The Top 10 New Energy Vehicle Companies of 2021

By Lingfang Wang

As the Lunar New Year approaches, it’s time for the annual grand comparison of corporations. Which CEOs will have the loudest voices and most confidence at the banquet tables?

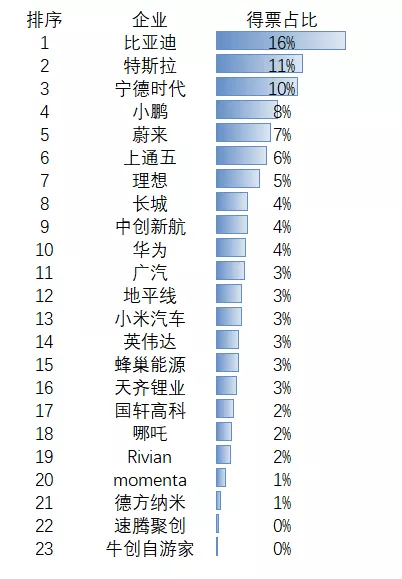

The Electric Vehicle Observer chose 20 new energy vehicle companies and suppliers that performed well in 2021, and held a vote among its readers to determine the top 10 companies of the year. The voting results are as follows:

In the following sections, we will discuss these top 10 companies and their highlights of 2021, ranked by number of votes.

- BYD: Targeting a Trillion-Yuan Market Cap with Various Concepts

BYD is expected to once again take the top spot in China’s new energy vehicle sales in 2021. From 2013 to 2020, BYD has won the sales championship of China’s new energy vehicles for eight consecutive years. This year, BYD’s DM-i hybrid models have become increasingly popular. According to recent insurance data, BYD’s hybrid and pure electric models are equally successful, making it one of the few companies with two successful lines.

BYD is also rapidly expanding its export and listing pace for core components in multiple markets worth trillions of yuan, including energy storage, batteries, electric vehicles, and chips.

With a market cap of 780 billion yuan at the end of this year, up from 150 billion yuan in 2020, BYD is now only next to Tesla and Toyota and ranks among the “Top Three” in market capitalization among global listed car companies. It’s only a matter of time before BYD reaches a trillion-yuan market cap.

- Tesla: Controversies Persist, Yet Inextinguishable

Despite ongoing controversies, Tesla’s global deliveries remained impressive, totaling 936,000 cars in 2021. Model 3 and Model Y are driving sales, with Model Y surpassing Model 3 to become the bestseller. Tesla’s Shanghai factory has also started exporting vehicles overseas, with over 90% of its supply chain localized in China. The positive momentum is still going strong.

- CATL: the Biggest Winner in the New Energy Vehicle Market

CATL has become the biggest winner in China’s new energy vehicle development, accounting for 50% of China’s power battery production and one-third of the global market share.

In 2021, CATL’s stock price skyrocketed to nearly 700 yuan, and its market capitalization exceeded RMB 1.6 trillion, with market value climbing rapidly by RMB 800 billion during the year. In July, as lithium prices continued to rise, CATL released its sodium-ion battery technology, which offered hope to automakers and battery companies by reducing reliance on lithium.# 2021: Expansion and Investment

In 2021, CATL announced a 58.2 billion yuan refinancing plan, which caused some controversy, but its dilution ratio was not significant compared to its market value of over one trillion yuan. In November, after facing inquiries from regulatory authorities, CATL denied “excessive financing” and adjusted the financing amount to no more than 45 billion yuan.

In addition, CATL has expanded its business to the battery swapping, energy, and chassis fields, which brings infinite imagination for future development.

4. XPeng: Leading New Chinese Enterprises

In November 2021, XPeng delivered over 10,000 vehicles for three consecutive months, with the highest monthly delivery volume reaching 15,600 units, a year-on-year increase of 270%, ranking first among new carmakers. XPeng had many historical moments in 2021, such as the listing of the G3i and P5 models, the debut of the G9 at the Guangzhou Auto Show, the listing on the Hong Kong Stock Exchange, the completion of the 100,000th vehicle, and the confirmation of revenue from the XPILOT autonomous driving software in the first quarter. As China’s first intelligent electric vehicle company to explore an all-stack self-researched system, the intelligentization is bringing greater dividends to this enterprise.

5. NIO: Truly Returning to Oneself

In 2021, NIO released the flagship sedan ET7 and the mid-size sedan ET5, which directly challenged Tesla’s Model 3. NIO’s proudest moment in 2021 was the release of the ET5 on NIO Day, with its explosively popular pre-orders that briefly crashed the app.

Of course, NIO also achieved some success abroad: it entered the Norwegian market for the first time in 2021, starting its first year of globalization. As for battery swapping stations, NIO increased its target for battery swapping stations from 500 to 700 on NIO POWERDAY and completed it ahead of schedule at the end of the year.

Although NIO did not have many big moves this year, according to NIO’s founder, chairman, and CEO William Li, “this is the year that NIO has a real opportunity to return to itself, including investment in battery swapping stations and NIO Houses”.

6. SAIC-GM-Wuling: Hongguang Mini EV Dominates the Market

There is no doubt that the Hongguang Mini EV was the best-selling electric car in China in 2021, which helped SAIC-GM-Wuling become China’s No.1 pure electric car company. This Chinese automaker’s global sales growth record is refreshed every 30 days. In November, the model sold 45,576 units, making it the sales champion in China’s new energy vehicle market for 15 consecutive months, with overall sales exceeding 500,000 units.

The success of SAIC-GM-Wuling has attracted more imitators, which is also a kind of praise for them.

- Ideal: One model dominates the subdivision market

Ideal dominates the subdivision market for monthly and annual sales with its only model, the Ideal ONE. In November, 13,485 units of the Ideal ONE were delivered, achieving delivery of over 10,000 units in the penultimate month, ranking first in the mid-size SUV sales chart for that month and leaving BBA behind.

Ideal Automotive is another “new car-making force” company listed on both the US and Hong Kong stock exchanges after XPeng Motors.

- Great Wall: ORA’s dominance, strong momentum of Salon brand and PHEV technology

In 2021, Great Wall’s new energy vehicle sales also entered the club of 100,000 units per company. Great Wall, which is well versed in category innovation, quickly conquered the minds of young female consumers with the ORA Cat series, achieving a significant increase in market sales. Great Wall also launched a new brand, “Salon,” at the end of the year, and unveiled its first vehicle, the “Mechanical Dragon”. Salon brand is positioned as a new automotive genre – mechanical technology category.

Through ORA and Salon, Great Wall’s layout in the low-end, mid-end, and high-end markets has become more complete.

On the technical level, Great Wall adheres to the strategy of “walking on two legs” of hydrogen power and electricity, and has multiple layout in battery, electric control, and intelligence fields. Its Honeycomb Energy has begun trading on the stock market and has firmly ranked among the top 10 Chinese battery companies. Undeniably, Great Wall has already made good foundation in the era of intelligent electric vehicles.

Great Wall, which is good at playing the “gender” card, will also massively market its PHEV technology which has been planning for a long time next year. The rising momentum of Great Wall continues.

- Zhongchuang Xinhang (CATL): Plans 1 TWh capacity by 2030

In 2021, Zhongchuang Xinhang planned to go public, and its installed capacity is already among the top three in China.

Its capacity construction is also very aggressive. After announcing the capacity plan in June at the “Global Partner Conference,” Zhongchuang Xinhang expanded its capacity plan again. The capacity in 2025 increased from 300 GWh to 500 GWh. It is expected to reach 1 TWh by 2030. This should be the first battery company to announce its TWh capacity plan.

This company, which won the “Ning Wang” customer and was sued by “Ning Wang” for intellectual property, has also gained a lot of attention this year.

- Huawei: Sworn to be an enabler of the intelligent automotive industry

Huawei, which “does not make cars,” has attracted the attention of the automotive industry with almost every move. The M5 model, which was just launched, has further brought Huawei closer to car manufacturing.The progress of Huawei’s non-vehicle business is also very good. In the past year, the development of Huawei Intelligent Automotive Solutions has attracted around 300 cooperation partners, exceeding expectations. The HarmonyOS is also about to be officially launched. In the field of intelligent automobiles, Huawei has always adhered to the “platform + ecosystem” strategy, launching the iDVP intelligent automobile digital platform, the MDC intelligent driving computing platform, and the HarmonyOS intelligent cockpit, providing these three digital foundations and development tools for intelligent automobiles, making it convenient and efficient for partners to develop and bringing consumers a better travel experience. The HI version of the HI-Phi Alpha S is about to be launched, and Huawei’s intelligent driving products are about to be mass-produced. At the same time, the AVITA, which is co-operating with Changan, has already been launched, and cooperation with GAC will also be fruitful. Huawei’s journey into the automotive industry is ambitious and controversial, but its achievements are not small.

2021 has already passed, and whether one feels proud or not has become history. Compared with the bigger future of smart electric vehicles, current achievements cannot determine the final outcome. We should continue to work hard when opportunities are ahead of us, believing that the stars will not let down the traveler.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.