Wanbo Lei Gang from Copilot Temple

Reference of Intelligent Vehicles | AI4Auto WeChat Official Account

“A breakthrough year.”

That’s what Elon Musk said after Tesla released its Q4 and full-year 2021 earnings report.

In fact, Tesla is currently experiencing its best period of growth.

Revenue, net income, and vehicle production and delivery have all reached record highs, and gross profit margins have been increasing year by year – and, as analysts have pointed out, the true high-margin software profit potential has yet to be fully realized.

Undoubtedly, Musk is happy about such performance.

In the analyst meeting that followed, he shared many new insights that left people surprised:

-

Robot business? More important than cars in the future.

-

Full Self Driving? Absolutely this year.

-

Cheaper models? No plans, but if FSD is pushed out, transportation costs will be greatly reduced.

-

4680 batteries? They will be the first to be installed on vehicles produced at the Texas factory, which is about to start delivery.

-

AI Supercomputing Center? It can also be used for commercial output.

-

Self-operated insurance business? The goal is for 80% of Tesla owners to choose Tesla insurance by the end of this year.

-

Profit margin? Let’s be friends with hardware, software is the key to profit, and it’s just the beginning.

…

Tesla Earnings Report Detailed Analysis

Q4 Earnings Report Trends

On January 27, Tesla released its Q4 and full-year 2021 earnings report.

Let’s take a look at the Q4 results, which were very good.

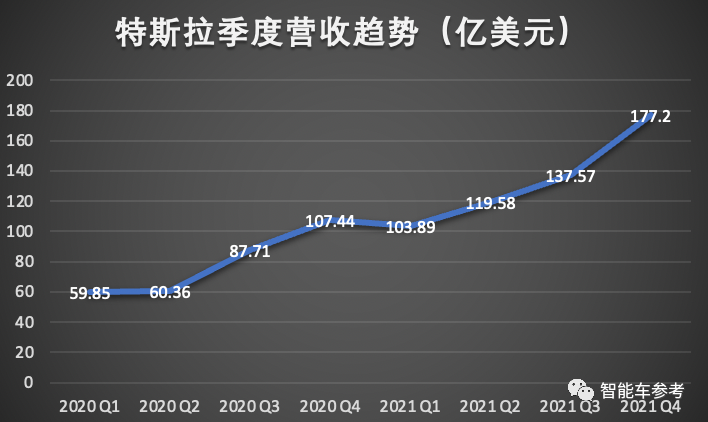

Revenue:

$17.719 billion, an increase of 65% from $10.744 billion in the same period last year.

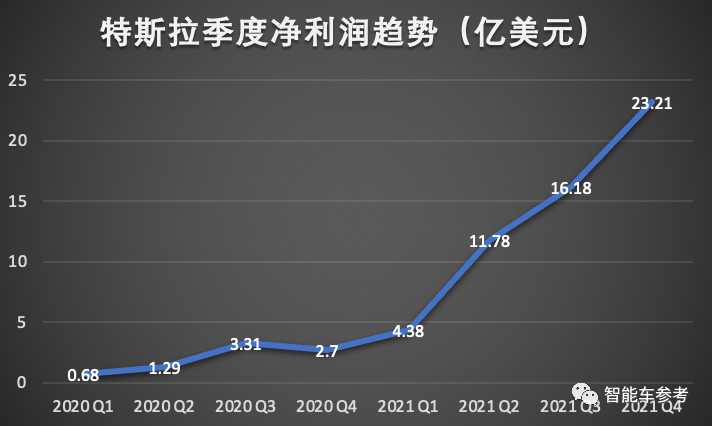

Net Income:

$2.343 billion, an increase of 760% compared to $296 million in the same period last year.

Net income attributable to common stock shareholders was $2.321 billion, with diluted earnings per share of $2.05, a significant increase from last year’s diluted earnings per share of $0.24.

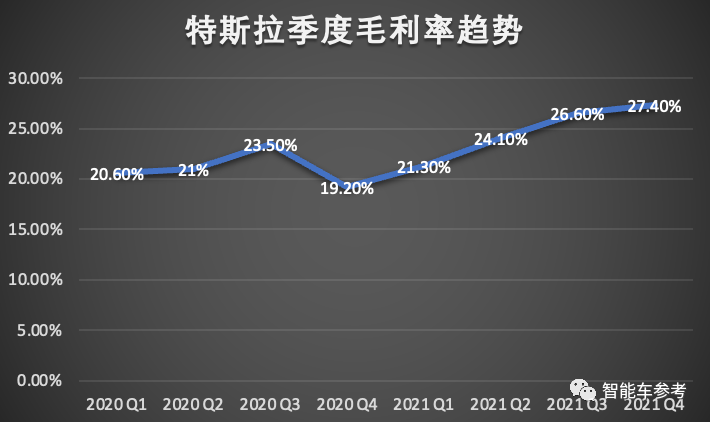

Gross Profit and Gross Profit Margin:

Total revenue from automotive business was $15.967 billion, a 71% increase from $9.314 billion in the same period last year.

The total gross profit of the automotive business for this quarter was 4.882 billion USD, an increase of 118% compared to 2.244 billion USD in the same period last year, and an increase from 3.673 billion USD in the previous quarter.

The total gross profit margin was 30.6%, up 648 basis points from 24.1% in the same period last year, and slightly up from 30.5% in the previous quarter.

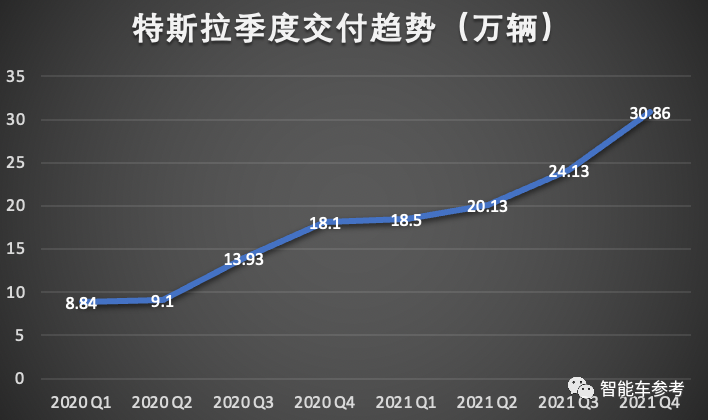

Deliveries:

Tesla delivered a total of 305,840 vehicles in the fourth quarter of 2021, an increase of 70% compared to 179,757 vehicles in the same period last year, and an increase from 237,823 vehicles in the previous quarter.

The total production of Model S and Model X vehicles was 13,109, a decrease of 19% compared to 16,097 in the same period last year.

The total deliveries of Model S and Model X vehicles in the quarter was 11,766, a decrease of 38% compared to 18,966 in the same period last year.

The production of Model 3 vehicles in the fourth quarter was 292,731, an increase of 79% compared to 163,660 in the same period last year.

The deliveries of Model 3 vehicles were 296,884, an increase of 84% compared to 161,701 in the same period last year.

Details of Model Y were not disclosed in this report.

In addition, Tesla’s global inventory (in terms of days of sales) was 4 days in the fourth quarter, a 64% decrease compared to 11 days in the same period last year, and a decrease from 6 days in the previous quarter.

Cash Flow:

Cash flow from operating activities in the fourth quarter was 4.585 billion USD, an increase of 52% compared to 3.019 billion USD in the same period last year.

Free cash flow was 2.775 billion USD, an increase of 49% compared to 1.868 billion USD in the same period last year.

It’s hard to imagine that just three years ago, Tesla was on the brink of bankruptcy.

Tesla’s 2021 Annual Report Analysis# Tesla Full-Year Results 2021

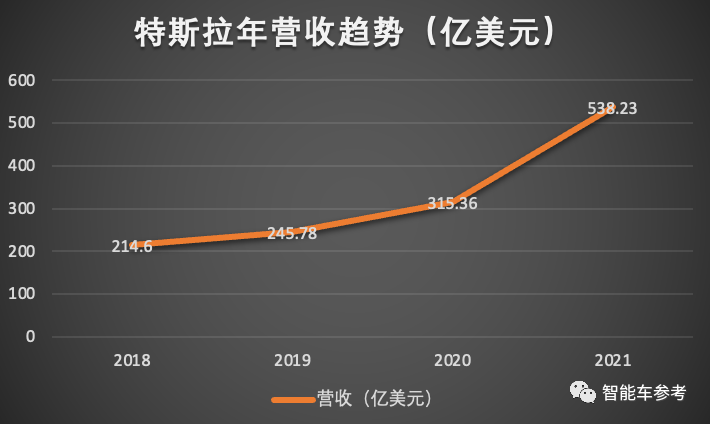

In 2021, Tesla’s total revenue was $53.823 billion, a 71% increase from the $31.536 billion in the 2020 fiscal year.

This translates to a daily revenue of $147 million and a daily revenue of CNY 933 million.

The total revenue from Tesla’s automotive business was $47.232 billion, a 73% increase from the $27.236 billion in the 2020 fiscal year.

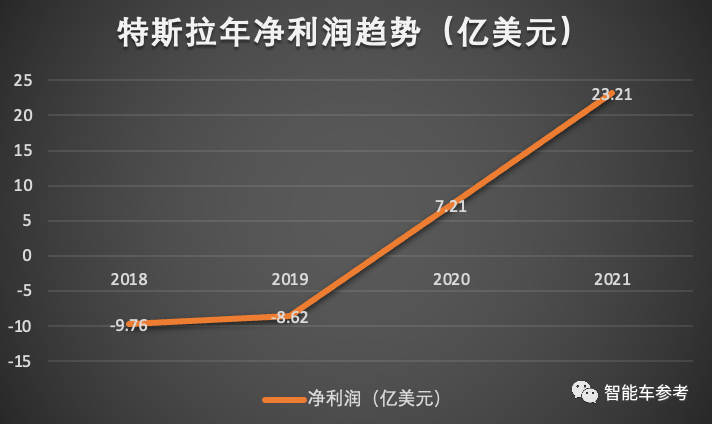

Net Profit:

Tesla’s net profit attributable to common shareholders for the 2021 fiscal year was $5.519 billion, a 665% increase from the $0.721 billion in the 2020 fiscal year.

Excluding US GAAP adjustments, Tesla’s adjusted net profit attributable to common shareholders for the 2021 fiscal year was $7.64 billion, a 211% increase from the $2.455 billion in the 2020 fiscal year.

The diluted earnings per share attributable to common shareholders for the full year were $4.90, a 666% increase from the $0.64 in the 2020 fiscal year.

Overall, investing in Tesla has been very profitable.

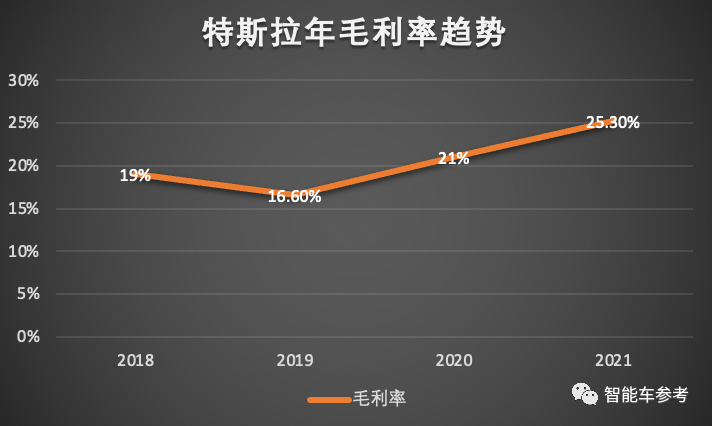

Gross Profit and Gross Margin:

The total gross profit for the year was $13.606 billion, a 105% increase from the $6.63 billion in the 2020 fiscal year.

The total gross margin was 25.3%, up 426 basis points from the 21.0% in the 2020 fiscal year.

Of course, for Tesla, there is always room for improvement in their financial reports as the company is entering its best years for growth.

In terms of stock price, although it has had a slight pullback in the past year, the overall increase is still impressive.

Musk’s Latest Insights

Lastly, if there is anything more important than the financial report, it would naturally be the analyst conference with Elon Musk.

This time, Musk, in high spirits, shared many new insights and accomplishments.

On Tesla’s Management:

Tesla’s 2021 Achievements and Plans

In 2021, Tesla achieved a breakthrough year with an overall growth rate of over 90%, setting new records in both revenue and net profit, and the company has begun to show steady profitability.

Tesla’s 4680 Battery

Tesla has started mass production of the new 4680 battery, which will be first delivered to new Tesla vehicles produced in the Texas Gigafactory, with the first batch of 4680 battery-powered cars to be delivered this quarter.

Tesla’s New Year Product Plan

Tesla plans to promote the Cybertruck and launch the Semi electric truck and Roadster sports car.

The Cybertruck faces some technical challenges, but battery capacity is not a problem, and the goal is to produce 250,000 vehicles per year at a reasonable price.

Tesla’s Cheaper New Car

There is no new car, let alone a cheaper new car (as rumored, a $25,000 Tesla). Tesla still faces many challenges, and the core goal is to drive overall production and deliveries, which new models will complicate.

Tesla’s real essence and challenge is autonomous driving. Once autonomous driving is fully implemented, transportation costs will be reduced by 4-5 times.

Tesla’s FSD Autonomous Driving

This year, for sure.

Tesla’s FSD test vehicles have increased from thousands in September 2021 to nearly 60,000.

Tesla’s Robots

Developing the Optimus humanoid robot is one of Tesla’s most important tasks this year.

Humanoid robots can help solve labor shortages in the United States and will first be applied to Tesla factories.

In terms of priority, there is no more important product than humanoid robots, which will eventually be more important than Tesla’s automotive business.

Tesla’s Chip Shortage

The shortage will ease in the coming year.

Tesla’s Insurance

Currently available in five states in the United States, Tesla’s internal goal is for 80% of Tesla vehicle owners to have the option of Tesla insurance by the end of 2022.

Tesla’s Dojo Supercomputer

Dojo is mainly used for data training of Tesla’s FSD system, which can greatly reduce costs and improve efficiency.

If Dojo becomes increasingly competitive, Tesla may consider offering it to other companies as an external service provider.

Tesla’s Profit Margin

Hardware is just “making friends.” The focus of profit margin is on the software business. When FSD and RoboTaxi are finally implemented, the profit margin will be very high.

–End–

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.