Lei Gang Posted from the Co-Pilot Temple

AI4Auto | Intelligent Car Reference

Tesla has submitted its 10-K report.

A series of annual data and details are disclosed in this “annual report”.

930,422 cars were produced, and 936,222 were delivered.

The total revenue was $53.823 billion (RMB 342.2 billion), of which $44.125 billion (RMB 280.5 billion) was generated from car sales, accounting for 81.98%.

By region, Tesla’s revenue in the Chinese market in 2021 was $13.844 billion (RMB 88 billion), with a year-on-year growth rate of over 107%, and the consecutive growth rate exceeded 100% for two years. The contribution to total revenue in China is nearly 26%.

Of course, Tesla also silently expresses gratitude to China, especially Shanghai in this serious document.

The increase in revenue and gross profit margin is closely related to local procurement and manufacturing in China. Even in the case of such a tight supply chain last year, vehicle production costs could still be significantly reduced.

In addition, Tesla also disclosed that it has won Shanghai’s award for three consecutive years and enjoys a 15% preferential tax policy.

Really, if you pay attention to Tesla or the smart car industry, Tesla’s annual 10-K report submitted to the U.S. Securities and Exchange Commission (SEC) every year is definitely not to be missed – much more informative than financial reports.

And regarding the key points of Tesla’s 116-page English-only 10-K report for 2021, AI4Auto has summarized them for you.

Tesla’s Latest Annual Disclosure

Production, Delivery and Revenue Data

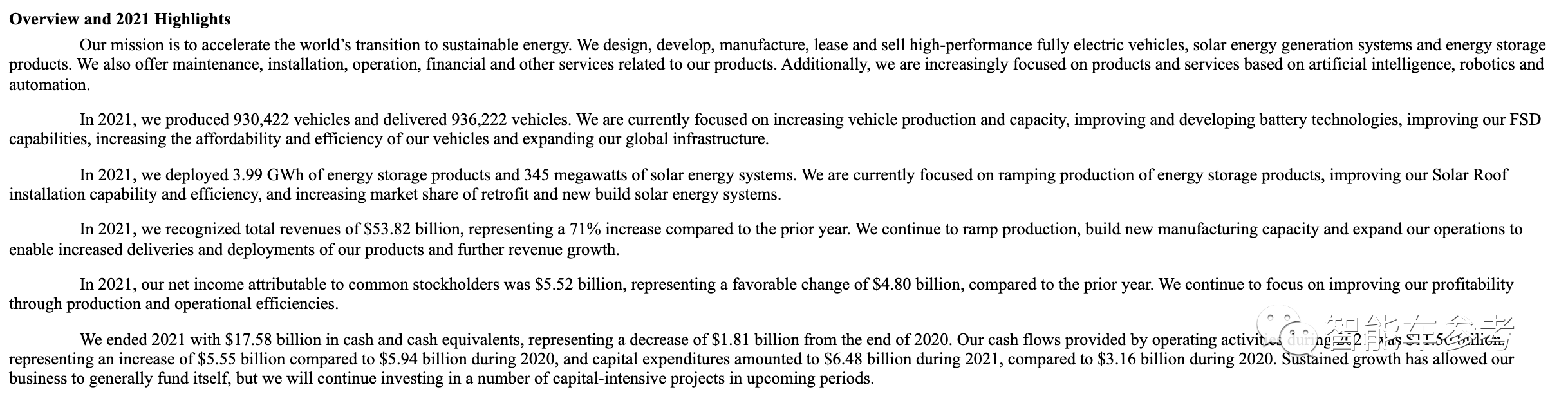

Firstly, let’s look at the highlights officially announced: Production, Delivery and Revenue.

In 2021, Tesla produced 930,422 vehicles and delivered 936,222. Compared to delivering nearly 500,000 vehicles last year, it almost doubled.

Revenue:

The revenue for the full year of 2021 was $53.823 billion (RMB 342.2 billion), a year-on-year increase of 71%.

$44.125 billion (RMB 280.5 billion) of which was generated from car sales, accounting for 81.98%.

The net profit attributable to shareholders was $5.52 billion, an increase of $4.8 billion over the previous year, an increase of 666%.As of 2021, Tesla has cash on hand of $17.58 billion.

Not only is Tesla’s financial data strong, but their gross margin is also increasing, thanks to their strong delivery capacity and production capacity.

Tesla’s gross margin for their 2021 car business has risen to 29.3%, further improving on last year’s 25.6%.

What does this gross margin level mean?

Traditional car giants, such as General Motors and Ford, have a gross margin of around 15%, and Toyota, which sells the most cars, has not exceeded 20%.

So why does Tesla have such good control over their gross margin?

Tesla itself claims that on the one hand, good sales contribute to good performance, and on the other hand, the Shanghai Super Factory is also performing well.

With guaranteed production capacity and continuously reduced costs, the Super Factory has contributed to Tesla’s success.

In their annual report, Tesla stated that due to procurement and manufacturing in China, although raw materials, goods, logistics, and supply chains all increased in price last year, production costs for Model 3 and Model Y actually decreased.

Is it hard to believe?

Tesla’s report also stated that they will further strengthen their local procurement and manufacturing ratio at the Shanghai Super Factory.

However, according to the plan, for a long time to come, Shanghai will mainly produce 3 and Y models.

Contribution of Revenue from China

Regarding China’s contribution to Tesla’s success, the company has also disclosed their revenue situation.

According to regional statistics, Tesla’s revenue from the Chinese market for the full year of 2021 was $13.844 billion (88 billion yuan).

The year-on-year growth rate exceeded 107%, and the growth rate has exceeded 100% for two consecutive years. The contribution of income from the Chinese market accounts for nearly 26% of Tesla’s total revenue.

However, Tesla’s biggest income source is currently in the United States.

In 2021, Tesla’s revenue in the US exceeded $23.973 billion, accounting for more than 44% of total revenue.

On the one hand, this is due to the high-priced models, Model S and Model Y, only being produced and sold in the US. On the other hand, Tesla’s other business outside of vehicle production is mainly carried out in the US.

However, some foreign media and analysts have expressed that, with Tesla’s production and sales momentum and the vastness of the Chinese market, China replacing the US as Tesla’s largest source of revenue may only be a matter of time.

Employee Numbers Approaching 100,000

In addition, Tesla reported that their employee numbers increased by 40% last year.As of the end of 2021, the total number of employed personnel has reached 99,290, an increase of 40% compared to the 70,757 people at the end of 2020.

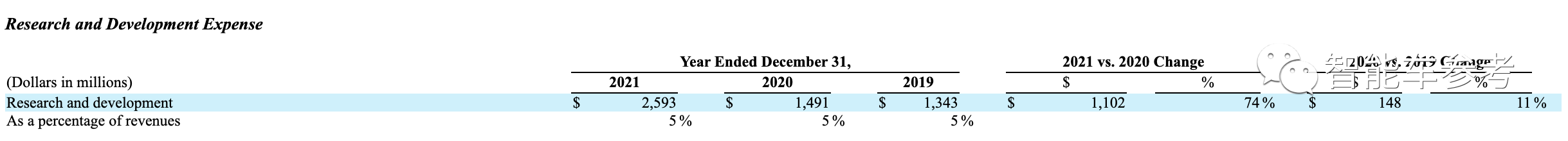

R&D spending of USD 2.593 billion, an increase of 74%

The number of employees and related R&D spending have also increased significantly.

As of the end of 2021, Tesla’s R&D spending was USD 2.593 billion, an increase of USD 1.1 billion over the previous year, an increase of 74%.

Tesla stated that USD 506 million was mainly used for employee-related expenses and USD 263 million was related to R&D materials.

The increased R&D spending mainly reflected in the new factories in Berlin and Texas, and the new versions of Model S and X.

Interestingly, although R&D spending has increased significantly, Tesla has controlled R&D spending to 5% of its revenue for 3 consecutive years.

Other odd disclosures

In addition to the above routine disclosures, Tesla’s 10-K report also has some unconventional items worth paying attention to.

Bitcoin investments lost USD 642 million

Yes, Tesla, which had data rising in all aspects, lost money investing in cryptocurrency.

Do you remember when Musk showed confidence in Bitcoin and had Tesla buy “a little” for investment?

On February 8, 2021, Tesla submitted documents to the US Securities and Exchange Commission, showing that it had purchased USD 1.5 billion worth of Bitcoin in total.

According to estimates, Tesla’s purchase cost of Bitcoin was lower than USD 35,000.

In addition, influenced by Musk, Bitcoin rose by 18.8% that day, breaking through USD 46,000 per piece.

However, the situation didn’t last, and Bitcoin was fluctuating up and down since last year.

In the end, as of the date of Tesla’s report, it incurred a floating loss of USD 101 million, or CNY 642 million.

It should be noted that in March 2021, Tesla sold a portion of Bitcoin for USD 128 million in cash.

So, it can be considered as hedging.

Musk’s unguarded remarks led to troubles again

Tesla’s annual report also revealed a series of lawsuits and regulatory subpoenas.

In addition to accident investigations and arbitration of employee disputes, the most interesting subpoena came from the US Securities and Exchange Commission (SEC).

On November 16 last year, the SEC requested that Tesla provide significant information disclosure governance procedures.After Musk announced “privatization” on Twitter in 2018, it caused stock price changes and led to an SEC investigation accusing him of securities fraud. Fortunately, it ended in a settlement, and Musk and Tesla promised to report significant information first in the future. But in 2021, in the “reducing tax by selling shares” incident, Musk once again sought public opinion on Twitter, causing Tesla’s stock price to fluctuate… Judging from the timing, the SEC subpoena should be related to similar events.

Number of Tesla Shareholders: 7,051 Ordinary Shareholders

So how many people’s interests are directly affected by Musk’s one tweet now? According to Tesla’s disclosure, as of January 31, 2022, Tesla had a total of 7,051 ordinary stockholders.

Straight Up Complimenting Musk

By the way, in this 10-K document, Tesla straight up compliments Musk. In the risk warning, it is prominently pointed out: “We highly rely on Elon Musk. Tesla cannot be separated from the CEO and Technoking.” Tesla also seriously stated: even if Musk cannot devote all of his energy to Tesla, because he also serves as SpaceX’s CEO and CTO, Tesla cannot be without Musk…

One more thing: Thank You, Shanghai

Finally, Tesla also solemnly thanked China and Shanghai multiple times. In addition to the cost reduction and efficiency improvement of the Shanghai Super Factory, there are also two small disclosures. Since 2019, Tesla has received cash rewards from Shanghai every year. $46 million in 2019, $123 million in 2020, and $6 million in 2021 (38.15 million RMB). The main reason for the award is Tesla’s investment in building the factory in Shanghai.

And, Tesla has also received tax incentives from Shanghai. Since 2019, Tesla Shanghai Branch’s corporate income tax has received a preferential rate of 15%, while the usual corporate income tax rate is 25%. Tesla said that this is because Tesla in Shanghai meets relevant qualifications and conditions. In short, Tesla’s annual 10-K report has a lot of details that are worth studying. Here is the link:

https://www.sec.gov/ix?doc=/Archives/edgar/data/0001318605/000095017022000796/tsla-20211231.htm

—完—

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.