Following yesterday’s train of thought, let’s take a look at the intelligence in commercial vehicles, especially in ADAS and autonomous driving for trucks. These are two separate topics.

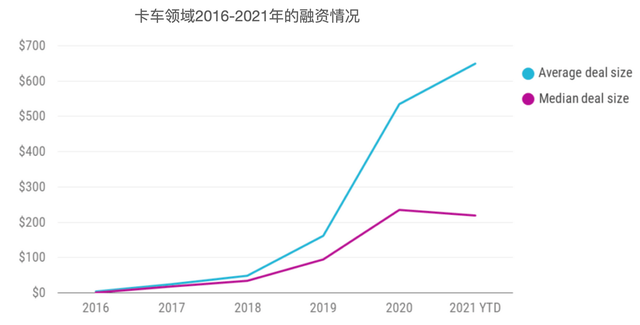

In CBI’s article “60+ Companies Shaping The Future Of Autonomous Trucking & Next-Gen Freight”, there is an interesting summary. The core logic is that during the Covid-19 period, due to the lack of truck drivers, there is a certain rigidity in the progress and demand for autonomous driving truck technology. With the maturation of autonomous driving truck technology, it may become an important component of modern logistics business faster than Robot Taxi (significantly improving efficiency and reducing costs, bridging many of the key weaknesses in the supply chain). CBI has involved large amounts of financing in terms of both amount and quantity.

Supporting Technologies for Autonomous Driving Trucks

In fact, in addition to the truck itself, there are subdivided industries supporting technology for logistics and freight transportation in the US and globally, covering fleet management, cargo matching, and supply visualization. My understanding is that the last three areas are all platforms supported by IT technology.

- Fleet Management

Involves real-time tracking of vehicles, improving driver communication, safety & monitoring fuel consumption, optimizing route planning, etc.

- Cargo Matching and Cost

Time efficiency can determine the success or failure of logistics companies. Cargo matching mainly pairs freight with specific drivers (this field is replaced by freight matching algorithms), and the freight and fleet management of autonomous driving fleets are becoming more and more digitalized. There will be great changes in this field as well.

- Cargo Tracking and Visualization

Dedicated cargo tracking and visualization tools are also important components of the entire process. For companies transporting high-value or sensitive goods, specialized cargo tracking tools can provide detailed information and insight into the movement of goods. By providing end-to-end cargo visualization through real-time supply chain data, the elasticity of the supply chain is improved. Digital freight forwarders include platforms that help shippers manage global end-to-end transportation (simplifying pricing, increasing communication, inventory visibility, insight, and analysis).

Note: Trucks are part of the global freight logistics system, and their tool attributes are very clear.

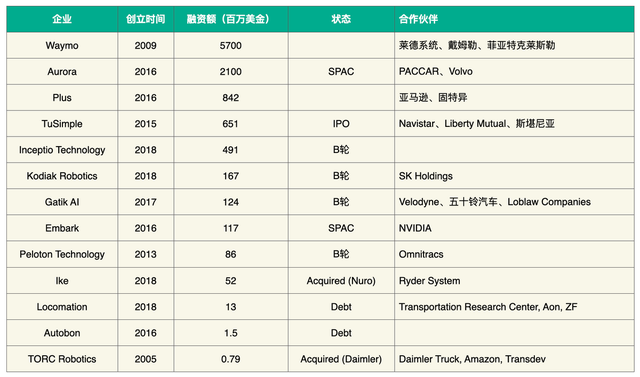

- Autonomous Driving Technology for TrucksThis field is mainly dominated by technology providers. Due to the high cost of trucking, startups in this field usually focus on specific areas. The opportunities and potential market in this field are considerable, but the barriers to entry are high. With Waymo and Aurora, two companies developing Robot Taxi autonomous driving systems, also entering this field through several core truck companies (the high R&D costs can benefit investors by developing passenger and commercial vehicles together), the competition in this field has become intense. Waymo has raised $5.7 billion, Aurora has raised $2.1 billion, and both have gone public. There are also several other companies in this field, such as TuSimple and Embark. However, the number of autonomous driving trucks that can actually compete is limited.

Situation of Listed Companies

Let’s take a look at the situations of Aurora, TuSimple, and Embark based on the available information:

(1) Aurora

After the end of cooperation with Volkswagen’s autonomous driving, Aurora’s core passenger car cooperation partner is now only Toyota (thanks to the acquisition of Uber’s autonomous driving department). Autonomous driving trucks have become its core business, and it has also partnered with DAF and Volvo in the US, covering 50% of the US truck market.

Note: technical details will be discussed later. In this field, Aurora has begun to penetrate the upstream perception area as a technology provider and integrator.

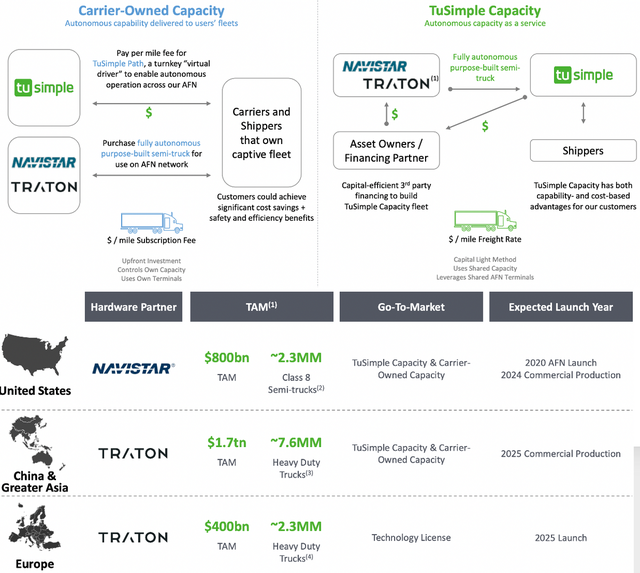

(2) TuSimple

Interesting enough, how autonomous driving systems occupy a reasonable commercial model in the entire freight system, including payment of transportation costs, whether it revolves around fleet operation or payment. Here, we can see a valuable change in commercial models.

(3) Embark

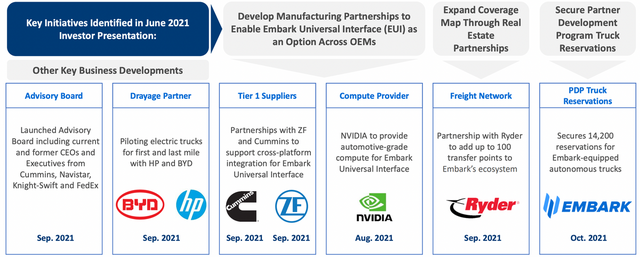

Among the companies already listed on the US stock market, Embark seems to have weaker partners, and still focuses more on the supply chain.

Summary: Relatively speaking, China also lacks freight drivers. In fact, the demand for autonomous trucks is only increasing in such a large logistics system. However, when viewed by region and by scenario, scenes like mining areas will see faster deployment of autonomous trucks.

In this large autonomous driving system, competition is still fierce for commercial and passenger vehicles. From the 2016-2021 wave of evolution, 2022 is a period of rest, but during the restructuring process, some players with stronger vertical integration capabilities will emerge.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.