Translated English Markdown text:

Following up on yesterday’s article “Survival Patterns of Second-tier Battery Manufacturers 1 – Several Companies Producing Battery Shells,” we have now completed our analysis of the situation with second-tier battery enterprises during the New Year holiday.

There are three relatively typical second-tier battery companies which we will focus on:

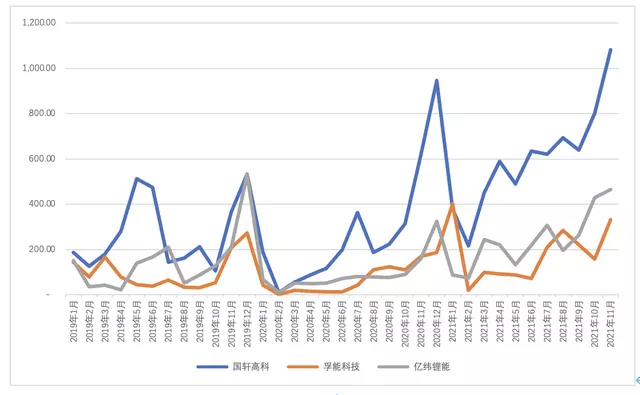

● Guoxuan High-tech: 1.08 GWh in November, 6.6 GWh from January to November; after shifting to the LFP battery line, the overall strategy is very clear.

● EVE Energy: 0.47 GWh in November, 2.59 GWh from January to November; the products line of EVE Energy covers many areas, with both soft-package and shell for the power field, causing a bit of volume limitation on their own.

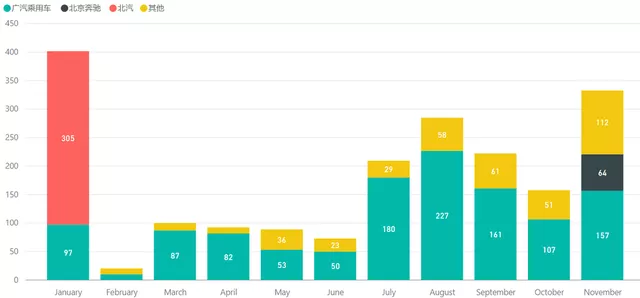

● Funeng Technology: 0.33 GWh in November, and 1.98 GWh from January to November; at the beginning of the year, BAIC accounted for 20%, followed by supplying GAC, but there is still no significant progress. They began supplying BEV produced by Mercedes-Benz in November.

In my personal view, the road to producing soft-pack three-element Li-ion batteries in China is too difficult, so if this technology pathway becomes ineffective, turning to short blade-shaped LFP batteries of around 600 mm in length may be more effective. Whether Guoxuan’s cylindrical LFP battery technology pathway can be sustained presents a challenge for battery processing, particularly in resolving the problem of liquid leakage.

Examination of Customer Distribution

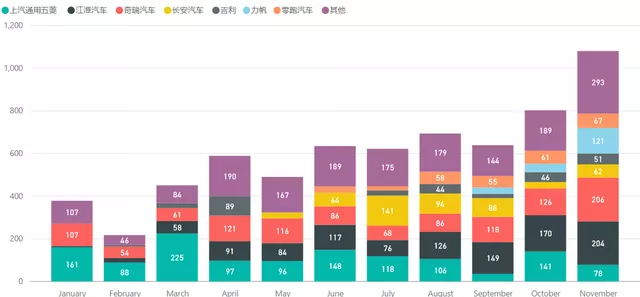

(1) Guoxuan High-Tech

The customer structure of Guoxuan High-tech is clearly illustrated in Figure 2 below: the basic customers include SAIC-GM-Wuling, JAC, and Chery, who then ordered A00-level BEVs from Changan and Lingling.

Guoxuan High-tech is currently constrained in its passenger car applications, and it is mainly used in low-cost A00 vehicles. The problem of rising costs has led to a ceiling in the ability of several customers for high-volume production.

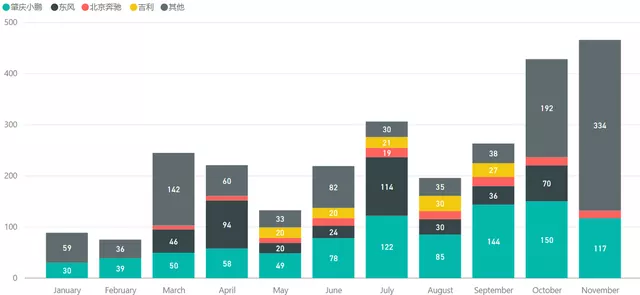

(2) EVE Energy

EVE Energy’s product line actually includes many commercial vehicles (PHFE phosphate-iron lithium battery products in shell), so passenger cars mainly comprise BEVs from XPeng and PHEVs from Mercedes-Benz, and it is indeed necessary to transform in the soft-pack technology path. Later, EVE Energy will shift towards high-nickel cylindrical technology, with the overall direction still positive.

(3) Funeng TechnologyApart from a batch of cars from BAIC at the beginning of the year, Funeng Technology is focused on the demand of GAC Passenger Vehicles. The overall demand is relatively scattered, but starting from November, there has been a significant demand for Beijing Benz’s BEV, which will be a major focus going forward. However, what I want to say is, how should they explore new customers in the future? Among so many enterprises, Funeng is the only one that does not produce lithium iron phosphate batteries, so it will be quite difficult to switch to the direction of energy storage or other high-safety routes later.

Difference between Ternary and Lithium Iron Phosphate (LFP)

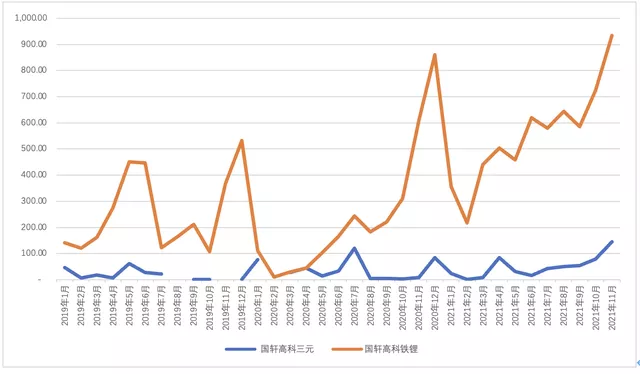

As mentioned earlier, Guoxuan High-tech has made a rapid conversion in the field of lithium iron phosphate.

At present, Guoxuan High-tech’s ternary and lithium iron phosphate numbers are 0.537 GWh (8.1%) and 6.06 GWh (91.8%) respectively. What I am more confused about is how Volkswagen and Guoxuan will operate in the future, whether based on square shells to produce ternary or focused around square shell lithium iron phosphate to produce CTC.

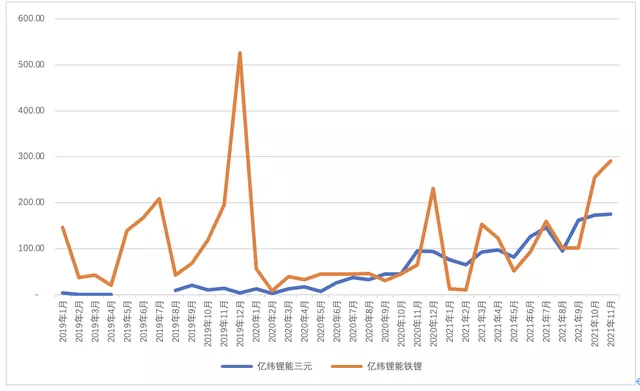

Regarding EVE Energy’s situation:

● In 2019, they exclusively produced commercial vehicles based on lithium iron phosphate;

● From 2020, they started to cooperate with SK and gradually moved towards the soft-pack ternary route;

● After encountering challenges in the original route in 2021, the pace of capacity expansion was not fast;

● However, after the demand for lithium iron phosphate emerged, they were very determined to improve in this direction.

In summary, in my personal opinion, changing the encapsulation process for soft-packs and switching to blade lithium iron phosphate may be a better approach, while for cylindrical batteries, there is room for development in both lithium iron phosphate and high-nickel (which requires the breakthrough of full-pole ears). Next year, the biggest challenge for all second-tier battery companies will be how to control costs or obtain raw materials.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.