Tesla’s Plans for 2022

This morning, I carefully reviewed Tesla’s telephone conference call to see what will happen in 2022. Here are some of the extracted and deduced pieces of information:

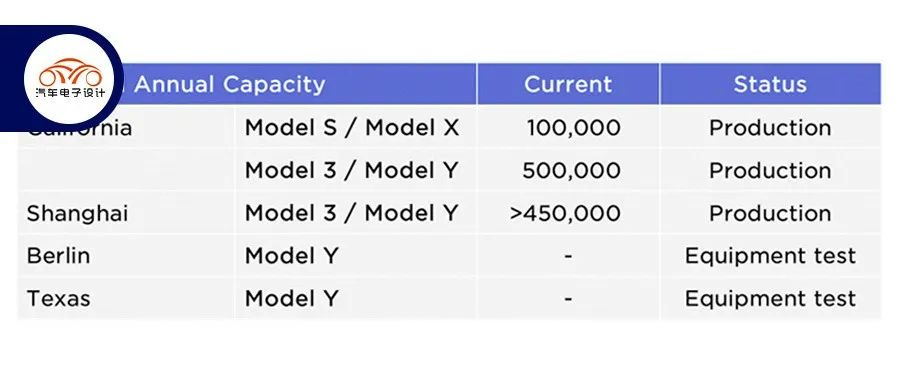

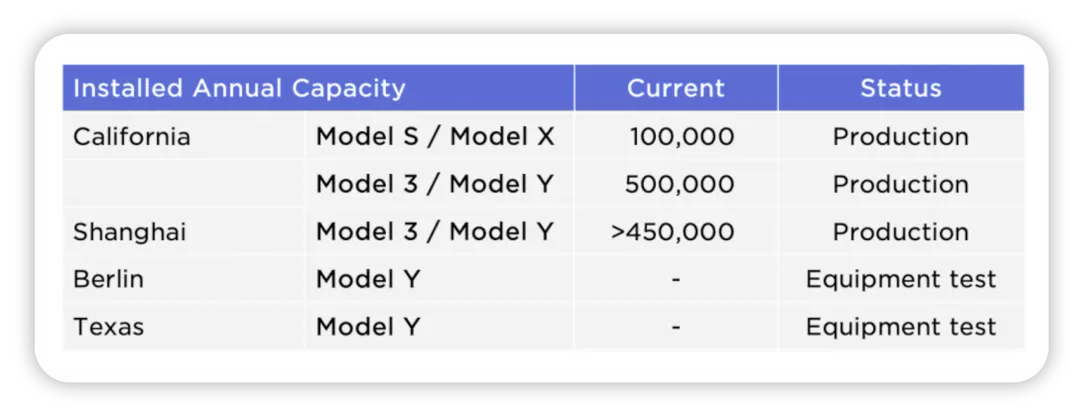

● No new car will be released in 2022, which means that the low-cost car priced at $25,000 is expected to be released in 2023. The focus for this period may be on setting up the production capacity in four factories, rather than holding a press conference to shift demand.

● Some 4680 batteries have already been stockpiled and are expected to be used for the Q1 2022 vehicle launch. At present, the Tesla factory in Texas is expected to be the first to use the 4680 battery, while the Berlin factory will continue to use the 2170 battery. Both types of batteries will be used synchronously in 2022, which will be an important turning point with Tesla’s own supply and the supplier’s support.

● As a player that is able to flexibly adjust itself and has a high priority with chip suppliers, the chip shortage has been a challenge for Tesla. There will be a 50% increase in demand for chips in 2022, making the chip shortage a major bottleneck in recovering production growth rate for the auto industry.

Tesla’s Business Growth

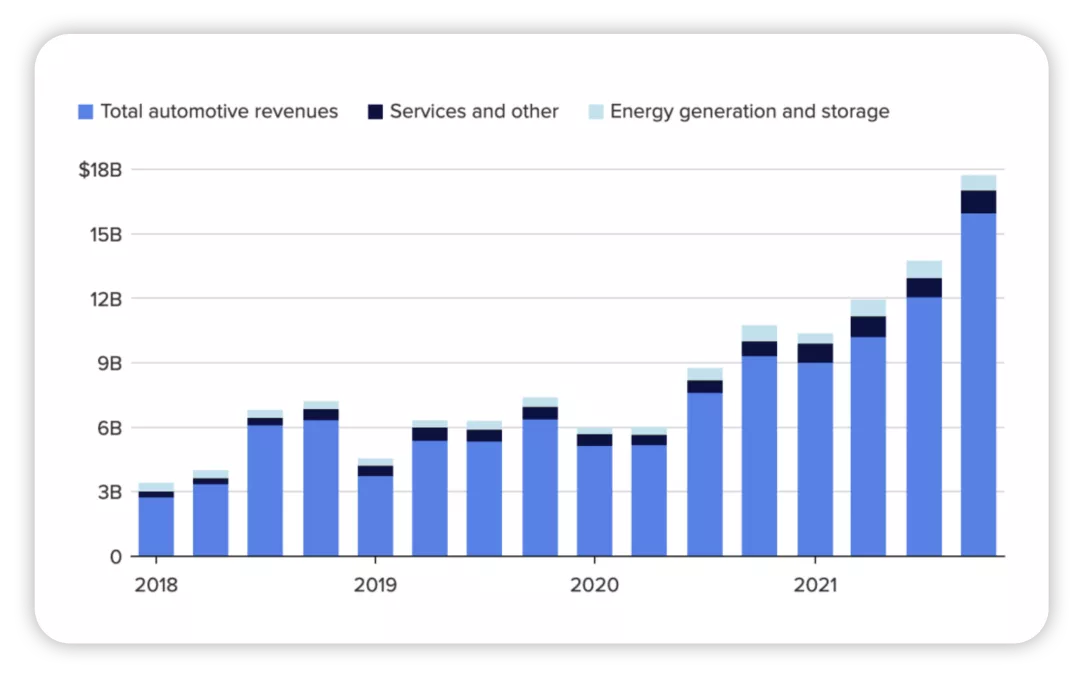

From the following chart, Tesla achieved high revenue growth in 2021, with a corresponding increase in production capacity (180k, 206k, 237k, and 305k). The official target for 2022 is an increase of more than 50%. If production is allocated, deliveries from Texas and Berlin are expected to start in Q1, with capacity expanding in Q2 and Q3. Tesla’s deliveries and revenue in 2022 are expected to show the same upward trend as in 2021, following a relatively flat revenue trend in 2018-2020. In other words, there may be a significant increase in Tesla’s revenue for the three years from 2021 to 2023.

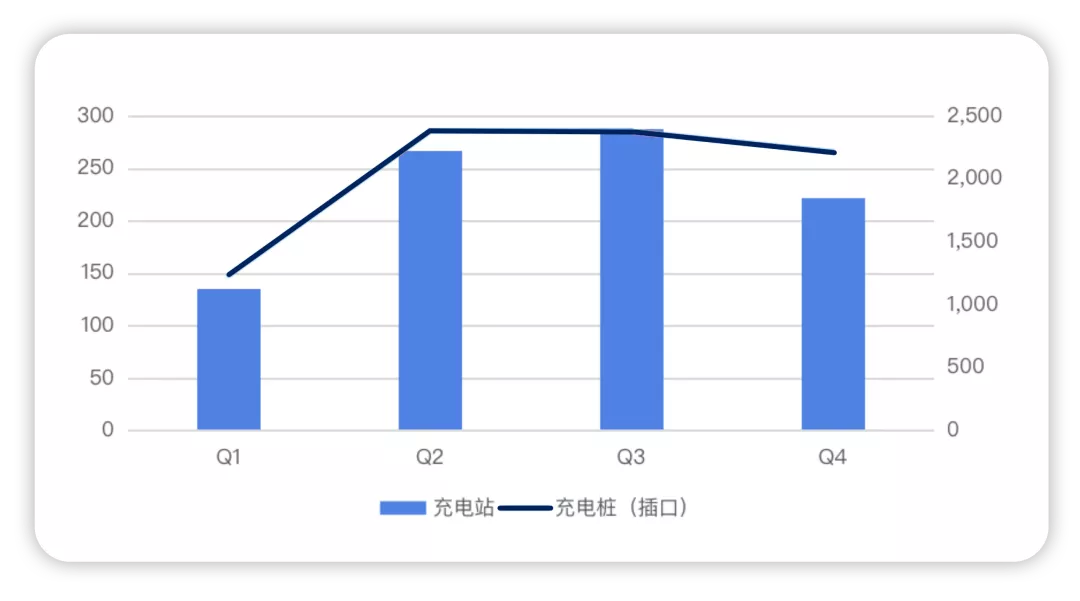

I have some doubts about charging infrastructure. Based on the data, 912 charging stations were built and 8,221 charging piles were added in 2021. Currently, there are 3,476 charging stations and 31,498 charging piles.The 35% growth rate and 930,000 global additions (a growth rate of 70%) in one year do not match. Furthermore, 2021 was the point in time when Tesla opened its charging facilities. Based on current observations, the effective area for fast charging (where there is sufficient distribution capacity and users are willing to use it frequently) may be limited globally, especially in China’s first-tier cities.

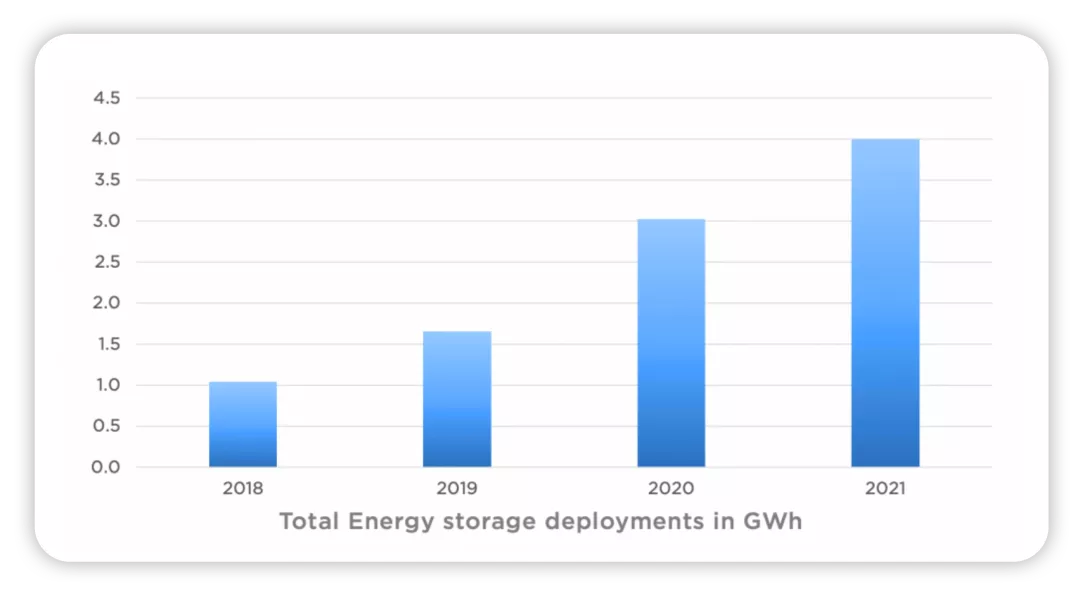

Energy Storage and Batteries

In Tesla’s small business area, there is rapid growth in energy storage, centered around the Power Pack and Mega Pack. Tesla’s guidance is for 200-300% growth. This involves switching from the previously used 18650 batteries to lithium iron phosphate batteries (it was explicitly confirmed during the conference call that cylindrical 4680 batteries will not be used), and there are significant guarantees from suppliers.

For now, the 4680 battery seems to be a fundamental platform that will continue to improve cost and efficiency through lean production, realizing the target cost goal for battery cells. In terms of the chemical system, it is the first time that lithium iron phosphate will not be used.

Taking into account a previous report by Nikkei Asia, Panasonic has approved a JPY 80 billion (USD 705 million) investment in its factories in Japan and Wakayama to produce 4680 batteries for Tesla, with production capacity of 10GWh in 2023. This is clearly a portion of it.

Note: From what we can see now, Panasonic will supply in both Japan and the United States; otherwise, Panasonic’s share in the Tesla system will decline further.

So let’s summarize the supply of 4680 batteries:

- Berlin: The first batch of LG2170 batteries switched to Tesla’s self-produced 4680 batteries, with LG’s 4680 batteries used in combination;

- Texas: The first batch of Tesla’s self-produced 4680 batteries, combined with Panasonic’s 4680 production capacity investment in Japan and the United States, and considering LG’s increased production capacity in the United States.

Conclusion: From what we can see now, the supply limitations of automotive chips on automotive companies in 2022 will still be greater than those of battery production capacity. In 2022, both Tesla and China’s new energy vehicles will experience a trend of low performance in the first quarter and high performance in the later quarters.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.