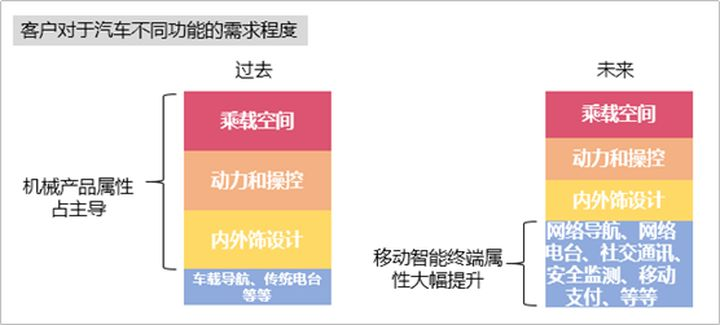

Technological change will trigger changes in consumer demands.One fundamental principle of marketing is that you should create products that meet consumer demands. However, as illustrated in the classic analogy in Steve Jobs’ biography, “if you ask customers what they want before the car was invented, they would tell you they want a horse.” We must also note that technological development and changes in consumer demand influence each other.

During a stable technology era, products usually need to meet customer demands for development. However, during a technology upheaval, product development may lead to changes in customer demand. The iPhone is a revolutionary smartphone that captured the opportunity presented by the technological upheaval in mobile technology.

Now, after several decades of stability in the automobile market, we are on the verge of another technological upheaval. Cars will become a mobile smart terminal, allowing us to imagine a future where vehicles have access to high-speed networks anywhere and anytime, driving on the elevated roads of Shanghai while playing “Let it be” by the Beatles from QQ’s online music service inside the car. When driving into the inner loop of Shanghai, the Alipay account bundled with the car’s system pays the 5 yuan/hour congestion fee.

A screen reminds you that a few good friends are drinking tea not far away from Jing’an Temple. You tap the screen, and the system analyzes the real-time traffic to help you navigate to your friends’ location with the optimal route. At the same time, you use voice commands to call your wife and tell her that you won’t be coming home for dinner tonight.

However, in the future, the importance of cars as mobile smart terminals may gradually approach or even surpass their mechanical properties. When autonomous driving technology becomes a reality, everyone may see the car as a completely mobile terminal. In this case, the mechanical properties may no longer be critical, and there will be no need for so many different styles of cars – just like the iPhone.

Even if we abandon traditional flat keyboards, full keyboards, flip phones, different materials for the casing, diverse designs, and rich colors, it will not affect its high market share worldwide. It is imaginable that a car brand that offers leading smart terminal experiences with just 3-5 simple car product lines can attract enough customers. People care more about how smart the car is, how easily they can input information, and how smoothly the system runs, without worrying too much about handling on curved roads, acceleration speed, or rear seat space.

To be continued…

Yiran

September 25, 2015, Shanghai

Zhihu Zhiyuan – Independent Automotive Review

一苒 is a Zhihu user’s ID.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.