Jia Haonan, sent from the copilot temple

Intelligent car reference report | WeChat Official Account AI4Auto

In the 2021 year-end report card, a start-up company clearly listed its revenue:

10 billion yuan in signed contracts in one year.

For the autonomous driving industry which often only talks about financing without mentioning revenue, this is truly a groundbreaking event.

This phenomenon itself is also a barometer of the industry.

From 2019 focusing on technology, to 2020 exploring business models, to 2021 beginning mass production, the autonomous driving industry is gradually maturing, and the biggest challenge for start-up companies has shifted from “surviving” to “thriving” .

Will “revenue” and “commercialization” become the new industry keywords in 2022?

What kind of commercial revenue?

It may come as a surprise to many that these orders are neither car sales nor a traditional source of revenue for selling autonomous driving solutions.

The 10 billion yuan contract mainly comes from smart city traffic systems and V2X infrastructure.

This includes the Hunan Hengyang smart transportation project, the Hebi project in Henan, and autonomous driving commercial projects in airports, universities, parks, scenic spots, and other scenarios in multiple provinces.

The company behind this is called Mogu Car Alliance.

Mogu Car Alliance was established at the end of 2017. It is still a start-up company under the “Baidu system”.

In the industry, Mogu Car Alliance has always been “covert” and operates in a low-key manner.

It wasn’t until 2021 when the Hengyang model for autonomous driving interpreted by Intelligent Car Reference was launched that the public began to have a more intuitive understanding of Mogu Car Alliance.

Through this model, we can catch a glimpse of the technology and product characteristics of Mogu Car Alliance.

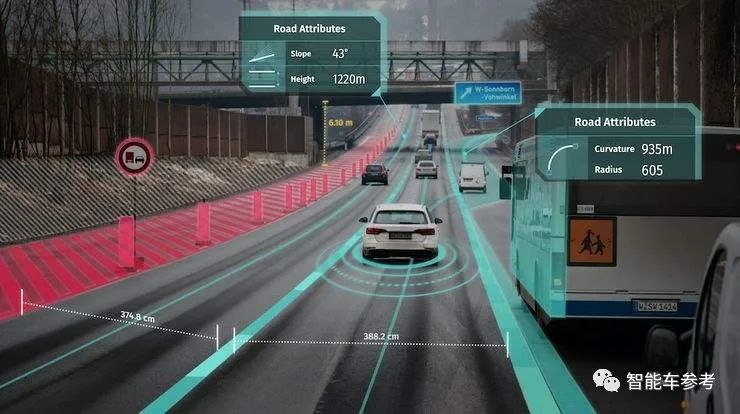

Simply put, the Hengyang model includes a whole set of products and services such as unmanned buses, RoboTaxis, unmanned sweeping cars, and delivery vehicles, among others. The most distinctive feature is the “vehicle-road-cloud integration” system.

From the perspective of Mogu Car Alliance’s own business, although there are various types of autonomous driving vehicles and corresponding fleet operations, it is more like a supporting part of the entire V2X solution or a component of the smart transportation infrastructure project.

It is indeed rare to see autonomous driving land in this manner.

Is infrastructure more profitable than car-making?

The commercialization of autonomous driving has also created a new path: infrastructure.

And this path may be more profitable than manufacturing cars or selling solutions.According to ITS114 statistics, in 2020 alone, the scale of China’s urban intelligent transportation market exceeded 100 billion yuan, with 32 projects awarded with a bid over one billion yuan (excluding parking projects), and the total market scale of projects awarded with a bid over one billion yuan was approximately 6.658 billion yuan.

Although the scale of the autonomous driving infrastructure market is currently not as large as that of car manufacturing or L2/L3 level intelligent driving solutions in absolute numbers, compared with such markets that are large but slow to earn money, smart transportation is relatively small but earns money the fastest.

In fact, this business can be understood as To G of autonomous driving.

The essence of intelligent transportation is the intersection of autonomous driving and infrastructure construction. Technology companies provide technologies such as autonomous driving and V2X, while infrastructure construction is of course led by the government.

At the national level, there is a top-level planning and design for intelligent transportation. At the local level, based on the stimulation and promotion of infrastructure and autonomous driving for the local economy, local governments have launched similar projects one after another in 2021.

For companies with relevant technological reserves, participation in such projects can be achieved with “light assets”, which eliminates complex supply chain management, production and manufacturing, quality management and other processes, making it more relaxed compared to car manufacturing.

Moreover, the number of places that carry out intelligent transportation construction in China is still limited, and with the maturity of technology and policy promotion, the market scale of about 100 billion yuan is destined to expand significantly in the future.

No wonder Li Yanhong listed infrastructure as one of the three ways for Baidu’s autonomous driving to make money.

2022 New Keyword for Autonomous Driving: Commercialization

Reviewing the annual keywords of autonomous driving in recent years, in 2019, it was still technology and muscle-showing.

In 2020, it turned into exploring commercial models.

In the just-passed 2021, mass production has become the question that autonomous driving players must answer.

From this trend, we can clearly see the process of autonomous driving from laboratory to mature commercialization.

In 2021, companies that surpassed the production line have a prerequisite for survival.

Therefore, in 2022, the revenue keyword will determine whether a company is doing well or not.

With relatively mature technology and basic understanding of commercial models, it is now time for companies to compete for market share.Mushroom Car Alliance announced a revenue of 1 billion yuan. Although it is far from enough to cover normal autonomous driving research and there is still a long way to go before the company turns a profit, this move itself illustrates that “revenue” has become an important reference for autonomous driving companies to prove their strength.

In fact, some autonomous driving companies have more or less disclosed revenue-related information in 2021.

For example, Hozon Auto, an autonomous driving company under Great Wall Motors, revealed that its total revenue reached “hundreds of millions of yuan” in 2021.

Meanwhile, Xpeng Motors, which is recognized for its intelligence and autonomous driving, announced during the 1024 event that the penetration rate of XPILOT 3.0 or above in the first three quarters of 2021 had reached about 60%.

Based on the sales volume of 56,404 cars in the first three quarters and the estimated subscription fee of RMB 36,000, the revenue generated by this system was at least more than 1 billion yuan.

Baidu has also disclosed quarterly that it has received over 20 million-yuan-level orders for autonomous driving business, most of which come from the Smart Transportation project.

Each autonomous driving player is trying to turn technology into revenue and build a positive feedback loop for themselves.

The commercialization of autonomous driving is becoming more complex and interesting.

Do you know any other autonomous driving-related players who have disclosed revenue or order information?

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.