Supply pattern of chip integration

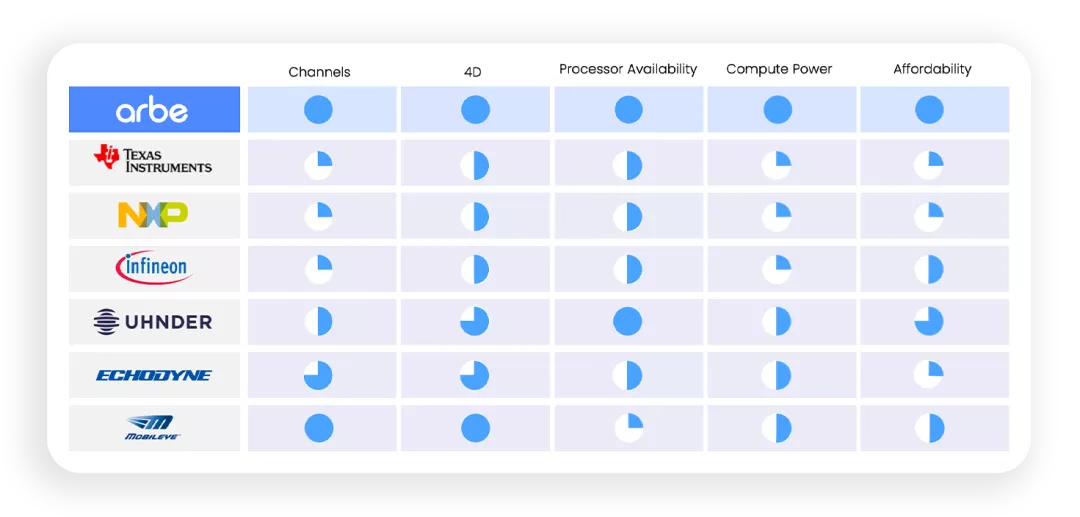

In the field of mmWave radar for vehicles, the competition among many foreign enterprises mostly revolves around antennas and chips (MMIC and post-processing). Therefore, we can see that these enterprises ultimately cooperate with traditional Tier 1 and become like Mobileye.

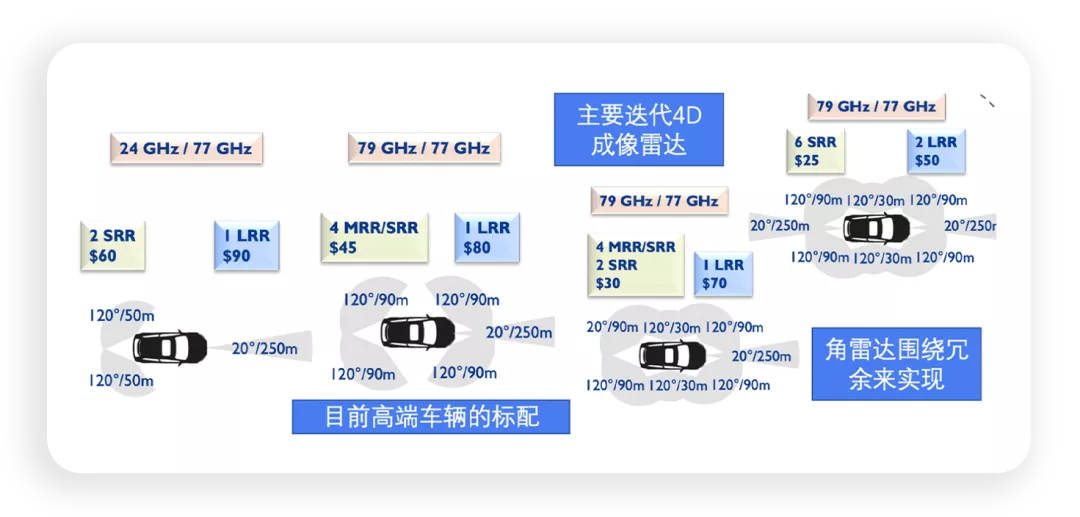

From a holistic perspective, the evolution pattern of mmWave radar can be observed.

The demand for radar in the market is increasing. In the popularization stage of ADAS, a general vehicle only needs a forward long-range mmWave radar with built-in algorithms to achieve the functions of FCW and ACC. In the L2-L3 stage, vehicles require one forward long-range radar + four corner radars (currently most vehicles are equipped in this way). However, the core issue here is whether traditional Tier 1 will continue to produce such radars or if it is possible for vehicle manufacturers to directly connect with chip manufacturers and then have contract manufacturers do the work.

According to this logic, there may be two types of vehicle manufacturers:

-

Vehicle manufacturers relying on external integration:

They use Tier 1 to provide a fusion solution for mmWave radar and camera, which means combining the algorithms of vision and mmWave to form a relatively complete perception solution. In fact, this trend is a continuation of the transition relationship after the coupling of Tier 1 and chip manufacturers. -

Strong vehicle manufacturers:

After transitioning to Zonal control architecture, they choose a complete solution, combine it with hardware contract manufacturing (many 4D mmWave start-ups may become technology-driven processing units), and implement a management method that integrates the hardware with image and image-radar algorithms (even including Lidar images).

The solutions provided by Infineon and NXP are as follows:

The solutions provided by Infineon and NXP are as follows:

● NXP: S32R45/S32R294

NXP’s radar processor is the S32R45 and TEF82xx transceiver, and the low-cost solution for angle radar and front radar is the S32R294 radar processor combined with NXP’s TEF82xx transceiver.

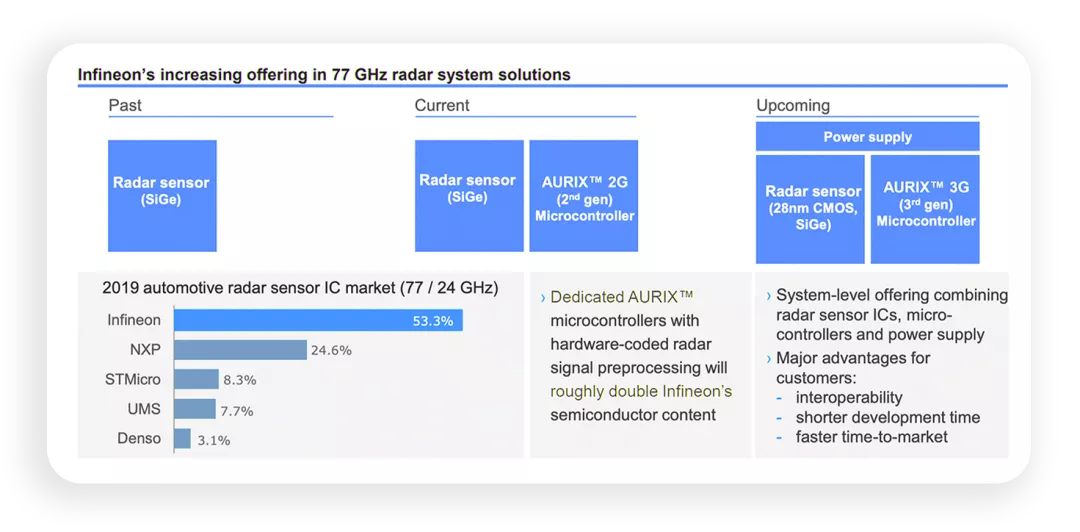

Due to Infineon’s dominance in the automotive radar chip market, progress in its 4D millimeter wave radar has been slow.

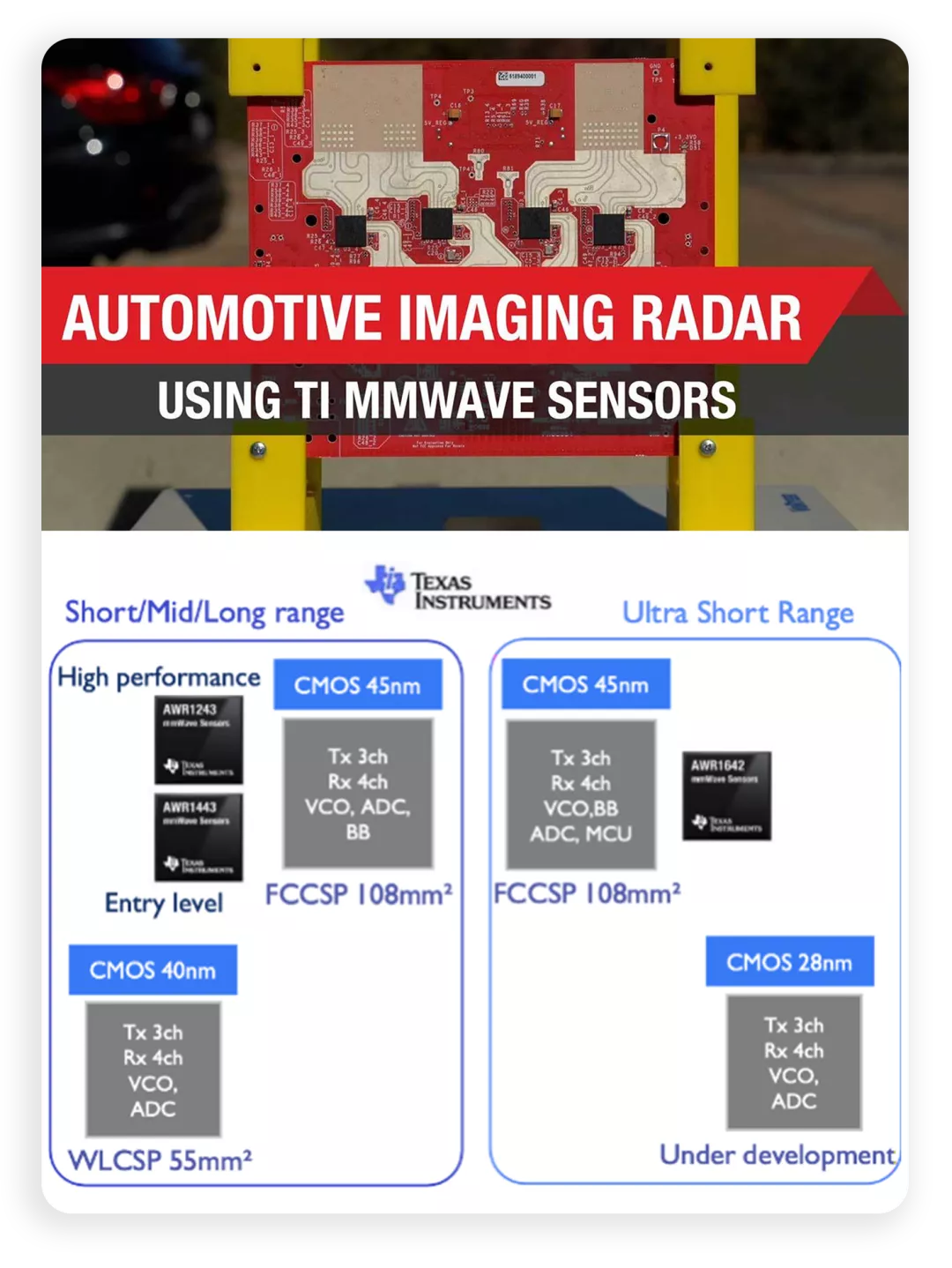

● Texas Instruments

Texas Instruments uses an open approach in the millimeter wave chip field (has been working hard but Tier 1 hasn’t bought in yet), providing an all-in-one solution called AWR2243, including a transceiver platform solution package, which includes hardware design, software drivers, sample configurations, API guides, and USER documents, with both 2-chip cascading and 4-chip cascading solutions, and a higher level of integration of the antenna-on-package (AoP) chip, which makes it the mainstream solution for 4D imaging millimeter wave radar for start-up companies.

Approach of Start-up Companies

● Arbe

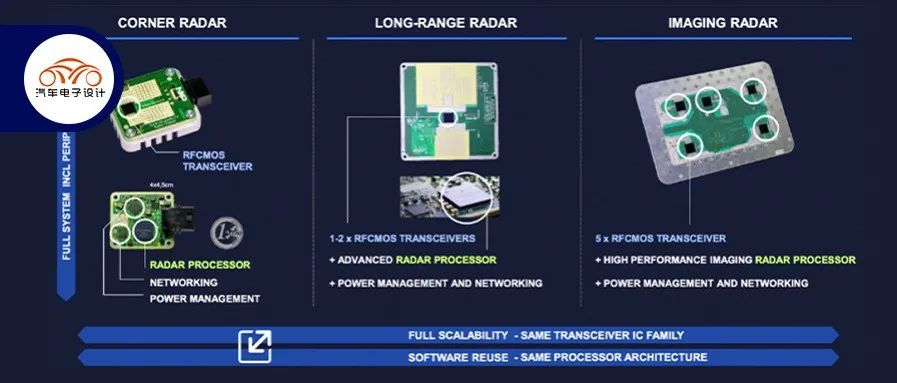

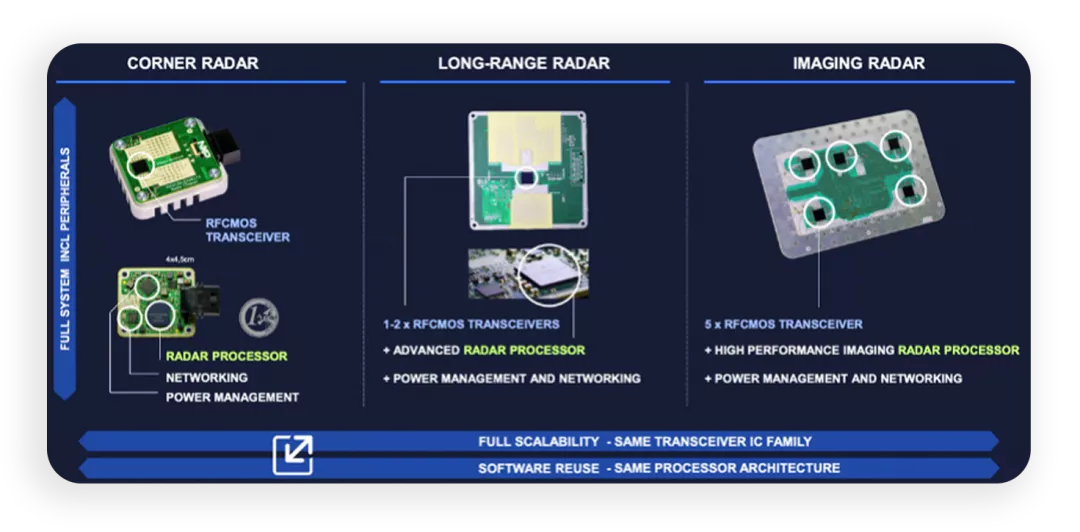

This is a listed enterprise (some information can be found through communication with investors) that uses the 22nm RF CMOS process developed by Globalfoundries for 4D imaging radar processing chips – RFIC, combined with self-developed algorithms and original antenna design, and launched a vehicle-grade 4D imaging radar chip set solution – Phoenix, and even developed a 4D millimeter wave development platform. Later on, there is a taste of disrupting the overall industry chain mode, allowing automakers to break through. Can’t this be the solution?

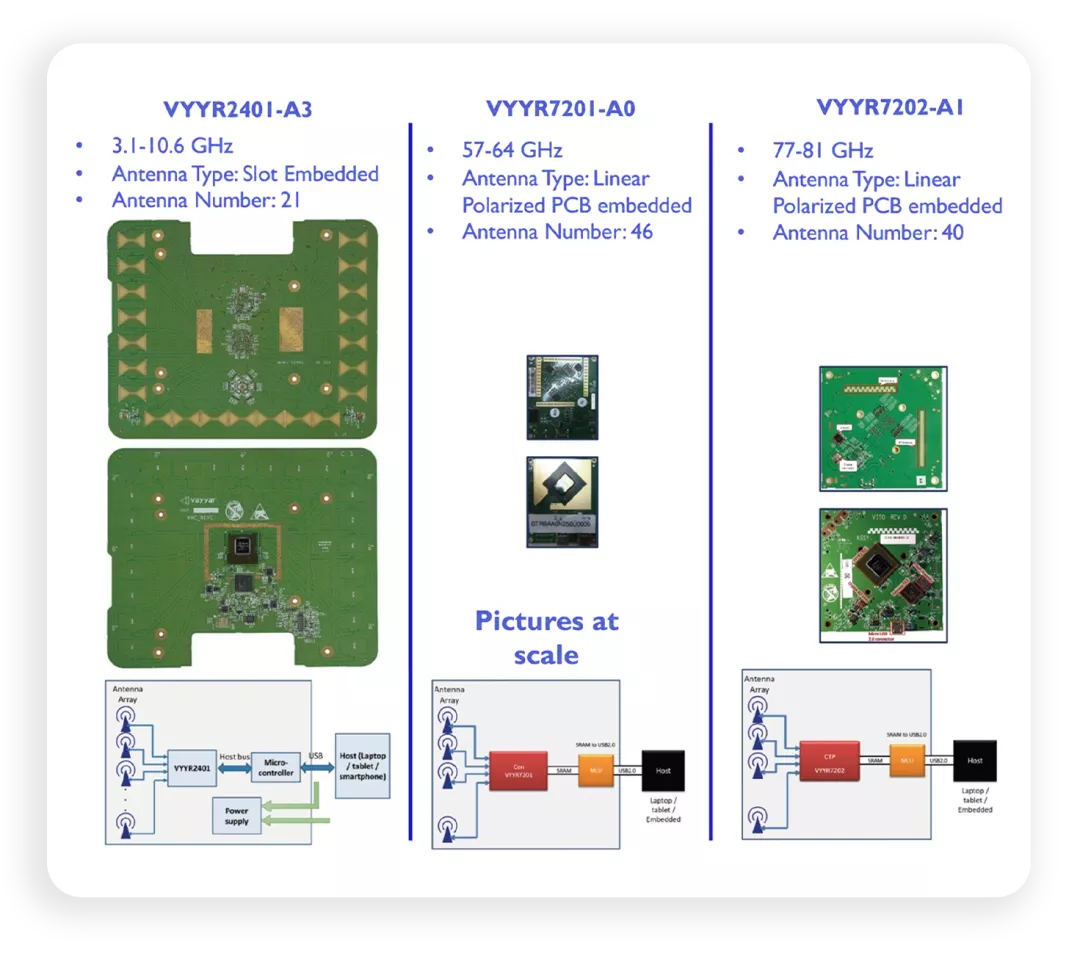

As the most funded enterprise, Vayyar realizes its commercial value through the System on Chip (SoC) chip, which integrates 72 transmitters and 72 receivers, an internal Digital Signal Processor (DSP) and Microcontroller Unit (MCU) for real-time signal processing. With a Radio Frequency Integrated Circuit (RFIC), it can sense, calculate, process, map and image targets, and provide functions like intrusion detection, child presence detection, seat belt reminders and eCall (crash alerts), which will be detailed with videos and teardown information provided later.

As the most funded enterprise, Vayyar realizes its commercial value through the System on Chip (SoC) chip, which integrates 72 transmitters and 72 receivers, an internal Digital Signal Processor (DSP) and Microcontroller Unit (MCU) for real-time signal processing. With a Radio Frequency Integrated Circuit (RFIC), it can sense, calculate, process, map and image targets, and provide functions like intrusion detection, child presence detection, seat belt reminders and eCall (crash alerts), which will be detailed with videos and teardown information provided later.

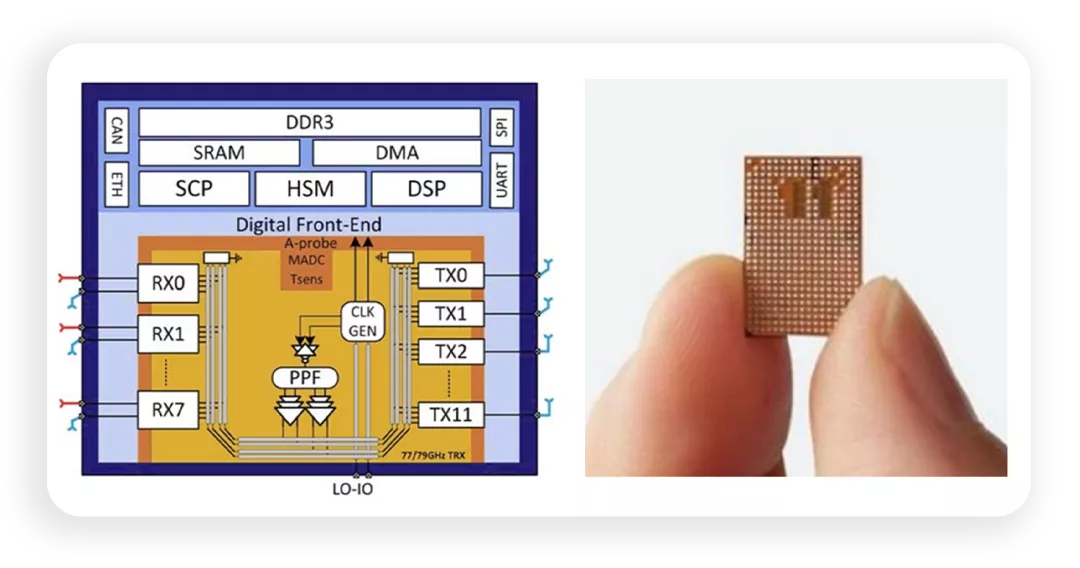

Uhnder, which received investments from many car manufacturers and Sonata, launched radar SoC chip, including 12TX/8×2 RX 77/79GHz MIMO transceivers, digital signal processing unit, memory and interfaces, which constitutes a general strategy.

In summary, with the progress of chip technology and increasing demand, the 4D millimeter-wave radar market will become a saturated market (as more and more chip manufacturers join and grow) from a Tier1 perspective, and the sensor market will gradually level off.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.