Last night, the US Department of Commerce released the results of the “Risk Report on Semiconductor Supply Chain Information Inquiry” (RFI) launched in September 2021.

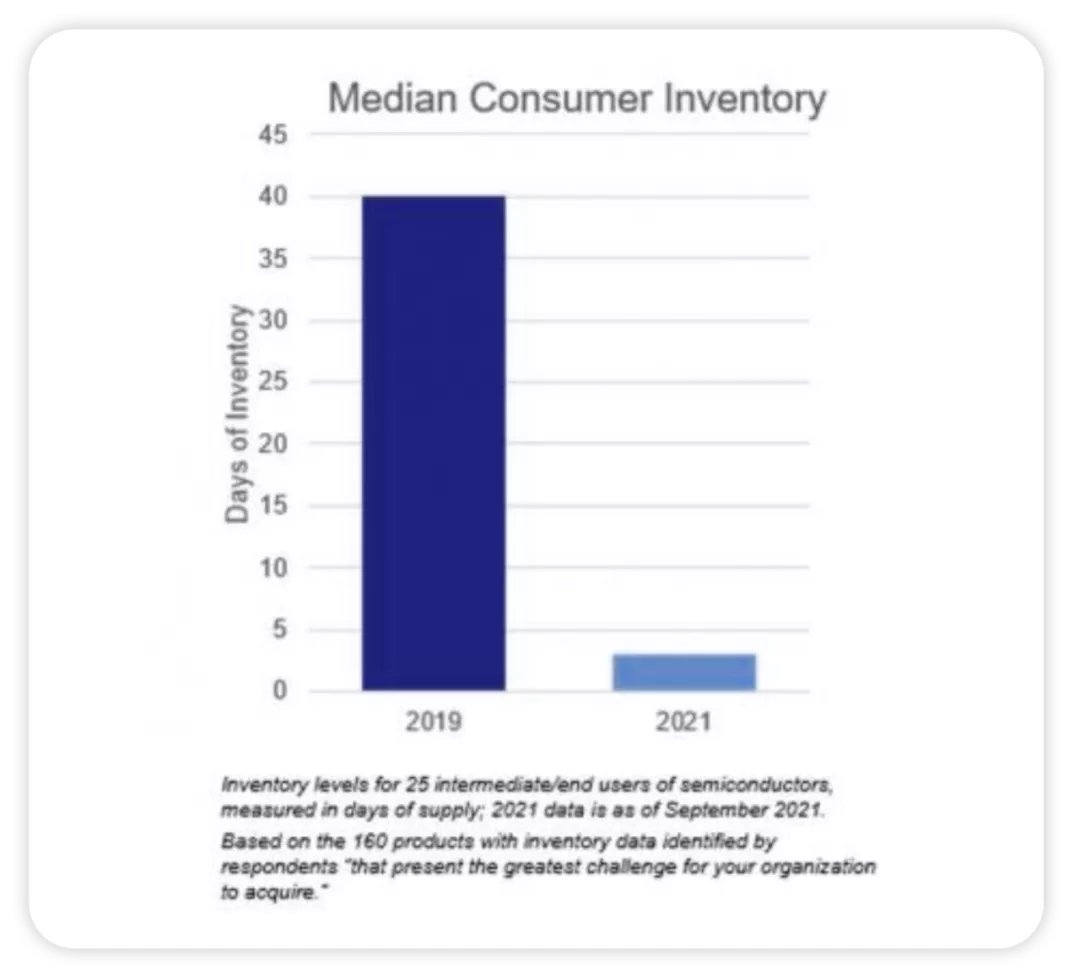

The report mainly highlights the depth of data on the global semiconductor shortage, which is necessary to support the $52 billion domestic semiconductor production in the United States. The core issue is that the semiconductor supply chain is still very fragile, with demand continuing to far exceed supply. The median chip inventory of chip-using companies, including automobile companies and medical equipment manufacturers, has dropped from 40 days in 2019 to less than 5 days in 2021.

Key points of the Risk Report on Semiconductor Supply Chain Information Inquiry

The main points of this report are as follows:

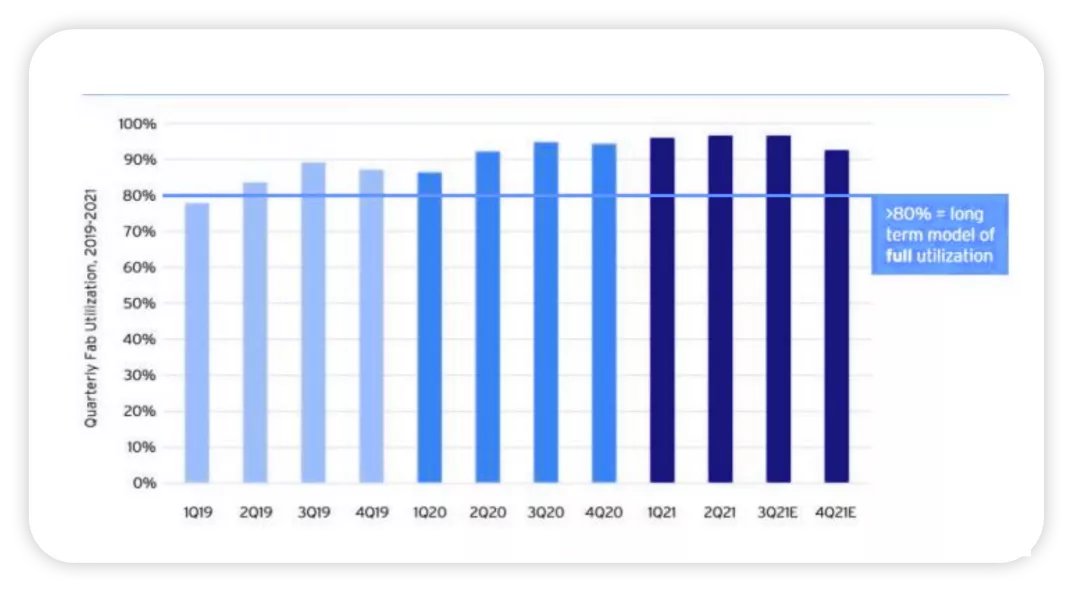

● In 2021, the demand for semiconductors is 17% higher than in 2019, but the added chips did not increase the visible available supply, and the output did not increase significantly (for example, in the United States and Europe, it decreased significantly in the automotive sector).

● The utilization rate of the production bases of most semiconductor manufacturing companies is above 90%, which means that the additional supply of chips that can be increased in the next two years without building new semiconductor facilities is very limited.

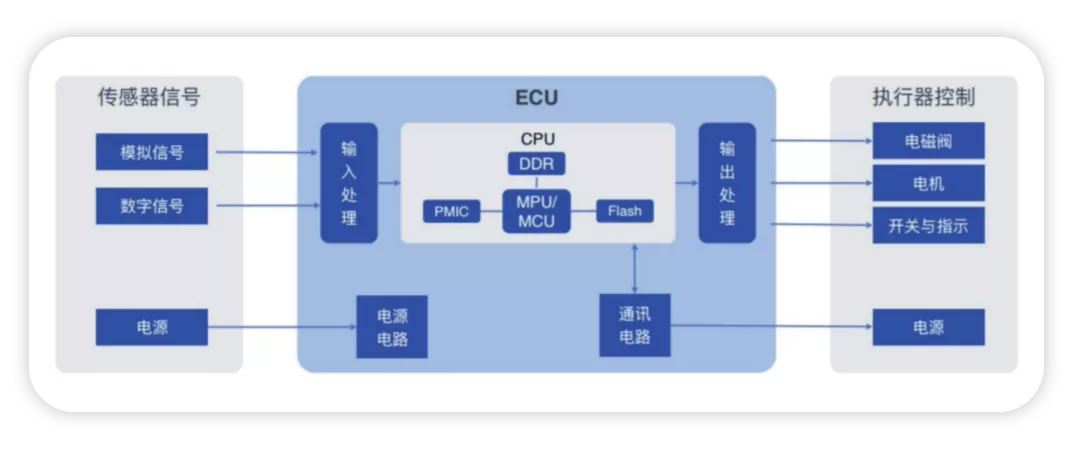

● The bottleneck mainly concentrates on specific semiconductors, including traditional logic chips (used in automobiles, medical equipment, and other products), analog chips (used in power management, image sensors, and radio frequency), and optoelectronic chips (including those used in sensors and switches).

◎ Microcontrollers made with traditional logic chips include 40, 90, 150, 180, and 250nm processes.

◎ Analog chips include 40, 130, 160, 180, and 800nm processes.

◎ Optoelectronic chips include 65, 110, and 180nm processes.

### 2022 Semiconductor Supply Situation for Automotive Industry

### 2022 Semiconductor Supply Situation for Automotive Industry

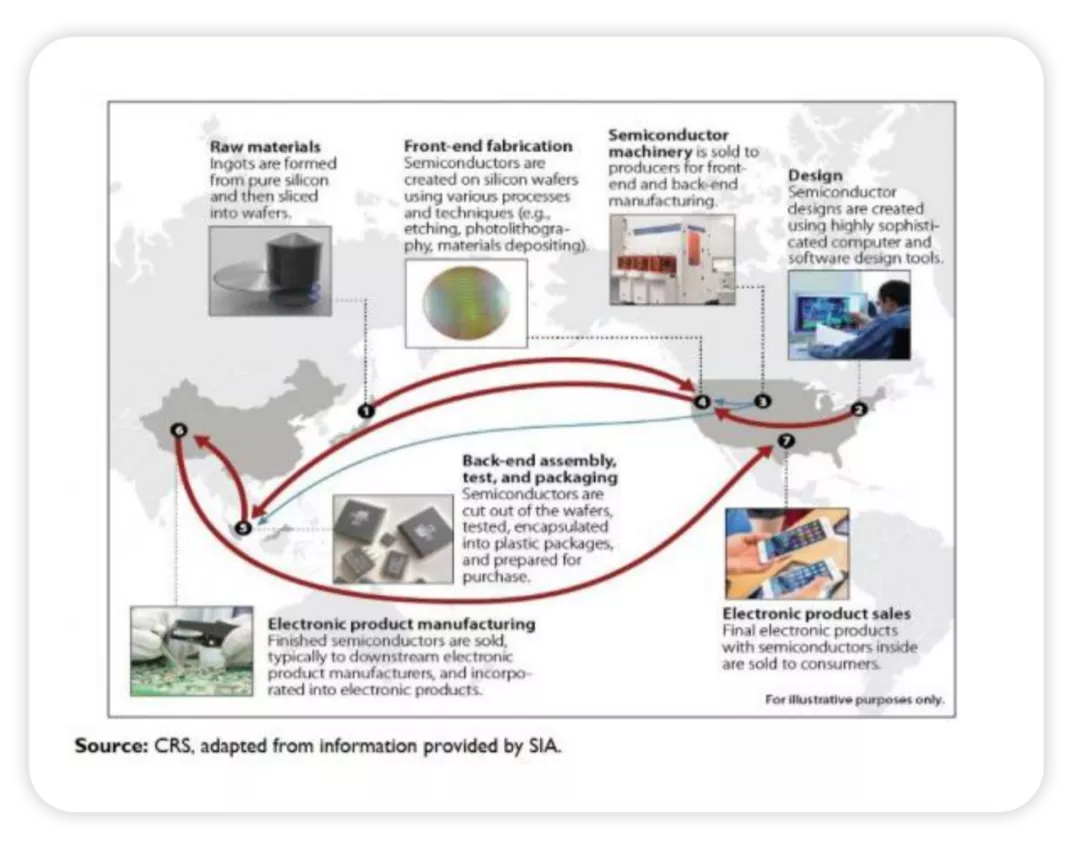

According to research, the main bottleneck currently lies in the need for additional wafer fab capacity, and of course, there is also a shortage in materials, assembly, testing, and packaging capabilities. The Semiconductor Industry Association predicts that capital expenditures (capex) in the semiconductor industry will catch up to nearly $150 billion in 2021 and exceed $150 billion in 2022, as of today. Capital expenditures in the semiconductor industry have never exceeded $115 billion annually before 2021. This investment will take time to convert into capacity.

In this report, although the US has its own perspective – the intent to promote the establishment of production lines locally in the US, we can clearly see: relying on the supply of original automotive chips will probably not meet our needs for automotive stock replenishment and recovery in 2022.

● The MCU supply of major chip suppliers, Infineon, NXP, Renesas, and ST, still poses a bottleneck. As of now, microcars and A00-level electric vehicles that were previously fueled by gasoline will be widely used in local MCUs in 2022, not only for vehicle applications but also for breakthroughs in vehicle control and powertrains.

● As far as power chip supply is concerned, the production capacity of major enterprises has basically been fully booked. Substitution opportunities exist in China for 2022. However, issues arise not just in design but in implementing local production.

● As of now, there may be few communications and SBCs that are compatible with MCUs.

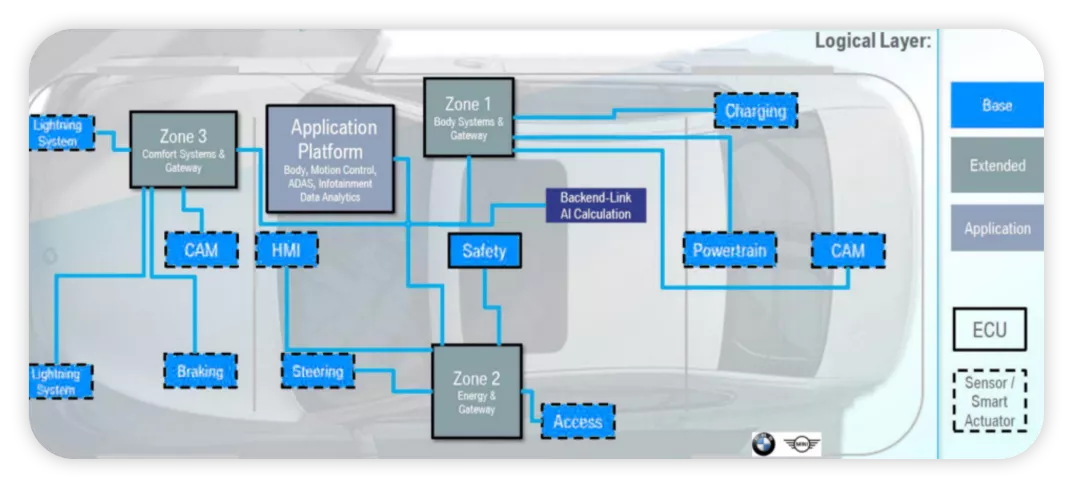

This semiconductor supply situation indeed promotes the acceleration of automobile enterprises towards Zonal architecture.

Conclusion: Be prepared early for 2022 since semiconductor issues are still relatively severe. Of course, this process may be fully launched with vehicles costing less than 50,000, and if we can’t get the chips, the cars under this price point may not make it.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.