CES 2022: Highlights on Intelligent Cockpit and Autonomous Driving

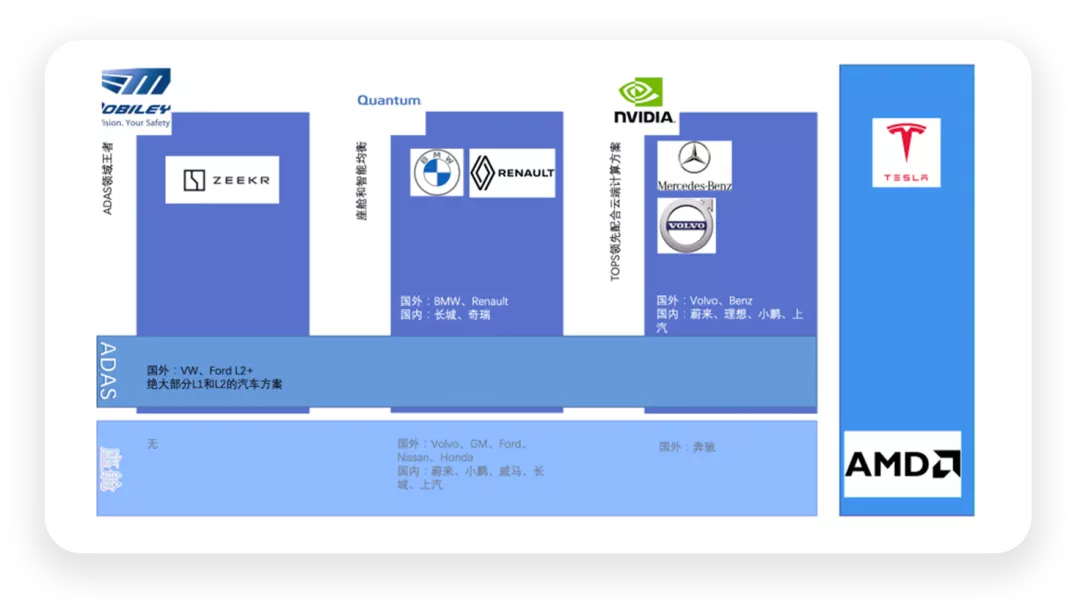

CES 2022 brought a lot of interesting things, with Intelligent Cockpit and Autonomous Driving being the main highlights of this event. The two fields have formed a quite interesting pattern, with Qualcomm being the leading supplier for Intelligent Cockpit and NVIDIA dominating Autonomous Driving.

Intelligent Cockpit

Qualcomm, as a leading supplier, is using this fortress to move towards Digital Chassis, which is the so-called Intelligent Driving.

Autonomous Driving

Mobileye’s core essence is to develop algorithms and chip-replacement proprietary solutions, which seem to be outdated in the current competition. Currently, NVIDIA is the dominant force in this field.

After starting the TOPS war, the computing requirements on the server side were raised, which means that a development path similar to Tesla’s edge computing and cloud computing collaboration is provided for automakers. At the same time, NVIDIA is also developing some high-end cockpit solutions.

Plans of various companies in CES 2022

Mobileye

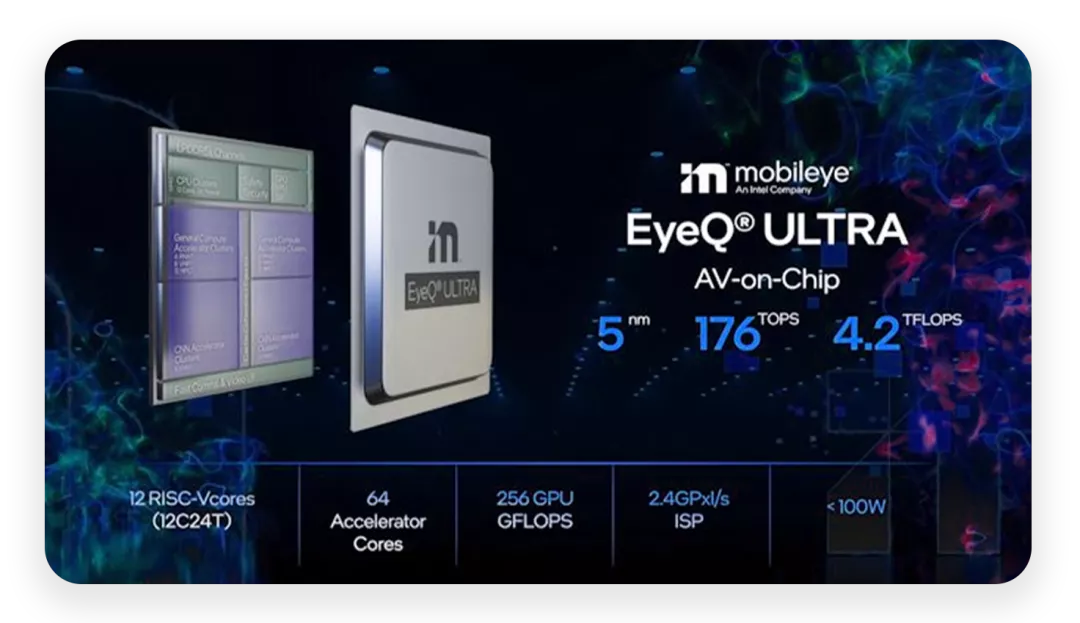

Intel’s intention to split Mobileye has revealed a sense of crisis. The next-generation L4 autonomous driving SoC, EyeQ Ultra, with 5nm process will be launched in 2025, aiming to achieve L4 autonomous driving (the basis for Robotaxi and other fixed-area vehicles, running in known and well-defined areas under limited weather conditions).

Previously, Mobileye’s L4 hardware solution was composed of 6-8 EyeQ chips, which is a cheap and evolutionary SoC for mass production market. The new EyeQ Ultra connects multiple cameras and other perception sensors with official performance data of 176 TOPS. From Mobileye’s perspective, vision-based autonomous driving is a relatively mature technical field, where ASIC can be constructed using highly specialized fixed functions (limited flexibility).

EyeQ Ultra’s internal cores include 12 RISC-V CPU cores, Arm GPU, Arm DSP, SIMD cores, VLIW cores CGRA (Coarse-grained reconfigurable array) cores, Deep Learning cores, and other different types of cores, with the last four groups containing Mobileye’s “proprietary accelerator”.

The starting point of Mobileye is centered around low cost and low power consumption. In terms of logic, the main competitor of this chip is Nvidia’s Atlan SoC (which will be launched at the same time in 2025). Atlan’s throughput of only SoC exceeds 1000TOPS. Nvidia’s high-throughput deep learning is indeed attractive to automotive companies.

The difference in TOPS throughput only reflects the difference in design philosophy between the two. Nvidia’s software-defined method and Mobileye’s specific task accelerator are two different paths. It is currently difficult to determine which method will produce better results.

Mobileye’s method is based on the technology direction and related autonomous driving algorithms accumulated in the past, while Nvidia has opened the door to more flexible methods for the future (automotive companies need more powerful weapons to catch up).

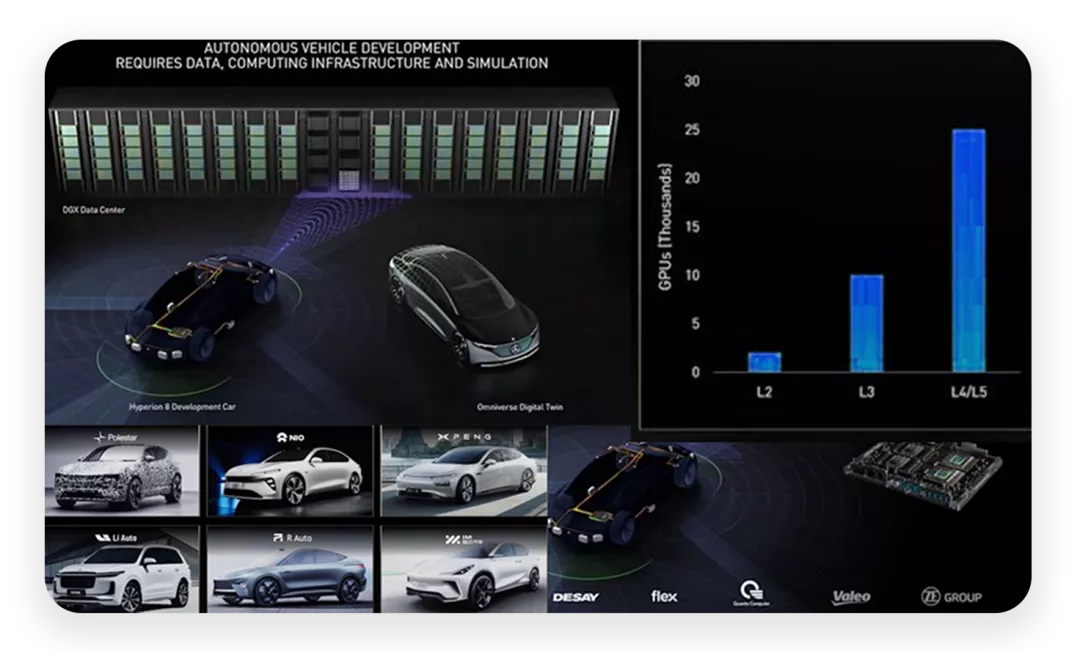

●Nvidia

This year CES 2022, Nvidia’s release content mainly focuses on platforms. Drive Hyperion 8 is produced around 9 radars, 12 ultrasonic sensors, 1 front-facing camera, and more than 12 cameras (sensors priced up to $10,000), which will start production in 2022. The first ones who can afford to use Nvidia’s autonomous driving platform are Chinese automotive companies including XPeng, NIO, Ideal, R Automobile, IM, and Polestar.

In terms of software, Nvidia has developed Drive Sim to generate driving scenarios to support development. Whether it’s a truck or a passenger car, it requires enormous backend infrastructure calculations to support (L5 requires 25,000 GPUs). The winner is still Nvidia, occupying the lion’s share of the market. This is also led by Tesla’s technology roadmap. Nvidia quickly followed suit with everyone.

●Qualcomm

This time, Qualcomm actually explained the story of the overall automotive product line, including:

◎Software service platform Snapdragon Car-to-Cloud

Enables automakers to develop new revenue sources. Vehicle interconnectivity solution Snapdragon Auto Connectivity 4G LTE, 5G, Cellular V2X, Wifi, Bluetooth, and satellite positioning can make vehicles interconnected.## Snapdragon Cockpit with Digital Instrument Cluster

Snapdragon Cockpit is a digital system that includes infotainment, controls, and visual displays. It is based on Android Automotive and is used by foreign automakers like Volvo, Renault, Honda, General Motors, Ford, and FCA. Chinese automakers including NIO, XPeng, WM Motor, and Great Wall have developed their own Android systems.

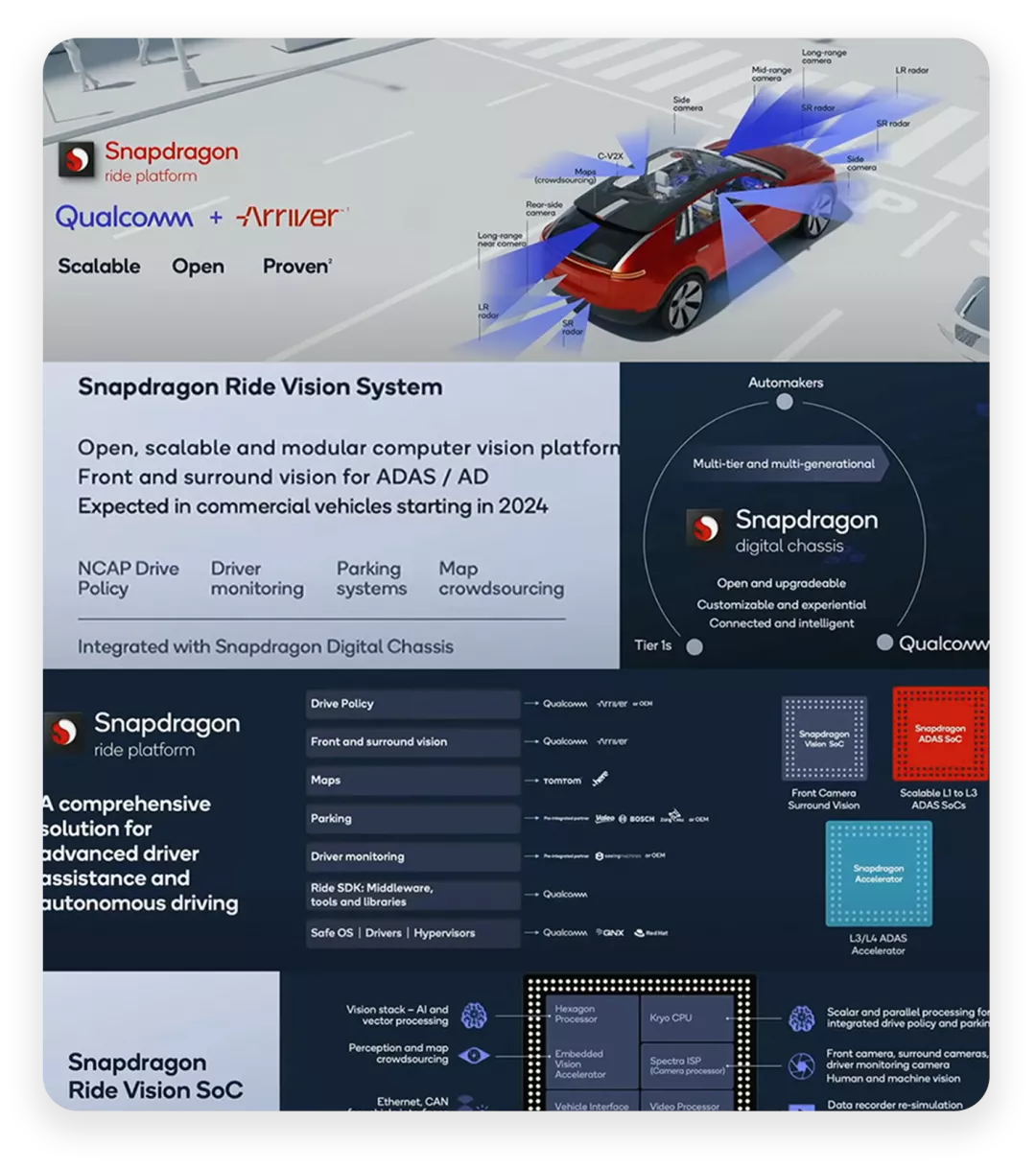

Snapdragon Ride Digital Chassis with Arriver Vision Perception System

Snapdragon Ride Digital Chassis includes the Arriver Vision perception system, jointly developed by Qualcomm and Veoneer. After Veoneer’s acquisition, Qualcomm acquired the Arriver business unit and integrated it into the Snapdragon Ride digital chassis.

Qualcomm’s strategy is based on openness. The Snapdragon Ride vision system supports multiple cameras, including higher resolution 8 MP cameras. The modular design allows automakers and Tier 1 suppliers to use Qualcomm’s complete stack or integrate the vision stack with driver strategy stacks developed elsewhere, along with various other components, including parking assistance, driver monitoring, and map crowdsourcing.

This system is expected to be mass-produced around 2023-24, mostly by GM, which will be the first to adopt Snapdragon Ride ADAS processors in its vehicles. Ultra Cruise will be used on urban roads from 2023. Starting in 2025, the next-generation BMW autonomous driving system and Renault’s digital chassis platform will adopt Snapdragon Ride.

In conclusion, the strong push from autonomous driving chip manufacturers has received great support from automakers. We can also see the demand from automakers for support for core hardware, as they build their own autonomous driving software teams. As automakers gradually take control, it is more appropriate for them to master this core technology themselves. In terms of developing autonomous driving, Chinese automakers may need to leapfrog the last two companies by setting up separate branches.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.