I want to intersperse a brief overview of the insurance data for new energy vehicles in recent industrial articles, with more detailed analysis later on.

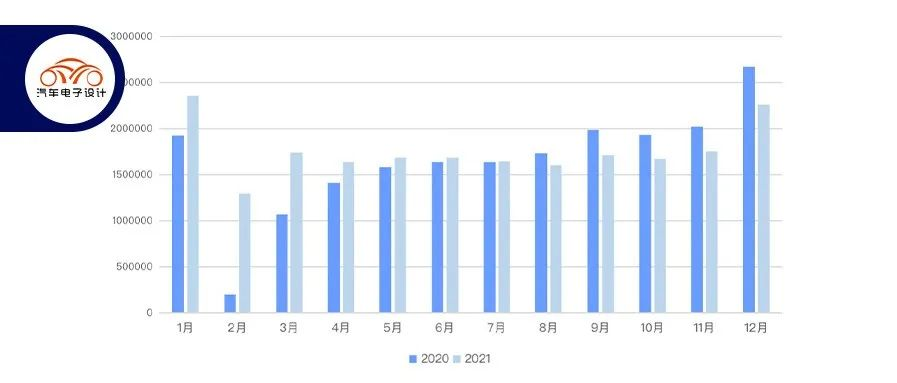

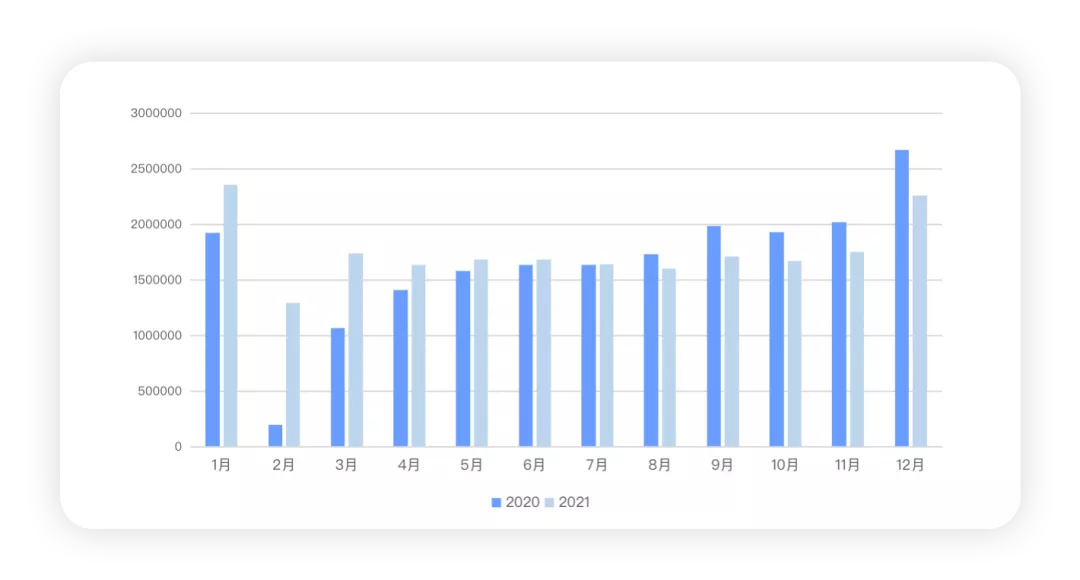

Overall, chips still have a significant impact on China’s terminal market: the entire insurance data for passenger cars in December was 2.2636 million units, which was 15.29% lower than the 2.672 million units in 2020, making it the lowest number since 2016.

Looking at the whole year, the final total number for passenger car insurance data was 21.0768 million units, which was basically the same as in 2019.

Overall Situation

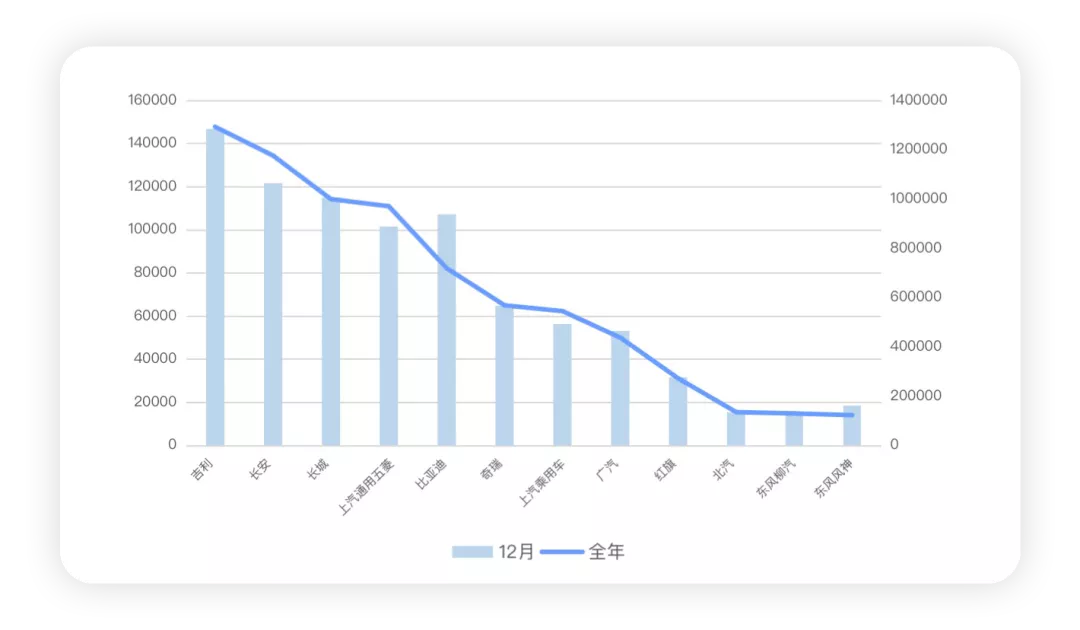

Figure 2 shows the situation for independent brands:

There are five companies that reached 100,000 units per month, including Geely (147,000 units), Changan (121,600 units), Great Wall (114,900 units), SAIC-GM-Wuling (101,400 units), and BYD (107,000 units), respectively, the cumulative insurance data for these five companies was 1,294,000, 1,177,000, 1,000,000, 971,000, and 719,800 units, respectively.

The second-tier mainly includes Chery (64,700 units), SAIC Motor Passenger Vehicle (56,300 units), GAC, and Hongqi (31,500 units), with a cumulative total of 569,000, 546,000, 438,000, and 272,000 units in 2021.

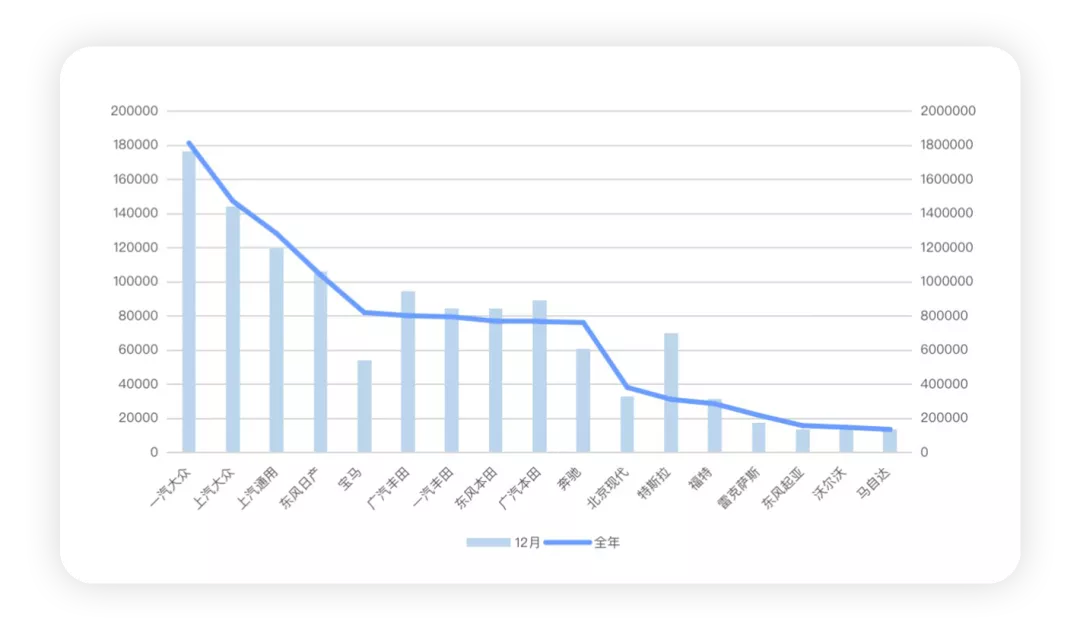

The situation for foreign-funded enterprises is as follows:

FAW-Volkswagen (176,000 units), SAIC-Volkswagen (144,000 units), SAIC-GM (119,800 units), and Dongfeng Nissan (106,100 units) had total annual volumes of 1.815 million, 1.4745 million, 1.284 million, and 1.0423 million units, respectively. BMW, Guangzhou Fengshen, FAW Toyota and two Honda companies, and Mercedes-Benz had insurance volumes ranging from 760,000 to 820,000 units.

The cumulative insurance volumes for Korean vehicles have been reduced to 530,000, Ford has rebounded slightly to 286,000, and Tesla has exceeded 320,000 units.

Overall, various automotive companies are still affected by chips.The biggest challenge in data analysis currently lies in that wholesale quantities often precede terminal sales. It is difficult to accurately gauge the true situation of this bulk optional consumption in automobiles and the recent impacts of the economic environment through wholesale data, which remains a challenge for us to discern. Since September, the year-on-year comparison has remained at a suboptimal -15%.

The situation of some new energy vehicles

I’ll discuss some typical companies here. Tesla, for instance, had over 70,000 vehicles insured in a single month, of which nearly 30,000 were Model 3 and 40,000 were Model Y. Total insured vehicles accumulated domestically for 2021 were 322,000, representing an increase of 118.6% compared to 147,000 in 2020. This is a very impressive statistic.

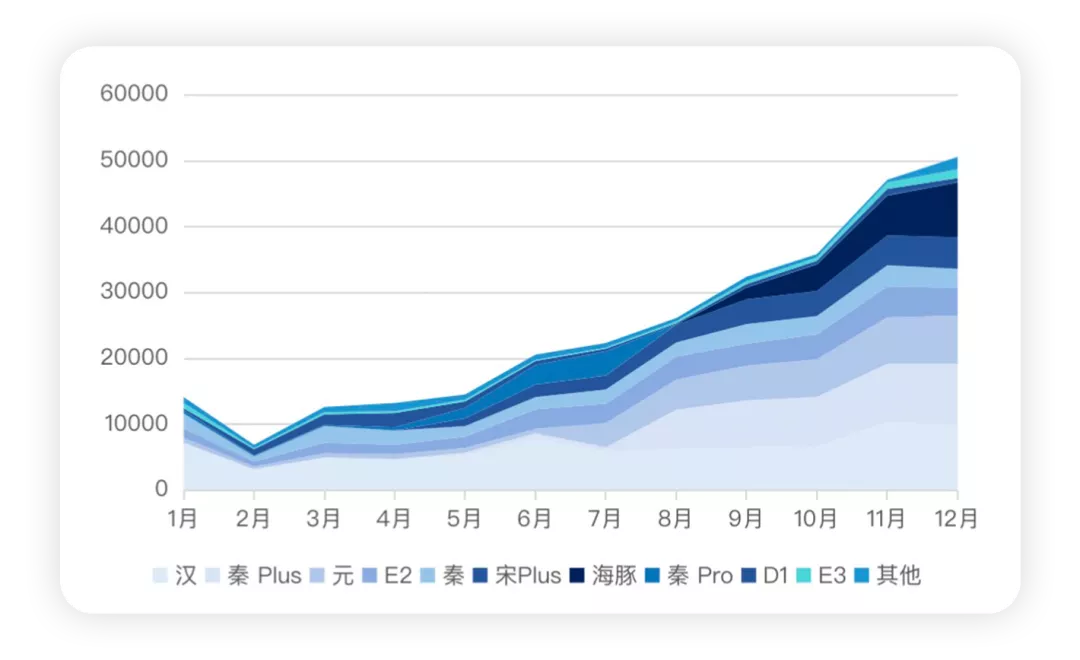

By contrast, BYD’s insured vehicles for a single month exceeded 107,200, of which 50,000 were BEV, 44,400 were PHEV and 12,000 were gasoline vehicles. The total counts for the entire year were 296,600 for BEV, 229,000 for PHEV, and 193,000 for gasoline vehicles.

Note: In 2022, gasoline vehicles will almost completely switch to PHEV.

Looking at the entire year, Qin DM-I had 83,400 units, Tang DM-I had 46,100 units, Song DM-I had 63,700 units, and Han PHEV had 30,000 units.

For purely electric vehicles, the entire year saw 78,700 units for Han EV, 40,000 units for Qin Plus, and subsequent models Yuan and E2 with 37,500 units and 32,000 units respectively, with Qin Plus, Song Plus, and Dolphin at 27,500 units, 24,700 units and 20,000 units respectively.

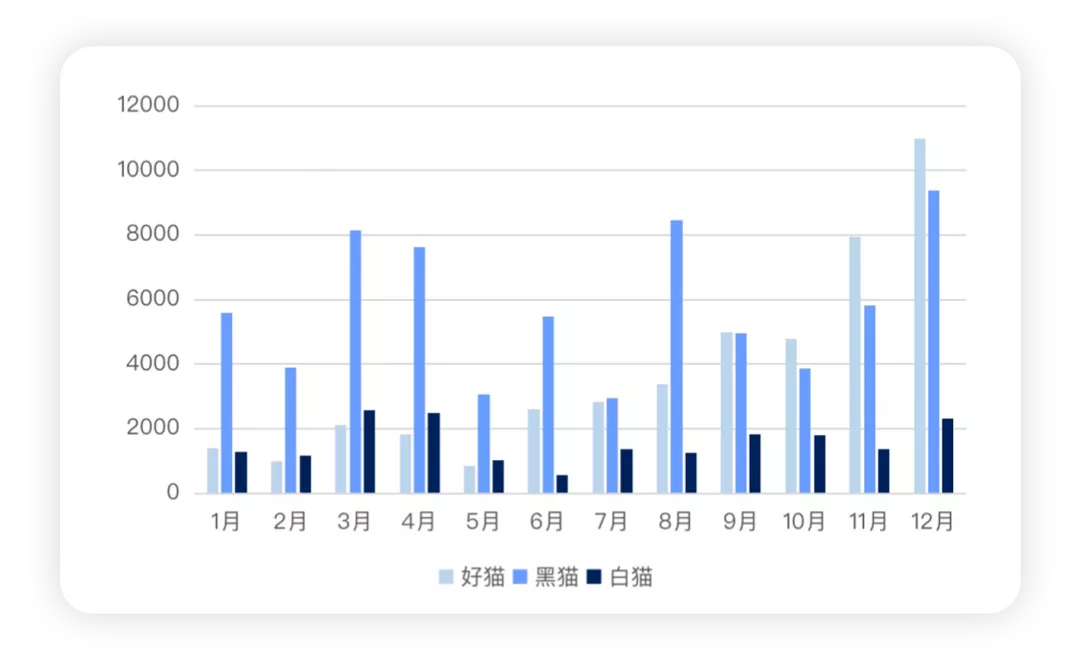

In traditional automotive companies, ora has completed a transformation from black cat to good cat – with good cat sales exceeding 10,000 units in a single month.

In 2021, black cat sold 69,000 units, white cat sold 19,000 units, and good cat achieved sales of 44,600 units, with a total of 132,900 units.

Summary: I will write about other information after I receive the complete data. Here is a summary of the terminal situation for everyone to see.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.