History and Changes of Wuhan Auto Industry

Authored by: Leng Zelin, Zhang Jin

Edited by: Wang, Pan

At the confluence of the Han River and the Yangtze River in history, three important towns, Wuchang, Hankou, and Hanyang were formed, and later merged to be named “Wuhan”. As the Han River travels upstream, passing by Jingmen and Xiangyang, Shiyan is on the mountainous area.

These two places have played a crucial role in the development of the automobile industry in Hubei, and the Dongfeng series is the protagonist that connects the whole story.

In 1969, FAW and Shiyan came together under the policy of the Third Front construction. The talents and capital from all over the country converged here, making this small town deep in the mountains rapidly grow into a modern automobile city. However, restricted by geographic location and transportation, Dongfeng’s development urgently needed expansion.

In pursuit of change, Dongfeng successively established auto bases in Xiangyang (formerly Xiangfan) and Wuhan in 1983 and 1992. The Wuhan base is not operated independently by Dongfeng, but is managed by the joint venture company, Shenlong, established by Dongfeng and French Citroen. The Wuhan Economic Development Zone was also established as a result.

It can be said that the two complement each other and sound the horn for the development of Wuhan’s passenger car industry. In 2016, Wuhan’s auto industry output value ranked sixth among major auto industry cities in China.

However, the changing times never come ahead of schedule for anyone. Just as the territory of the Byzantine Empire once spanned three continents of Asia, Europe, and Africa, and stood for a thousand years in the Mediterranean, it could also have a day when it could not keep the “Holy City”.

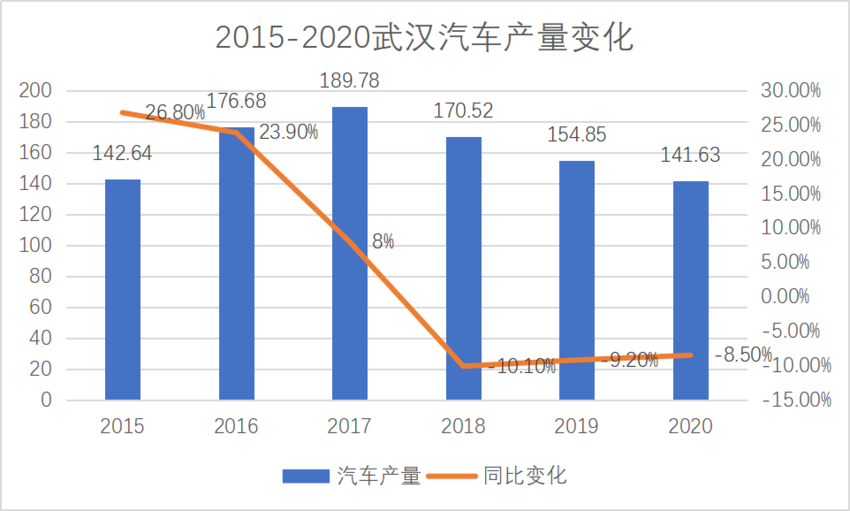

There has been a car company that saw its production capacity fall from over 700,000 to 50,000 in just five years. Wuhan’s auto production has also declined since 2017, and the outbreak of the pandemic caused its production to fall back to the level of five years ago.

However, there are always two sides to everything, and the pandemic is not only a wound to Wuhan’s auto industry, but also a catalyst for transformation.

An engineer from a car company in Wuhan told Photon Star that the development of Wuhan’s auto industry has been somewhat sluggish in recent years, but after the rapid growth of the national new energy vehicle penetration rate since the outbreak of the pandemic, Wuhan’s auto industry is also beginning to revive. The most obvious example is the large number of headhunting calls received by the engineer this year. Job hopping and transformation have become a common topic among auto industry professionals.

What changes has Wuhan’s auto industry undergone in the past two years? And how is it positioning itself in the field of new energy vehicles? For this, we have interviewed several auto industry practitioners in Wuhan to share the changes that this city is currently experiencing.

Rise of New Energy Vehicles in Wuhan

Lu Wei, who has worked in R&D in the main engine factory and the auto supply chain in Wuhan, recently moved to Lotus in the fall of 2021 to enter the field of new energy vehicles. Lotus had just arrived in Wuhan last summer.Starting in the summer of 2021, Lu Wei has been receiving calls from headhunters at a frequency several times higher than before. Almost every well-known company in the industry has made an offer to him.

Among them, what impressed him most was that the auto companies spared no expense to “poach talents” from other provinces.

As the penetration rate of new energy vehicles continues to rise, talents in the auto industry have become “hotcakes”. Wuhan, the famous auto city, has become the “backyard” for auto companies to recruit talents. NIO and XPeng invited Lu Wei to work in Shanghai and Guangzhou respectively, while BYD invited him to Shenzhen.

Lu Wei explained to Photon Planet that although the “three electric” parts of new energy vehicles have replaced the three major components of traditional fuel vehicles, new energy vehicle companies still need to poach a large number of talents from traditional companies. Many engineers who have worked with him have gone to work for new startups.

It is not only a salary issue, but for most people, state-owned enterprises, centrally-owned enterprises, and traditional auto companies are also synonymous with cumbersome organizations and slow decision-making.

The input and output of talents determine the survival of enterprises and also the rise and fall of cities.

In fact, as early as 2009, Wuhan City proposed the slogan of building the “capital of new energy”. This is also one of the first cities to propose the transformation to new energy. As an important auto company in Wuhan, Dongfeng also launched pure electric buses and hybrid cars in 2011 and 2012 respectively.

However, the problem with Wuhan is that it has never had a popular product or brand in the new energy vehicle field. Like NIO for Hefei, XPeng for Guangzhou, and Hongguang MINI EV for Liuzhou.

In early 2020, Hefei pulled NIO out of the water with a strategic investment of 7 billion yuan. A year later, NIO’s delivery volume continued to rise, and the new Qiao intelligent electric vehicle industrial park jointly planned and constructed by Hefei and NIO officially started.

The optimization of talents, capital, cost, efficiency, and local economic development in the New Bridge Intelligent Electric Vehicle Industrial Park has created a win-win situation for NIO and Hefei.

As early as 2016, NIO announced a strategic partnership with Hubei to build the Yangtze River NIO Intelligent New Energy Vehicle Industrial Park in Wuhan East Lake Development Zone. The planned investment for the park was no less than 20 to 30 billion yuan, including an annual output of 200,000 cars, R&D, and standard testing center. However, there were not many follow-up actions.

In the end, NIO settled in Hefei, and Wuhan lost a “big fish” that could have stirred up the local auto industry.

But is Wuhan really too far behind?

In the Economic Development Zone in the southwest of Wuhan, there is a 13-kilometer-long Dongfeng Avenue, with more than 20,000 companies distributed along the way, making it one of the most densely populated axis lines globally. In addition to vehicle companies and automobile assembly factories, there are also more than 500 auto part companies.# The Automobile Industry is an Important Pillar of Cities and Countries

The automobile industry is an important pillar of cities and countries. It takes more than just a few years of development to establish a complete system. The foundation laid by the efforts of Wuhan automobile people for decades has given confidence to Wuhan’s rise.

Against the backdrop of the development of new energy industries in various places, Wuhan is not willing to become a “relic” of the times. It is actively attracting investment to revitalize the entire automobile industry.

In the past two years, new brands such as Lotus, XPeng, and Nio have all laid out complete vehicle factories or supply chain enterprises here. However, at the same time, new forces that have fallen down such as Borgward, Youxia, Sailin, and Byton were once companies that many cities hoped for. Therefore, “internal mining” is also one of Wuhan government’s strategies in addition to “external attraction.”

In the summer of 2021, the Wuhan Economic Development Zone shouted the slogan of “Taking advantage of the East Wind and Setting up the Army Mountain, Starting Again for the Second Venture” . Junshan refers to the large and small Junshan between the Economic Development Zone and Hannan District, and Dongfeng refers to Dongfeng Group.

The Dream of Independent High-end Automobiles by Automobile People

As with the determination to move from Shiyan to Wuhan 20 years ago, as the most important automobile company in Wuhan, Dongfeng has also begun its “second venture” and the LanTu brand is an important part of it. It is not only the need for transformation to new energy, but also its sharp edge in breaking through high-end.

A senior director of the LanTu automobile told the Photon Planet that due to the innovation and desire for independent high-end of the entire Dongfeng Group, Dongfeng had been planning to create a high-end brand like LanTu in 2018. In July two years later, the LanTu brand was released in Wuhan, the headquarters of Dongfeng, and the product was released in Shenzhen in December. In August 2021, LanTu officially began delivery.

Thanks to Dongfeng’s more than 50 years of car-making experience, LanTu is one of the few new energy vehicle companies with high parallel R&D efficiency. It is also parallel R&D SOA architecture, 800V charging, SUV, MPV, and sedan. Just three months after the delivery of the LanTu FREE, LanTu released its second car, the Dreamer.

From decision-making to first delivery, it took LanTu only three years, and even from the brand’s release, it was only one year. Parallel R&D made the launch of the second product particularly rapid. This is not only a speed that central and state-owned enterprises find difficult to achieve, but even many private automobile enterprises find it difficult to reach.

In addition to the main engine manufacturers, automotive parts companies in the supply chain have also joined the battle for talent. Top companies such as BorgWarner, Magneti Marelli, and Cummins had all hoped to sit down and talk with Wang Yuan, who had worked for a certain engine company in Wuhan. But for Wang Yuan, the attraction of creating an independent high-end brand from scratch was more appealing than working for a more mature upstream supply chain company.

Independent high-end has always been the dream of many automobile people in China.In this round of new energy transformation, Hefei has not only laid the foundation for the automotive industry but also established NIO’s image as a high-end brand. Over the past three years, NIO’s average selling price has exceeded RMB 430,000, higher than BMW and Audi’s average selling price.

If NIO is the benchmark for new energy layout in Hefei, then Voyah, a state-owned enterprise with an independent high-end brand, is the benchmark for new energy layout in Wuhan.

Wang Yuan has chosen Voyah in this round of changes. For Wuhan’s automotive industry, the influence brought by Dongfeng’s development over the past few decades has already been ingrained in the bones of many car enthusiasts, more so than “imported” brands.

Dongfeng’s attempt on the high-end self-owned model Fengshen A9 is a exploration of high-quality upstream and downstream resources, which lays a solid foundation for the industrial research and development of Voyah and shaping the brand upwards. It also gives Wuhan’s automotive enthusiasts a sustained confidence in self-owned high-end vehicles.

Before the delivery of Voyah’s first SUV, Voyah FREE, Photon Planet was invited to Wuhan to exchange ideas with Voyah executives. Unlike the impression of a leader, Lu Fang would prepare to appear in the workshop at around 1:30 pm every day to check the situation of the offline vehicles. The leader’s first-hand experience can stimulate employees’ fighting spirit even more.

Voyah is not just a sub-brand but also a start-up company. According to Lu Fang, their goal has been to do something innovative since the company’s inception, to innovate in the system, and to inspire vitality and creativity in people.

In fact, Voyah has successfully broken through itself.

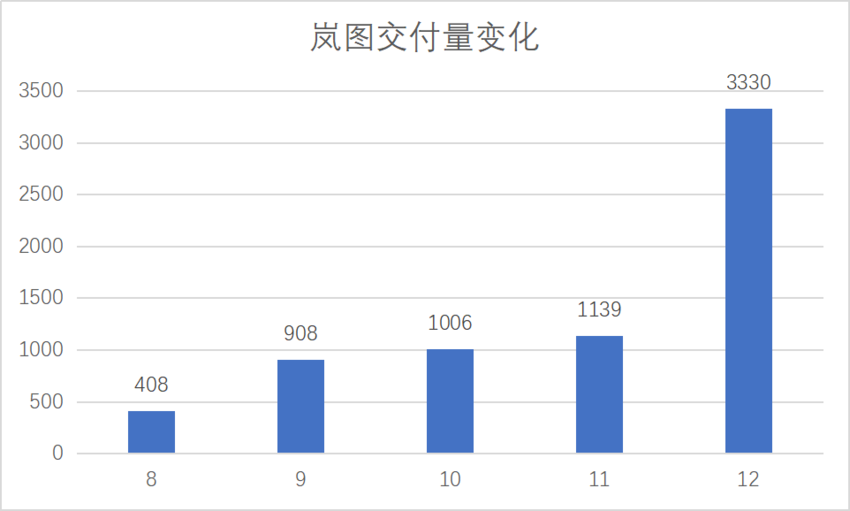

In December 2021, Voyah’s delivery volume reached a historic high of 3,330 vehicles, almost three times the delivery volume of the previous month and eight times the delivery volume four months ago. Voyah has pressed its own accelerator, and to some extent, this is a microcosm of the entire Wuhan automotive industry accelerating forward.

Among them, the statistical average transaction price for Voyah FREE, the first SUV, was RMB 338,600, which exceeds or equals high sales automakers in the new force sector, such as NIO. If NIO provides a model for private enterprises, then Voyah provides a feasible path for self-owned high-end brands of traditional automobile manufacturers and state-owned enterprises.

A senior Wuhan automotive practitioner shared with Photon Planet some opinions about local OEMs. Lotus hopes to become “Geely’s Porsche” someday, XPeng Motors is directly confronting Tesla, and Changan Nio Aviation hopes to become the next NCM. But Voyah is not the same. Instead, it is taking a bite out of the traditional BBA market share.

It is reported that 80% of Voyah’s users come from increased exchange purchases of luxury car users, of which the proportion of original BBA users is as high as 61%.

“SUV is a big cake, and for Landtu, occupying a certain share is enough. The traditional BBA sector has a relatively small user group for six or seven-seat vehicles, but for sedans such as BMW 3 Series, 5 Series, X3, Q5 and other large user groups, we are targeting that core segment,” said the senior director of Landtu to Photon Planet.

After the epidemic, factors such as capital, policy, technology, etc. have been continuously pushing the transition from fuel vehicles to new energy vehicles, stirring up the long-stagnant automobile manufacturing industry, and Wuhan’s automobile industry has also accelerated.

Central Enterprise’s Determination to Reform

In 2020, after the epidemic, China’s new energy vehicles began to boom, and Wang Yuan also saw this trend and chose to take the initiative to seek change.

According to Wang Yuan’s account to Photon Planet, in the past two years, many traditional fuel vehicle engineers have felt the impact of the times. “In a few years, it will be the era of electric cars, and we will all lose our jobs. Those who do engine R&D will probably lose their jobs too.”

However, the original organizational structure and thinking of the company have solidified, making it difficult to transform with the same energy as a startup company. “The engineers around me are all quite anxious, so everyone is seeking transformation, and basically everyone who can’t stay is moving closer to the new energy industry.”

Wang Yuan chose to jump to Landtu Automobile not only because Dongfeng is the backbone of the Wuhan automobile industry, but also because Landtu embodies a spirit of entrepreneurship that is different from the impression of central enterprises in the past.

Just as everyone in ByteDance calls each other classmates to eliminate barriers between superiors and subordinates and achieve flat management, Landtu also has its unique name inside — “teacher.”

With the help of the “teachers” around him, Wang Yuan mastered some changes in work skills in a few months. For him, who never liked to stick to the rules, he could get more of what he wanted here.

“You cannot use one technology for a lifetime. You always have to keep learning and adapt to the development of society.” From graduation to now, Wang Yuan has been constantly changing and learning, adapting to new jobs, and the set of things that haven’t changed for decades will eventually be discarded in this era of dramatic change.

In his view, this is a good thing. The acceleration of the electrification brings a new opportunity for both automakers and practitioners. Once seized, it may rewrite destinies.

“Both traditional car companies and new forces are accelerating the launch of new models, competing by speed.”

In the short term, new models in the new energy market are the main driving force for delivery growth. The intensifying competition among automakers is increasing the speed of upstream suppliers.

“Because of the emergence of new forces, the competition in the entire automobile industry has become more intense, and our project cycles are constantly being compressed.” Zhang Fan, a engine designer at a traditional automobile manufacturer in Wuhan, has a noticeably heavier workload than in the past year.

Of course, no matter how much the R&D cycle is shortened, there is always a limit. While ensuring the speed of product launch, Landtu is also ensuring R&D investment.

Voyah FREE is based on the self-developed ESSA native electric architecture, and has not chosen the “oil to electricity” route, which saves time and money. In fact, in the first round of “oil to electricity” by BBA, consumers voted with their feet, showing a lack of interest in such products.

In addition, considering the user’s acceptance of pure electricity, ESSA architecture was designed to match two power modes from the beginning, so Voyah FREE has both a range-extender and a pure electric version. Voyah has also become the first automaker to adopt a dual power layout.

The changes brought by new forces are not only the acceleration of R&D cycle.

Many traditional car companies face some constraints in the face of the transformation to new energy, and the most intuitive feeling is that they are unwilling to break the original dealer system. For example, the transformation of traditional luxury brands such as BBA still cannot make up their minds to reform the host factory and dealers.

Nowadays, the definition of luxury brands is changing. Price and interior are no longer the top priority. The offline system and after-sales service will also be one of the factors that users define as high-end. After all, if you spend 500,000 yuan to buy a BBA, but cannot get the same treatment as the next-door 300,000 yuan car, the user’s previous concept will inevitably be shaken.

As a traditional automaker, Voyah has resolutely become the first state-owned enterprise to launch a direct sales system.

Of course, direct sales are not so easy to do. From the experience of new forces, a large investment of funds and manpower can hardly achieve rapid expansion of the offline system, but for Voyah, this is one of the “difficult but correct” things to create a high-end brand.

By the end of 2021, Voyah has opened 43 Voyah Spaces, 96 city showrooms, and 20 delivery and service centers, covering 24 cities nationwide.

Wu Qing, who once worked for a certain automobile supply chain company in Wuhan, told Photonic Planet that in his own experience, “it is very painful for traditional automakers to transform into new energy, after all, they have been lying on the merits for decades”.

He can already see what retirement will look like at the company. Every day is calm and unchanging, without any surprises or accidents. Thinking that if he doesn’t strive now, he will miss the opportunity, Wu Qing chose to go to Geely halfway, and finally returned to his hometown of Wuhan, also dived into Voyah. He saw Voyah’s determination and courage and felt that he couldn’t miss the opportunity to grow with the company.

Voyah is using its own actions step by step, changing the public’s impression of traditional automakers and state-owned enterprises.Although they come from different backgrounds, Wang Yuan and Wu Qing have the same surprise about one thing: the company’s emphasis on users from top to bottom.

Voyah’s Chief Brand Officer Ye Xin once stated directly, “the purpose of choosing a direct sales model is to connect with users.”

At Voyah, almost everyone maintains user feedback in the group and App, paying close attention to the user experience. Many middle and senior managers often call users to inquire about their feelings after delivering the car to improve the product.

The above-mentioned Voyah director told Guanzixingqiu that COO Jiang Tao also contacts users one by one. This is already a very rare thing, especially for organizations from state-owned enterprises.

The fact that senior executives call users is not as simple as it seems on the surface. Some people may think that this is just a surface display.

In response, Jiang Tao once told colleagues inside the company, requiring executives to make calls not to let them truly become customer service representatives. The education this round requires is not for users, but executives. Only when each responsible person has truly experienced the pain can they realize what a user-centered enterprise really is.

In addition, Voyah has made considerable efforts regarding organizational changes. “As an independently operated company doing comprehensive marketization, Dongfeng only provides guidance. Even though some managers come from Dongfeng Group, they all resign from their previous positions.”

All in all, Voyah is working hard to become a truly user-centered enterprise.

Last year, a user from Chongqing encountered a problem of a forward surge feeling in the car when pressing the brakes during a long downhill ride, which did not affect safety, but brought a bad driving experience. Therefore, the user reflected this problem to Voyah.

At this time, the results of Voyah’s organizational and ideological changes came into play. The engineers received the task quickly after work, immediately flew to Chongqing, and continuously replicated the user’s driving environment from midnight until 3:00 am. They tested and solved the problem repeatedly and even had supper with the user after solving the problem.

On the second day of non-stop work, several engineers still felt excited and eagerly sorted out data and submitted analysis reports, then took a plane back to Wuhan. They boarded the plane to return to Wuhan at noon.

Conclusion

In addition to Voyah, Wuhan’s accelerating auto industry also includes leading manufacturers such as Lotus and Xpeng Motors, as well as supply chain enterprises such as Zhongchuang Innovation Aviation.

According to Guanzixingqiu, Lotus has been recruiting heavily in Wuhan since the fourth quarter of 2021. The Wuhan office has rented a floor, housing financial, sales, accounting, and other positions. Some staff members have been relocated from Wuhan to the headquarters in Ningbo and will return to Wuhan after the new building is completed.

Not only the manufacturers and supply chains are accelerating themselves, but the Wuhan government is also accelerating to support the iterative development of the auto industry.On December 14, 2021, the first session of the Tenth People’s Congress of Hannan District, Wuhan City, was opened, pressing the “fast forward button” for “second entrepreneurship”. In the next five years, Wuhan Economic Development Zone will focus on the center goal of “China Car Valley” and “take advantage of Dongfeng and determine Junshan, second entrepreneurship and start again”, devoting itself to building a trillion-level Car Valley industrial innovation grand corridor.

For example, in order to make new energy projects land and take effect as soon as possible, Wuhan Economic Development Zone has joined hands with multiple departments to optimize the business environment and provide “waiter-style” personalized services for enterprises, helping projects to be quickly promoted.

Among them, the new energy battery company Zhongchuang innovation-hang landed in Wuhan, and the project took only two months from signing to construction. On the other hand, at the beginning of the year, Lei Jun just spoke about his “car-making dream” at the spring conference, and Wuhan Economic Development Zone announced that it had started to proactively connect with Xiaomi.

In the vast wave of new energy, from the upper-level government departments to the OEMs or suppliers, they are all breaking their inherent mechanisms and seeking change.

This generation of Wuhan auto industry professionals has greater ambitions and faster actions.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.