Toyota Ventures’ Risk Investment in the Automotive Industry

During the spring vacation, the focus was on the risk investment of global and domestic automotive companies, hoping to identify some clues within this.

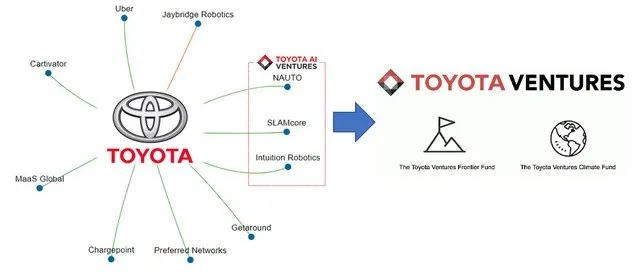

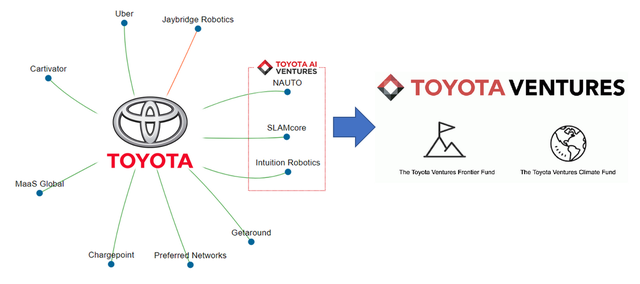

In mid-2020, Toyota’s independent early-stage risk investment firm Toyota AI Ventures was renamed Toyota Ventures. The fund management company is focused on AI and software investment, with total assets exceeding $500 million. Toyota also manages two early-stage funds, the Toyota Ventures Frontier Fund and the Toyota Ventures Climate Fund, with $150 million in total.

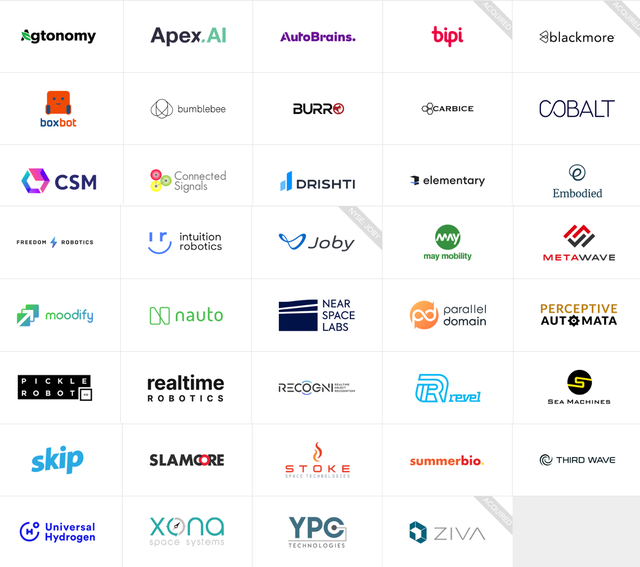

Established in 2017 as a subsidiary of the Toyota Research Institute, Toyota Ventures aimed to invest in autonomous driving, which was then very hot. Toyota hoped to discover future technology through the risk investment model outside of its own investment. Toyota Ventures has invested in 38 artificial intelligence, autonomous, cloud computing, data, mobile and robot technology companies. Through investment, Toyota Ventures will continue to explore these areas and expand the fund’s themes to include smart cities, digital health, financial technology, materials and energy.

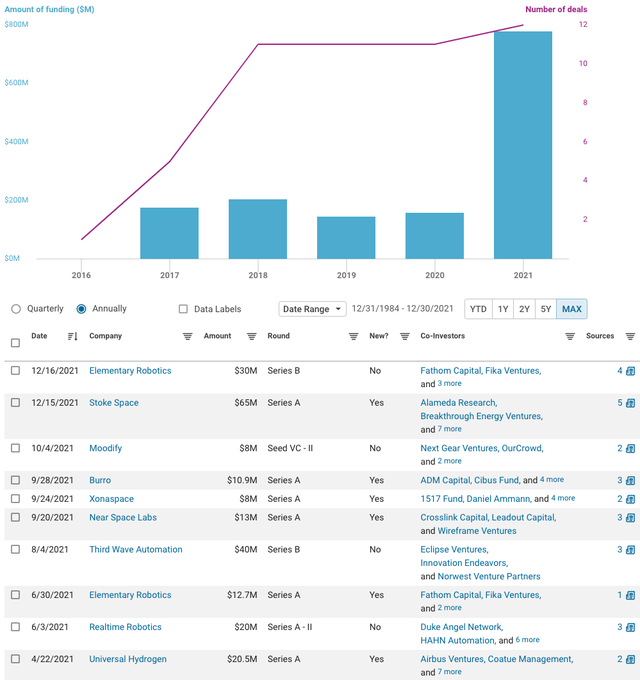

Looking at the above, after Toyota’s decision to invest in Uber and other targets, it has independently operated Toyota AI Ventures since 2017 and reached a small peak after injecting more funds in 2021.

Toyota Ventures

2017 was the peak of global investment in future transportation vehicles. We can see that the investment in autonomous driving at that time was all large-scale.

At this time, Toyota also began to build the prototype of future “transportation vehicles” for cities, including launching the i-ROAD single-person driving vehicle, actively promoting the development of hydrogen fuel energy, and research and development of new electric vehicles. What’s interesting is that at the beginning of 2020, Toyota announced that it would build the smart city “Woven City”, a city completely driven by hydrogen fuel cells, where Toyota will test various new technologies such as electric vehicles, unmanned vehicles, robots, etc.

From the investment cases below, it can be seen that the technologies that including artificial intelligence, autonomous driving, robotics, shared cars, and cloud technology, are mostly software-based and concentrated in Europe and America.

From the investment cases below, it can be seen that the technologies that including artificial intelligence, autonomous driving, robotics, shared cars, and cloud technology, are mostly software-based and concentrated in Europe and America.

Note: Most of the venture capital of car companies put their headquarters in the United States to operate, and find technology hotspots through this side of the United States.

Among the above combinations, Joby Aviation has already gone public, which specializes in flying cars and develops an electric vertical takeoff and landing aircraft (eVTOL) that can transport 5 people (4 passengers and 1 pilot) for up to 150 miles on a single charge. The Toyota Ventures team cooperated with eVTOL flight tests, led a $100 million investment in Joby Aviation in 2020, continued to lead a $590 million financing, and announced the establishment of a strategic partnership to mass-produce eVTOL aircraft. Now, eVTOL has completed more than 1,000 test flights and has become the first eVTOL approved by the United States. It is expected to carry passengers in the air from 2023.

Mainly invested companies

The autonomous driving software invested by Toyota includes the following:

-

Apex.AI is reliable, safe and certified software developed for autonomous mobility system. The product is Apex.OS, a powerful software framework based on the Robot Operating System (ROS) and Apex.Autonomy, a set of software combinations, that allows developers to create custom autonomous driving stacks.

-

AutoBrains applies a new approach that is closer to human driving perception with deep learning. It provides solutions for the next generation of autonomous vehicles.

-

Blackmore develops frequency-modulated continuous-wave (FMCW) lidar sensors and supports analysis tools and software, brings the advanced tools of modern radar into the optical field. In 2019, Aurora announced the acquisition of Blackmore.

-

Burro is an autonomous driving technology company that provides solutions for agriculture.

-

May Mobility is an autonomous transportation company that provides daily transportation services to local communities.

-

Metawave builds advanced analog beamforming radar to develop intelligent antenna platforms.- Nauto has developed a real-time, AI-driven driver behavior learning platform that uses machine learning algorithms to predict, proactively prevent, and reduce high-risk events (distracted driving).

-

Parallel Domain uses synthetic data to support autonomous driving systems, enabling customers to develop their technology in a safe virtual environment and deploy it quickly and cost-effectively.

-

Perceptive Automata enables vehicles to predict and understand human behavior, anticipate human reactions, so that they can safely and smoothly navigate around pedestrians, cyclists, and other drivers.

-

Recogni builds a vision-focused AI platform for autonomous vehicles.

-

Sea Machines Robotics is an autonomous driving technology company that specializes in advanced control technology for commercial watercraft such as workboats.

-

SLAMcore develops a full-stack “Spatial AI” solution for robots and drones, transforming sensor data into spatial intelligence.

-

Third Wave builds the most advanced autonomous forklifts by combining software and hardware.

Summary: We see now that automotive companies adopt a model that combines large-scale strategic investments with venture capital and private equity to seize and maintain sensitivity to strategic technologies and interesting tech. AI and other interesting technologies are the focus of the VC+PE investment strategy.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.