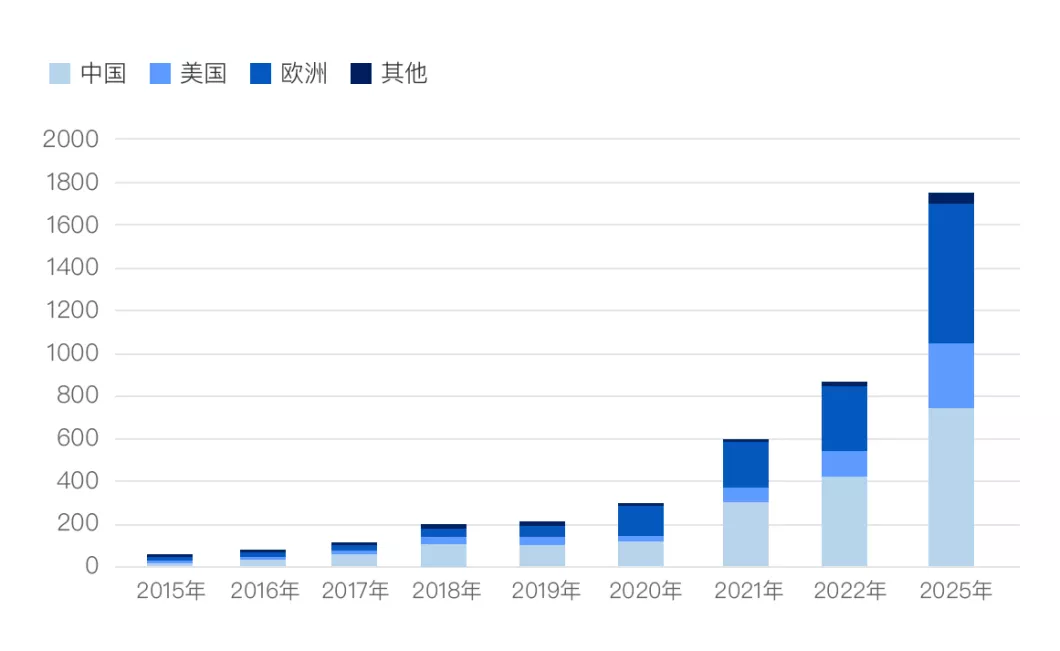

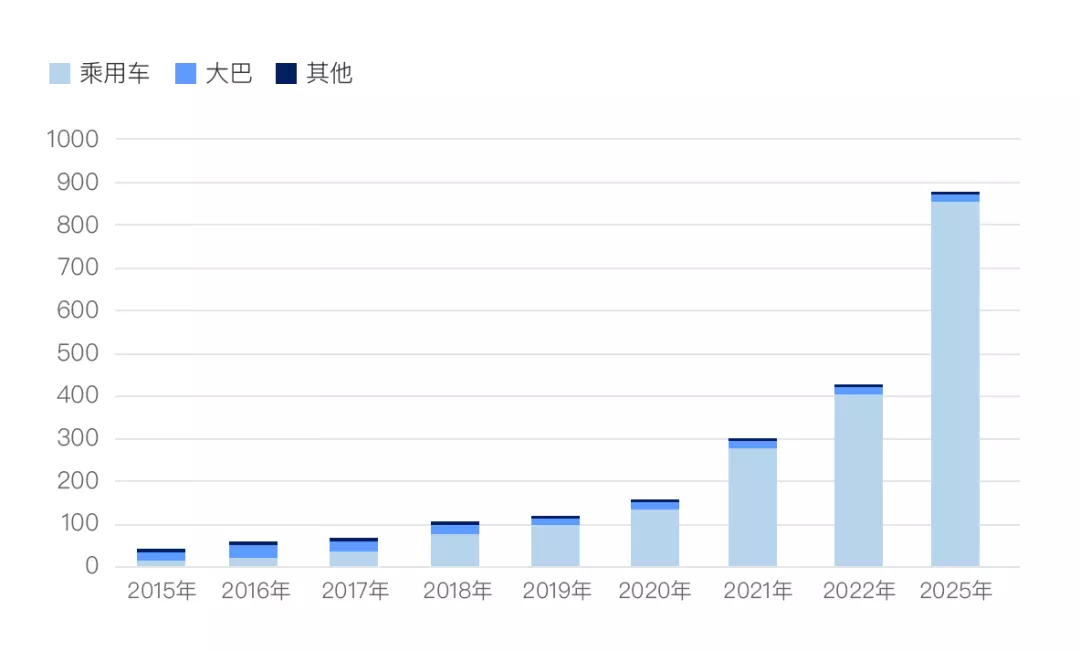

The other day, we published an introduction article on Electric Vehicle Observer, and one of the key issues discussed was whether or not the entire battery industry chain can meet the demand for rapidly expanding electric vehicle production. As shown in the following figure, the demand for global electric vehicles rose rapidly from 3 million in 2020 to 6 million in a short period, and is expected to reach 8 million next year. In just four years, by 2025, the market may grow to 18 million.

In other words, based on this trend, the amount of battery usage will exceed 300 GWh globally by 2021, and will substantially increase to over 800 GWh by 2025.

Something to note is that Chinese power battery companies are not hesitant about expanding their production. They have rapidly increased their current production capacity to a significant scale. However, the core issue is whether there will be enough battery materials to meet the required demand.

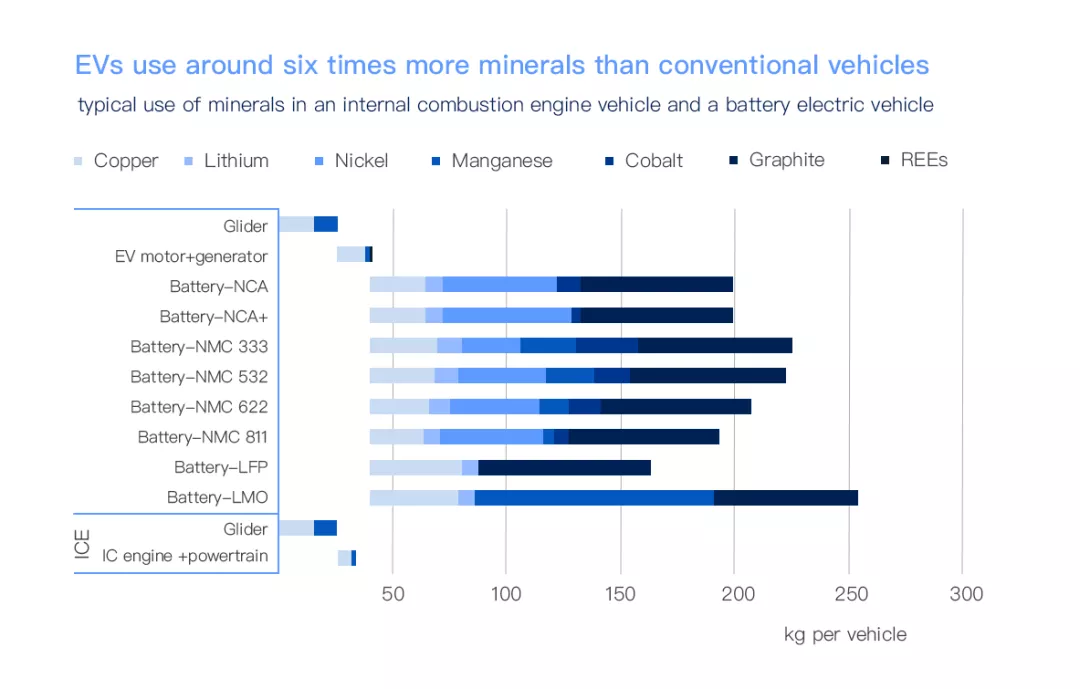

According to previous calculations based on normal vehicle use, the main materials required for batteries are nickel, cobalt, and lithium. For a 1 GWh lithium iron phosphate battery, it is estimated that 2,000-2,500 tons of positive material is needed, and 1 ton of lithium iron phosphate material requires approximately 0.25 ton of lithium carbonate.

○ Microscopically:

A 60 kWh lithium iron phosphate battery requires 30 kg of lithium carbonate for one vehicle.

○ Macroscopically:

In other words, if we take a 60 kWh battery as a rough calculation, 6 GWh will be required for 100,000 vehicles, and 60 GWh for 1 million vehicles. The corresponding demand for lithium carbonate is as high as 30,000 tons. According to the calculation based on a 4.4% year-on-year increase in China’s lithium carbonate production in 2020, which was 166,000 tons, of which the production of battery-grade lithium carbonate was 106,000 tons, and the industrial-grade lithium carbonate was 60,000 tons. This means that all 100,000 tons of battery-grade lithium carbonate can correspond to 200 GWh lithium iron phosphate batteries.

Taking LG’s products used by Tesla as an example, the weight of the battery cell is 201.68kg with a power output of 51.75kWh. The weight of nickel is 65.57kg and the weight of cobalt is 4.8kg.

○ Nickel

Since the nickel in batteries accounts for only about 5% of the total nickel usage, the increasing demand in this direction has little impact on the overall demand.

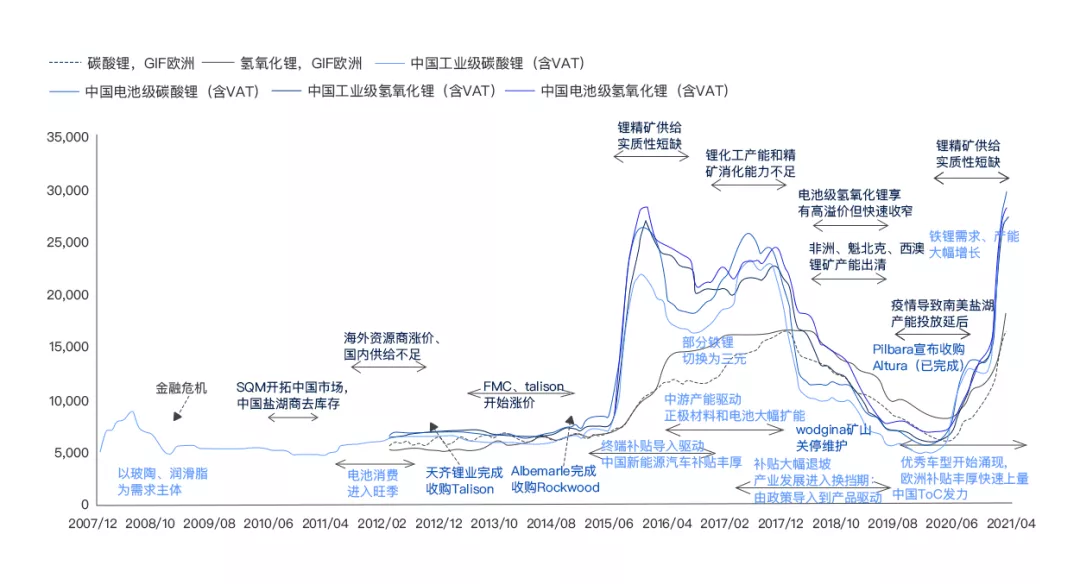

○ Lithium

Currently, the demand for lithium resources is mainly structured, and the overall supply and demand are not balanced.

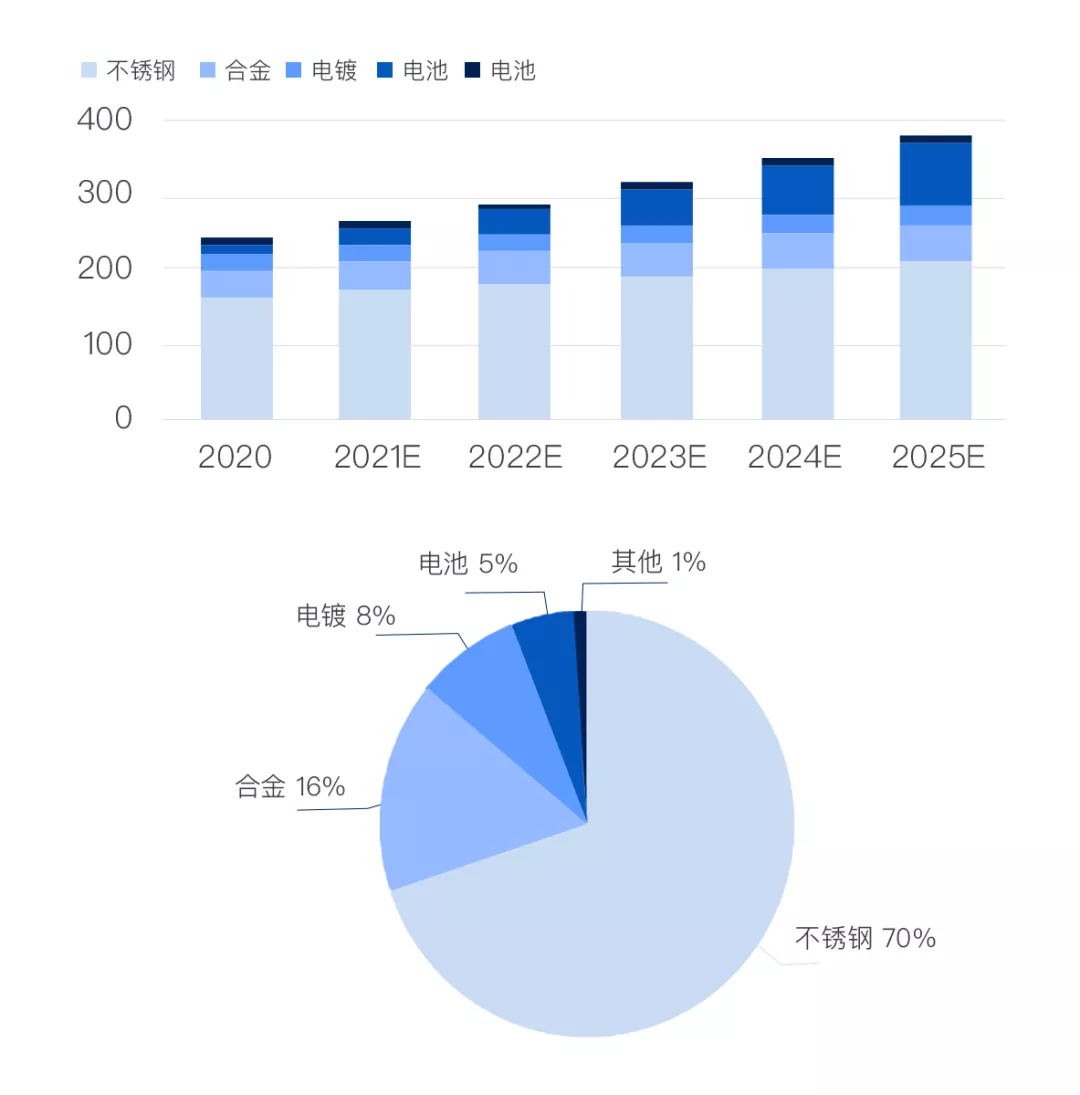

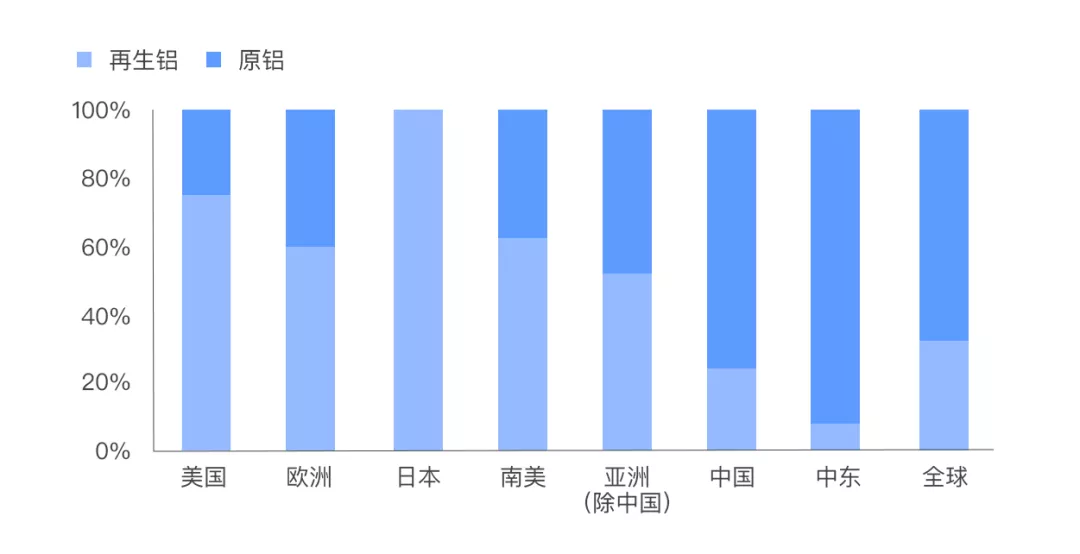

What I find interesting is that the balance of demand in developing battery materials can learn from the aluminum industry. The development of the aluminum recycling industry in developed countries is relatively mature, constructing a complete closed-loop industrial chain. Secondary aluminum is made from scrap aluminum generated during aluminum processing (new waste aluminum) or waste aluminum produced from scrap aluminum (old waste aluminum). Looking at the proportion of secondary aluminum production in total aluminum production, in 2019, Japan’s secondary aluminum production accounted for nearly 100% of total aluminum production, the United States nearly 80%, and Europe nearly 60%, which is at a relatively high level globally.

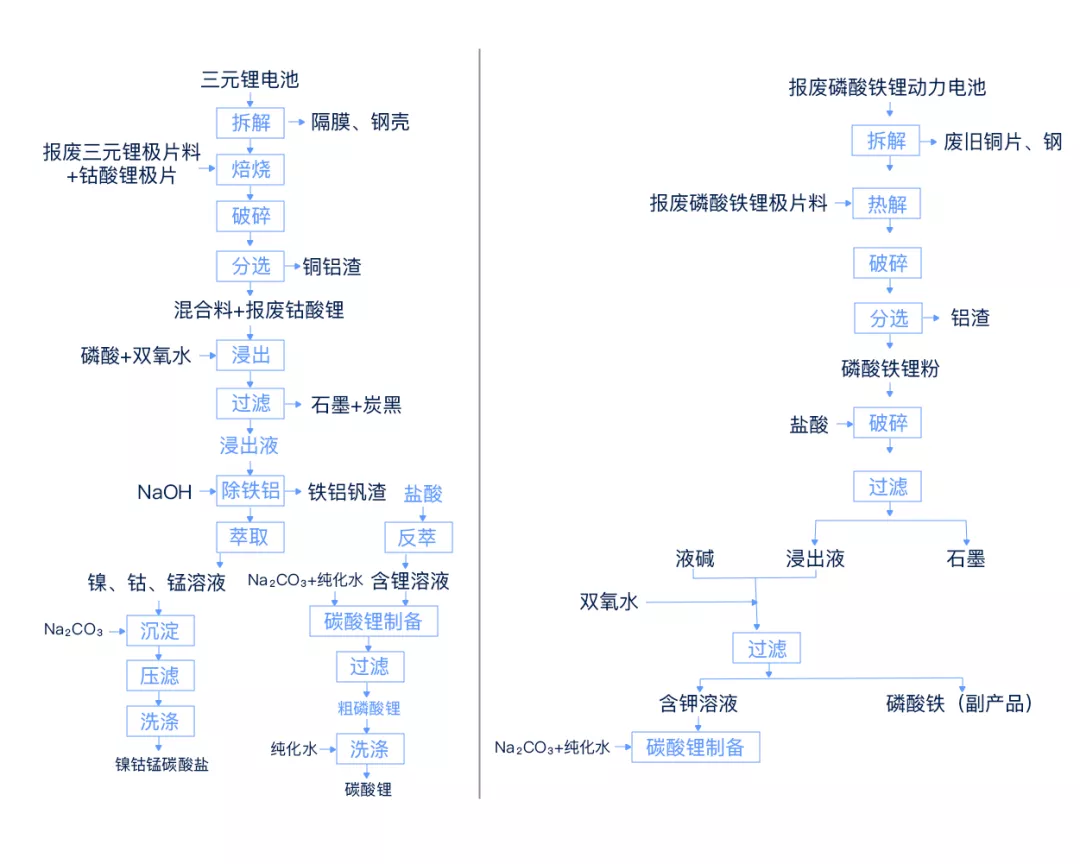

In fact, the battery of an electric vehicle is also a warehouse. Generally speaking, the capacity of power batteries used in cars cannot be less than 80% of a certain capacity, otherwise they can no longer be used in cars. Power batteries used in cars can be used in a hierarchical manner. After this stage, scrapped batteries can be recycled. This requires ensuring that the battery will not cause significant pollution to the environment during its life, and materials inside the battery can be reused in a circular manner, achieving a certain level of battery material regeneration and supporting the sustainable development of electric vehicles.

In fact, the battery of an electric vehicle is also a warehouse. Generally speaking, the capacity of power batteries used in cars cannot be less than 80% of a certain capacity, otherwise they can no longer be used in cars. Power batteries used in cars can be used in a hierarchical manner. After this stage, scrapped batteries can be recycled. This requires ensuring that the battery will not cause significant pollution to the environment during its life, and materials inside the battery can be reused in a circular manner, achieving a certain level of battery material regeneration and supporting the sustainable development of electric vehicles.

Conclusion: Overall, the material of the battery can be recycled, providing a continuous and stable power source for the development of electric vehicles.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.