Author: Zhu Yulong

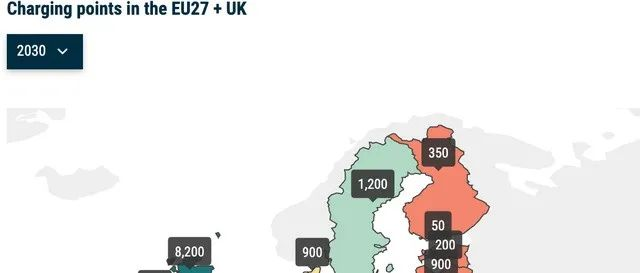

Previously, we discussed China’s attempt to switch to electric heavy-duty vehicles. At the same time, Tesla, Europe, and the United States also began a series of high-power charging infrastructure preparations. Unlike passenger cars, in the 2B business, overall operational efficiency is the top priority. Without the implementation of energy replenishment facilities, the electrification of trucks cannot be propelled forward. In mid-2020, the European Automobile Industry Association (ACEA) issued a demand overview for truck charging infrastructure, as shown in Figure 1.

The electrification penetration rate of trucks is very low. In Europe, approximately 40,000 medium and heavy-duty electric trucks will be put into use by 2025. By 2030, the number of medium and heavy-duty trucks will increase to about 270,000. According to ACEA’s calculations, the corresponding charging infrastructure will require the establishment of 10,000-15,000 high-power public charging stations within the European Union by 2025, and the establishment of 40,000-50,000 charging stations by 2030. According to actual demand, by 2030, at least 40,000 low-power (100 kW) public overnight charging stations will also need to be established along the highways for truck parking.

The charging power for trucks is divided into three power categories: less than 350 kW, 350-500 kW, and greater than 500 kW.

Construction of Charging Networks by Vehicle Manufacturers

From the current situation:

- Europe

The three major commercial vehicle manufacturers in Europe (Volvo, Daimler, and Volkswagen Group’s Scania and MAN brands) have signed an agreement to establish a joint venture charging network in Europe in 2022. The network will deploy and operate a high-performance public charging network for heavy-duty long-haul trucks, with a total investment of €500 million, and each enterprise will contribute €167 million to the joint venture.

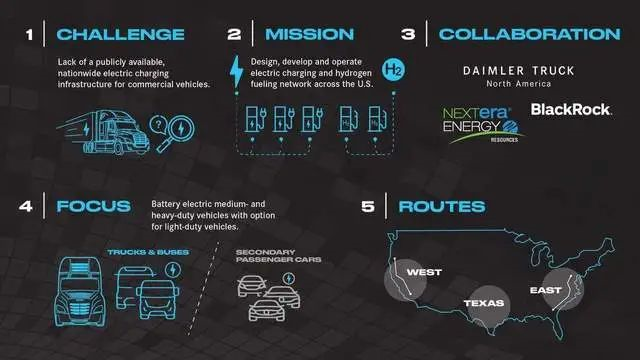

- United States

Daimler Truck North America, NextEra Energy Resources, and BlackRock Renewable Power signed an MOU on how to solve the truck charging problem in the United States. Their goal is also to create a joint venture enterprise, design, develop, deploy, and operate a national high-performance charging and refueling network, with operations planned to begin in 2022 and a total investment of approximately $650 million, split evenly among the three parties.

- Tesla

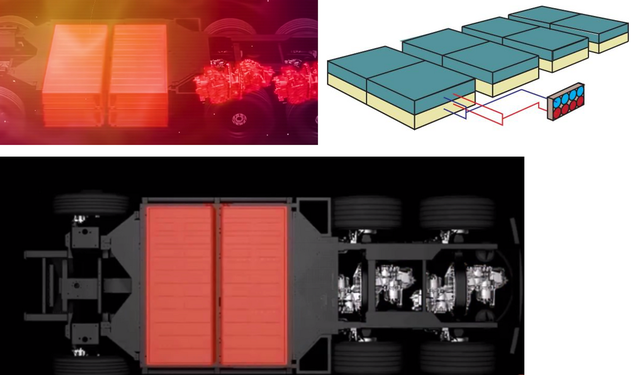

Tesla is more practical, and the vehicle development and infrastructure are built synchronously. Based on current data, the charging stations developed for Semi Truck may have a maximum power of 1.6MW, charging the vehicle’s battery through parallel connections.

From the existing information, charging four groups of batteries with 800 kWh, it may be charged in parallel in four channels. According to the method of 400 kW*4, the wiring design and overall logic of this system is not complicated.

Note: From the perspective of the driving system, the complexity of this design is mainly that different battery groups can flexibly drive different driving systems in electrical terms.

Charging and Swapping in the Truck Field

Like passenger cars, there are two different paths for charging and swapping in the truck field, only fast charging (slow charging is meaningless for trucks) is needed for trucks (commercial vehicles) on the current implemented paths.

(1) Swapping: The first step has already been taken in some scenarios. In the context of medium and long-distance, standardization also restricts the next step of swapping.

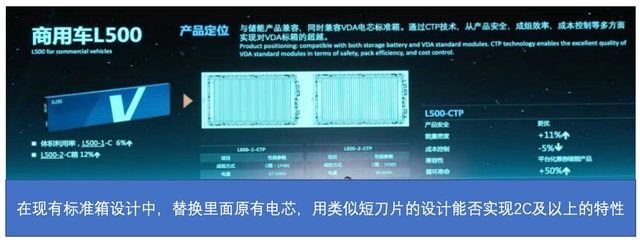

(2) Fast charging: Fast charging can cover more vehicle models, and the bottleneck is still charging stations. Due to the load problem of the main highways, it may need to be combined with distributed generation. It may be the best way to build some photovoltaic and energy storage stations near the highways. Because even for fast charging of 1 MW or more, through the design of a separate interface and liquid cooling line inside the vehicle, it is possible to achieve liquid cooling on both ends, reducing the weight of the charging line. By parallel design, the current bottleneck is the fast charging characteristics of lithium iron phosphate batteries.

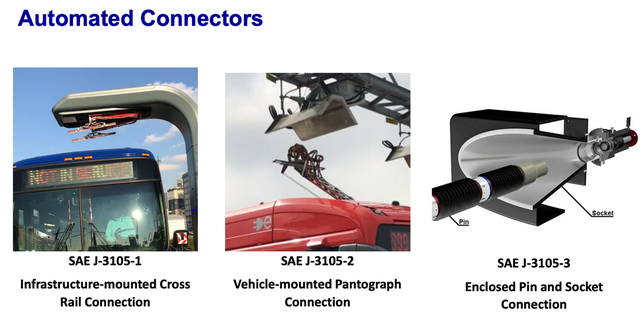

From the standards and paths perspective, Europe and the US have come a long way based on SAE J3105, and have made some references and adjustments to passenger car charging. Due to the high power fast charging, automation can be achieved in one step in the charging field, which is consistent with the idea of battery swapping.

From the standards and paths perspective, Europe and the US have come a long way based on SAE J3105, and have made some references and adjustments to passenger car charging. Due to the high power fast charging, automation can be achieved in one step in the charging field, which is consistent with the idea of battery swapping.

Summary: Due to the low penetration rate of electrification in the truck industry, there is a lot of room for growth in the next 3-5 years based on current policy requirements and technology maturity trends.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.