Author: Qiu Kaijun, Wang Lingfang

Chen Weifeng, the General Manager of Times Electric Vehicle Service, is one of the most trusted people by Zeng Yuqun.

As a fellow native of Fujian and a graduate of Tsinghua University, Chen has worked in many positions since his graduation, including R&D and public relations. He has also served as an assistant to Zeng Yuqun.

Only those who have undergone multiple job rotations and gained the trust of their boss at Times can handle the task of battery swapping.

On January 18th, CATL, the world’s largest battery manufacturer, held an online press conference to announce its battery-swapping brand EVOGO and its integrated battery-swapping solution. One of the unique features is that they compared each battery module to a “chocolate” block, which can be used individually or combined together on a vehicle.

Chen Weifeng was the main speaker at the press conference. At the end of the video, Zeng Yuqun handed a block of chocolate out of an electric car and greeted the audience, “Want some?”

His personal appearance can also illustrate the importance of battery swapping.

At the press conference, Chen Weifeng did not reveal any grand plans, only mentioning that EVOGO battery swapping service will be launched in the first batch of 10 cities.

He also said after the press conference, “Today’s press conference is just the first step from 0 to 0.001.”

This is a small step for CATL, but no one should underestimate the impact of a giant corporation.

What does it take for CATL to go from 0 to 1 in battery swapping? What will CATL look like by then?

How CATL operates battery swapping

As the first battery manufacturer to enter the battery swapping market, how will CATL go about it?

CATL is currently the world’s largest battery company.

At the press conference, Chen Weifeng introduced CATL’s integrated battery swapping solution, which includes three products: battery module, fast-swapping station, and APP.

(1) Battery module

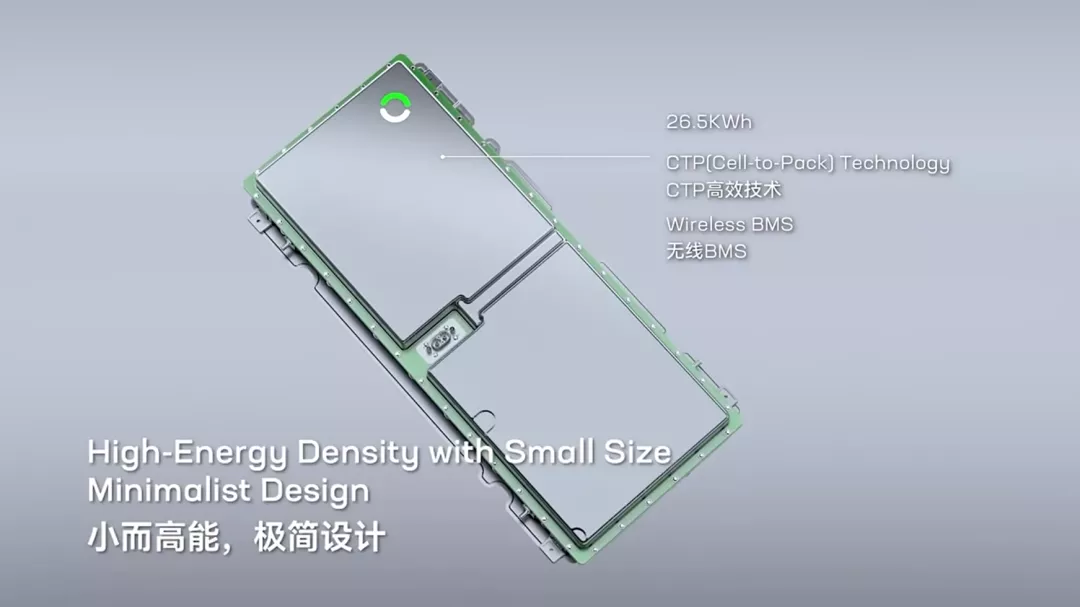

The battery module is a standard battery pack with a capacity of 26.5 kWh. It can be placed on a vehicle alone or in multiples.

Resembling blocks of chocolate that can be combined, CATL has named them “chocolate battery module”.

Chen Weifeng elaborated on the three major features of the battery module: compact and high-energy, free combination, and minimalistic design.

The so-called small but high energy refers to high energy density: weight energy density exceeds 160Wh/kg, and volume energy density exceeds 325Wh/L. A single battery can provide about 200 kilometers of endurance.

The so-called small but high energy refers to high energy density: weight energy density exceeds 160Wh/kg, and volume energy density exceeds 325Wh/L. A single battery can provide about 200 kilometers of endurance.

The reason for such high density is that, on the one hand, the swapping block utilizes the latest CTP technology from CATL, eliminating the intermediate module link and improving the efficiency of the group. On the other hand, the swapping block uses nickel-cobalt-manganese ternary lithium batteries, which have higher energy density compared to lithium iron phosphate batteries.

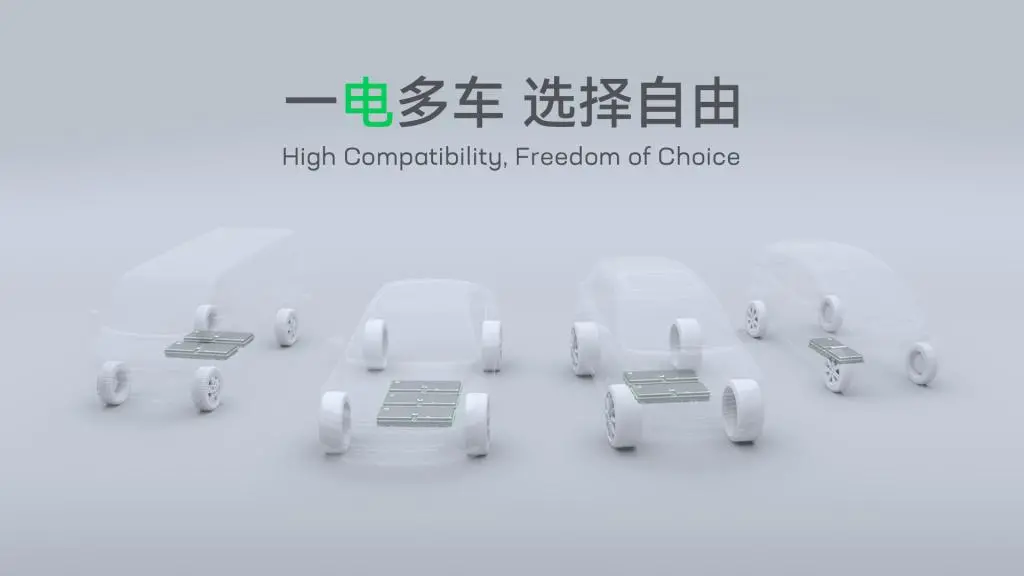

The so-called free combination means that a car can be equipped with multiple swap blocks. Consumers can choose to install one to multiple batteries to match different mileage requirements when using them.

For example, for daily short-distance commuting, only one block needs to be swapped, which can support about 200 kilometers of endurance and can be used for several days. If you want to travel long distances, you can swap three blocks, which supports 600 kilometers of endurance, enough to make a round trip of 300 kilometers.

The realization of free combination can significantly improve consumer experience and reduce costs. It can save consumers from carrying a large battery pack every day for a few long-distance trips, not only saving the cost of purchase, but also responding to long-distance travel needs at any time for a better experience.

The so-called minimalist design is the use of wireless BMS technology for swapping blocks, which has only high-voltage positive and negative interfaces, greatly improving the reliability of plug-and-play components.

In addition, the swapping block also uses air cooling technology, and there are no cooling liquid pipeline layout and connection problems.

The difficulty of this design is that regardless of how many battery blocks, the voltage of each individual battery block needs to be the same as the voltage of the entire vehicle platform. Each battery block adopts parallel connection mode and achieves simultaneous discharge at the system level. In solving the consistency of multiple blocks, CATL has independently developed a station control system and cloud platform, which can guarantee that the initial voltage of the swapping block is consistent through package selection strategy.

After swapping is completed, CATL’s BMS control strategy can also ensure that the voltage between multiple block batteries is consistent.

The biggest feature of the swapping block and the place where CATL’s ambition can be reflected is the “chocolate swap block”, which is actually a standard battery block developed specifically for realizing shared swapping.

Chen Weifeng said at the press conference that the “chocolate swapping block” can be adapted to 80% of the pure electric vehicle models already on the market as well as those to be launched in the next three years globally. Moreover, the “chocolate swapping block” can not only be used for passenger cars but also for logistics vehicles.

This means that CATL hopes to use this standard battery block to support all swapping vehicle models. Moreover, if other companies also do swapping, they can also adopt the size and specifications of this standard battery block to promote the standardization of battery packs across the industry.

If this standard pack becomes popular, as the pioneer and standard setter, CATL can certainly take the lead.

(2) Fast Swap Station

“Fast Swap Station” is the swapping station of CATL.

Chen Weifeng also summarized four characteristics:

The first is small footprint, which means that a standard station only needs three parking spaces.The second feature is fast circulation, meaning that a single battery can be replaced in about one minute, including the time for the vehicle to enter and exit. Based on the video of the press conference, CATL’s battery swapping system uses a buckle-style connection, with a one-sided track for delivering and collecting batteries. This scheme may take longer than the one used by Aulton but shorter than that used by NIO.

The third feature is large capacity, with each station capable of storing 48 battery swapping blocks. According to Chen Weifeng, this ensures that users always have fully charged blocks available for replacement without having to wait for a long time. In terms of the number of battery swapping blocks, CATL’s stations indeed have more blocks than those of NIO, whose second-generation station only has 13 battery packs, and Aulton, whose third-generation station has 28 battery packs.

However, CATL’s battery swapping blocks have a total capacity of about 26.5 kWh, which is similar to that of NIO and Aulton’s swapping stations.

Nonetheless, in situations where only a small number of battery blocks need to be replaced, CATL’s battery swapping station can serve more cars. In addition, if one were to constantly replace battery blocks until the 49th one was fully charged, the swapping station would need to charge at a rate of 1C.

The fourth feature is all-weather adaptability. CATL can provide versions of its battery swapping stations that are suitable for different regional climatic conditions. Given CATL’s worldwide customer base, the company has accumulated a vast amount of experience and data in designing and operating battery swapping stations that cater to different climate conditions.

(3) APP

The “APP” is the “EVOGO” app that provides connections and services among individuals, vehicles, stations, and battery blocks, including searching for stations and swapping batteries.

The clarity of the app lies in the fact that CATL directly serves end-users. Instead of partnering with other operators or automakers as merely a provider of power batteries, CATL has boldly entered the market and taken on the responsibilities of 2C (business-to-consumer) services. This will undoubtedly be CATL’s biggest challenge as there has been no prior experience in providing 2C services.

Undoubtedly, if CATL’s battery swapping business develops well and the app attracts more users, CATL will be able to offer services beyond battery swapping to its target customer group. For example, the app could provide vehicle leasing and sales, or even commercial information or services based on geographic information, such as nearby restaurants and cinemas.

Chen Weifeng also mentioned that the app will have more and more functional modules to serve consumers in the future.

(4) Business Model

CATL’s combined battery swapping solution is branded as “EVOGO.” The EVOGO brand has three major characteristics concerning vehicle matching and operation: one battery for multiple vehicles, on-demand power rental, and both charging and swapping options.

The first characteristic, “one battery for multiple vehicles,” has two meanings.# One

“Chocolate Battery Swapping” can be used for passenger cars and logistics vehicles from A00 level to B and C levels. Different models share battery swapping, differing only in the quantity.

Two

Battery swapping stations can accommodate various brands of vehicles that use the “Chocolate Battery Swapping” standard, breaking down the barrier of incompatibility between batteries and vehicles, achieving freedom of choice for battery-swappable vehicles. In other words, the swapping station can service all vehicle models that use this standard battery pack. Just like petrol and diesel stations of China Petroleum and Sinopec, they mainly pump standard marked petrol and diesel and can both provide services.

The second feature is “Rent-a-Battery” which means that battery blocks can be flexibly combined. Consumers can decide to replace one or multiple batteries based on their needs each time they use the car.

Here’s the background: when selling the CATL battery swapping model, the car and battery are sold separately. In NIO car purchases, separation is optional, but in this case, it is compulsory. Consumers only buy the vehicle as the battery has to be leased from CATL.

The third feature is “Charge-and-Swap”, which together with home charging and fast charging forms a comprehensive solution for charging, providing freedom in batteries. NIO also has this feature, while ODC requires battery swapping only.

The problem with having Charge-and-Swap capability in a vehicle that has separation between battery and car is that a vehicle owner can only charge the battery without swapping it.

This means that in the CATL battery swapping model, there has to be income from leasing batteries and providing charging services. Otherwise, if one owner only charges, but does not swap, CATL will not generate income.

Five: Collaboration Status

At the event, Chen Weifeng revealed that the first collaboration carmaker with CATL battery swapping is First Auto Works HONGQI. The company’s NAT combination battery swapping version became the 001 member of EVOGO “Small Green Ring Family.”

The HONGQI NAT combination battery swapping version is currently used as a taxi. In Liaoyuan City, Geelyn Province, local enterprises have purchased a batch of Hongqi NAT and are operating in CATL battery swapping stations.

Chen Weifeng revealed that EVOGO will choose the first ten cities to launch battery swapping services. As for the future collaboration carmakers and cities, CATL has not disclosed this information.

Chen Weifeng also stated that if the CATL chocolate battery swapping block is used and swapped at the EVOGO battery swapping station, battery swapping should be considered in the design phase.

Six: Differences

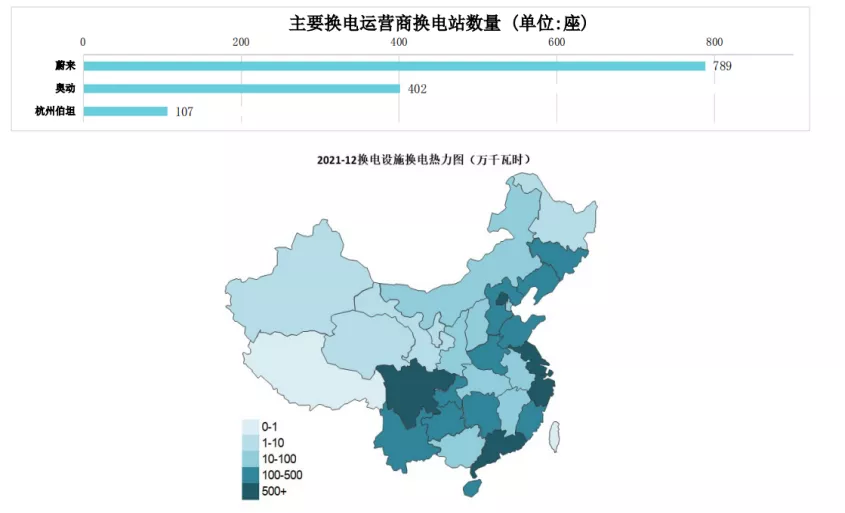

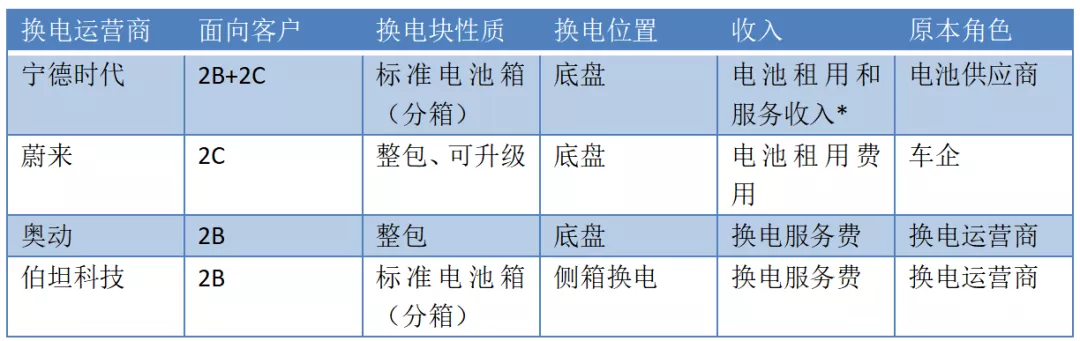

Battery swapping for EVs is not new, and there are many players around the world. In China, EV players such as NIO, BAIC, and Geely are developing battery swapping solutions, and there are also battery swapping operators, such as ODC and Boray Technology.According to the statistics of China Electric Vehicle Charging Infrastructure Promotion Alliance, as of December 2021, NIO has 789 battery swapping stations, Leap Motor has 402 battery swapping stations, and Bortana has 107 battery swapping stations.

They have different technical solutions and business models for battery swapping.

Ningde Times does not limit its customer types. Although it is currently promoting battery swapping for taxis, its overall goal is ordinary people, which can be said to be the biggest expectation.

On the battery swapping block, Ningde Times and Bortana Technology use the same standardized battery box method to lay the foundation for later shared battery swapping. Ningde Times also provides a standard product for peers, battery banks, investment companies, and partners, hoping to lead the fast development of the battery swapping industry.

Of course, if this standardized battery box becomes industry-recognized, Ningde Times’ advantages will be more apparent.

The idea of the standardized battery box is not an illusion. Many industry insiders, even deputies to the National People’s Congress and members of the CPPCC, have proposed concentrating on a few types of battery packs that can be used interchangeably between production companies. Inclucding the existing standards, there are battery pack size standards, but there are many specifications and not mandatory.

Regarding the battery swapping locations, Ningde Times, NIO, and Leap Motor use the same chassis battery swapping method. By using battery swapping robots, the battery pack is unloaded from the chassis, and another robot lifts, aligns, and locks the fully charged battery pack into place.

The process is slightly different. Ningde Times and Leap Motor both need to lift the vehicle, while NIO’s second-generation station does not. The locking mechanism is similar to that of Ningde Times and Leap Motor, using a snap-on type that is easy to detach and more durable.

Bortana Technology uses a side-box battery swapping method, and the lifting mechanism is on the vehicle, which can be swapped outside the station.

Regarding income, Ningde Times has not disclosed the details. But based on the separation of the car and the battery and the ability to charge and swap, its charging model should include independent fees for battery rental and battery swapping.

Of course, the biggest difference is that Ningde Times itself is a power battery supplier. In the battery swapping business, the core is asset management of battery packs and operation management of battery swapping stations.

Ningde Times manages its battery assets. Firstly, it is already an old driver in the field of batteries and knows how to utilize its strengths and avoid weaknesses. Secondly, it is familiar with the characteristics of the batteries it produces. Thirdly, it has data on the use of large numbers of customer’s batteries in the past and can make targeted adjustments and maintenance. Therefore, Ningde Times has innate advantages in battery asset management.## On the Management of Battery Swap Station

Battery swap station operation and management is a field that CATL (Contemporary Amperex Technology Co., Limited) has not previously engaged in. However, the company has learned and observed the practices from its cooperating partners, such as NIO and ODM, and will need to further test and evaluate its own practices.

The industry’s major concern is whether car manufacturers will trust and rely on CATL’s standard battery module for their electric vehicles. Will they be confident that the core features of their vehicles will not be limited by CATL?

In the case of a determined battery capacity and discharge performance, the driving range of an electric vehicle would still depend on the motor and electric control systems, and there could still be differentiation in these aspects. Of course, the available options would become more limited.

Looking at the development trend of intelligent electric vehicles today, consumers and car manufacturers are no longer sensitive to driving ranges beyond four to five hundred kilometers. Car manufacturers are more focused on non-drivetrain performance, design and user experience. They are even exploring concepts such as super chassis, and shifting their focus to the car body, including exterior and interior design, intelligent cockpit, and marketing and service.

It is worth noting that if CATL’s proposed practices are adopted, car manufacturers would no longer have to worry about replenishing battery energy, and CATL’s role in the battery swap station would be similar to petrol stations run by China National Petroleum Corporation and China Petrochemical Corporation, responsible for solving the issue of replenishing battery energy.

For car manufacturers, it’s like yesterday.

Why Adopt Battery Swap?

CATL is a 10-year-old company and became the first start-up listed on the China Growth Enterprise Market with a market capitalization of over a trillion yuan last year. Nowadays, CATL is in an unparalleled position in the field of power batteries. Shareholders and industry experts have affectionately nicknamed the company “King CATL”.

Given the competitive landscape, the stage of development of electric vehicles, and CATL’s financing and investment layout, it is necessary and feasible for CATL to adopt battery swap technology.

(1) The Worry of “King CATL”

Is CATL adopting battery swap because it cannot sell batteries?

From the market perspective, CATL is in high spirits.

CATL’s power batteries have long accounted for more than 50% of the Chinese market and about one-third of the global market. It topped the list of global power battery shipments in 2017, and has continued to gain global market share since then. As of November 2021, CATL’s global market share was 23.4%, 27.87%, 24.82%, and 31.8% respectively.

CATL’s products are widely used, which is mainly reflected in two aspects: the application areas and the business models. CATL’s commercial models include charging, sharing, and battery swap in commercial, passenger and two-wheel vehicles sectors. In addition, CATL has developed other specialized vehicle markets and provides customized solutions, such as sanitation vehicles and port trailers.

Secondly, CATL has many clients and has provided power battery products to various car manufacturers in the Chinese market, including SAIC, FAW, Geely, Yutong, BAIC, NIO, XPeng, and etc.In terms of vehicle models, as of September 2021, the MIIT’s valid catalog of new energy vehicle models totals over 5,500, of which models equipped with power batteries from CATL account for about 54%, making it the power battery manufacturer with the most supporting vehicle models.

In the overseas market, CATL has further deepened cooperation with international automotive brands such as Tesla, BMW, Daimler, PSA, and more. According to SNE data, in the first six months of 2021, CATL ranked second in terms of installed capacity of power batteries in Europe.

A market manager of a “friendly competitor” of CATL said that judging from its accumulated orders, CATL has no worries about selling batteries in the short term.

However, undoubtedly, as the leader, CATL is being watched closely by all its competitors. Competition comes from all directions, including old opponents Panasonic, LG Chem, Samsung, as well as local competitors such as BYD, SVOLT, FUNENG, Gotion, and many small enterprises competing fiercely.

The greater challenge is that with the increasing importance of power batteries, various countries and large automotive groups are rising in the trend of supplying domestically controllable power batteries. Many countries are supporting their own power battery production enterprises. Some automotive companies produce their own batteries or invest in battery production enterprises. For example, Europe supports Swedish battery manufacturer Northvolt. Another example is CATL’s largest customer, Tesla, which is also planning to produce some batteries in-house.

In the short term, CATL will still have huge advantages, and there will be no shortage of customers. However, in the long run, CATL needs to have a strategy to elevate its game to avoid falling into vicious competition in the field of power batteries.

Otherwise, even if CATL can still maintain its market share, its gross profit will continue to be squeezed.

CATL needs to open up a new battlefield.

(2) There are still pain points for electric vehicles.

The past decade of CATL’s rise as a “Battery King” has also been a decade of global electric vehicle growth.

Taking China, which occupies half of the global market, as an example, the market size has expanded by more than a hundred times.

Consumer acceptance of electric vehicles has greatly increased. The consumer groups cover luxury, high-end, terminal, low-end markets, and the market areas cover first-tier, second-tier, and even towns and rural areas.

Difficulties such as safety and reliability, cruising range, and purchasing costs have been solved and eased.

However, what is currently hindering the development of electric vehicles is difficulty in replenishing energy.Electric vehicle replenishment methods have two options: charging and battery swapping.

Initially, charging was the natural choice for the market, but it also had obvious problems. The cost of space and time in big cities was the highest. For example, community charging, the lowest-cost replenishment method for customers, was the most difficult to implement. In old residential areas, parking spaces are already scarce, and parking spaces equipped with charging piles are even rarer. Even if there is a parking space, there are still problems such as complicated approval procedures, insufficient power supply, high increasing capacity costs, lack of maintenance and management, and safety hazards.

During the National Day and Spring Festival holidays, when people tend to travel outside of their city, news reports about electric vehicle owners “charging for 1 hour and waiting in line for 4 hours” in highway service areas are often seen in various media outlets.

In some cases, a shorter charging time and a higher utilization rate of space can be achieved. For example, if the charging speed is fast and the waiting time for vehicles is short, the utilization rate of space can be improved, and fewer charging facilities can be built.

Under the charging strategy, the solution proposed by passenger car companies is to develop models that can fast charge at high power.

High-power charging can compress the replenishment time to about 10 minutes, significantly improving the replenishment experience. However, its downside is that car, charging pile, and power grid need to work together, and if any one of them is missing, the replenishment cannot be achieved. Currently, only a small number of charging stations that support high-power charging are in the demonstration and verification phase.

On the other hand, for consumers, in order to reduce the need for long-range and fast replenishment under certain scenarios, a large battery pack and high-power performance need to be equipped, which is costly but is not frequently used.

Battery swapping is another solution.

In China, the charging and battery swapping routes have had many rounds of PK.

In the early stages of new energy vehicle promotion, State Grid Corporation of China was a staunch supporter of battery swapping, but did not receive a response from car companies. State Grid also gave up pushing battery swapping, which was strongly emphasized by the country’s service positioning, and instead focused on charging. Except for a few companies such as Aulton and Bortana, there were not many players in the “battery swapping camp.”

Most passenger car companies have taken the charging route, and a few have tried battery swapping in cooperation with Aulton and Bortana.

However, in the past two or three years, car companies have once again examined the feasibility of the battery swapping route. This is because, as policies are relaxed and encouraged, batteries and vehicle bodies are no longer closely tied together; battery swapping replenishment is as fast as refueling; the demonstration effect of NIO, Aulton and other companies; and car companies seeking differentiated replenishment experiences…all of these contribute to the renewed attention to battery swapping.

In terms of taxi and ride-hailing car battery swapping, Aulton has expanded its collaboration with car companies from Beijing Automotive to Guangzhou Automobile, Shanghai Automotive, First Automobile, Changan, Dongfeng, NETA, Ai Chi and many others. Geely is trying to promote battery swapping independently, and Beijing Automotive is also developing its battery swapping business independently.## Private Consumer Oriented Battery Swapping

Currently, only a small number of vehicles, such as those produced by NIO and BAIC, are equipped with battery swapping for private consumers. However, some automakers, such as SAIC, are considering offering battery swapping services for private consumers.

Against this backdrop, CATL has entered the battery swapping game with a business model that includes separating the vehicle’s electric motor and battery, rapid battery swapping, and renting batteries based on demand. This model reduces the cost of owning a car and alleviates range anxiety, practically solving all issues affecting consumers.

The high acceptance rate by consumers proves the efficiency of the “separate motor and battery, rapid swapping, and rental on demand” model. Taxi, ride-hailing companies, and private consumers welcome the experience of battery swapping, which means CATL does not need to invest much effort in consumer education.

Judging from the operational results of companies such as Aulton and NIO in the swapping business, battery swapping can be profitable in at least some markets and scenarios. That’s why CATL dares to venture into this new business model.

Of course, if this “separate motor and battery, rapid swapping, and rental on demand” model is adopted by other automakers, it will facilitate large-scale adoption of Electric Vehicles, thereby increasing the size of the power battery market.

CATL is already the biggest beneficiary of this market, and the company can reap more rewards in the future.

Close Observation Battery Charging and Swapping

It comes as no surprise that CATL has entered the battery swapping game since the company has previously invested in numerous charging and swapping companies and conducted extensive research on said technologies.

In the charging space, in 2020, CATL and Fujian Baicheng jointly invested in Shanghai Kuai Bu Xin Energy Technology Co., Ltd. holding 49% of the company’s shares. The company offers not only charging stations but also integrated systems combining photovoltaic, energy storage, charging, and testing. CATL aims to explore the post-market of power batteries in the charging sector.

On June 21, 2021, CATL invested in Yun KuaiChong, the nation’s leading third-party charging IoT SaaS platform (Software-as-a-Service). As of September 2021, Yun KuaiChong serviced more than 2,700 charging station operators with over 130,000 directly connected charging stations.

CATL has accumulated significant amounts of data and operational experiences in the charging and swapping industries, thanks to these two companies.

In the swapping sector, CATL has secured a leading position. In July 2020, CATL, acting as a battery manufacturer, signed a contract to participate in the battery swapping project with Beijing Automotive’s “New Energy” division. CATL has also invested in Guanzhihui, an EV battery swapping operator established by Beijing Automotive.

Subsequently, the swapping heavy-duty trucks provided by CATL and Futian Zhilan EV were delivered in Beijing, representing the first commercialized application of battery swapping heavy-duty trucks in China.

# Ningde Times Making Waves in EV Battery Rental Market through Wuhan Weyneng

# Ningde Times Making Waves in EV Battery Rental Market through Wuhan Weyneng

Ningde Times announced its joint venture with Nio, Wuhan Weyneng, in August 2020. The purpose of the company is to own assets related to Nio’s EV battery rental service.

In addition, a plethora of auto companies purchase Ningde Times batteries to make battery packs for EVs.

As a veteran in the charging and battery fields, Ningde Times not only has a sufficient budget and data but also ample experience from investing in related companies. The company is well positioned to enter this market.

Overall, Ningde Times requires sustained growth and an early investment in the EV battery rental market to stay viable.

Ningde Times recognized the potential of the EV battery rental market and launched its charging service platform, Power Swap.

Power Swap completes Ningde Times’ full cycle value chain, from R&D and battery manufacturing to battery usage and recycling.

The Next Era of Ningde Times

The CEO of Ningde Times says, “The entire EV market is a vast pool. There are various sections to choose from. We are merely adding another option – a fourth choice. If you don’t like it, choose one, two, or three.”

Ningde Times has no bias toward battery charging or swapping. Its business activities are solely based on strategic self-interest.

(1) Intense Focus on Expansion

Ningde Times aims to do more than its current standing. It envisions a larger market with growth momentum that builds speedily.

As users anxiously want EV with longer driving ranges and less supplemental power, EV car manufacturers embark on building larger batteries. This option, however, increases initial purchase costs – a significant barrier to many limited consumer wallets in relation to fuel cars.

Ningde Times’ vision of separating the batteries from the EVs and its charging services overcomes this barrier. The separation model can lower costs, increase convenience, and redefine the charging market as a whole.

Users can replace their EV’s battery packs, and with quick and easy access to a charging site, charging is now made more like refueling with fuel cars.

The charging fees and refueling expenses will still differ as the cost fluctuates with electricity and location costs, thereby allowing consumers to choose the most affordable option.If electric vehicles can match or even surpass fuel vehicles in terms of purchase price, ownership cost, and driving experience, the widespread adoption of electric vehicles is just around the corner.

In this process, the cake of power batteries will become larger, but it does not rely on enlarging the battery of every vehicle. Instead, it allows consumers to use batteries on demand, which is a relatively more efficient way.

Some may ask if adopting battery swap mode could increase battery sales for the same number of electric vehicles?

If adopting a whole package battery swap mode, where electric vehicles usually carry a battery and the swap station has a batch of reserve batteries, it is possible to sell more batteries.

However, CATL’s “chocolate battery swap block” reduces the total amount of electricity needed for vehicles. Originally, a vehicle required a battery equal to the capacity of two swap blocks, but now one block may be enough. Therefore, CATL is still calculating the overall account and making decisions accordingly.

From being a company that makes products to being a service provider, CATL has transformed from a product-oriented enterprise into a service-oriented one by offering battery banking services and operating battery swap stations.

In the power battery supply market, although “Ning Wang” (the king of battery manufacturers) is dominant, there are many other strong players and dozens of smaller enterprises eager to take the lead to win customers, resulting in ferocious competition. Compared to others, CATL’s product quality, bargaining position, and attitude are all higher. This has given rise to many jokes that satirize CATL’s arrogance.

To break this kind of vicious competition, it is necessary to open up a closed system, create a new system, and let competitors compete on different levels.

One way to break away from this situation is to move from selling products to providing services. This tactic has significant benefits. When selling products, products are designed to meet the needs of the entire vehicle system. Even if the products exceed the performance standards, such as having a long life, the automakers would not approve them. If the product quality and safety are inferior, as long as the supplier is willing to compensate and replace them, the automakers will have no complaints, reducing products to mere price competition.

After transforming to providing services, product differences can be highlighted. If one battery can serve one car, and it can also serve another car, that would be like making twice as much money.

If CATL has an independent battery bank, besides earning revenue from selling batteries, it can also earn revenue from providing charging services. Aurora Mobile, in some cities, has already turned a profit, demonstrating the profitability of this business. Chen Weifeng also said that “If there were more cars using swap station, then we would have a chance to make a profit.”

Currently, electric vehicles have a theoretical advantage over fuel vehicles in terms of the cost per mile of driving. For example, for a Class A car, a fuel car consumes six liters of gasoline per 100 kilometers, roughly equaling 45 yuan ($7). On the other hand, an electric vehicle consumes 15 degrees of electricity per 100 kilometers, which costs only 7.5 yuan ($1.16) at home electricity price, or even lower for industrial electricity.

For battery swap operators, there is the potential to reduce the “fuel-electricity difference,” share part of the savings with consumers, and earn profits. Selling products, in contrast, is a one-off deal. The profit made is simply the difference between the purchase price and the selling price, and those with poor product quality may also face penalties or bear enormous maintenance costs.And providing services can be a sustainable way of producing returns. Just imagine, if all the battery packs sold by CATL were swapped at their EVGO battery swapping stations, how much daily income would CATL generate?

Additionally, CATL’s EVGO battery swapping brand is now operating in a direct-to-consumer mode, and their app is directly engaging users. On the one hand, if CATL’s battery swapping stations are heavily built and become more visible to consumers, it may influence their decision to choose a vehicle with CATL batteries. On the other hand, there is great potential for derivative services with the app, as it already has a large number of electric vehicle users.

Even further, if CATL’s “chocolate battery swapping block” standard is recognized by peers, other companies may make the same kind of swapping block. CATL’s battery swapping stations could store competing battery blocks and provide swapping services to electric car owners.

This will be another CATL.

(3) Targeting “Urban Mines”

Will the cost of batteries become expensive?

Based on the experience of the past ten years, the answer to this question is simple – the price of power batteries has dropped to one-fifth or even lower of the original price.

However, at the beginning of 2022, the prices of many electric cars have increased.

Why?

The cost of power batteries has increased.

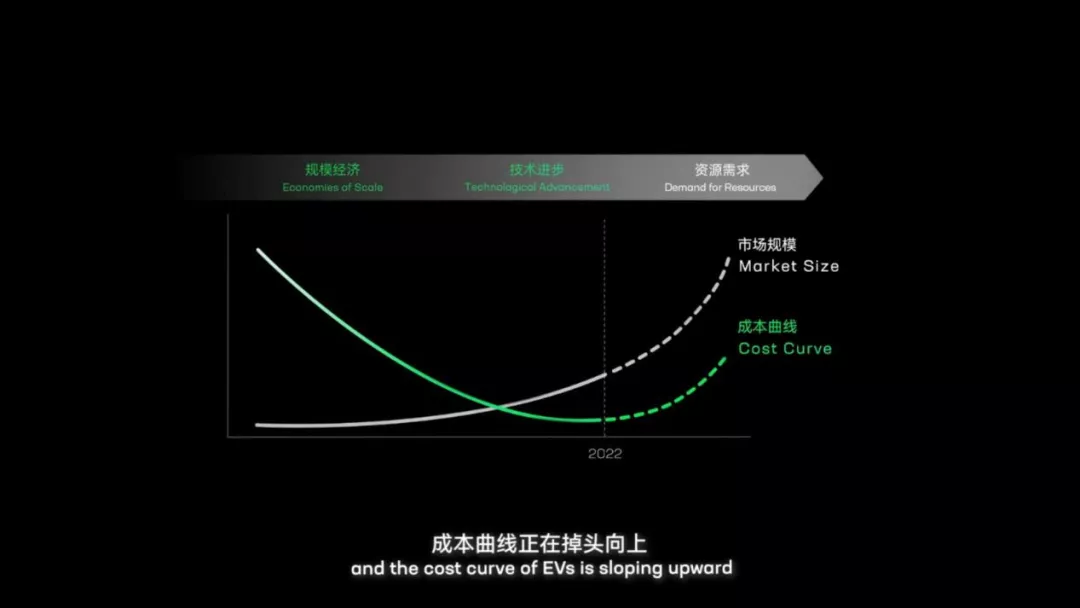

Chen Weifeng also said at the press conference, “(The cost curve of power batteries) is turning upwards.”

Why?

The demand is high, and material costs have risen.

“The global new energy vehicle market has entered a new stage of explosive growth. The demand for power batteries has soared, and the prices of raw materials have risen sharply. In contrast, the benefits of economies of scale and technological progress have only been a drop in the bucket.”

CATL’s battery swapping strategy focuses on maximizing the use of batteries on vehicles and recycling them once they are no longer usable. This makes battery recycling easier compared to a charging cycle.

This is because the battery assets belong to the battery bank, which is CATL.

These recyclable batteries are called “Urban Mines,” and whoever can recycle them, holds the mining rights to this “mine.”

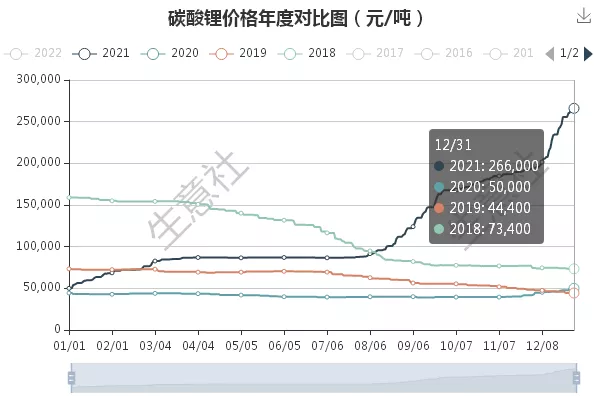

This is especially crucial during price surges in raw materials. As Chen Weifeng mentioned, starting from the end of 2020, the price of battery raw materials has skyrocketed.

For example, the price of lithium carbonate has risen from a low of 50,000 yuan/ton in 2021 to over 300,000 yuan/ton. Due to the COVID-19 pandemic and supply-demand mismatches, the prices of nickel, cobalt, copper, and other raw materials have also continued to rise.

In order to obtain a stable supply, CATL (Contemporary Amperex Technology Co., Ltd.) is willing to pay a huge price.

In July 2021, Ganfeng Lithium announced that it would acquire Millennial Lithium for no more than CAD 353 million (approximately USD 276 million). Then at the end of September, CATL announced that it would launch a tender offer to acquire Millennial Lithium at a “higher price” of CAD 377 million (approximately USD 298 million).

However, CATL’s plan to acquire Millennial Lithium has also encountered changes. AmeriLithium, which is partially owned by Ganfeng Lithium, made a similar move and launched a bid to acquire Millennial Lithium at a higher price than CATL.

This “Three Kingdoms-style” scenario is a microcosm of Chinese enterprises’ global “mine-grabbing” in 2021 and vividly illustrates concerns over raw materials for power battery companies.

Mines are not only far away but also close at hand. After retiring from power batteries, they become mines waiting to be excavated.

The leader of a domestic battery recycling company told Electric Vehicle Observer that now more than 98% of lithium, nickel, cobalt, and manganese in power batteries can be recycled, and the cost is lower than that of primary mines.

Obviously, recycling old batteries and extracting raw materials, on the one hand, can save a lot of costs for CATL when raw material prices are high; on the other hand, metals such as nickel, cobalt, and lithium have a high dependence on foreign countries, and the more they are recycled, the more advantageous it is for the supply chain security.

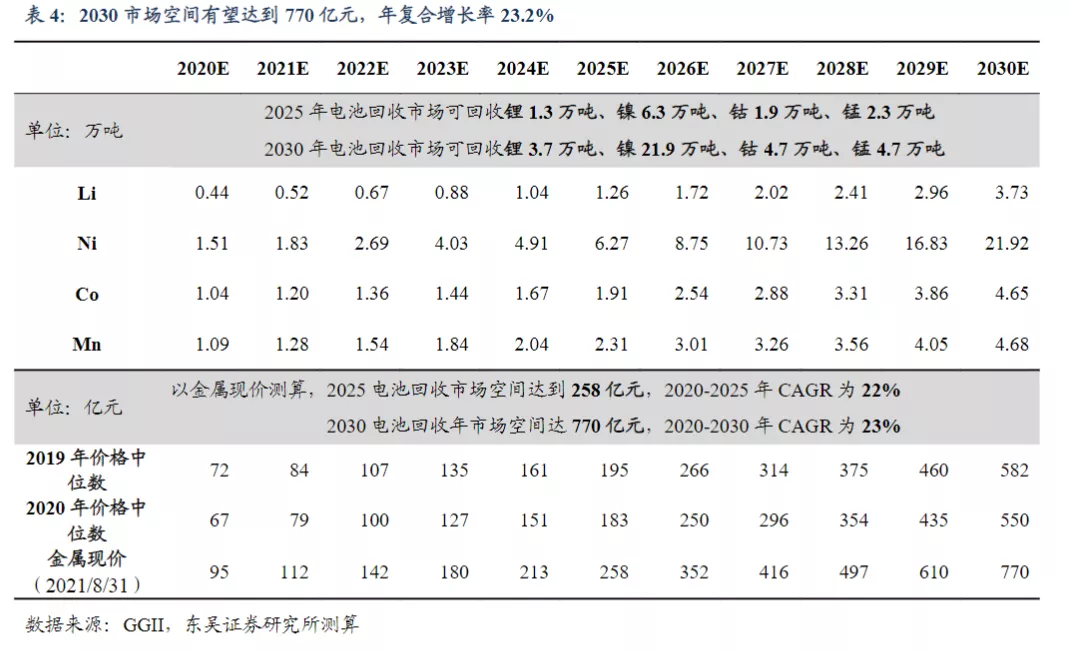

According to Dongwu Securities’ forecast, the battery recycling market can recover 37,300 tons of lithium, 219,200 tons of nickel, 46,500 tons of cobalt, and 46,800 tons of manganese by 2030. Calculated based on the current price (as of August 31, 2021) of each metal, the overall market space will reach 77 billion yuan, which is more than 7 times the market space in 2020. The 5-year CAGR of the battery recycling market space from 2020 to 2025 is 22%, while the 10-year CAGR of the battery recycling market space from 2020 to 2030 is 23%. Along with the upswing of the battery industry, the market for recycling waste batteries has steadily grown.

Based on CATL’s current market share in the power battery market, if we calculate the market space of 77 billion yuan in 2030, CATL’s contribution will account for half of it. If CATL can successfully recover half of the waste batteries, then the market size will also reach a considerable 19.25 billion yuan.

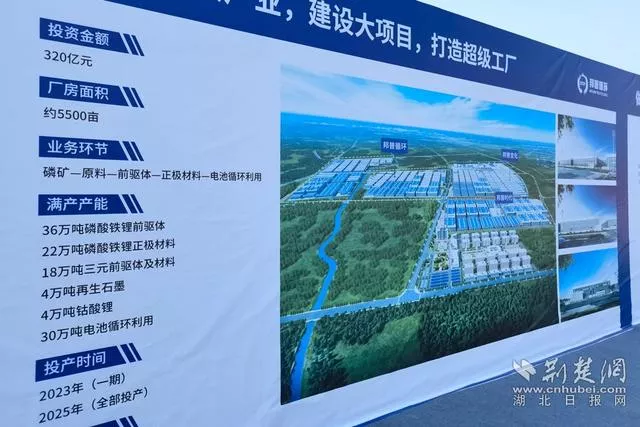

At present, CATL’s main focus in the battery recycling field is its subsidiary Bangpu in Guangdong.# Ningde Times New Energy Integrated Industry Project Kicks Off in Yichang, Hubei

In December 2021, the Ningde Times Bangpu integrated new energy industry project, located in Yichang, Hubei, officially started, covering the entire life cycle of batteries and integrating multiple links such as “phosphate mines, raw materials, precursors, positive electrode materials, and battery cycles”.

According to the project plan, the full capacity production will reach 360,000 tons of lithium iron phosphate precursors, 220,000 tons of lithium iron phosphate positive electrode materials, 180,000 tons of ternary precursors and materials, 40,000 tons of recycled graphite, and 40,000 tons of lithium cobaltate after completion in 2025. This will effectively help China alleviate the external dependence on key battery materials such as nickel, cobalt, manganese, and lithium.

However, this is just a factory.

(4) Connecting Power and Energy Storage Services

Ningde Times is not satisfied with being just an electric vehicle battery supplier.

In 2021, Ningde Times Chairman Zeng Yuqun stated at a speech at Shanghai Jiao Tong University that putting batteries on cars is the foundation of Ningde Times, but they do not want to be defined as a pure electric vehicle battery manufacturer.

Zeng Yuqun elaborated on three development directions for Ningde Times.

The first is to regard power batteries as the core and to replace mobile fossil fuels with them. For example, devices such as cars or robots that move require batteries. Batteries are high-efficiency energy storage devices.

The second is to combine energy storage and power generation fields, especially new solar cell technology, to replace fixed fossil fuels, such as coal-burning power plants.

The third is to collaborate on intelligence and electrification in specific fields.

Undoubtedly, Ningde Times has already done very well in the first direction. In the non-automotive battery field, Ningde is also actively exploring.

In the second direction, Ningde Times has collaborated with State Grid Energy Conservation Company, Kstar, Yongfu, and KuaiBo New Energy to explore energy storage units participating in grid peak load regulation, and research and develop applications of photovoltaic, energy storage, and charging products to cultivate the photovoltaic + energy storage field.

After Ningde Times does battery swapping, especially after building a large-scale battery swapping network, there will be greater opportunities and space for energy storage and power generation.

The battery swapping network itself is a heavy electricity user and may impact the power supply capacity of the grid. However, the battery pack in the battery swapping station is a natural energy storage device. Technically, the battery swapping network has the ability to help urban power grids with peak load regulation.

In the battery swapping station, Ningde Times can also build small-scale photovoltaic power plants to supplement the power grid.

In addition, after the current electricity sales market is opened up, Ningde Times can directly purchase green electricity for charging in the battery swapping stations, thereby influencing the behavior of upstream power plants.

In the power generation end, transmission and distribution end, and power consumption end, Ningde Times can participate in energy storage businesses. In the process of the whole human society moving towards green electricity, Ningde Times’ opportunities are not limited to the energy storage of electric vehicles.## Ningde era after changing the battery

“Today’s press conference is just the first step from 0 to 0.001,” said Chen Weifeng.

The 0.001 mentioned by Chen Weifeng is in relation to the large space of Ningde era’s battery swapping and related businesses.

Regarding only the battery swapping network, Chen Weifeng disclosed that Ningde era “hopes to build the largest global service network in the next two to three years.”

As deduced above, after taking a small step, if Ningde era’s plan can be smoothly implemented and approved by consumers and the industry, it will mean:

more incremental battery sales;

disruptive business models;

alleviation of raw material supply issues;

more involvement in energy storage and power generation businesses.

The scenery should be viewed from a long-term perspective. The imagination space of the “Ning King” battery swapping is vast, and its effectiveness needs continuous observation.

However, it is evident that the “Ning King” is not resting on its laurels and is still expanding its territory.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.