When discussing plug-in hybrid (PHEV) separately, I think that in order to study this product line carefully, it may be necessary to look at the product benchmarking strategy. This is not a typical and very generalized market.

Just discussing data such as production volume and insurance, the goal is simply to answer: can this product strategy support an overall category strategy? And what are the necessary conditions?

In our sales data, we can see successful examples, as well as those from SAIC (Roewe and MG), and Geely (Volvo, Lynk&Co, and Emgrand) that were promoted throughout the whole range, but with minimal results. Therefore, discussing this issue cannot simply be viewed from the perspective of the power system, but rather requires more insight into product and corporate sales strategies.

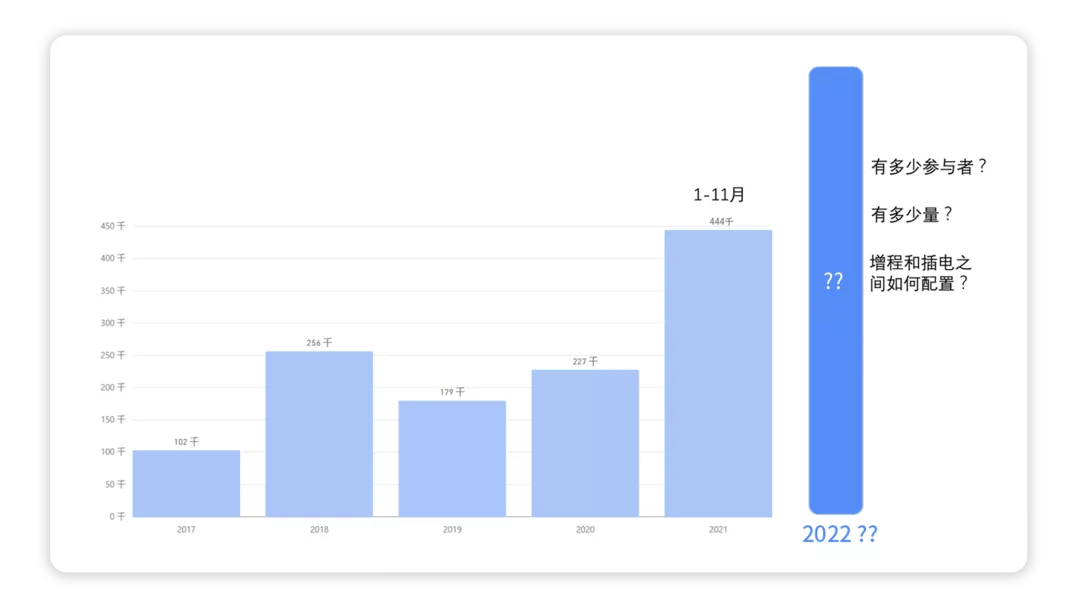

Interpreting Production and Insurance Volume Data

As shown in Figure 2, from the perspective of production volume, PHEVs have been lukewarm in the past few years since reaching a certain peak in 2018 (256,000 units).

Actually, this phenomenon can be understood: plug-in hybrids were considered from two dimensions of travel demand and license plate restrictions; after the market demand for travel reached a peak in 2018, pure electric vehicles became a necessary condition for travel, and as a result, the popularity of hybrids began to decline.

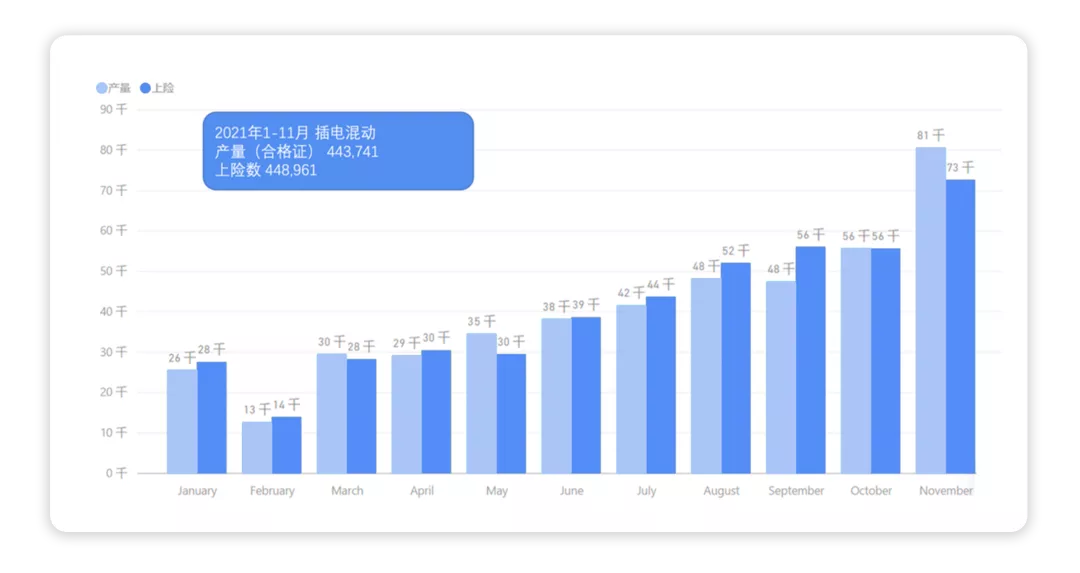

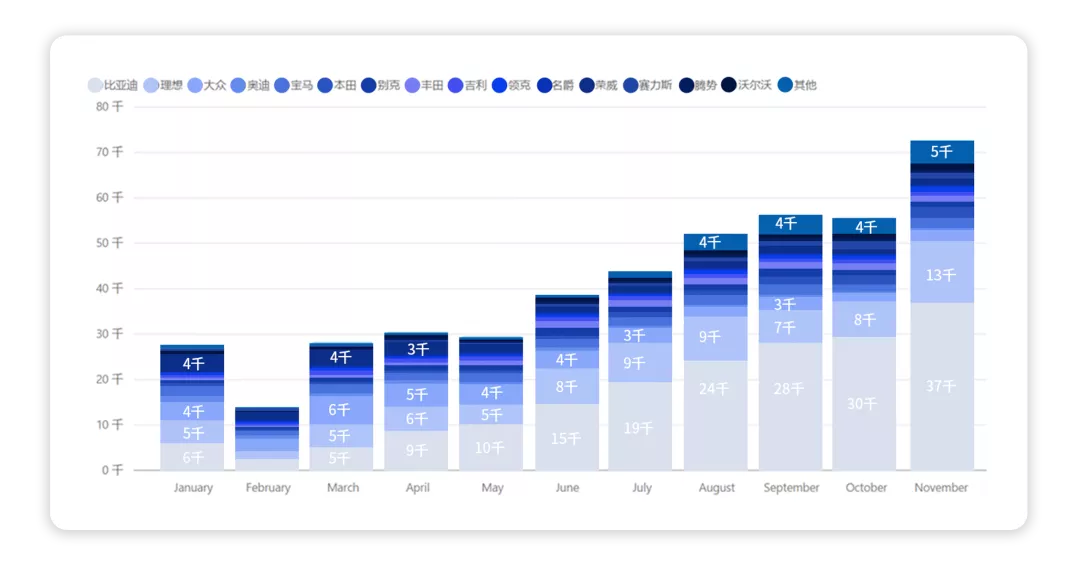

In 2021, DM-i and Li ONE have found some ways out in terms of both production and sales. In the production data for 2021, PHEVs totaled 443,000, with insurance data at 448,000 units.

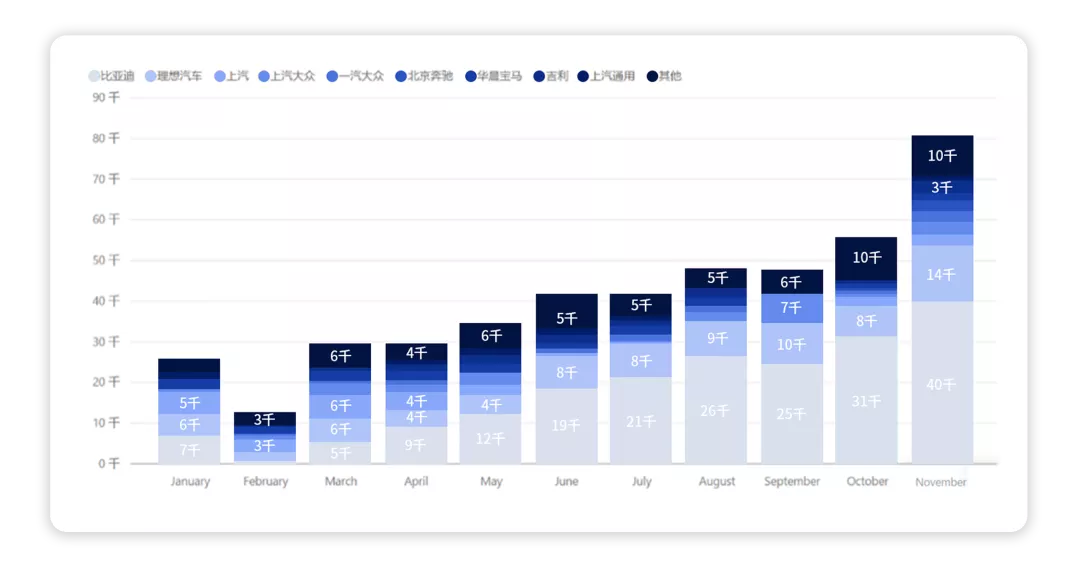

If we review the overall trend, from the perspective of production data, hybrid models are mainly being gradually increased by BYD and Li AUTO. The main changes are: DM-i has replaced DM-p completely, and Li ONE has undergone an upgrade, achieving a breakthrough in product strength, thus making the first and second half of the year completely different.

Looking at the competitive landscape in the first half of the year, it was still relatively chaotic, but the landscape was clear in the second half of the year.

Note: The plug-in production of independent companies such as SAIC and Geely in China has shown a high-then-low pattern.

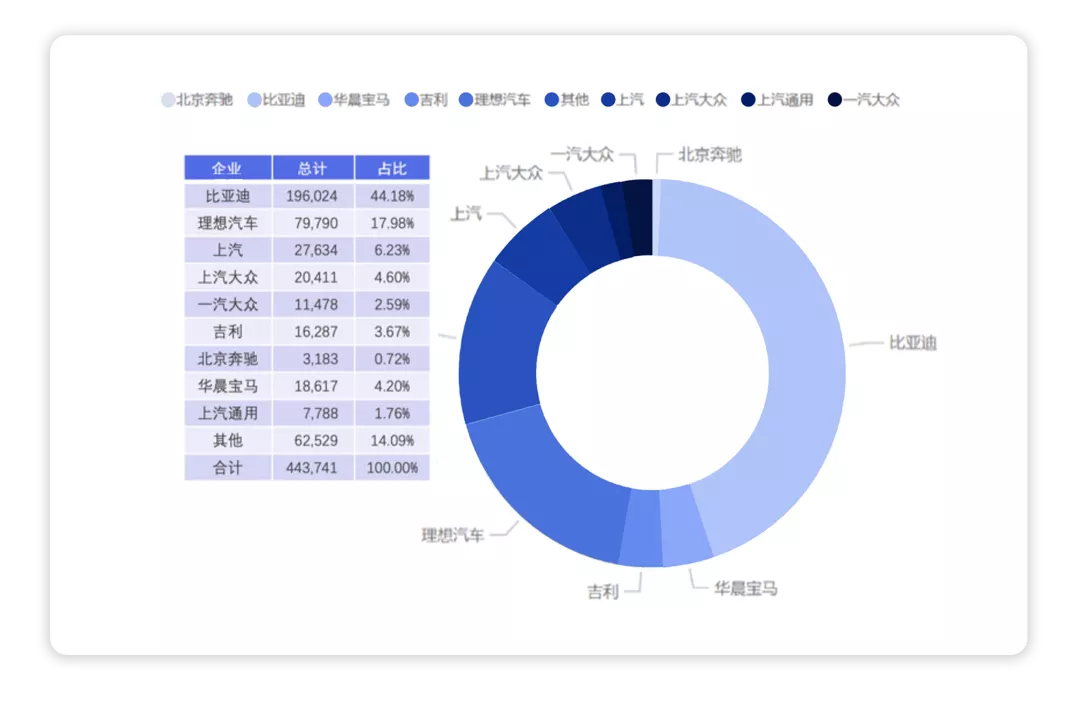

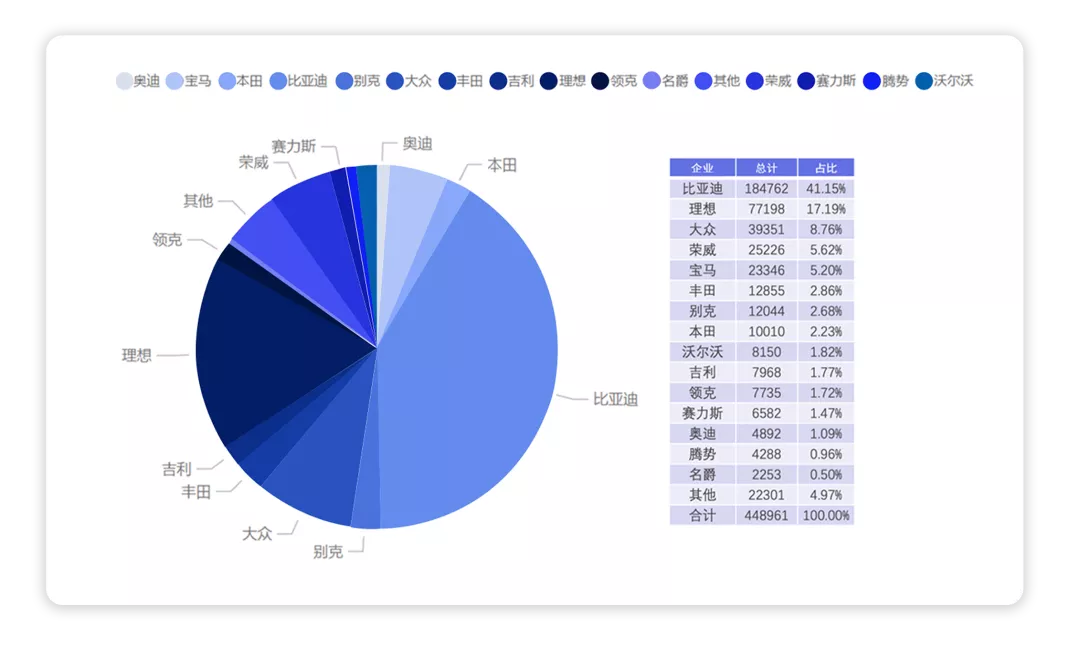

As the two companies ramp up production, BYD accounts for an overall market share of 44.18%, while Tesla’s China-made Model Y takes a 17.96% share with about 5-6% of the share held by other players.

As the two companies ramp up production, BYD accounts for an overall market share of 44.18%, while Tesla’s China-made Model Y takes a 17.96% share with about 5-6% of the share held by other players.

Looking at the overall situation, the gap between the top two and the rest is widening.

Compared to production data, terminal insurance data is more reliable. It can be observed that cities that rely on license plates have seen increasing demand for EVs due to government incentives. In the second half of the year, there has been a surge in demand for different EV models in the broader lower-tier markets, targeting various energy replenishment paths.

According to terminal data, BYD continues to lead with a 41.15% market share, followed by Tesla’s China-made Model Y with a 17.19% share and VW with 8.76%. This trend is expected to continue into 2022.

So where does the difference lie? I believe the core issue can be seen in the data from the past 4 months.

Plug-in hybrids and range extenders have been primarily dominated by BYD Qin DM-i, Song DM-i, Tang DM-i, and Tesla’s Model Y. Even BYD Han DM does not perform as well. In my opinion, there are some decisive factors when it comes to predicting the success of a new model:

-

BYD: It has taken very aggressive measures to promote the production of DM-i, including lowering overall costs by sacrificing the market share of ICEVs, under the premise of certain subsidies, new energy and points incentives, and the exemption from vehicle purchase tax. From an overall strategic perspective, this is not just a matter of making cars, but a way to enhance product characteristics and make plug-ins more cost-effective, by compressing costs and offering reasonable prices, ignoring the factor of license plates in larger cities, and planning for the long term.

-

Tesla’s China-made Model Y: With the green license plate and energy replenishment (refueling) system, this car boasts a unique product design and logic in the era of increasing demand for larger vehicles. As the product evolves, it has also entered a self-reinforcing product logic.

In other words, I believe the market will tend to adopt similar strategies, either similar to Huawei’s extended-range new brand to strengthen the self-supplementary energy points. If SAIC and Geely reform their own plug-in systems, they will undermine the cost-effectiveness of their brother departments’ gasoline cars. There is a strategic trade-off here, one cannot have both.

In summary, as mentioned above, plug-in hybrid vehicles are not significantly affected by subsidy reductions or battery price increases due to their low electric range. Therefore, this area should have great growth potential in 2022. We have seen Great Wall and Changan also expanding into plug-in hybrids and we should see some action in 2022.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.