Analysis of China’s Pure Electric Passenger Vehicle Adoption and Manufacturers’ Progress

I was quite busy today and now I have some time to write an article. Let’s do a simple analysis of data to show everyone the current adoption rate of pure electric passenger vehicles in China, as well as the actual situation of different manufacturers’ progress.

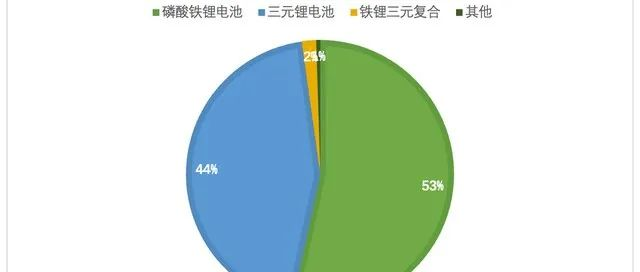

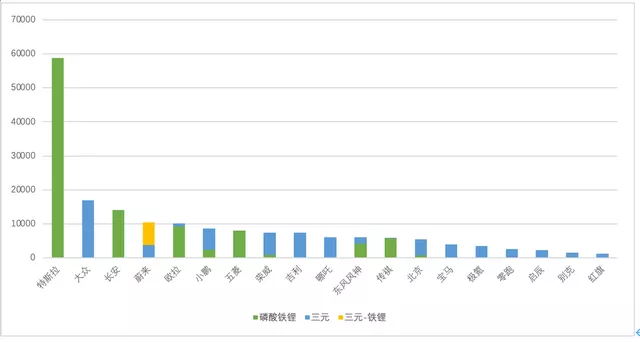

Overall, among all pure electric vehicles, ferrous phosphate lithium batteries account for 53%, and ferrous lithium-ternary hybrids are also starting to increase, with ternary accounting for only 44% of the market share.

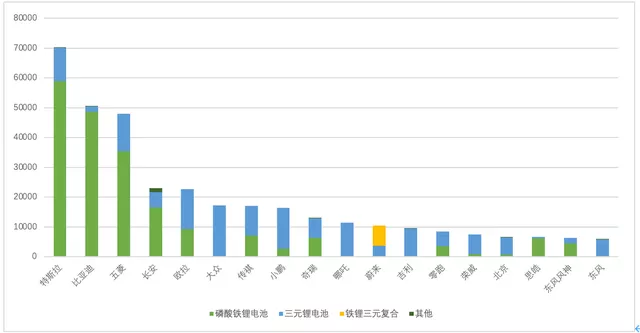

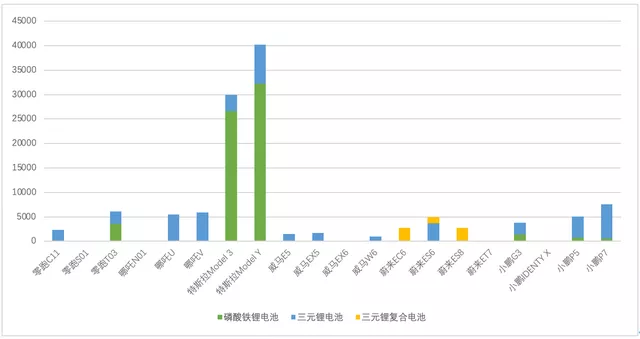

Looking at the overall data, in December, Tesla, BYD, and Wuling made rapid progress in ferrous lithium transformation, followed closely by Changan and Ora. Meanwhile, most other car manufacturers are still in the planning stage.

Ferrous Lithium Transformation Speed of Major Enterprises

Currently, Tesla’s application and improvement ratio in ferrous phosphate lithium batteries are the fastest, as shown in Figure 3. This accounts for the vast majority of new car manufacturing.

NIO’s 75kWh ternary composite battery currently accounts for roughly half of the total.

XPeng is currently unable to effectively obtain enough ferrous phosphate lithium production capacity, so most of their batteries are based on ternary batteries. Leading Ideal One (Li One) has acquired a lot of ferrous lithium cores, so their ferrous lithium transformation rate is relatively fast.

Here, I have classified the major enterprises assisted by CATL in deploying ferrous lithium, and you can see the supply and distribution of ferrous lithium and ternary to different automobile manufacturers in the figure below.

Energy Density and Mileage Data

● Mileage Data

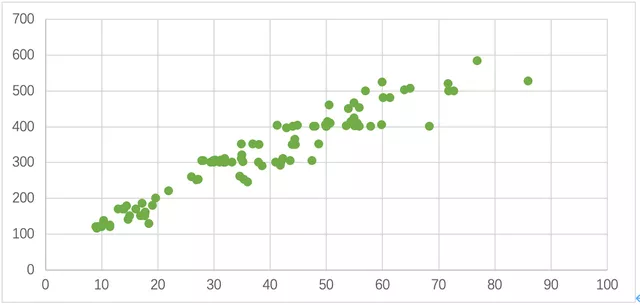

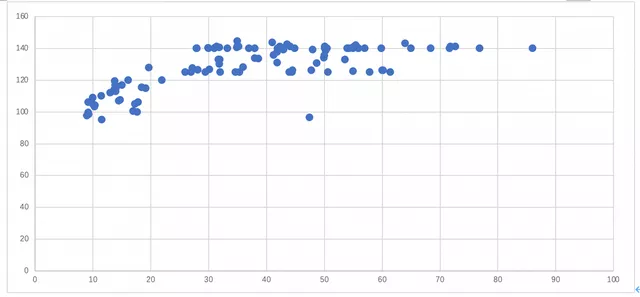

Looking at it now, ferrous phosphate lithium covers a range of about 500 kilometers:

Linear coverage of 100-200 kilometers on a 10-20kWh line; many products fall under the 300-kilometer subsidy line; then there is a range of 300 kilometers, 400 kilometers, and 500 kilometers; and the current highest coverage is 600 kilometers.

Note: We predict that the next generation of ferrous phosphate lithium blade improvement can increase the coverage to 700 kilometers.

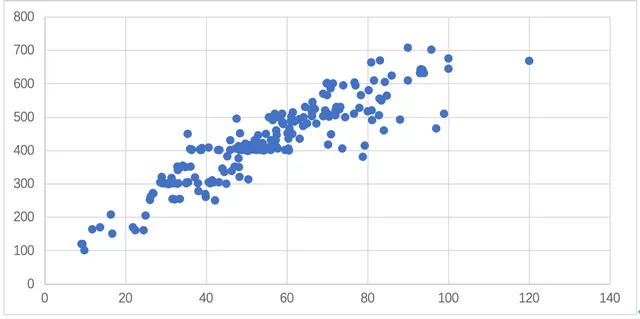

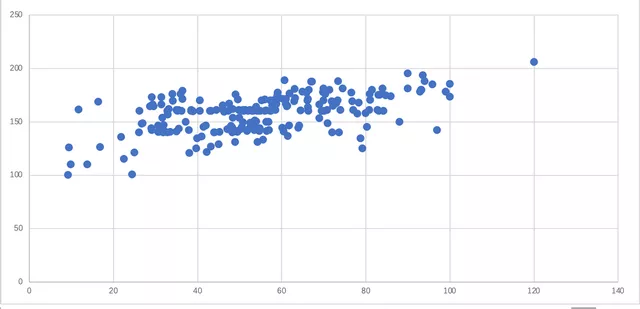

Figure 6 shows the current situation of ternary materials. The biggest problem of ternary compared to lithium iron phosphate is that while it can achieve a range of up to 700 km, it is mostly reliant on battery products of around 100 kWh. The cost is quite prohibitive for products below 20 kWh without subsidies. There are many products with ranges around 300 km, 400 km, 500 km, and 600 km. I believe that there needs to be a large-scale transition to lithium iron phosphate in order for it to be effective.

This is the product situation of CATL, which is a combination of the above two diagrams.

● Energy Density

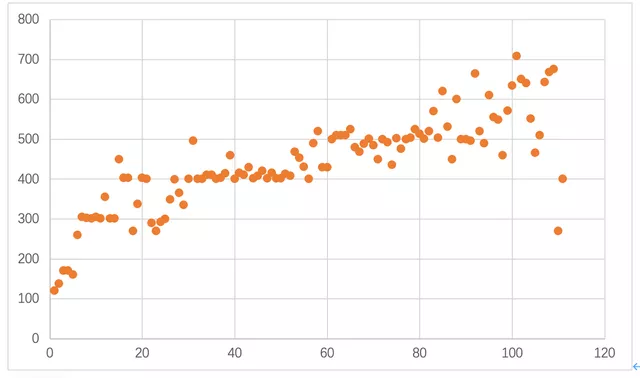

The increase in energy density of lithium iron phosphate packs is relatively fast, making it a quick substitute for ternary materials, as shown in Figure 8 below. Currently, the energy density of lithium iron phosphate is around 140Wh/kg.

Figure 9 shows the energy density of ternary materials, which is currently still below 200Wh/kg.

In summary, I believe that the transition to lithium iron phosphate will further accelerate next year, which is really something that cannot be changed in the short term.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.