Author: Wang Lingfang

The China Association of Automobile Manufacturers (CAAM) has raised its prediction for new energy passenger vehicle (NEPV) sales to 5.5 million for 2022, with the overall NEV sales expected to reach 6 million.

On January 11, 2022, the CAAM held an online press conference for December to announce the sales data of NEVs for December and the full year, and made a forecast for the market in 2022. The sales prediction for NEPVs was raised from the original prediction of 4.8 million to 5.5 million.

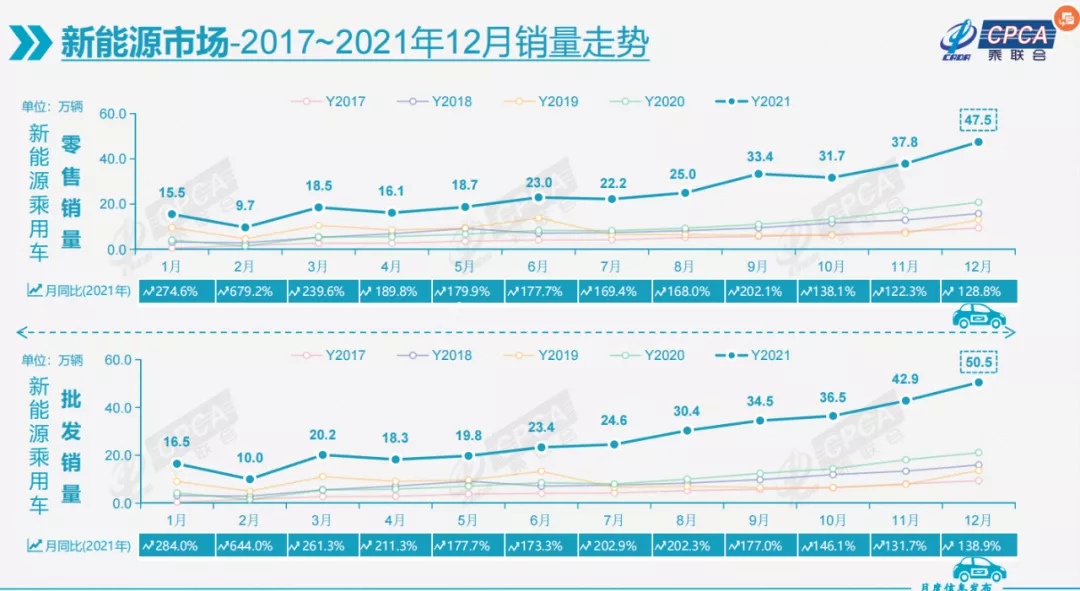

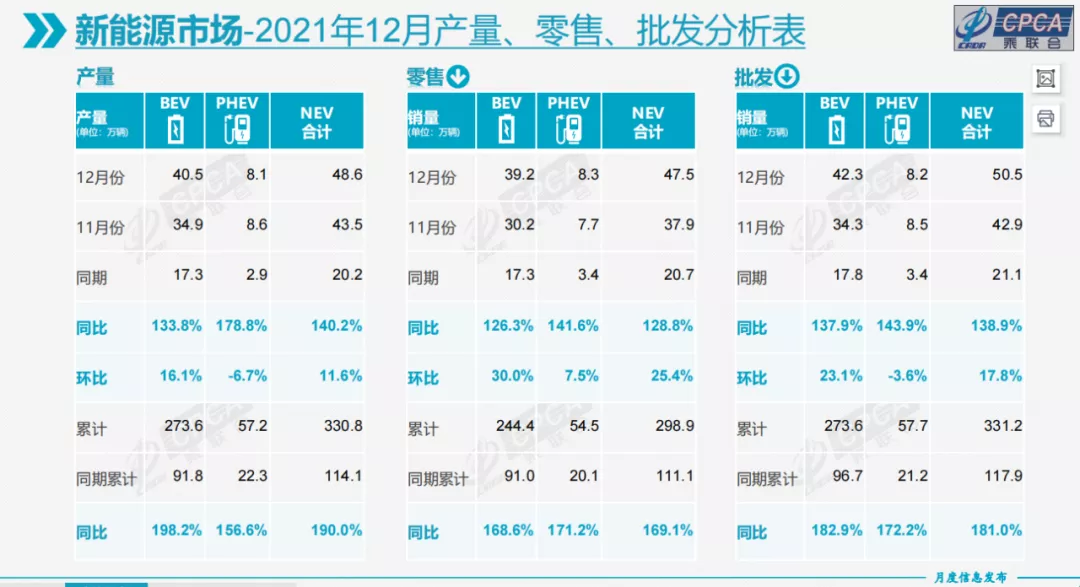

According to the CAAM, the wholesale volume of NEPVs reached 505,000 units in December, a year-on-year increase of 138.9%, and the wholesale volume of NEPVs for the full year was 3.312 million units, a year-on-year increase of 181%. The retail sales of NEPVs in December reached 475,000 units, a year-on-year increase of 128.8% and a month-on-month increase of 25.4%; the total retail sales for the full year were 2.989 million units, a year-on-year increase of 169.1%.

The wholesale penetration rate of NEVs for December was 21.3%, and the penetration rate for January to December was 15.7%; on the retail side, the domestic penetration rate of new energy vehicles (NEVs) for December was 22.6%, and the penetration rate for January to December was 14.8%.

Obvious end-of-year push in December NEV market

From the wholesale volume of CAAM, it can be seen that the wholesale volume of NEPVs has reached and stabilized at the level of 300,000 units since August. After reaching 429,000 units in November, it directly increased to 500,000 units in December. Correspondingly, the retail sales volume has also entered the level of 300,000 units since September, and nearly reached 500,000 units in December.

In the view of CAAM Secretary-General Cui Dongshu, NEVs have already formed distinct and differentiated characteristics compared to traditional fuel vehicles, and NEVs have achieved partial substitution effect in the fuel vehicle market.

(1) Prominent pull of pure electric vehicles (EVs) in December, with a slight decline in plug-in hybrid EV (PHEV) production

According to the CAAM, the production, retail sales, and wholesale volume of pure EVs in December were 405,000, 392,000, and 423,000 units, respectively, with month-on-month growth rates of 16.1%, 30%, and 23.1%, respectively, and year-on-year growth rates of around 130%.

In terms of PHEVs, the production, retail sales, and wholesale volume of PHEVs in December were 81,000, 83,000, and 82,000 units, respectively, with year-on-year growth rates of 178.8%, 141.6%, and 143.9%, respectively; the month-on-month rate of production and wholesale volume was negative, only the retail sales volume increased by 7.5%.Cui Dongshu said that this was mainly due to the impact of the Xi’an epidemic, and the production and wholesale of plug-in hybrid models were slightly affected, resulting in losses caused by the epidemic.

(2) The penetration rate of new energy vehicles exceeded 20% in December.

In terms of wholesale volume, the penetration rate of new energy vehicles reached 21.3% for manufacturers in December, and the penetration rate for January to December was 15.7%, which was a significant increase from only 5.8% in the same period last year. In December, the penetration rate of independent brand new energy vehicles was 35.2%; the penetration rate of luxury car new energy vehicles was 27.2%; and the penetration rate of mainstream joint venture brand new energy vehicles was only 3.7%. In December, the wholesale sales volume of pure electric vehicles was 423,000 units, a year-on-year increase of 137.9%; the sales volume of plug-in hybrids was 82,000 units, a year-on-year increase of 143.9%, accounting for 16%.

Cui Dongshu analyzed the sales of high, medium, and low-end new energy vehicle models in December and believed that the dumbbell-shaped structure in the pure electric vehicle market has improved, with a strong increase in the sales of high-end models and relatively strong trends for medium and low-end models. The wholesale volume of A00-level models was 139,000 units, accounting for 33% of the pure electric vehicle market; the wholesale volume of A0-level models was 60,000 units, accounting for 14% of the pure electric vehicle market; A-level cars accounted for 25% of pure electric vehicles and rebounded from the bottom; and B-level cars reached 114,000 units, a month-on-month increase of 25%, accounting for 27% of pure electric vehicles.

In terms of retail, the domestic retail penetration rate of new energy vehicles in December was 22.6%, and the penetration rate for January to December was 14.8%, a significant increase from the 5.8% penetration rate in 2020. In December, the penetration rate of new energy vehicles for independent brands was 39%; the penetration rate of new energy vehicles for luxury brands was 32.7%; and the penetration rate of new energy vehicles for mainstream joint ventures was only 3.3%.

In December, exports of new energy vehicles remained strong, with SAIC passenger cars exporting 5,716 new energy vehicles, Geely automobiles exporting 637 vehicles, BYD exporting 563 vehicles, Tesla China exporting 245 vehicles, Great Wall Motors exporting 203 vehicles, and other automakers mainly focusing on the domestic market for new energy vehicles.

Independent traditional automotive enterprises had bright spots, and new forces performed well overall.

Cui Dongshu said that the traditional automotive enterprises had bright spots in December, and the overall new energy vehicle market showed diversified growth. SAIC and GAC performed relatively well. BYD’s pure electric and plug-in hybrid dual-wheel drive vehicles performed well.14 companies in the automotive industry have exceeded 10,000 units in wholesale sales, showing significant growth compared to the previous period, including BYD with 93,338 units, Tesla China with 70,847 units, SAIC-GM-Wuling with 60,372 units, Great Wall Motors with 20,926 units, Chery Automobile with 20,501 units, Geely Automobile with 16,831 units, XPeng Motors with 16,000 units, SAIC Passenger Vehicle with 14,868 units, GAC Aion with 14,500 units, Ideal Automobile with 14,087 units, FAW-Volkswagen with 11,213 units, NIO with 10,489 units, Changan Automobile with 10,404 units, and Hezhong Automobile with 10,127 units.

In terms of new energy vehicle companies, in December, Xpeng, Ideal, NIO, NETA, Leapmotor, and WM Motor performed well in both year-on-year and month-on-month sales. Especially Xpeng, Ideal, NIO, and NETA have all exceeded 10,000 units in a single month, and second-tier companies such as Leapmotor and WM Motor are also quickly increasing sales, with monthly sales of more than 5,000 units.

Among mainstream joint ventures, new energy vehicles from FAW-Volkswagen and SAIC Volkswagen accounted for 46% of mainstream joint ventures with 19,498 units sold, showing Volkswagen’s firm electric transformation strategy is bearing fruit. SAIC-GM-Wuling and BMW Brilliance’s new energy vehicle sales also exceeded 5,000 units, while other joint ventures and luxury brands have yet to exert their efforts.

New energy subsidies remain a major benefit, and there will be no large-scale price increases

It was originally expected that new energy passenger vehicle sales would reach 4.8 million units in 2022. However, this number is expected to be adjusted to over 5.5 million units, with new energy vehicle penetration rate reaching about 25%.

In addition, given that new energy vehicles are already standing on the threshold of 500,000 units at the end of the year, Cui Dongshu believes that new energy vehicles are expected to exceed 6 million units, with a penetration rate of about 22%.

Cui Dongshu’s expectations are based mainly on two factors: the subsidy policy framework and threshold requirements remaining unchanged, and scale reduction. The latest subsidy policy keeps the current purchasing subsidy technology index system framework and threshold requirements unchanged in 2022, but the subsidy scale is not limited to the previously expected 2 million units, and will continue throughout the year. With the doubling of the scale of the new energy industry chain and the improvement of cost reduction capabilities, it is expected that the new energy vehicle increment at the end of 2022 will be very strong.

As the subsidy standard remains unchanged and battery and vehicle integration technology is improving, it is mainly policy-driven growth of the new energy vehicle industry on a large scale, reflecting the policy’s strong support for low-carbon industries and promoting the transformation of the traditional fuel vehicle industry.

New energy passenger vehicle sales in China in the fourth quarter of 2021 reached 1.3 million units. Cui Dongshu believes that with the significant increase in domestic consumers’ recognition of the new energy market and the stable strength of policy subsidies, the total sales of new energy vehicles in China in 2022 will inevitably surge, maintaining a super-strong leading position with over 50% market share worldwide.For the situation where raw material price hikes push up terminal prices, Cui Dongshu is not worried. He believes that the likelihood of mass price increases for new energy vehicles is not great from an objective perspective. Currently, new energy vehicles are in a rapid growth period, and the scale will reduce costs. Although the cost of batteries is difficult to decrease rapidly, the rapid rise in lithium resources is a mismatch issue and not a supply shortage. Battery companies will also compete for mines, and when demand stabilizes, raw material prices will fall sharply.

Car companies are not very willing to increase prices subjectively, and there is great competitive pressure among them. The new energy vehicle market is not an oligopoly. In addition, the market for traditional fuel vehicles is still large. Consumers will not buy new energy vehicles at too high prices.

In addition, Cui Dongshu mentioned the problem of the high cost of insurance for new energy vehicles. The result is that the saved fuel cost of new energy vehicles has to be used to pay insurance premiums, which seems uneconomical and creates a phenomenon where one can afford to buy but not use them. It increases the purchase concerns of price-sensitive consumers and the difficulty of selecting insurance types (considering the degree of dispersion of additional insurance types), which is not conducive to the promotion of new energy vehicles.

Therefore, Cui Dongshu suggested that on the basis of big data accumulation, car companies need to establish their own insurance products. With the new technology improvement of new energy vehicles and the continuous improvement of traffic department and other department’s efforts to improve road traffic environment and efficient law enforcement, insurance companies may have more accurate insurance rate calculations and insurance plan recommendations. He also expects national policies to support reasonable subsidies for insurance costs, enabling more consumers to save money and worry by buying new energy vehicles.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.